Mfiridwuma mu nhwehwɛmu wɔ aguadi mu – mfitiaseɛ ne akwan, akwankyerɛ a ɛfa mfiridwuma mu nhwehwɛmu ho, akontabuo ne nhwɛsoɔ wɔ nhwehwɛmu mu a nkyerɛkyerɛmu ne mfonini ka ho.

- Ɛhe na wɔde mfiridwuma mu nhwehwɛmu di dwuma na dɛn ne atirimpɔw a ɛwɔ ne di dwuma wɔ aguadi mu?

- Akwankyerɛ a ɛfa aguadi mfiridwuma mu nhwehwɛmu ho

- Akontaabu ne nhwɛso ahorow a ɛfa mfiridwuma mu nhwehwɛmu ho wɔ aguadi mu a wɔde mfonini bi di gua: dɛn ne ne nea ɛkyerɛ

- Nsɛnkyerɛnnede: dɛn ne na ɔkwan bɛn so na wɔde di dwuma wɔ mfonini nhwehwɛmu mu?

- Mfiridwuma mu Nhwehwɛmu: Mfitiasesɛm a Ɛfa Wɔn a Wɔafi Ase Ho

- Guadi mu nhwehwɛmu: mfiridwuma anaa ɔkwan titiriw a wɔfa so yɛ ade

- Mfiridwuma mu nhwehwɛmu ho mfitiasesɛm

- Nhwehwɛmu a Wɔyɛ no Gyinapɛn

- Mfonini nhwehwɛmu a wɔde nsɛnkyerɛnnede ahorow di dwuma

- Nhoma ahorow a edi mũ ho adesua

- Guadi mu nhwehwɛmu a wɔde kyɛnere ayɛ

- Fapem nhwehwɛmu: dɛn ne ne titiriw

- Nnwinnade a wɔde di dwuma wɔ mfiridwuma mu nhwehwɛmu mu

- Sɛnea wɔyɛ mfiridwuma mu nhwehwɛmu: anammɔn anammɔn akwankyerɛ a wɔde bɛhwehwɛ nsakrae ne sikasɛm gua so nnwuma mu

- Trend aguadi

- Breakout aguadi

- Mfaso ne ɔhaw ahorow a ɛwɔ mfiridwuma mu nhwehwɛmu mu

Ɛhe na wɔde mfiridwuma mu nhwehwɛmu di dwuma na dɛn ne atirimpɔw a ɛwɔ ne di dwuma wɔ aguadi mu?

Mfiridwuma mu nhwehwɛmu fata na wɔde di dwuma wɔ stock aguadi mu, baabi a stocks, nneɛma ahorow, sikasɛm mu agyapade, bonds, options ne sikasɛm mu nnwinnade afoforo ba, a wɔde ne bo si hɔ wɔ abɔde mu wɔ nneɛma a wɔde ma ne nea wɔhwehwɛ no mu. Wɔ mfiridwuma mu nhwehwɛmu mu no, bo ho nhyehyɛe yɛ bo a wɔde bue, bo a wɔde wie, nsɛntitiriw a ɛkorɔn ne nea ɛba fam a wɔde kyɛnere ayɛ ma agyapade pɔtee bi wɔ bere pɔtee bi mu a wɔaka abom. Bere a ɛda ntam no betumi ayɛ da no mu (efi simma 1 kosi nnɔnhwerew pii), anaasɛ da biara, dapɛn biara, ne nea ɛkeka ho. https://articles.opexflow.com/analysis-methods-and-tools/yaponskie-svechi-v-trajdinge.htm Sɛ wobɛhwehwɛ stock aguadi mu nkɔso ne gua no nyinaa mu a, ɛkyerɛ sɛ wubehu mprempren tebea no na woanya ahotoso wɔ wo nsusuwii ahorow mu ɛfa nneɛma bo a wɔbɛma anya nkɔso bio ho no , . de nnwinnade a wɔde yɛ mfonini di dwuma. Enti, botae titiriw a ɛwɔ mfiridwuma mu nhwehwɛmu mu ne sɛ wobehu bere a ɛfata a ɛsɛ sɛ wohyɛn aguadi bi mu, bere a wɔahu eyi ho gyinaesi wɔ nhyehyɛe ahorow no ankasa so no.

