Amfani da tashoshi na farashi a cikin ciniki, ginawa da dabarun aikace-aikacen a aikace. Duk wani dan kasuwa zai gaya muku cewa

gano yanayin kasuwa shine mabuɗin samun kuɗi. Dabarun cinikin tashar farashi hanya ce mai wayo don gano waɗannan abubuwan da ke faruwa da yuwuwar fashewar farashin da bounces a kan wani lokaci.

Ma’anar tashar farashi da ainihin sa a cikin ciniki

Tashar farashin da ‘yan kasuwa ke amfani da su don kasuwanci bisa ga

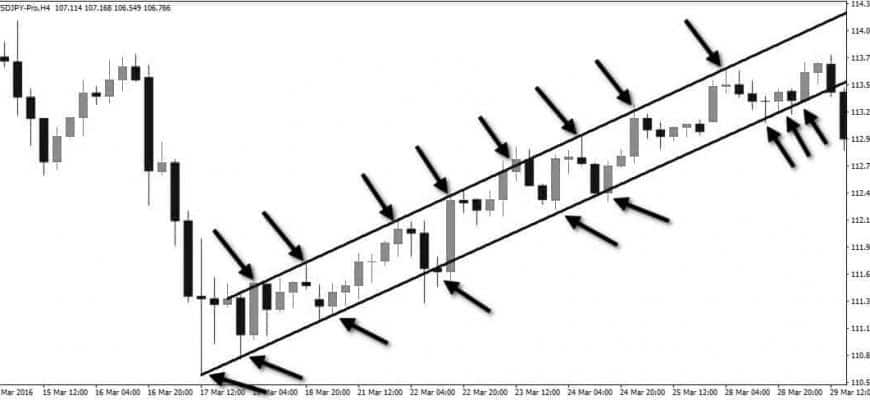

nazarin fasaha an ƙirƙira su ta hanyar biyan farashin kadari. Lokacin nazarin bincike na fasaha, ya faɗi ƙarƙashin nau’in tsarin ci gaba na yanayin da ake wakilta ta hanyar layi biyu masu kama da juna (suna kama da tashoshi akan ginshiƙi). Layin layi na sama yana haɗuwa da haɓakar haɓakar farashin farashi, ƙananan layi na layi – ƙananan ƙananan sauye-sauye. Yana taimakawa nuna ci gaban kasuwar bijimi ko bear. A matsayinka na mai mulki, ‘yan kasuwa suna ƙoƙarin yin ciniki a cikin waɗannan layi, amma ana yin ainihin kuɗi lokacin da abin da ake kira “fashewar tashar” ya faru. Wannan yana nufin cewa farashin yana motsawa sosai a waje da abin da alamar tashar farashin ta annabta (a kowace hanya).

matakan tallafi da juriya . Layi na sama na tashar yana wakiltar layin juriya, yayin da ƙananan layi yana aiki azaman layin tallafi. [taken magana id = “abin da aka makala_14934” align = “aligncenter” nisa = “800”]

Tashoshin ainihin annabci ne mai cika kai. Suna aiki ne saboda ’yan kasuwa da yawa sun gano su kuma suna amfani da su don kasuwanci. Yayin da ‘yan kasuwa ke gane tashar, yawan amfani da shi wajen shiga da fita kasuwa.

Tsarin Tashoshi

Mai ciniki yana kafa tsarin tashar farashin farashi idan ya gano aƙalla mafi girma biyu mafi girma da mafi girma. Yana zana layin da ke haɗa maɗaukaki da ƙasa (don samar da tsarin tashar farashi).

- Ƙayyade mafi girma da mafi ƙanƙanta a baya. Wannan zai zama wurin farawa na tashar.

- Nemo wani mafi girma na gaba, da mafi ƙaranci na gaba.

- Haɗa manyan manyan biyun don zana layin da ake kira “Upper Trendline” kuma haɗa ƙananan ƙananan biyu don zana wani layi mai suna “ƙananan Trendline”.

- Idan waɗannan layukan da aka haɗa ta haka da aka samu sun kusan layi ɗaya, an kafa tasha.

- Don haka, akwai aƙalla wuraren tuntuɓar juna biyu akan layi na sama na sama, kuma aƙalla wuraren tuntuɓar biyu akan layin da ke ƙasa.

