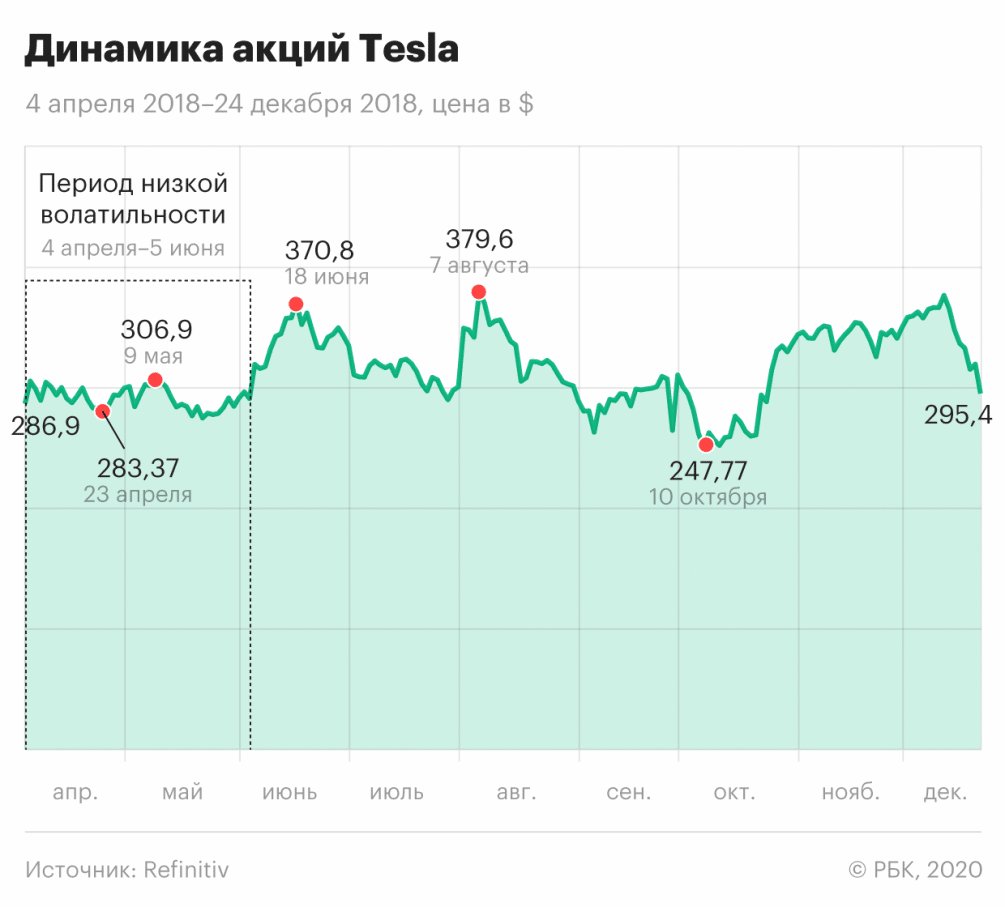

Mene ne rashin daidaituwa a cikin kasuwar jari, ƙananan ƙananan ƙima, ƙididdiga da bincike. Ana iya samun ma’anar rashin daidaituwa sau da yawa a cikin girman ciniki. Domin ya shahara sosai a wurin. Wannan kalmar galibi tana nufin yin ma’amaloli masu nasara da ingantaccen hasashen motsin kadarori daban-daban. Daga wannan za mu iya ƙarasa da cewa volatility wani wajen da muhimmanci sashe a cikin ciniki, ba tare da wanda zai yiwu a kawai kasa fahimtar abin da mahalarta na kowace kasuwa ke magana game da. [taken magana id = “abin da aka makala_12266” align = “aligncenter” nisa = “565”] Ƙarƙashin ƙima da ƙaranci

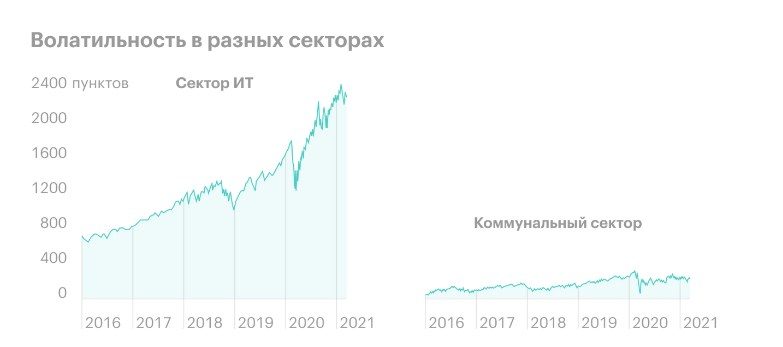

Ƙarfafawa shine sauyin farashin kadarori daban-daban a kasuwar canji. Dangane da matsayinsa, zai iya zama babba da ƙananan, wannan matsayi ya dogara da rata tsakanin matsakaicin matsakaici da ƙananan rata a cikin darajar matsayi.