Akwankyerɛ a ɛfa aguadi mfiridwuma mu nhwehwɛmu ho

Mfiridwuma mu nhwehwɛmu a wɔyɛ wɔ aguadi mu no wɔ akwan atitiriw abien:

- Nsɛm a ɛtaa ba a ɛne akontaabu ahorow bi anaa nea wɔaka abom hyia ho nkyerɛkyerɛmu.

- Mfonini mu nsɛm a wɔde di dwuma.

Akontaabu ne nhwɛso ahorow a ɛfa mfiridwuma mu nhwehwɛmu ho wɔ aguadi mu a wɔde mfonini bi di gua: dɛn ne ne nea ɛkyerɛ

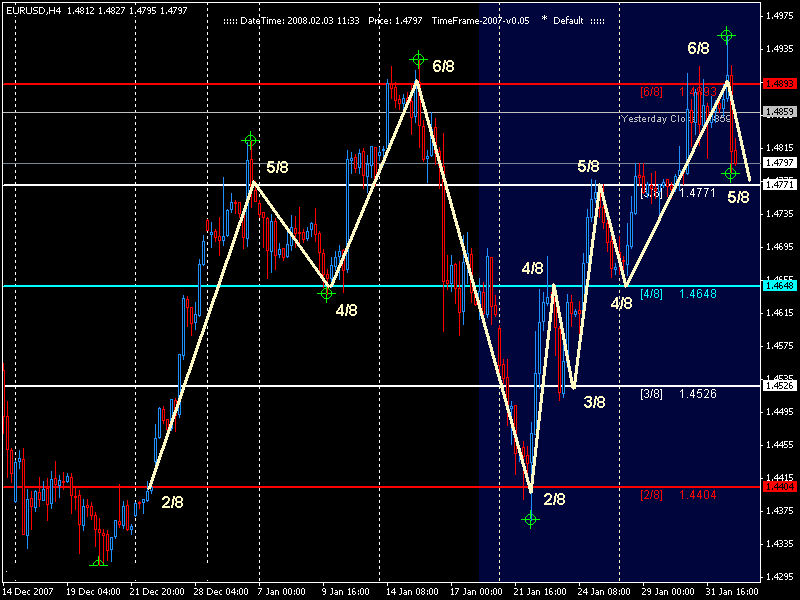

Wɔn a wɔtaa

akontaabu ne nhyehyɛe a wɔde di dwuma wɔ mfiridwuma mu nhwehwɛmu mu akyi no wɔ awerɛhyem sɛ nsakrae, nsakrae ne nsakrae a ɛba wɔ nneɛma bo nhyehyɛe mu no yɛ adebɔ mu adeyɛ ma sikasɛm gua no. Graphic mfonini, nea edi kan koraa no, ma wo kwan ma wo ani hu sɛnea nneɛma bo kɔ so – nneɛma a ɛrekɔ so. Bio nso, wobetumi ahu dynamic trend lines (mmoa ne resistance) wɔ charts no so. Eyinom ne fã ahorow a ɛwɔ ase a nhwɛsode no ntumi nkɔ fam mprempren (mmoa gyinabea) anaasɛ ɛrentumi nkɔ soro (resistance level).

Nsɛnkyerɛnnede: dɛn ne na ɔkwan bɛn so na wɔde di dwuma wɔ mfonini nhwehwɛmu mu?

