Broker Tinkoff.Investments: current commissions, obvious and hidden, tariff plans 2026.

Attention! Below is a selection of useful tools for trading on the Tinkoff Investments platform, as well as a month of commission-free trading as a gift.

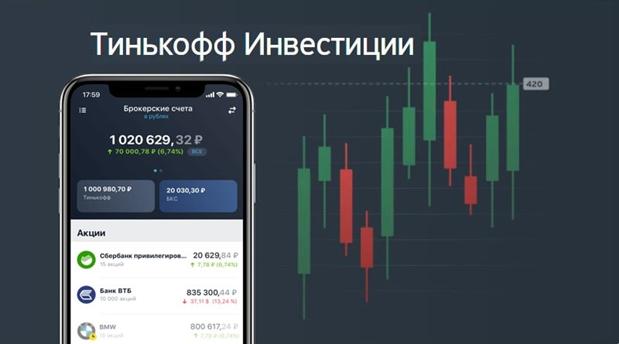

Since 2018, Tinkoff has launched a new direction for new and regular customers. During the first year of operation, the investment service managed to overtake most of the stock brokers, after which it took a confident 2nd place in the total number of registered investors who regularly trade on the Moscow Stock Exchange .

The Tinkoff company is officially registered in Moscow and is the holder of a brokerage license. The provision of services and access to financial instruments is carried out within the scope of the Tinkoff Investments service.

Brokerage services of the Tinkoff broker

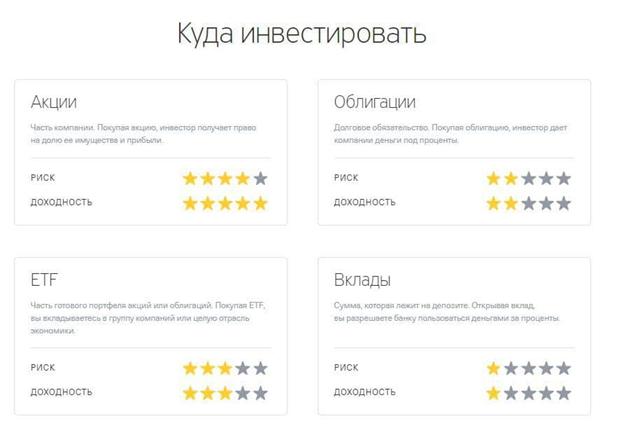

According to the current conditions, a certain list of services is available to registered individuals at Tinkoff Investments. The most significant are:

- trading in numerous government and corporate bonds, including Eurobonds, company shares and ETFs, in currencies, according to the established exchange rate at the time of the transaction;

- providing unhindered access to numerous transactions related to over-the-counter securities – exclusively for qualified investors;

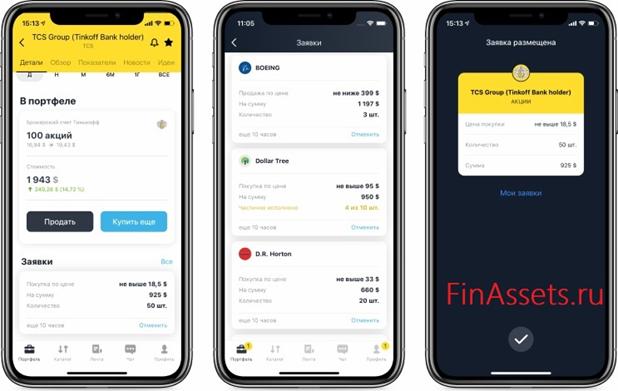

- a convenient mobile application that has many tools for effective work, for example: a forecast feed, real-time portfolio control, a dividend payment calendar, and directly key indicators of issuers;

- personal dedicated manager, professional analytics and an expanded package of effective tools from currency exchanges, subject to activation of the Premium tariff package;

- free access to a robot advisor, which provides significant assistance in forming an investment portfolio.

How to open IIS TinkoffAdditionally, registered clients of the Tinkoff broker can operate on the EverQuote insurance market. To purchase shares of interest, the functionality of the mobile application is provided. In order to register a brokerage account, the service does not require minimum threshold values - trading can begin with any amount. It is possible to use a card. When purchasing shares on foreign stock exchanges, conversion into rubles is carried out automatically. Connecting to the “Trader” and “Investor” tariff plans involves trading without the use of specialized intermediary traders, including insurance and credit brokers. Trading is carried out through the official website, the active category of clients can access the corresponding web terminal. Help: The current rules do not allow legal entities to register on the service.

