The whole truth about the stock broker . A novice investor or trader who wants to buy stocks, bonds and other financial assets should understand that he needs a brokerage account. You can’t just go to the office of the exchange and buy assets there. There must be an intermediary between the exchange and the buyer.

- Intermediary between the exchange and the trader / investor

- How to choose a broker – important criteria other than a license

- What does a broker do?

- Opens accounts

- Manages accounts

- Carries out assignments

- Informs about the course of trading

- Provides reports

- Pays tax to the state

- Replenish and credit funds

- How do I open a brokerage account?

- How to work with a broker?

- What to do if a broker goes bankrupt

- As a result

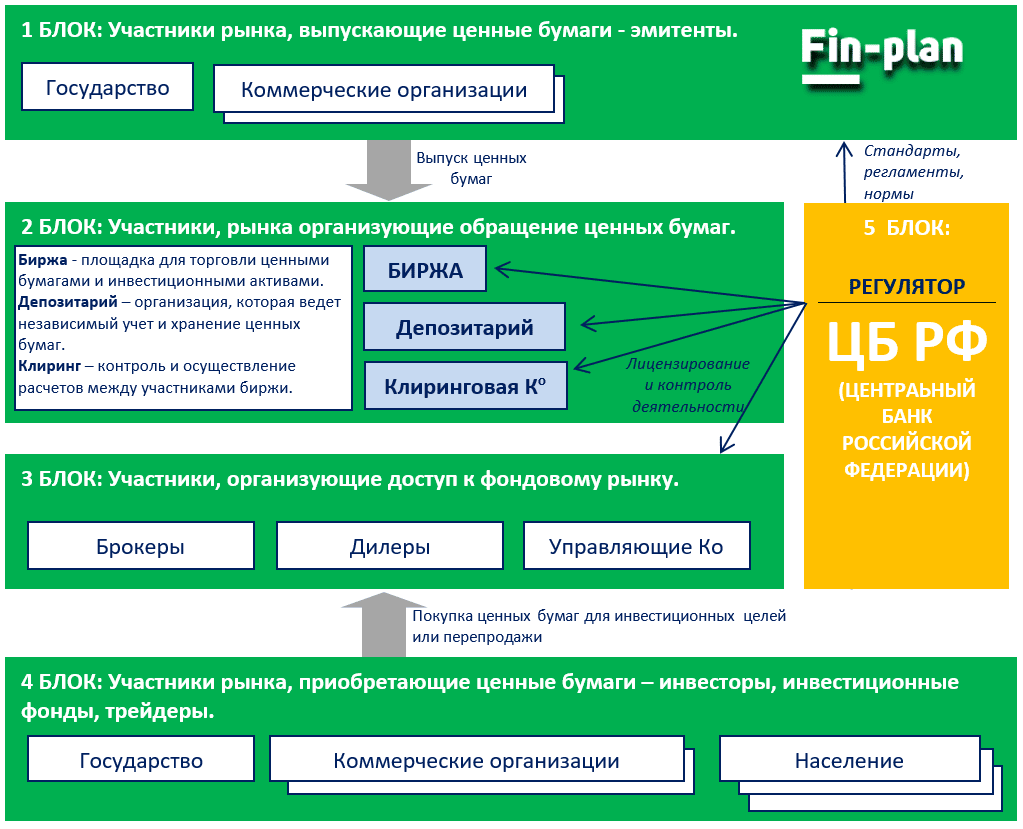

Intermediary between the exchange and the trader / investor

An intermediary is a person or company that sits between the buyer of the asset and the owner. If an investor decides to buy the assets of the company, he does not come to the owner, but goes to the exchange and makes a purchase. There are two types of intermediaries:

- A manager can be one person or a company that searches for financial instruments, analyzes and purchases. This method is suitable for those who want to invest, but do not want to spend a lot of time on the selection and analysis of financial instruments.

- A broker is a company that conducts business on behalf of an investor, buys assets and holds them in a depository. This method is suitable for people who want to make an independent investment of money. In this case, the investor gives an order to buy the selected assets, and the broker executes.