Wɔ mfiridwuma mu nhwehwɛmu adesua a ɛtɔ so mmienu no mu no, wɔde mfoniniyɛ nneɛma soronko di dwuma – nsɛnkyerɛnneɛ. Saa adwinnade yi ma sɛnkyerɛnne pɔtee bi a ɛkyerɛ sɛ ntease wom sɛ wobɛtɔ/tɔn agyapade. Wɔ aniwa so no, nsɛnkyerɛnne no te sɛ mfonini mfonini ahorow, a wɔabu ho akontaa na wɔahyehyɛ sɛ ade a wɔde ka bo module no ho. Wɔkyekye no sɛnea sɛ wɔkyekyem pɛpɛɛpɛ a, nneɛma bo a ɛsom anaasɛ sɛnea wɔn nsakrae no te no te. Nsɛnkyerɛnnede ahorow no wɔ nhyehyɛe no nkyɛn denam bo module so, anaasɛ wɔ nhyehyɛe a ɛyɛ nkitahodi nhyehyɛe a ɛsakrasakra a ɛyɛ soronko wɔ tab foforo mu. Ɛmfa ho ɔyɛkyerɛ option no, adwuma titiriw a saa adwinnade yi yɛ ne sɛ ɛbɛma ayɛ den, apaw random volatility na akyerɛ pefee sɛnea ɛrekɔ so denam bo module so wɔ gua so mprempren bere yi.

Mmoa nwoma! Nea ɛyɛ mmerɛw sɛ wobesua na wɔasiesie na sɛnea sɔhwɛ ahorow pii kyerɛ no, nnwinnade a wɔde yɛ nhyehyɛe a wotumi de ho to so sen biara ne nkyerɛwde a wɔde kyerɛ sɛnea nneɛma bo yɛ den, kyerɛ sɛ, nhyehyɛe ahorow a ɛkyerɛ bo a ɛsom bo a ɛwɔ bo module no mu wɔ bere a etwa to no mu.

Mfiridwuma mu Nhwehwɛmu: Mfitiasesɛm a Ɛfa Wɔn a Wɔafi Ase Ho

Nsiesiei atitiriw abiɛsa na ɛwɔ hɔ a mfiridwuma mu nhwehwɛmu no mu ade titiriw no nyinaa gyina so:

- Biribiara ka bo no ho . Ɛho hia sɛ yɛte ase na yehu nea sikasɛm mu agyapade bi bo pɔtee bi fi mu mprempren. Wɔn a wodi saa kwan yi akyi a wɔfa so hwehwɛ nsakrae aguadi mu no kyerɛ sɛ nsɛm foforo a aba foforo nyinaa, nsakrae a ɛba afã horow no nyinaa wɔ nsakrae no so (adetɔnfo-adetɔfo), ahyehyɛde ahorow nyinaa a ɛhwɛ sikasɛm nnwumakuw adwuma so ne akwanhwɛ a wɔn a wɔde wɔn ho hyɛ nsakrae aguadi mu no hwɛ kwan – biribiara te saa mprempren bo no fã bi. Ɛho hia sɛ wuhu eyi na ɛno ansa na woakɔ stock exchange no mu.

- Bo module no a ɛkɔ so no gyina mprempren tebea no so . Module no nyɛ nea ɛnhyia na ɛnyɛ nea ɛyɛ pɛ na ɛsakra, na mmom egyina ntease pɔtee bi so. Dodow a emu da hɔ no, dodow no ara na obi a ɔde ne ho hyɛ nsakrae aguadi mu no bɛkyere nsakrae yi ntɛmntɛm. Wɔn a wɔde wɔn ho hyɛ mu nyinaa yɛ nnipa, enti, wɔde wɔn ani asi so sɛ wɔbɛyɛ apam pa. Enti, wohyehyee adee, na ahwehwedee di akyire firi mu – adee titire a ewo gua no mu. Eyi ne ɔkwan a wɔfa so hyehyɛ nneɛma a ɛrekɔ so.

- Sɛnea abakɔsɛm kyerɛ no, nneɛma bo a ɛkɔ soro no yɛ nea ɛba bere ne bere mu . Ɛyɛ den sɛ yɛbɛkyerɛ nea enti a eyi te saa: ebia asɛm no wɔ adwene mu tebea horow a ɛfa nnipa nneyɛe ho no mu. Efi ha no, nneyɛe a ɛba ara kwa di akyi: sɛ tebea a ɛwɔ gua so no ntumi nnyina a, wɔtɔn agyapade, sɛ tebea no yɛ komm a, wɔtɔ. Nkɛntɛnso a ɛne no bɔ abira nso wɔ hɔ – bo module no kɔ soro bere a wɔde sɛnkyerɛnne bi ma, a aguadifo ne wɔn a wɔde wɔn sika hyɛ mu nyinaa kenkan, sɛ wɔbɛtɔ agyapade bi.