Help: The current rules do not allow legal entities to register on the service.

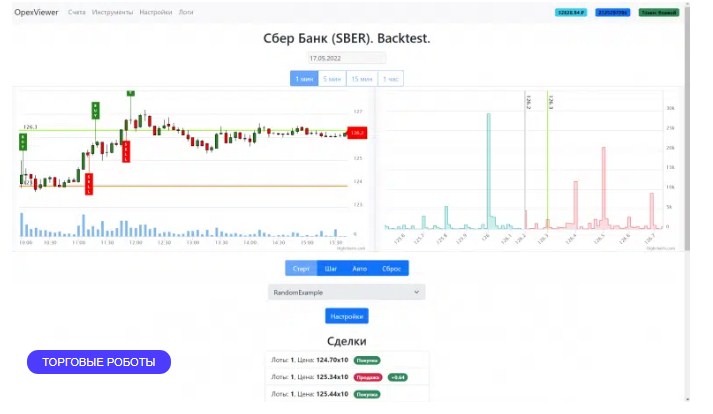

Important: useful tools for trading on the Tinkoff.Investments platform

OpexBot : free platform for algorithmic trading on Tinkoff Investments. Introduction to the functionality of the OpexBot algorithmic trading platform.  Using this link you can open an account to trade commission-free for a month on the Tinkoff Investments platform https://tinkoff.ru/sl/1Ld1HbbpHxY . How to get a token for Tinkoff investments . How to view details of expenses and commissions on a brokerage account automatically: Opexbot.info platform

Using this link you can open an account to trade commission-free for a month on the Tinkoff Investments platform https://tinkoff.ru/sl/1Ld1HbbpHxY . How to get a token for Tinkoff investments . How to view details of expenses and commissions on a brokerage account automatically: Opexbot.info platform

Current tariffs

Clients who have registered on the Tinkoff.Investments service are provided with several available tariff plans:

- “Premium”;

- “Trader”;

- “Investor”.

Each tariff plan differs in terms and cost of service. To reduce the risk of errors and misunderstandings, it is recommended that you read each of them separately.

Each tariff plan differs in terms and cost of service. To reduce the risk of errors and misunderstandings, it is recommended that you read each of them separately.

Tariff “Investor”

The tariff plan sets a commission of 0.3% of the value of the concluded transaction. Free service is provided. In addition, no fees are charged for registration, closing of a brokerage account, including custodial services, deposits and withdrawals.

Help: clients are given access to a robo-advisor who provides assistance with working in the securities market, which is important for beginners. You can contact support specialists by phone and online chat.

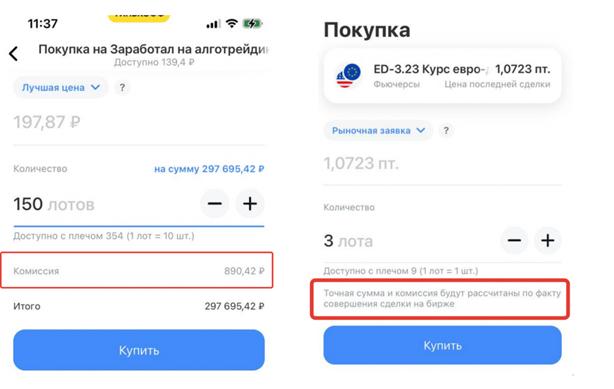

It is worth noting that Tinkoff claims on the page https://www.tinkoff.ru/invest/tariffs/ that there are no hidden commissions, but this is not true. To verify this yourself, use the service https://opexbot.info/ , which takes into account all commissions without manual work. If you carefully read the screenshot above, it becomes clear that the first one does not display the commission and transaction amount, the second one does not indicate the service fee. Immediately after purchasing a stock, there is a minus. Therefore, it is advisable to indicate in the terminal the profitability minus two commissions. In the first case, 150 lots are purchased, the stock goes up by 50 kopecks, which is equivalent to +0.25%, the transaction is +750 rubles. When deciding to sell, many believe that this is exactly the income there will be, but some point to 0. When closing a position, the loss amount is 1000 rubles. – profit, minus service fee for purchase and minus commission for sale. If you examine the right side of the screenshot, the information is even more attractive. The commission is set at 400 rubles, so when purchasing 3 lots – 1200 rubles. In case of closure, you must pay a similar amount, resulting in -2400 rub. To reach at least 0, the cost of one lot must increase by 800 rubles. Therefore, with an increase of 1%, the return is not +1%, but 0.