Abin da ke shafar rashin daidaituwa

Ƙaƙƙarfan ɗimbin yawa na abubuwan waje da na ciki suna shafar haɓakawa. Wannan ya haɗa da: abubuwa daban-daban na duniya da na kamfanoni, abubuwan tattalin arziki, labarai na kasuwannin zuba jari, da kuma ra’ayin masu saka jari. Misali, idan gungun manyan masu saka hannun jari da matsakaitan masana’antu suna da ko da ɗan shakku game da kadarorin, sai su fara sayar da su gabaɗaya, kuma daga wannan ne rashin daidaituwa ke girma. Abubuwan da suka fi dacewa da mahimmanci da kuma lokuta da yasa rashin daidaituwa ke girma za a gabatar da su a ƙasa. Ga wasu daga cikinsu:

- Muhimman abubuwan tattalin arziki, kasuwa da siyasa . Wannan lamari ya hada da haramcin daban-daban na wata kasa a kan wata, ko kuma haramcin wani babban kamfani akan wani.

- Ci gaban Tattalin Arziki da Siyasa . Wannan factor yana da tasiri mafi girma akan rashin daidaituwa. Kuma wannan factor za a iya raba zuwa manyan kungiyoyi biyu:

- Macroeconomics . Wannan rukunin yana wakiltar duk bayanan game da rashin aikin yi, yanayin GDP, ƙimar riba mai tushe, hauhawar farashin kayayyaki, yanayin kuɗi, da sauransu.

- Geopolitics . Kuma wannan kungiya ta kunshi cikakken dukkan bayanai game da zabuka, na ma’aikatan gwamnati, game da takunkumi, da dai sauransu, a hakikanin gaskiya, wadannan su ne mafi muhimmanci da muhimman al’amura a duniya wadanda ke matukar tasiri a kasuwar hada-hadar hannayen jari da musayar hannayen jari, kuma za su iya haifar da shi. rashin daidaituwa.

- Rahoton kamfani . Hakanan, rashin daidaituwa na samfuran wani kamfani na iya shafar bayanan kuɗin su, sake dubawa na samfuran ko bayanai game da gabatarwar sabbin samfura masu mahimmanci, ranar mai saka hannun jari, da sauransu. Wannan kuma sanannen dalili ne na canza rashin daidaituwa, kamar yadda kamfanoni sukan sami wasu nau’ikan abubuwan da ba a zata ba da yanayi.

- Labarai Da Shahararrun Jita-jita . Wannan dalili kuma ya shahara sosai, saboda ko da yaushe akwai jita-jita da yawa a cikin kafofin watsa labarai waɗanda zasu iya shafar haɓaka ko raguwa a cikin rashin ƙarfi. Misali: bayan bayanan da suka bayyana akan Intanet cewa Yandex yana siyan Tinkoff Bank. Dangane da waɗannan jita-jita, haɓakar hannun jari na Yandex da Tinkoff nan da nan ya karu kuma kusan ya kai matsakaicin matsayi.

- magudin kasuwa . Wannan dalili ya dogara ne akan ayyukan manyan ‘yan kasuwa da masu kasuwa, waɗanda, tare da yanke shawara, suna da babban tasiri a kan matsayi na rashin daidaituwa a cikin musayar da kasuwanni. Amma kuma kada mu manta cewa ba kawai mashahuran mutane waɗanda ke da babban iko a kan al’umma da ra’ayinsu na iya yin tasiri ga rashin daidaituwa ba, amma har ma masu amfani da zamantakewa na yau da kullun. Amma kafin aiwatar da irin wannan magudi, kada mu manta cewa waɗannan ayyukan na iya haifar da wasu sakamako marasa kyau. Ko da yake yana da wuya a tabbatar da su, yana da kyau kada ku yi kasada da sunan ku.

[taken magana id = “abin da aka makala_12267” align = “aligncenter” nisa = “1005”]

Abubuwan da ke da kyau da mara kyau na rashin daidaituwa

Kowane mai saka jari mai girmama kansa ya kamata ya san fa’ida da rashin amfani da kowane ra’ayi a cikin kasuwar hannun jari. Abin da ya sa, kamar yadda a cikin kowane ra’ayi, rashin daidaituwa yana da bangarori masu kyau da marasa kyau ga mai saka jari.