Mfitiaseɛ ne akwan a wɔfa so yɛ mfiridwuma mu nhwehwɛmu wɔ aguadi mu – nteteeɛ ma wɔn a wɔrehyɛ aseɛ ne wɔn a wɔakɔ anim: https://youtu.be/uwxmyD-qQtU

Anigyesɛm!Nsakrae a ɛtaa ba ne gua no nkɔso nyɛ obiara nwonwa bio, enti sɛ́ wobɛhwɛ so na woabɔ mmɔden sɛ wobɛkɔ so adi suban foforo a ɛwɔ nsakrae no mu no yɛ den, nanso ɛnyɛ anigye a ɛba fam koraa!

Bio nso, wobetumi de mfiridwuma mu nhwehwɛmu adi dwuma wɔ sikasɛm mu adwinnade biara ho. Agyapade a ɛyɛ mmerɛw pii wɔ hɔ a wobetumi adi ho dwuma na wɔadi so, na “Mfiridwuma” de nso sua, nanso eyi nkyerɛ sɛ wontumi nni akyi.

Guadi mu nhwehwɛmu: mfiridwuma anaa ɔkwan titiriw a wɔfa so yɛ ade

Akwan pii wɔ hɔ a wobɛfa so ayɛ cryptocurrency gua no mu nhwehwɛmu, na sɛ worepere wo ho wɔ paw mu a, fa abien no nyinaa di dwuma! Wɔ akwan abien no nyinaa mu no, nneɛma bi wɔ hɔ a ɛho hia bere a wɔde sikasɛm ho nnwinnade reyɛ adwuma no. Momma yɛnhwehwɛ ɔkwan biara so nkɔ akyiri.

Mfiridwuma mu nhwehwɛmu ho mfitiasesɛm

Classic technical analysis gyina nhwehwɛmu akuw a edidi so yi so:

- gyinapɛn nhwehwɛmu – kyerɛ akwan a wobetumi afa so asesa bo module ahorow denam ɔkwan a wɔde aniwa hu so – wɔakyerɛ nhwɛso ne nkyerɛwde ahorow wɔ mfonini a ɛkyerɛ bo ahorow no so;

Kanea a wɔde ayɛ nhwɛso ahorow - graphical analysis a wode indicators di dwuma – da akwan a wobetumi afa so asesa bo module no de akontabuo akontabuo adi dwuma;

- adesua a ɛfa dodow a edi mũ ho – kyerɛ sɛnea ɛbɛyɛ yiye sɛ nsakrae bɛba wɔ bo module no mu daakye fi gyinabea a ɛfa nkitahodi dodow a wɔde sikasɛm adwinnade bi a ɛde bo nsakrae bae no ho;