If you carefully read the screenshot above, it becomes clear that the first one does not display the commission and transaction amount, the second one does not indicate the service fee. Immediately after purchasing a stock, there is a minus. Therefore, it is advisable to indicate in the terminal the profitability minus two commissions. In the first case, 150 lots are purchased, the stock goes up by 50 kopecks, which is equivalent to +0.25%, the transaction is +750 rubles. When deciding to sell, many believe that this is exactly the income there will be, but some point to 0. When closing a position, the loss amount is 1000 rubles. – profit, minus service fee for purchase and minus commission for sale. If you examine the right side of the screenshot, the information is even more attractive. The commission is set at 400 rubles, so when purchasing 3 lots – 1200 rubles. In case of closure, you must pay a similar amount, resulting in -2400 rub. To reach at least 0, the cost of one lot must increase by 800 rubles. Therefore, with an increase of 1%, the return is not +1%, but 0.

Tariff “Trader”

The tariff plan differs from the previous one in a number of parameters. Among them are:

- the base commission is set at 0.05%;

- subject to achieving a daily turnover of 200,000 rubles before the exchange closes – 0.025%;

- monthly service cost is 290 rubles per month.

It is worth paying attention to the fact that the monthly fee is not deducted provided that:

It is worth paying attention to the fact that the monthly fee is not deducted provided that:

- the client entered into transactions for the purchase/sale of securities;

- Tinkoff premium card available;

- the total turnover for the previous period exceeded 5 million rubles;

- the declared volume of real investments exceeds 2 million rubles.

Additionally, commissions and additional fees for registering and closing a brokerage account, including depository services, as well as operations related to the replenishment and withdrawal of funds are excluded. The benefits include providing access to a robot assistant that provides recommendations on the securities market. 24-hour communication with support service representatives is provided via a hotline or online chat.

Tariff plan “Premium”

The base commission is only 0.025%. Key features include:

- concluding transactions with over-the-counter securities – commission varies from 0.025% to 0.4%;

- the cost of monthly maintenance is 3,000 rubles.

According to the current terms of the tariff plan, the indicated monthly fee may not apply in exceptional cases. These include:

- the total volume of the investment portfolio varies from 1 to 3 million rubles – monthly fee is 990 rubles;

- the real volume of the investment portfolio exceeds 3 million rubles – free service;

- registration, closing of a personal brokerage account, including depositary services, financial transactions for replenishment and withdrawal – free of charge.

The main benefits of the tariff plan are the provision of personal assistance from leading analysts of the broker in question, including useful recommendations for building an effective diversified portfolio. Comprehensive support is provided by a personal consultant. Reference: the “Investor” and “Trader” tariff plans provide access to the basic catalog of securities, while the owners of “Premium” additionally have the right to trade shares of foreign exchanges, which is due to the receipt of the corresponding over-the-counter instruments. An accessible list of shares is always available on the official portal of the Tinkoff broker.

The main benefits of the tariff plan are the provision of personal assistance from leading analysts of the broker in question, including useful recommendations for building an effective diversified portfolio. Comprehensive support is provided by a personal consultant. Reference: the “Investor” and “Trader” tariff plans provide access to the basic catalog of securities, while the owners of “Premium” additionally have the right to trade shares of foreign exchanges, which is due to the receipt of the corresponding over-the-counter instruments. An accessible list of shares is always available on the official portal of the Tinkoff broker.

Advantages and disadvantages of Tinkoff.Investments

The specialized service “Tinkoff.Investments” has advantages and disadvantages. The advantages include:

- the right to choose the current tariff plan, including instant registration of a brokerage account – existing bank clients can open remotely within 1 minute, new clients can sign an agreement the next day after the application;

- intuitive interface with a mobile application for trading, there are built-in entertainment elements;

- the ability to withdraw and top up your account without commission;

- numerous promotions that offer reduced commissions;

- availability of an up-to-date investment course, after completion of which a certain reward is provided;

- it is possible to open up to 10 brokerage accounts simultaneously;

- opportunity to start trading from 1 dollar.

The main disadvantage is the presence of numerous hidden commissions and the lack of transparency in their accounting. Tinkoff commissions for banking services The existing advantages allow us to speak with confidence about the advisability of using the service to earn money. However, do not forget about the presence of a large number of hidden commissions, which are most conveniently taken into account automatically using a specially developed tool Opexbot.info . Careful study of the rules allows you to eliminate all kinds of risks.