Brokerage account: what is it and how does it work? In the context of lower tariffs on deposits of banking organizations, sources of passive income are gaining enviable demand. Recently, citizens have been willingly asking about the specifics of investing in stock exchanges and the specifics of dealing with securities. It is important to remember that participation in the auction directly for citizens and legal entities is impossible. In order to make investments and conduct transactions in the stock market, you will need to enlist the help of a competent intermediary – a broker (an organization licensed to access the world exchange markets).

The article provides information on how to make money on a brokerage account without becoming a victim of scammers and acquiring profitable assets.

The article provides information on how to make money on a brokerage account without becoming a victim of scammers and acquiring profitable assets.

- What is a brokerage account – in simple words about the complex

- What are the types of brokerage accounts?

- By number of contributors

- By the method of cooperation with a broker company

- By payment methods

- Difference from IIS

- How it works?

- Why open a brokerage account

- How and where is it better to open a brokerage account in the Russian Federation for 2022, according to what criteria a broker is chosen, specific examples

- How to open a brokerage account

- Brokerage account insurance

- Questions and answers

- What are the risks?

What is a brokerage account – in simple words about the complex

A personal client account opened by a brokerage organization and intended for the safe storage of business papers and currency units is called a brokerage account. It is used to carry out purchase and sale operations of various securities (

stocks ,

bonds ,

futures , options, forwards, etc.) on the domestic exchange and on foreign markets. The investor does not have the opportunity to purchase securities on the stock exchange. Need

a broker– an intermediary person who has a confirmed license from the Central Bank. The brokerage company creates an account to which the investor transfers the savings. The broker gets the opportunity to purchase and sell securities on behalf of the depositor.

Note! The main advantage of a brokerage account is that the owner gets access to financial instruments of leading international and Russian companies. The investor’s profit is formed from promotional dividends, interest payments on bonds and income from the sale of securities if their value has increased.

What are the types of brokerage accounts?

Types of brokerage accounts are usually classified according to the following criteria.

By number of contributors

They can be individual or collective (it depends on the number of owners). Collective are most popular in the United States. A married couple, friends or business partners may have unlimited access to financial savings and securities. In the Russian Federation, on the contrary, individual wallets are common. If a resident plans to maintain a brokerage account abroad, there may be problems with the withdrawal of funds.

By the method of cooperation with a broker company

Account management can be trust (the depositor entrusts the management of savings to the project portfolio manager) and independent (the investor undertakes the implementation of trading transactions).

By payment methods

Depending on the method of making a payment, a brokerage account is divided into cash, margin, clearing, and individual investment. If the investor is interested in

whereopen a brokerage account for a beginner, it is advisable to give preference to cash. This is the most reliable and secure method. It is possible to deposit any amount of money and immediately carry out exchange transactions. To apply the proceeds from the sold shares, you must wait until they arrive on the wallet. A margin account allows you to use additional services and trading tools. The key feature lies in the fact that profitable offers will not be missed, even if there are not enough funds on the account. Securities are purchased against the security of assets. Using an options account, you can engage in the sale of options (an agreement that gives the buyer the authority to purchase or sell an asset at a specific point in time at a price agreed on the day before). The seller of the shares receives moneyand he undertakes to conclude a deal with the buyer in the future.