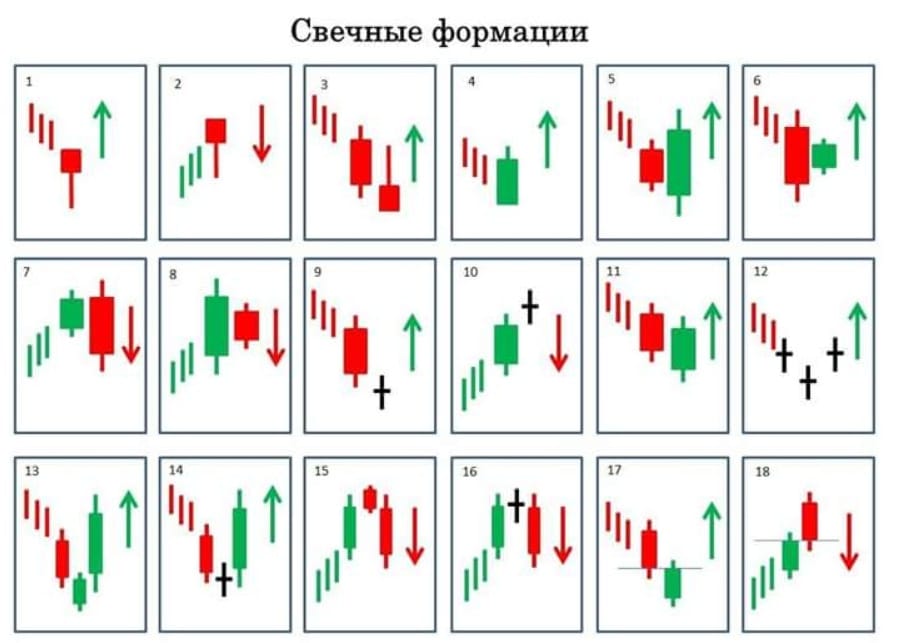

- gua so nhwehwɛmu a wɔde kyɛnere di dwuma – susuw sɛnea ɛbɛyɛ yiye sɛ nneɛma bo bɛkɔ so a egyina Japanfo kyɛnere nneɛma a wɔaka abom so.

Enti dɛn ne nhwehwɛmu akuw biara.

Nhwehwɛmu a Wɔyɛ no Gyinapɛn

Ɔkwan no nteaseɛ ne sɛ wɔyɛ boɔ module nkyerɛwdeɛ ho nhyehyɛeɛ, a ɛhyɛ aseɛ na ɛkyerɛ akwankyerɛ a ɛboɔ no bɛsesa, ne ne gyinabea nso, a ɛkyerɛ mmeaeɛ a wɔn a wɔde wɔn ho hyɛ nsakraeɛ aguadi mu no de wɔn ho hyɛ mu kɛseɛ – saa suban yi na ɛkyerɛ akwan a ebetumi aba sɛ wɔbɛtoa so, adwenem naayɛ anaasɛ wɔadan mprempren su no.

Hyɛ nso! Ansa na wode nhwehwɛmu a ɛte sɛɛ bedi dwuma no, hwɛ hu sɛ wowɔ nimdeɛ a ɛdɔɔso. Mfomso nketenkete mpo betumi ama wahwere ade kɛse.