Bangaskiya mai kyau

Ƙarfafawa yana da fa’idodi da yawa waɗanda za su taimaka wa masu zuba jari yin ciniki mai riba a cikin kasuwar hannun jari. Ga daya daga cikin mafi mahimmanci. Lokacin da aka sami raguwa a cikin kasuwar hannun jari, rashin daidaituwa yana taimaka wa duk masu zuba jari su sayi kadarorin riba da riba. A halin yanzu lokacin da farashin hannun jari na babban kamfani ya faɗi daidai saboda rashin daidaituwa, to a wannan lokacin masu haɓakawa sun zama ƙasa kaɗan kuma a wannan lokacin ne za a iya siyan hannun jari da tsare-tsare a farashi mai ban sha’awa, tare da babban ragi.

Bangaranci mara kyau

Amma sauyin yanayi yana da nasa wasu illoli da rashin amfani ga mai saka jari. Amma waɗannan gazawar suna shafar kawai novice masu saka hannun jari waɗanda ke tsoron rashin ƙarfi da kanta. Ga wasu daga cikin wadancan illolin:

- Yawancin saboda tsoron rashin daidaituwa ne masu zuba jari ke yin wauta da yanke shawara marasa ma’ana waɗanda ke shafar abin da suke samu na kuɗi. Misali: wani lokacin suna sayar da hannun jari da hannun jari lokacin da farashin ya faɗi sosai, amma tuni a lokaci guda suka fara tashi. Saboda haka ya zama dole a lura da motsin motsi da kuma haddace babban motsinsa.

- Saboda motsi na rashin ƙarfi, jimillar ƙimar fayil ɗin na iya raguwa a fili. Wannan matsala ta zama ruwan dare ga masu zuba jari. Bayan haka, har sai an sayar da duk kadarorin, za a yi la’akari da su kawai asara. Ga masu zuba jari, wannan nauyi ne mai nauyi mai nauyi, don haka dole ne a kula da wannan a hankali, in ba haka ba yana iya haifar da sakamako mai kyau.

[taken magana id = “abin da aka makala_12270” align = “aligncenter” nisa = “800”]

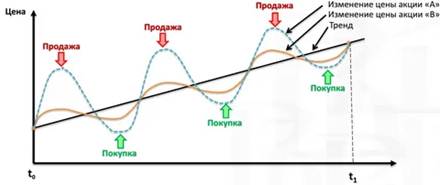

Yadda ake amfani da volatility a cikin kasuwar hannun jari

Volatility yana taka rawa sosai a cikin kasuwar kuɗi, wanda shine dalilin da ya sa lokacin haɓaka dabaru na musamman, zaku iya mai da hankali kan shi. Ainihin, masu zuba jari masu gogaggen, don rage girman haɗari, shigar da kasuwar hada-hadar kuɗi kawai a lokacin lokacin kwanciyar hankali, sa’an nan kuma jira ƙarin haɓakar aiki da rashin daidaituwa, kamar yadda akwai babban kewayon farashin farashin. A halin yanzu, wannan dabara ita ce mafi daidai kuma mafi riba a tsakanin sauran.

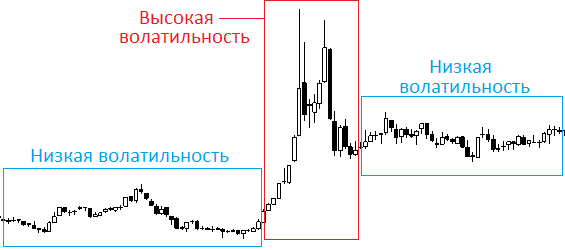

- Ƙananan rashin ƙarfi . Wannan mai nuna alama zai iya gaya mana cewa kasuwa ba ta cika da umarni ba kuma yana da daidaito sosai, wato, a wani lokaci farashin kada ya canza. Amma wannan shine kawai idan har girman ciniki ya kasance iri ɗaya. Wato idan a kowane lokaci za a sami canji kwatsam na yawan masu siyarwa ko masu siya a kasuwa, to a lokacin ne farashin zai tashi sosai.

- Babban rashin ƙarfi . Idan mai saka hannun jari ya ga ana samun sauyin yanayi a kasuwa, to wannan na iya nuna cewa babu wata fa’ida a shiga kasuwar a yanzu, tun da ba za a iya siyan komai a kan farashi ba. Har ila yau, kuna buƙatar tunawa cewa wannan kuma ana la’akari da motsi mai haɗari, tun da yake a cikin wannan yanayin ba za ku iya samun kome ba kawai, amma har ma kasuwanci a cikin ja.