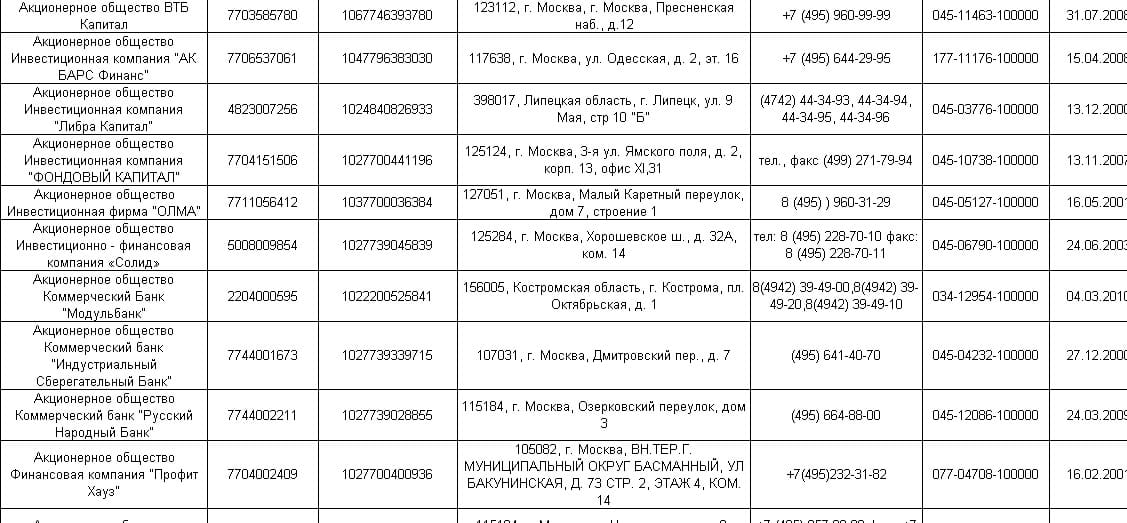

Important: The broker and manager must be registered in Russia and have a license to carry out activities issued by the Central Bank, check for a license:

https://www.cbr.ru/securities_market/registries/ .

Forex Brokers with a license Other companies offering their investment services are scammers. Working with such a company, you can lose all your funds. In order to check a company, you need to go to the Moscow Exchange website, it is best to choose a broker from the top ten.

How to choose a broker – important criteria other than a license

There are three main criteria:

- Reliability – in order to assess it, there are ratings of brokers. There are two key rating agencies in Russia: Expert RA and NRA (National Rating Agency). In addition, you can assess the reliability by looking at the statistics on the number of open accounts and active clients, the number of open individual investment accounts that are available on the Moscow Exchange website. It is also worth considering that there are banking divisions engaged in brokerage activities and companies that are engaged only in brokerage business, many of them become banks.

Important: The data is contradictory, one broker has a large number of registered clients, but few active accounts, and vice versa.

The purchased financial instruments are stored in the broker’s depository and in case of bankruptcy, the investor will not be refunded the money, it is also impossible to receive compensation from the Deposit Insurance Agency, in order to return the assets, you will need to contact the depository where the broker kept the securities and transfer them to another brokerage account. Rating of brokers in Russia by the number of clients at the end of 2021-beginning of 2022:

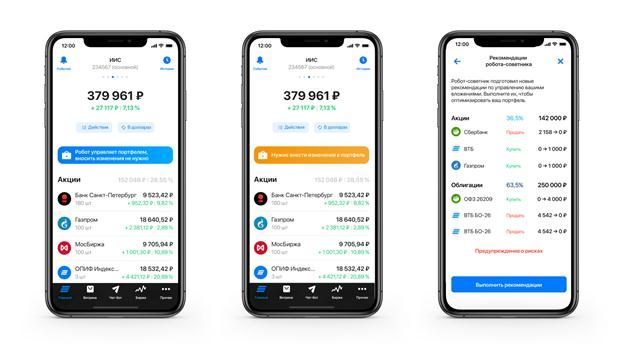

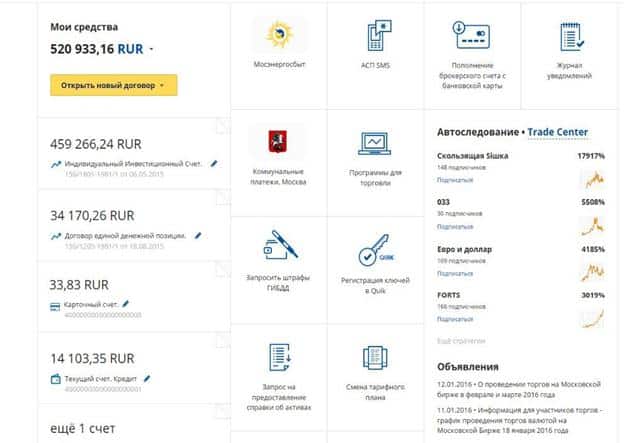

- Convenience and accessibility – it is understood that the broker has a mobile application and a personal account in a computer browser. A good broker will provide all the necessary functionality, organize work without failures and freezing.