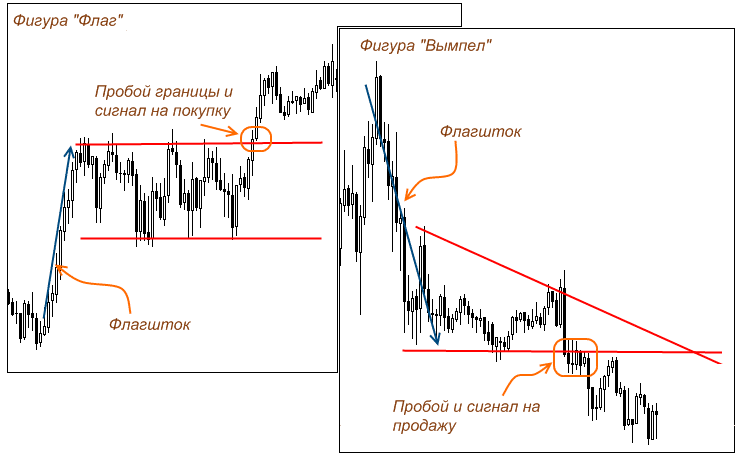

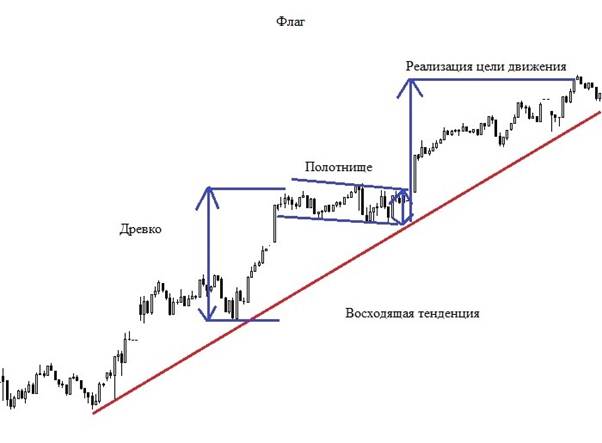

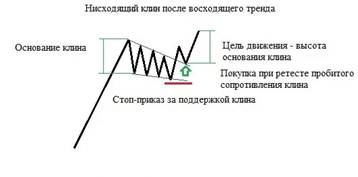

Frɛmfrɛm ne pennant no na ɛma su no kɔ so. Wɔhyehyɛ wɔn wɔ mfonini mfonini so sɛnea edidi so yi: aguadifo akɛse anaa sikasɛm mu asisifo pɛ sɛ wɔtɔ sikasɛm adwinnade bi wɔ nsɛm a eye so, sɛ bo module no sesa ne gyinabea wɔ su no so a ɛkame ayɛ sɛ akwanside biara nni mu na ɛkɔ so gyina hɔ pintinn wɔ ne nsakrae mu (fi mfiridwuma ho adwene mu a nhwehwɛmu a wɔyɛ wɔ bo no ho, wosusuw ne nneɛma atitiriw nso ho ). Enti, wɔ nhyehyɛe no so no, wɔda nhwɛso ahorow a ɛtete saa adi denam bo a ɛkɔ soro nnam a wɔnhwɛ kwan so (nnua), akyiri yi wodu gyinabea ahorow (nhama ahorow) ho, afei wɔde nkate bi ma a ɛkyerɛ nneɛma abien yi trɛw.

ahinanan. Wɔhyehyɛ bere a gua no de pɛyɛ si adetɔfo ne adetɔnfo ntam, bere a wonnim ɔfã a ɛbɛboro so ne ɔkwan a bo no bɛkɔ so akɔ akyiri no. Wɔ mfonini a wɔde kyerɛ no so no, wɔde gyinapɛn a ɛba fam ne nea ɛsen biara na ɛyɛ ahinanan no, ne nsakrae a ɛreyera, a ɛkyerɛ sɛ wɔn a wɔde wɔn ho hyɛ mu no fã biako ba fam sen ɔfã foforo no.

Mfonini nhwehwɛmu a wɔde nsɛnkyerɛnnede ahorow di dwuma

Nsɛnkyerɛnneɛ no fã no ka akontabuo akwan a wɔfa so kyerɛ boɔ module a ɛkorɔn a nteaseɛ nnim (wɔtɔɔ boro so) ne boɔ a ɛba fam a ɛnteɛ (wɔtɔn boro so) nyinaa a ɛfa kankyee ahodoɔ a atwam no ho. Ade biara a ɛrekɔ so no wɔ bere a ɛma nkɔso ne nkɔso a ɛkɔ fam / ɛkɔ fam nyinaa. Enti, obi betumi atɔ sikasɛm adwinnade bi wɔ bo a eye wɔ ɔkwan a ɛkɔ soro so na afei wasan atɔn no bo kɛse so, anaasɛ ɔde oscillators atɔ agyapade bi wɔ bo a ɛyɛ anigye sen biara so. Mfitiaseɛ oscillators (indicators) ne Relative Strength Index.Wɔkyerɛ boɔ tebea wɔ formed ne nsakraeɛ ranges a price module volatility, nyinaa kɔ soro ne fam.

Mmoa nwoma! Wɔtaa de oscillators ne indicators a edi kan frafra wɔn ho wɔn ho mu, na wonya nkabom a etu mpɔn ma filtering adwuma wɔ stock gua so. Wɔ ɔkwan soronko so no, wɔde oscillators di dwuma ma botae pɔtee bi a wɔpaw a ɛyɛ anigye sen biara.

Nhoma ahorow a edi mũ ho adesua

Nhwehwɛmu a wɔyɛe wɔ aguadi dodow a ɛkɔ so wɔ gua so ho no agye din nnansa yi. Wobetumi ayɛ aguadi dodow nhwehwɛmu wɔ standard TA mu anaasɛ wɔde akwan foforo adi dwuma: cluster nhwehwɛmu ne horizontal volumes ho adesua.