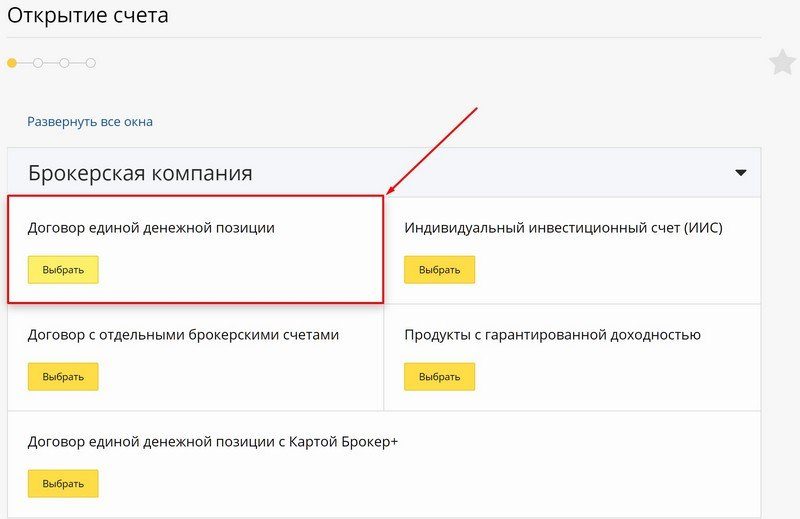

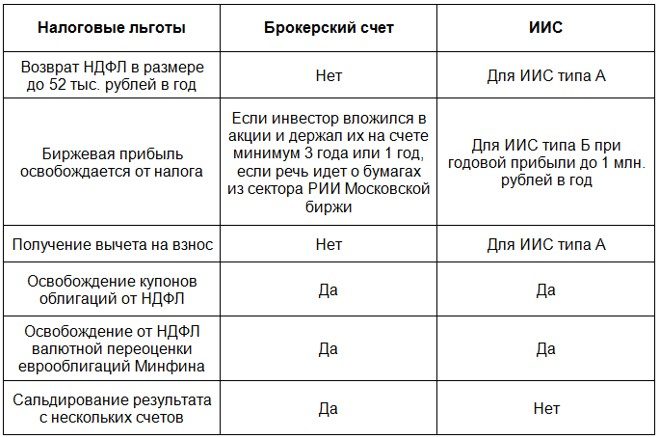

An individual investment account (IIA) is a brokerage wallet with tax preferential payments from the state. [caption id="attachment_12231" align="aligncenter" width="812"]

Difference from IIS

An individual investment account (opening in the Russian Federation has been possible since 2015), as one of the varieties of a brokerage account, allows you to access trading on the stock exchange, but with a certain limit. Another significant difference is the payment of tax benefits from state bodies. The owner’s income definitely becomes more if we take into account deposit and brokerage wallets. He can buy assets of commercial and government organizations. IIS can create banking institutions, brokerage and management companies. The investor has the right to open only one account and only one broker. The amount transferred within 12 calendar months must not exceed 1 million Russian rubles (other currency units cannot be used). Receiving tax benefits is possible if the wallet is valid for at least 3 years.Withdrawal of financial savings is not possible until the end of the application period.

Need to know! Access is available only to domestic stock exchanges (Moscow, St. Petersburg). Benefit payments are deductions for income and contributions.

The difference between IIS and a brokerage account – an explanation for beginners: https://youtu.be/YwC1EVhNvHo

How it works?

The following steps describe how a brokerage account works:

- The investor contacts the broker (licensed organization) and enters into an agreement to create an account.

- The depositor transfers material savings to the deposit.

- Using the software, the consumer manages his capital. When it becomes necessary to purchase securities, he generates a request for the transaction (by phone number, through a utility or mobile application).

- The brokerage company formally confirms the transaction. Investment and commission amounts are deducted from the deposit, after which the client receives a notification that financial assets are now at his disposal.

Why open a brokerage account

The explanation of what a brokerage account is for involves many nuances. The brokerage organization gives the investor the opportunity to enter the exchange market and begin to carry out transactions for the purchase and sale of securities. There are commission fees for this service. It is also important that only intermediary brokerage companies that have a confirmed license have the right to participate in trading. This makes cooperation fruitful and indispensable. The investor is explained in detail how to use the brokerage account.

Important! Brokers do not use their own savings, but only distribute the income of depositors. In most cases, investors are interested in the question of how to create a brokerage account of a trust type. The reason for this is simple: they simply have no desire to go into the details of trading on the stock exchange. Then the intermediary firm is free to independently make decisions on the purchase or sale of financial instruments.

