What is volatility in the exchange market, low and high volatility, calculation and analysis. The concept of volatility can often be found in the vastness of trading. Since it is especially popular there. This term most often means successful transactions and a positive forecast for the movement of various assets. From this we can conclude that volatility is a rather important part in trading, without which it is possible to simply not understand what the participants in any market are talking about.

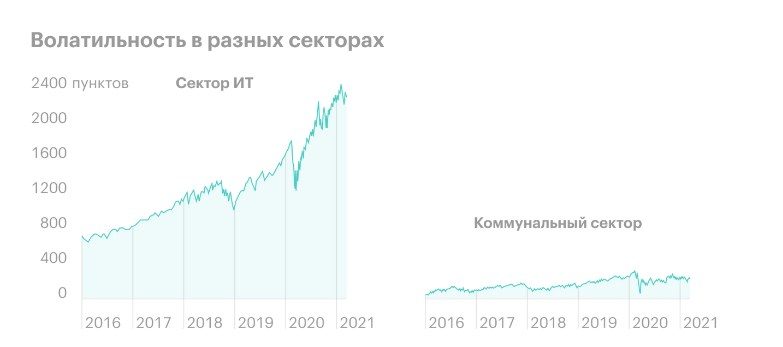

Volatility is the fluctuation in the prices of various assets on the exchange market. Depending on its position, it can be high or low, this position depends on the gap between the maximum and minimum gap in the value of positions.

What influences volatility

Volatility is influenced by a fairly large number of external and internal factors. This includes: various global and corporate events, macroeconomic factors, investment market news, as well as investor sentiment. For example, if a group of large and medium-sized investors has even the slightest doubt about assets, they begin to sell them en masse, and this is why volatility increases. Below will be presented the most common and important factors and cases why volatility is growing. Here are some of them:

- Important economic, market and political events . This factor includes various bans of one country relative to another, or bans of one large company against another.

- Economic and political events . This factor has the greatest impact on volatility. And also this factor can be conditionally divided into two large groups:

- Macroeconomics . This group contains all the information about the unemployment rate, GDP dynamics, base interest rates, inflation, monetary conditions, and so on.

- Geopolitics . And this group includes absolutely all information about elections, about government officials, about sanctions, etc. Basically, these are significant and most important events in the world that strongly affect the stock and exchange market, and can also cause its volatility.

- Company reporting . Also, the volatility of the products of a particular company can be influenced by their financial statements, product reviews or information about the introduction of significant new products on sale, the investor’s day, and so on. This is also a fairly popular reason for the change in volatility, as some kind of unforeseen incidents and situations often occur in companies.

- News and various popular rumors . This reason is also quite popular, since there are a lot of rumors in the media that can affect an increase or decrease in volatility. For example: after information appeared on the Internet that Yandex was buying out Tinkoff Bank. It was based on these rumors that the volatility of Yandex and Tinkoff shares immediately increased and almost reached their maximum position.

- Market manipulation . This reason is based on the actions of large businessmen and market makers, who, by their decisions, have a major impact on the position of volatility in the exchange and stock markets. But we also must not forget that not only popular people who have great power over society and their opinion, but also ordinary users of social networks can influence volatility. But before carrying out such manipulations, one must not forget that these actions can lead to certain not very good consequences. Although it is difficult to prove them, it is better not to risk your reputation.

Positive and negative sides of volatility

Every self-respecting investor should know about the pros and cons of each concept in the stock market. That is why, as in every concept, volatility has both positive and negative sides for an investor.

Positive side

There are many advantages to volatility that will help investors make profitable deals on the stock market. Here is one of the most important. When there is a drawdown in the stock market, volatility greatly helps all investors to buy profitable and payback assets. At the moment when the price of shares of a large company falls precisely because of volatility, then at that moment the multipliers become quite low and it is at this time that shares and securities can be bought at an attractive price, with large discounts.

Negative side

But volatility also has its own drawbacks and drawbacks for the investor. But these shortcomings affect only novice investors who are afraid of volatility itself. Here are some of these downsides:

- It is mainly because of the fear of volatility that investors make rather stupid and unreasonable decisions that affect their financial earnings. For example: sometimes they sell their securities and shares exactly when prices have dropped significantly, but already at the same time they begin to rise. It is because of this that it is necessary to carefully monitor the movement of volatility and remember its main movements.