Guadi mu nhwehwɛmu a wɔde kyɛnere ayɛ

Saa kwan a wɔfa so hwehwɛ nneɛma mu yi fii ase wɔ Mfinimfini Mmere no mu na Japanni aguadifo Munehisa Homma na ɔyɛɛ saa. Nnyinasosɛm a ɛwɔ kyɛnere nhwehwɛmu mu ne sɛ wɔyɛ nkɔmhyɛ ahorow bi fa bo module no ho denam Japanfo kyɛnere a wɔaka abom a ɛfa wɔn ho wɔn ho ho di dwuma. Saa kwan yi nso fa adwuma a ankorankoro kaneadua nneɛma a ɛkyerɛ ntease pɔtee bi a egyina beae a su no wɔ mprempren so no yɛ ho. Ntease a ɛwɔ kyɛnere nhwehwɛmu mu ne sɛ wɔbɛbɔ nea ɔde ne ho hyɛ aguadi mu no amanneɛ wɔ tumi a ɛkari pɛ wɔ sotɔɔ ahorow no mu bere a nneɛma bo a wobue ne nea wɔde to mu no yɛ pɛ no.

Fapem nhwehwɛmu: dɛn ne ne titiriw

Sikasɛm ne nsakrae niches wɔ agyapade a ɛyɛ spontaneity: mpo tebea horow a ɛho nhia sen biara, nsakrae anaa ɔhaw ahorow a ɛho hia sɛ ɛde tebea a ɛnkari pɛ ba bo module no mu – nsakrae bo sesa, nsɛm a wɔafa aka no sesa. Tebea a ɛte saa no betumi anya adwene a ɛbɛkyɛ (sikasɛm mu ahokyere), anaasɛ ebetumi aba awiei wɔ bere tiaa bi mu – bere a nsakrae a ɛte saa no bɛba no gyina sɛnea adeyɛ no kɛse te ne sɛnea ɛkaa sikasɛm so. Fapem nhwehwɛmu wɔ aguadi mu yɛ ɔkwan a ɛma stock aguadifo tumi sesa wɔn suban bere a wɔredi gua no. Nhwehwɛmu titiriw hwehwɛ sɛ nsɛm foforo kɔ so bere nyinaa, ne nimdeɛ dodow a ɛdɔɔso ne obi a ɔde ne ho hyɛ aguadi aguadi mu no ho adwene a emu da hɔ ankasa. Esiane eyi nti, ɛnyɛ sɛ wubetumi ahu nsɛm ho amanneɛbɔ ho nsɛm ntɛmntɛm na woadi ho dwuma nko na ɛho hia, .

Nnwinnade a wɔde di dwuma wɔ mfiridwuma mu nhwehwɛmu mu

Mfiridwuma mu nhwehwɛmu ye efisɛ sɛnea wɔde bedi dwuma no, aguadifo betumi de nnwinnade biara a ɛyɛ mmerɛw na etu mpɔn a ɛfa n’adwuma ho adi dwuma, efisɛ wɔn dodow dɔɔso yiye. Nanso, linear nnwinnade adi kan wɔ nneɛma a wɔde sesa nneɛma mu bere tenten ni. Linear TA nnwinnade no bi ne nsensanee a wɔahyehyɛ: nsensanee a ɛda hɔ, ɛda fam ne nsensanee a ɛkɔ so.

Anika! Ebinom a wɔde wɔn ho hyɛ exchange trading mu no twe levels wɔ angle bi so – dodow a angle no dodow kɔ soro no, dodow no ara na su no renya ahoɔden. Enti, wobu nsensanee a wɔatwe wɔ anim a ɛyɛ 45° no sɛ ɛyɛ ɔkwan a ɛkɔ so denneennen.

Sɛnea wɔyɛ mfiridwuma mu nhwehwɛmu: anammɔn anammɔn akwankyerɛ a wɔde bɛhwehwɛ nsakrae ne sikasɛm gua so nnwuma mu

Aguadi nhyehyɛe dodow no ara yɛ akuw a edidi so yi mu biako fã:

- trend aguadi;

- aguadi a ɛpaapae;

- aguadi a ɛkɔ ɔkwan a ɛyɛ den so;

- counter trend aguadi .

Trend aguadi

Wɔ saa adwuma yi mu no, nkonimdi fomula ne: su + beae a ɛho hia + entry sɛnkyerɛnne.

- su a ɛrekɔ so . Ɛha no, mfaso wɔ so kɛse sɛ wode nkyerɛwde a ɛkɔ soro bedi dwuma.