How and where is it better to open a brokerage account in the Russian Federation for 2022, according to what criteria a broker is chosen, specific examples

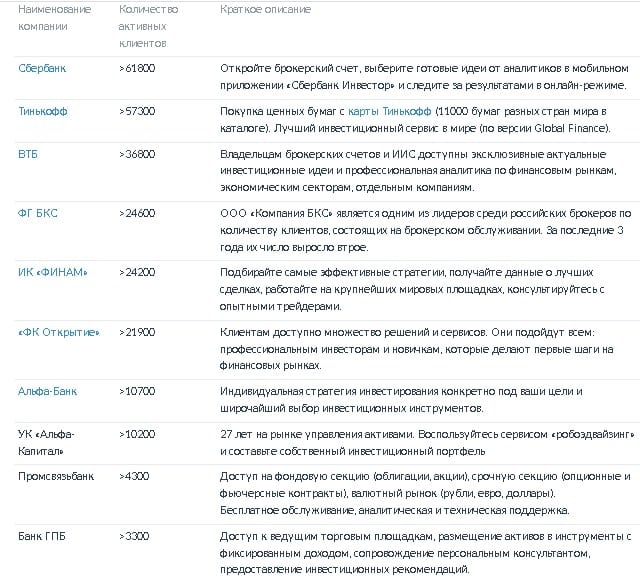

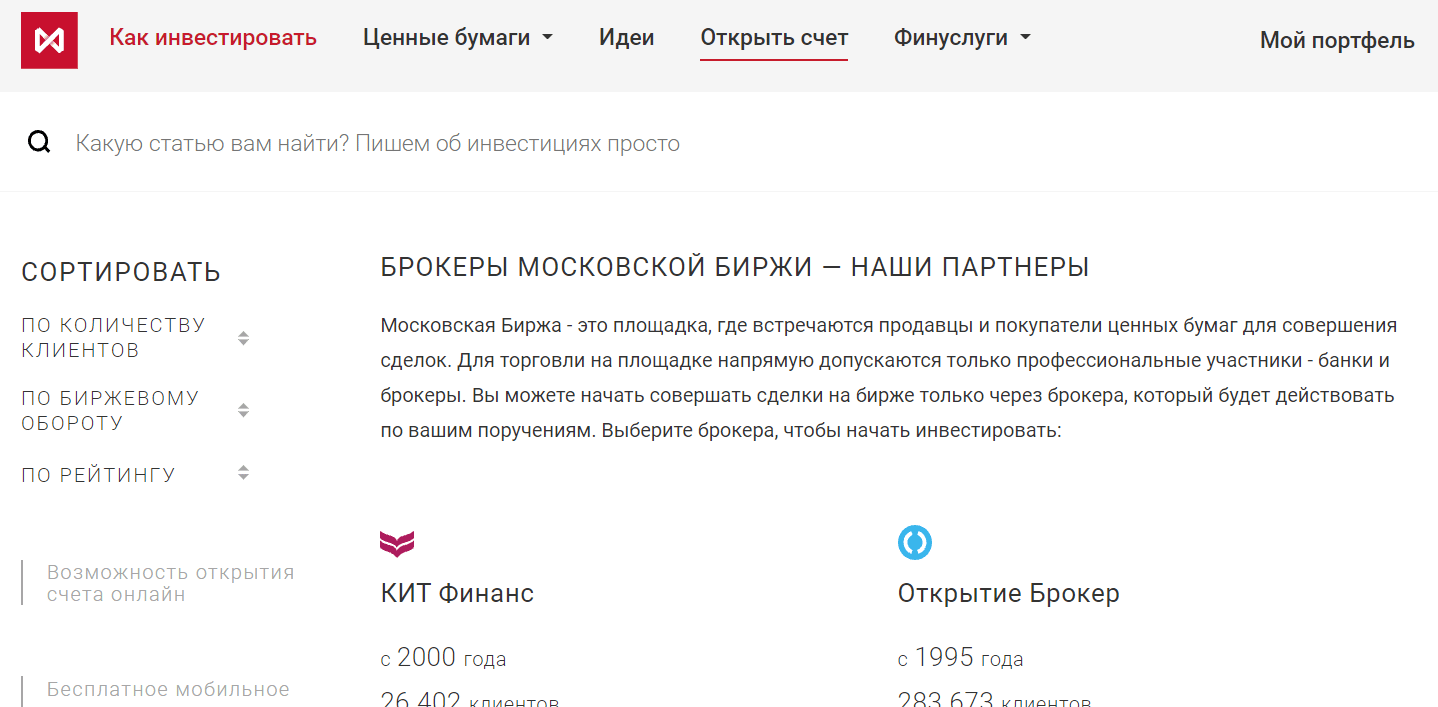

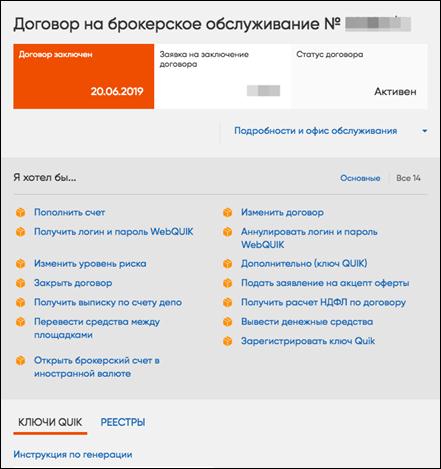

At the moment, citizens and organizations can open a brokerage account with a Russian banking institution or with an intermediary. A reliable broker must have a license document from the Central Bank, work experience of more than 15 years (to be resistant to economic changes) and a place in the rating of the Moscow Exchange Market. These are the criteria that allow you to choose a reliable intermediary company. According