- Due to the movement of volatility, the final value of the portfolio can clearly decrease. This problem is quite common for investors. After all, until all assets are sold, they will be considered only losses. For investors, this is a rather heavy emotional burden, so this must be carefully monitored, otherwise it may lead to not very good consequences.

How to use volatility in the exchange market

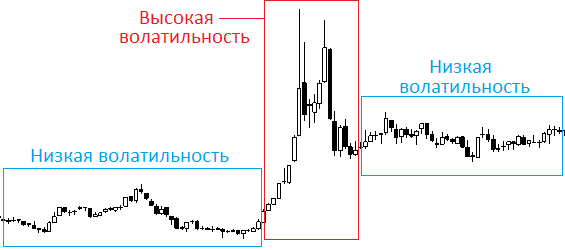

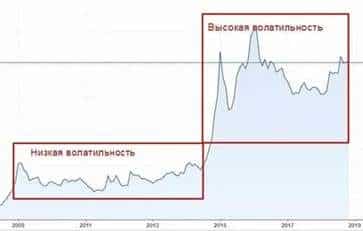

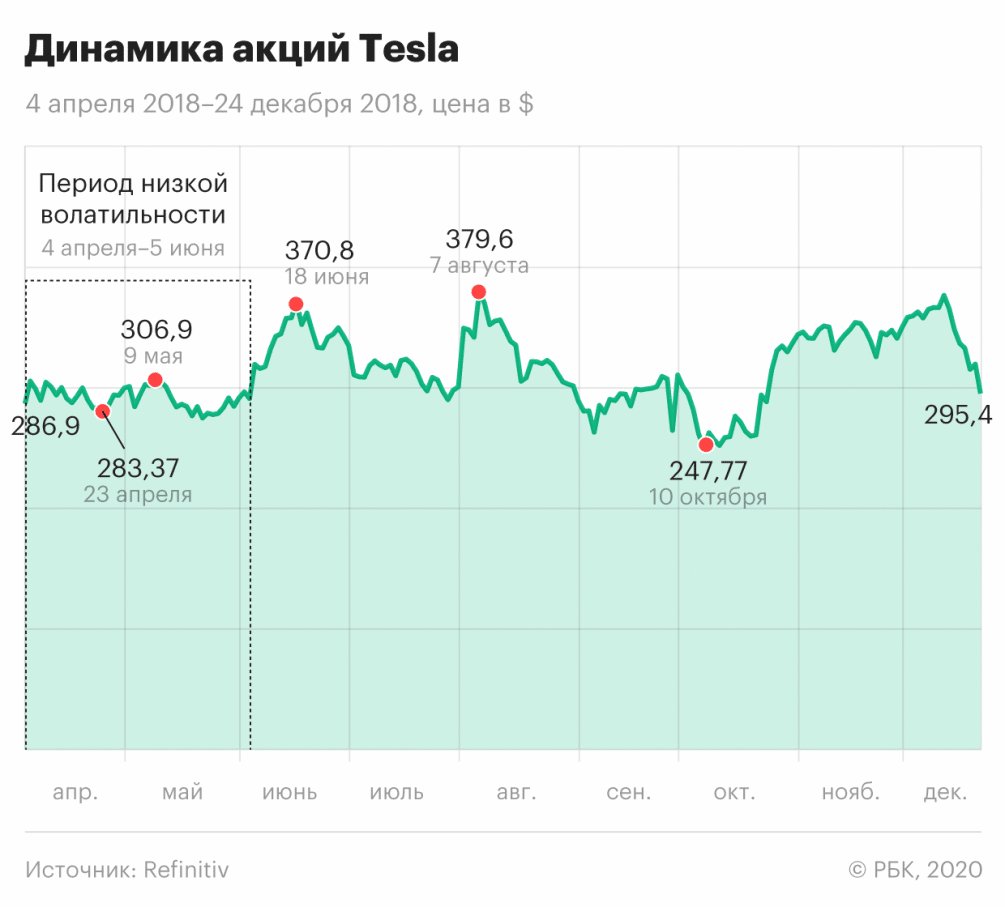

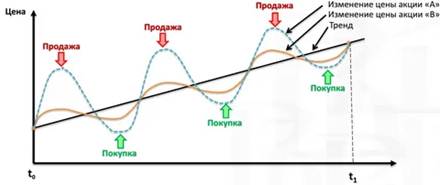

Volatility plays a fairly large role in the financial market, which is why, when developing special tactics, you can focus on it. Basically, experienced investors, to drive risk to a minimum, enter the financial market only during a period of calm, and after that they expect a clear increase in activity and volatility, since there is a large range of price fluctuations. At the moment, this tactic is the most correct and beneficial among all the others.