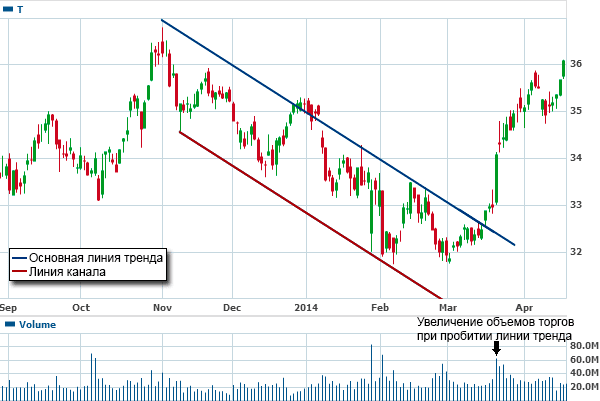

Hankali! Komai tashar farashin da kuke ciki, da zaran an ga hajoji biyu ba su kai kololuwar tashar farashin ba, nan ba da jimawa ba farashin zai karye. Hakazalika, tare da raguwa biyu waɗanda ba su kai ga kasan tsarin tashar farashin ba, ƙila farashin zai ragu. Mafi girman rata tsakanin farashin karya ta layin juriya, mafi girman yiwuwar buɗe ciniki.

Mafi munin kuskuren da ɗan kasuwa zai iya yi shine shigar da ciniki kafin farashin ya karya ɗaya daga cikin layin tashoshi. Shigar da ciniki da wuri na iya sa farashin ya koma tashar. Yana da mahimmanci koyaushe don jira tabbatarwa na fashewa (lokacin da farashin ya karya matakin juriya na sama ko matakin tallafi na ƙasa).

Nau’in tashoshi

Ga yawancin ‘yan kasuwa, an fi son tashoshi masu hawa da sauka. Ta yaya “mafi kyau” su ne ko a’a shine tambaya mai mahimmanci, amma, duk da haka, waɗannan alamu sune ma’auni idan ya zo ga kasuwancin tashar da kuma nazarin alamun tashar ciniki.

Ba tare da la’akari da yanayin ba, yana da mahimmanci cewa layin sun kasance daidai da juna. Zane layi a kusurwa mara kyau zai haifar da ƙarshe na ƙarya.

Maganin Ciniki

Ƙidaya tana motsawa ta hanyar tashar farashi lokacin da ƙarfin samarwa da buƙata ya rage farashin da ke ƙasa. Suna iya motsawa ƙasa, sama ko ta gefe. Ƙarshen waɗannan abubuwan yana tura aikin farashin cikin motsin yanayin rami. Lokacin da aka sami ƙarin wadata, tashar farashin tana ƙoƙarin ragewa, ƙarin buƙatu yana haɓaka haɓaka, idan ma’auni na samarwa da buƙatu yana gefe. ‘Yan kasuwa yawanci suna neman kadarorin da ke ciniki a cikin tashar farashi. Lokacin da suke ciniki a babban ƙarshen tashar farashin, yana nuna cewa ana iya yin ciniki a ƙasa zuwa tsakiya, kuma lokacin da aka yi ciniki a kasan tashar farashin, yana nuna cewa ana iya yin ciniki a kasuwa. mafi girma:

- Hanya mafi sauƙi don amfani da tashar ciniki ita ce ɗauka cewa kadarar da aka yi ciniki za ta kasance cikin wasu iyakoki . Don haka, ɗan kasuwa yana yin ɗan gajeren lokaci a duk lokacin da farashin ya faɗi mafi girma kuma yana yin kasuwanci mai tsayi a duk lokacin da farashin ya faɗi ƙasa kaɗan.

- Wata hanya ita ce kasuwancin breakout . Da zarar kyandir ya buɗe kuma ya rufe a waje da tashar – kasuwanci mai tsawo lokacin da babban iyaka ya karye da ɗan gajeren ciniki lokacin da ƙananan iyaka ya karye. Lokacin da farashin ya tashi daga tashar, yawancin waɗancan fasalolin na iya zama ƙarya. Don kauce wa wannan, kafin shiga kasuwa, kana buƙatar jira kyandir don rufewa a waje da tashar ko, a gaba ɗaya, don sake gwada layin layi.

- Wani yuwuwar yayin aiki tare da tashoshi na farashi shine amfani da su azaman jagora don nazarin ɓangarorin lokaci da yawa . Wannan yana nufin cewa idan kadari yana ciniki a kusa da babba iyaka akan mafi tsayin lokaci, yana yiwuwa a shigar da gajerun cinikai akan ƙananan firam ɗin lokaci tare da asarar tasha. Hakazalika, zaku iya buɗe dogayen umarni akan ƙaramin tazara lokacin da farashin ke gabatowa ƙaramin iyaka akan tazara mai tsayi.