- Beae a ɛho hia ne horizontal levels, trend lines anaasɛ moving averages.

- Nsɛnkyerɛnne a ɛkyerɛ sɛ wɔhyɛn mu . Sɛ́ sɛnkyerɛnne a ɛkyerɛ sɛ wobɛkɔ mu no, wubetumi de ɔkwan biara a wɔfa so yɛ gua so nhwehwɛmu a wɔada no adi wɔ atifi hɔ no adi dwuma. Sɛ nhwɛso no, ɛbɛyɛ kyɛnere mu nhwehwɛmu.

Breakout aguadi

Nsakrae a ɛba wɔ bo module no mu no nyɛ nea ɛkɔ so daa, enni nhyehyɛe pɔtee bi. Wɔde mmere a ɛboɔ sesa kakra no si mmerɛ a ɛboɔ module no huruw kɔ soro ne fam no ananmu. Eyi kyerɛ sɛ bere a eye sen biara a wɔde bɛpaapae nneɛma mu ne bere a nneɛma bo a ɛkɔ fam no sakra. Nhyehyɛeɛ:

- Yɛkyerɛ bo a ɛsakrasakra no dodow: bo module no mu nsakrae kɛse anaasɛ ɛba fam. Saa atirimpɔw ahorow yi nti, wubetumi de ATR oscillator no adi dwuma, ɛma wutumi hu tebea a nsakrae no wom mprempren. Bere a nsakrae a ɛba fam no kyerɛ sɛ ɛrenkyɛ na gua no retwɛn nneɛma foforo.

- Yɛretwɛn sɛ sɛnkyerɛnne no bɛba mu.

Mfaso ne ɔhaw ahorow a ɛwɔ mfiridwuma mu nhwehwɛmu mu

Te sɛ ɔkwan biara a wɔfa so yɛ adwuma wɔ sikasɛm ho gua so no, TA nhyehyɛe no wɔ mfaso ne ɔhaw ahorow. Ahoɔden a ɛwom:

- Wobetumi de TA adi dwuma wɔ sikasɛm mu nnwinnade biara ho ne niches biara mu: ɛfata ma wiase aman ahorow sika ne sikakorabea ahorow nyinaa;

- charts a wɔde di dwuma no ma aguadifo no tumi hwehwɛ bere biara mu wɔ ɔkwan soronko so – efi simma 60 kosi afeha;

- akwan a wɔfa so yɛ mfiridwuma mu nhwehwɛmu no gyina nneyɛe a ɛrekɔ so wɔ nsakrae ankasa so;

- Nsɛm a wɔde di dwuma wɔ TA mu nyinaa yɛ nea ɛwɔ hɔ nnɛ.

Afã horow a ɛyɛ mmerɛw:

- asɛmti a wɔde di dwuma. Adwene a nnipa ahorow baanu a wɔde wɔn ho hyɛ aguadi mu aguadi mu wɔ tebea pɔtee bi ho no betumi ayɛ soronko koraa, na ɛnyɛ den sɛ aguadifo a onnim ade betumi ahu nea ɔpɛ sɛ ohu, na ɛnyɛ mfonini ankasa a ɛrekɔ so mprempren wɔ gua so no;

- TA ka sɛ ɛkyerɛ biribi a ebetumi aba sɛ asɛm bi bɛba nkutoo, nanso ɛmma ahotoso pɔtee bi sɛ ɛbɛba;

- mfiridwuma mu nhwehwɛmu gyina akontaabu dwumadi so, enti wɔ wɔn a wɔrefi ase a ebia wonni nimdeɛ ne ahokokwaw a ɛdɔɔso fam no, ɔkwan a wɔfa so hwehwɛ gua no mu yi bɛyɛ te sɛ nea ɛyɛ den na ɛboro so;

- mfiridwuma mu nhwehwɛmu gyina nsɛm a ɛyɛ foforo ne nsɛm foforo so, enti ɛho hia sɛ wotumi hwehwɛ nsɛm ntɛmntɛm, di ho dwuma na wɔde di dwuma wɔ bere a ɛfa ho no mu.

стадии освоение.изучаю