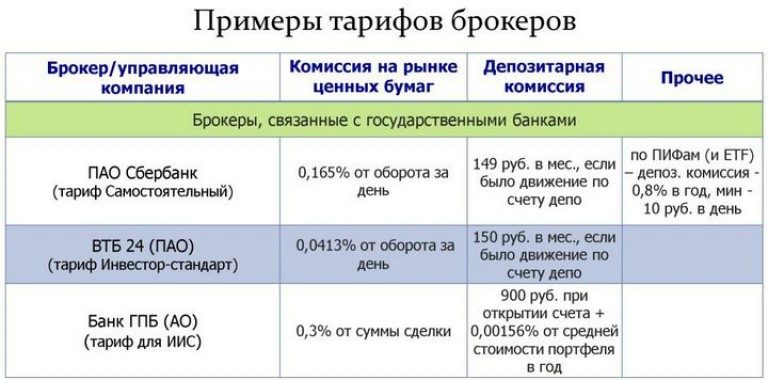

- Benefit – This item includes: transaction or trade commissions and service charges. Brokers earn on commissions and the more transactions an investor makes, the more profitable he is. Each broker has its own commission and is hardly distinguishable from another. Maintaining an account is more important and can consume a significant share of the capital, in order to find out the conditions and amount of servicing an account, you need to read the tariffs before opening a brokerage account with a particular broker.

https://www.banki.ru/investment/brokers/

Important: Some brokers may not charge brokerage fees

under certain conditions, for example: the turnover of a brokerage account or a certain amount on the account, at which a minimum fee is charged.

What does a broker do?

The broker performs many functions, including: opening and maintaining an account, executing client orders, informing about trades, providing reports on completed transactions, calculating dividends and coupons, and withholding taxes.

Opens accounts

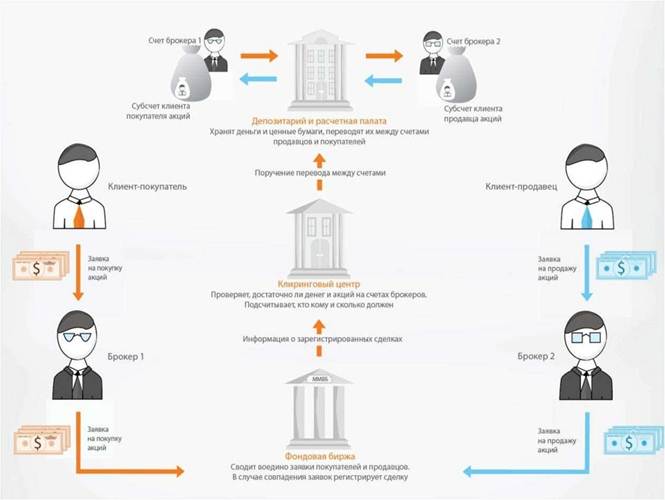

A person who wants to invest opens a brokerage account, where money is stored for the purchase of financial instruments, a depository account is automatically opened for him, in which securities are stored.

Manages accounts

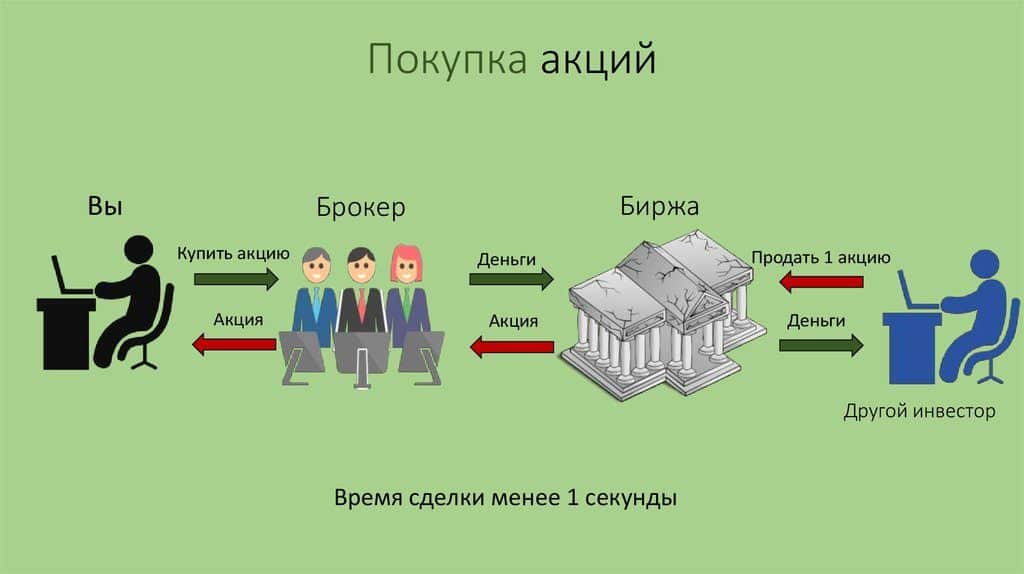

A client who buys assets must transfer money to the owner through a broker who transfers money to the exchange, and the exchange transfers the assets to the broker and the client receives them and vice versa when selling assets.