Yadda ake gina tashoshi na farashi, aikace-aikacen a cikin ciniki: https://youtu.be/iR2irLefsVk Volume shima yana iya ba da ƙarin bayani yayin cinikin waɗannan alamu. Ƙararren ƙima yana da kima lokacin da aka tabbatar da fashewar kowane tsarin tashoshi biyu sama ko ƙasa. Idan ƙarar ya ɓace tare da ƙirar ƙira, to, siginar ciniki da aka samu ba abin dogaro bane. An lura cewa ɓarna na ƙarya na wani tsari yana faruwa lokacin da babu ƙarar girma a cikin tsarin ƙaddamarwa. Daga ƙarshe, ko mai saka hannun jari ya yi ciniki mai ban sha’awa ko bearish a cikin tashar ƙasa / sama gaba ɗaya ya rage gare shi da dabarun da yake tunanin mafi dacewa da bukatunsa a halin yanzu. Binciken fasaha na duka tashoshi na ƙasa da na sama, a matsayin mai mulki, ya shawarci masu zuba jari / yan kasuwa su saya (ko su yi tsayi) wani kadara mai tasowa kuma su sayar (ko gajere) a cikin raguwa. Koyaya, nawa yakamata su biya wannan ra’ayin da tsawon lokacin da yakamata su bi yanayin ya rage nasu gaba ɗaya. Wannan shine dalilin da ya sa ƙididdiga da ƙididdiga daidai na tashoshi na kasuwanci da kuma layi na layi yana da mahimmanci yayin da yake ba ‘yan kasuwa tushe don tsarawa da sauƙaƙe yanke shawara na kudi. https://articles.opexflow.com/analysis-methods-and-tools/price-channel-indicator.htm kamar yadda yake ba yan kasuwa tsarin tsarawa da sauƙaƙe yanke shawara na kudi. https://articles.opexflow.com/analysis-methods-and-tools/price-channel-indicator.htm kamar yadda yake ba yan kasuwa tsarin tsarawa da sauƙaƙe yanke shawara na kudi. https://articles.opexflow.com/analysis-methods-and-tools/price-channel-indicator.htm

Ribobi da rashin amfani

Ana amfani da ciniki na tashar tashoshi a kusan kowane nau’i na ƙididdigar kuɗi na fasaha don dalili, kamar yadda yake ba masu zuba jari hanya mafi sauƙi don amfani da bayanai a cikin yanke shawara na kasuwanci. Har ila yau, a kalla a kallon farko, tashar farashin ba ta buƙatar bincike mai yawa, ilimin lissafi ko wasu nau’i na bincike, ko da yake, ba shakka, akwai nuances. Don haka:

- Babban fa’idodin da ke tattare da kasuwancin tashar farashin sun haɗa da babban dawowa, ƙarancin haɗari, da haɓaka haɓaka.

- Daga cikin rashin amfani akwai rashin ƙarfi, yanayin ɗan adam, siginar ƙarya.

Kasuwancin tashar farashi na iya zama mai saurin

canzawa kuma ba za a iya faɗi ba a cikin motsin farashi, musamman idan aka yi amfani da shi akan ɗan gajeren lokaci. Duk da komai, kurakurai har yanzu na iya shafar bayanan da aka bayar ta masu nuna alamar kasuwanci ta tashar, kodayake wannan a fili yana ɗan ragewa ta hanyar sigogin da aka yi amfani da su na mai nuna alama a cikin tambaya. Amma wauta ce a yi watsi da yiwuwar kuskure, tun da ingantaccen bincike na fasaha yana buƙatar shekaru na nazari (don haɓaka ilimin yadda ake gano waɗannan kurakurai).

Tashar farashin, kamar kowane ma’aunin bincike na fasaha, ana iya haɗa shi da siginar ƙarya / mara kyau wanda zai iya zama ɓatarwa. A saboda wannan dalili, ya kamata a yi amfani da duk alamomi tare da wasu, samar da mafi daidaito da zurfin bincike.

Tashoshin ciniki wani bangare ne na nazarin farashi. Idan ba tare da irin wannan ra’ayi ba, masu zuba jari za su yanke shawara mai mahimmanci na kuɗi a makance, dangane da ƙungiyoyi masu ban sha’awa na kasuwa maras sha’awa. Sai kawai ta hanyar nazarin sauyin farashin da ya gabata a hankali da kuma gano tushen tattalin arzikin waɗannan sauye-sauye a cikin sarkar samarwa / buƙata yana ba ‘yan kasuwa damar yin nasarar tsarawa da aiwatar da dabarun cin nasara.