- Low volatility . This indicator can tell us that the market is not overflowing with orders and it is quite balanced, that is, the price should not change at a certain time. But this is only as long as the trading volume remains the same. That is, if at any time there is a sudden change in the number of sellers or buyers in the market, then at this time the price will have to rise very strongly.

- High volatility . If an investor sees that the volatility in the market is high, then this may indicate that there is simply no point in entering the market now, since it is no longer possible to buy anything at a bargain price. It should also be remembered that this is also considered a very dangerous move, since in this case you can not only get nothing, but at the same time trade with disadvantages.

- Decreasing volatility . If volatility goes down, then this is exactly the same as low volatility can tell an investor that the price will only grow in the near future and that this is the most favorable time to enter the stock and exchange market to search for various assets and securities …

- Increasing volatility . This volatility position can tell the investor that this is a great opportunity to enter the market and make purchases that are quite profitable for him, however, as the opportunity for opening positions increases, the risk of loss also increases.

Volatility calculation

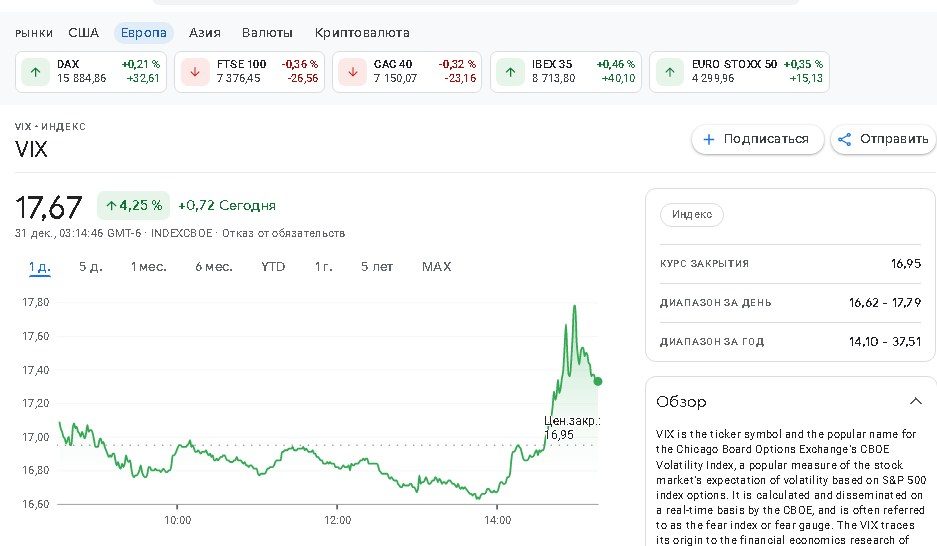

There are two types of volatility in the stock market:

- Realized or historical . This concept shows the deviation of the price from the most average indicator for any previously established settlement period. You also need to know that most often volatility is measured as a percentage.

- Expected . Such volatility represents future price fluctuations that a trader expects in the near future. That is, it is considered a more predictable value. You also need to know that in most cases the expected volatility does not coincide with the real one. This is due to the fact that it is simply not possible to accurately predict the future at all times.

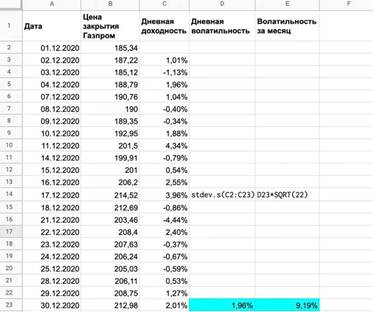

- In order to start calculating volatility, you need to open the Excel program, which is found on almost all computers.

- Upload all available data to the program, and then insert the required formula for calculating volatility and income.

- Get the desired result in the total icon.