to the statistics of the Moscow Exchange, the following brokers are leading in terms of the number of users and the volume of transactions.

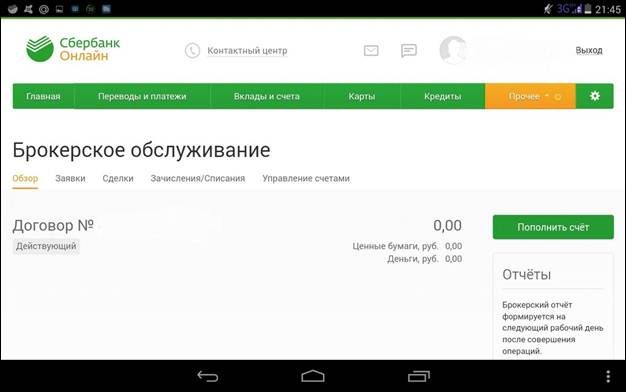

- Sberbank . By installing the Sberbank Investor mobile utility, users get the opportunity to create a brokerage wallet, choose one of the methods proposed by experienced analysts, and monitor results in real time.

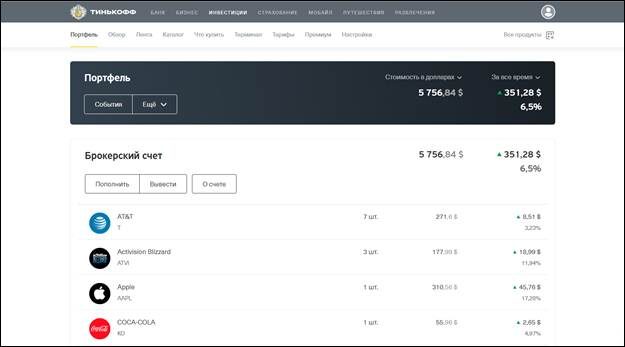

- Tinkoff . It is considered the best service for depositors in the world (according to the English-language financial magazine Global Finance). The purchase of securities is possible using a Tinkoff card. The catalog contains at least 11,000 assets.