Carries out assignments

When an investor decides to buy or sell an asset, he transfers the order to the broker, who fulfills the required according to the submitted orders.

Important: The broker cannot sell or buy assets on his own, the manager is engaged in this.

Informs about the course of trading

In the personal account or mobile application, the client sees the current price for each asset, the number of which depends on the broker. Analytics, news, ideas and other data can also be provided for the convenient work of the client.

Provides reports

Each client’s operation is recorded and on demand or automatically, a report on the operations performed is provided: which asset was bought, how much was bought and paid, commission and profit or loss from transactions.

Pays tax to the state

When making a profit from transactions, the investor is obliged to pay income tax of 13%. To simplify the investor’s work, the broker independently calculates the profit and pays tax.

Important: Each broker chooses a time to pay taxes, monthly, annually.

Replenish and credit funds

The broker makes a transfer from a bank account to his own and vice versa when withdrawing funds. It is impossible to withdraw the amount invested in financial instruments. Who is a broker in simple words, what does it do, functions and what services a brokerage company provides on the exchange market: https://youtu.be/LTWBYDL5mnk

How do I open a brokerage account?

After evaluating and choosing a broker, it remains to open an account. Many companies have simplified the opening procedure and do it remotely, in a few minutes. Tinkoff offers to open a brokerage account in 5 minutes and in several steps (

https://www.tinkoff.ru/invest ):

https://www.sberbank.ru/ru/person/investments/broker_service/onboarding ):

https://open-broker.ru/invest/open-account/):

Important: By filling out the questionnaire and sending the data to the broker, the client agrees with the terms of the agreement, which must be studied so as not to face problems and misunderstandings in the future.

How to work with a broker?

After the passed stages, interaction with the broker begins. If the company issues additional software (

terminal ), then it should be installed following the instructions. After that, the account is replenished and work begins, the investor chooses the desired financial instrument, sends an order to buy or sell an asset, the broker executes it by debiting money from the account. Financial instruments, analytics from the company, news, advice and training can be available in your personal account.

- The training is varied : webinars, interactive, web courses, etc. Usually these are small lessons with the basics of investing, in which they will describe the principles of investing, teach you how to use a terminal or a mobile application.

- Analytics . Maybe from the company and from leading foreign banks, the content is different, there can be whole articles explaining the reasons for the purchase or upcoming changes in the company that will affect the rise in asset prices.

- Ideas . The bank’s analysts are putting forward topical ideas for the purchase of assets.

- News . Articles allow you to find out information about a specific company or about what is happening in the financial world.

What to do if a broker goes bankrupt

It is impossible to protect oneself from force majeure circumstances, the broker with whom the investor works may go broke or his license may be revoked. And the client needs to understand that he is partially protected by the law “On the Securities Market”. It all depends on the type of organization:

- Banking division – in this situation, the money is not divided into clients (depositors, investors and others), they are in a common “heap” and in order to return what they have, it will be necessary to wait for the bankruptcy procedure and stand in the queue of victims, most likely they will first issue large debts, and then they will begin to return the client’s money. Returned from the total, i.e. no matter what amount is on the brokerage account, they will divide the rest between everyone.

- Separate structure – money in a brokerage account will be divided between clients without waiting for bankruptcy proceedings if the broker did not use the funds for personal transactions.

Important: for clients serving in banking divisions, it is important to know that the funds in the brokerage account are used by the bank and this is legal.

How to become a stock broker, what is needed for this and is it possible privately: https://youtu.be/rbMjkC1T1NM

As a result

| How to choose a broker? | |

| Go to the website of the Bank of Russia | Read rates and contract |

| Select the first 5-10 companies | Rate convenience and functionality |

| Check rating in RA expert and NRA | Make sure you have the right financial instruments |

The choice of a broker will affect the further work of a trader / investor; in order to avoid delays and inconveniences, you will need to collect information on the Internet, check ratings, evaluate the convenience and benefits of using the broker’s services, read the tariffs and the agreement. It is equally important to evaluate the quality of the services provided, to which exchanges it gives access and how many financial instruments it provides, how it processes requests in the support service. Fortunately for the investor, videos are available on YouTube with information about each broker, job reviews. After watching the video, it remains to be sure of what has been said by checking the information provided on the Internet yourself. The sources are trusted sites, forums (here you need to be vigilant and not believe every word), news publications, often they have a tab about the financial world.