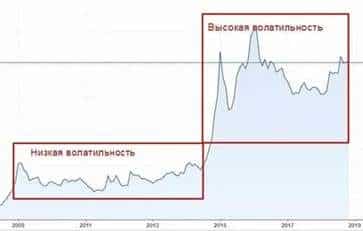

- Rage rashin ƙarfi . Idan rashin daidaituwa ya ragu, to, wannan daidai yake da ƙananan rashin daidaituwa na iya gaya wa mai saka jari cewa farashin zai girma ne kawai a nan gaba kuma wannan shine lokaci mafi kyau don shigar da kasuwanni da musayar kasuwanni don neman dukiya da tsaro daban-daban. .

- Tashin rashin ƙarfi . Wannan matsayi na rashin daidaituwa zai iya gaya wa mai saka jari cewa wannan babbar dama ce ta shiga kasuwa da kuma yin sayayya da ke da riba sosai a gare shi, duk da haka, yayin da damar bude matsayi ya karu, haɗarin hasara kuma yana ƙaruwa.

Ƙimar rashin ƙarfi

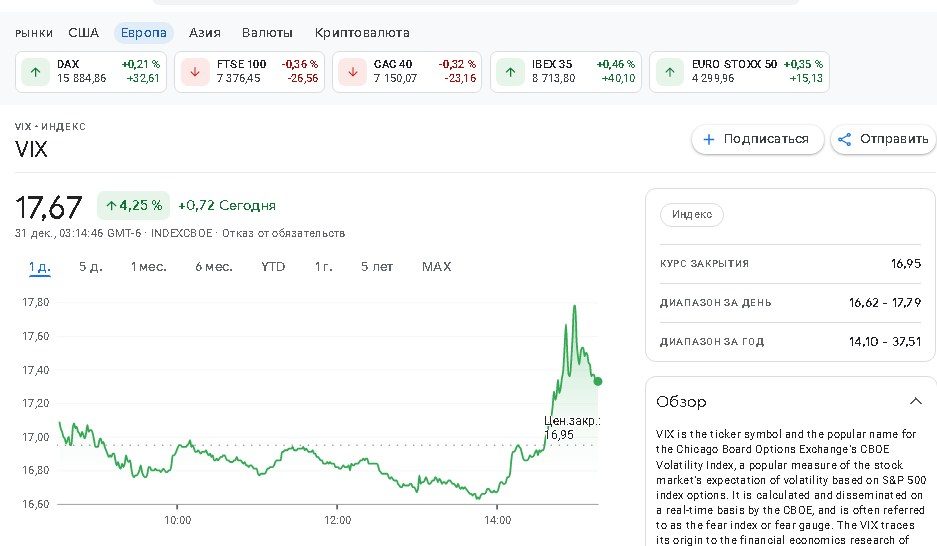

Akwai nau’i biyu na rashin daidaituwa a cikin kasuwar hannun jari:

- Gane ko tarihi . Wannan ra’ayi yana nuna karkatar da farashin daga mafi yawan matsakaicin nuni ga kowane lokacin lissafin da aka kafa a baya. Hakanan kuna buƙatar sanin cewa galibi ana auna rashin ƙarfi azaman kashi.

- Wanda ake tsammani . Wannan rashin daidaituwa yana wakiltar canjin farashi na gaba wanda mai ciniki ke tsammani a nan gaba. Wato, ana la’akari da ƙimar tsinkaya. Hakanan kuna buƙatar sanin cewa a mafi yawan lokuta canjin da ake tsammani bai dace da ainihin ba. Wannan shi ne saboda gaskiyar cewa ba zai yiwu ba a koyaushe a yi hasashen makomar gaba daidai.

[taken magana id = “abin da aka makala_12274” align = “aligncenter” nisa = “783”]

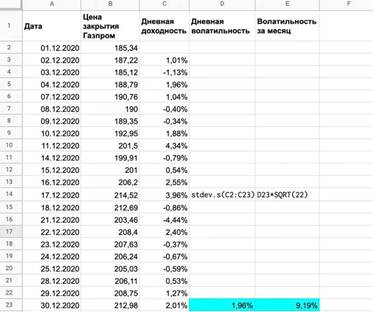

- Don fara ƙididdige ƙididdiga, kuna buƙatar buɗe shirin Excel, wanda ke kan kusan dukkanin kwamfutoci.

- Loda duk bayanan da ke akwai zuwa shirin, sannan saka tsarin da ake so don ƙididdige ƙima da samun kudin shiga.

- Samu sakamakon da ake so a cikin jimlar gunkin.