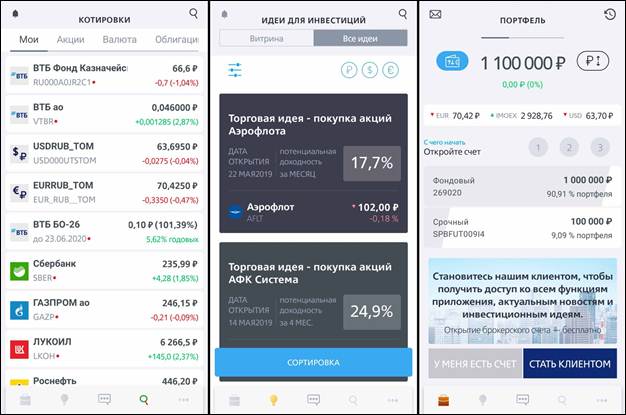

- VTB . Holders of brokerage and individual investment accounts get access to the latest ideas of investors and professional analytical analysis of stock markets, private sectors of the economy, firms, and enterprises.

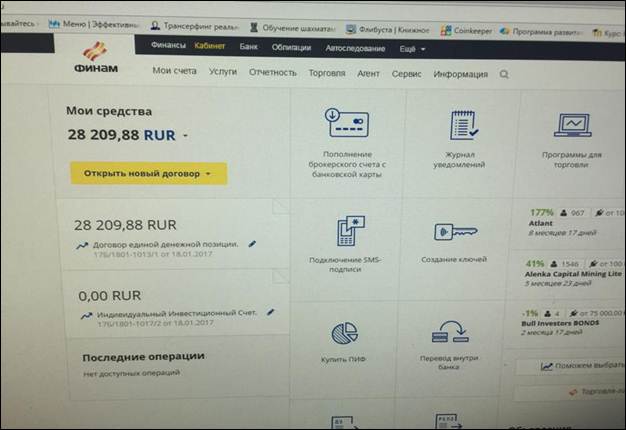

- Finam Investment Holding JSC . You can select the most accurate strategic decisions, get information about profitable deals, work on extensive exchanges, consult with eminent traders.

- Promsvyazbank . Citizens are provided with access to the stock (bonds, shares) and urgent (futures) zones of the exchange, as well as to the currency market.

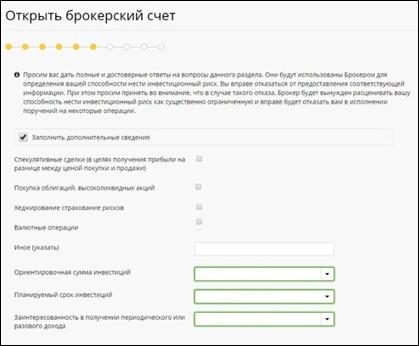

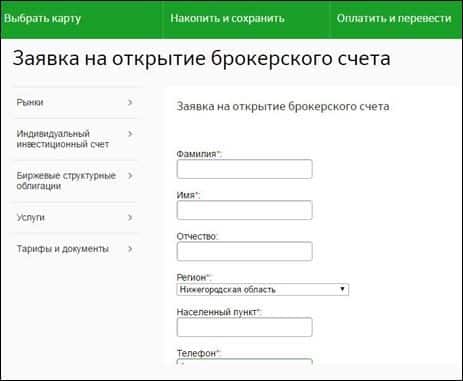

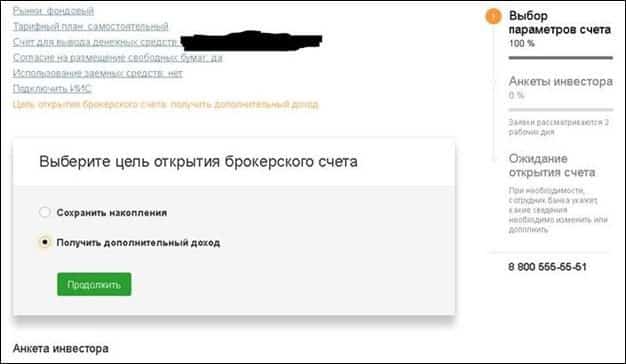

How to open a brokerage account

The interaction between the broker and the client is as follows.

- The broker creates a trading account for the consumer, from which it is possible to carry out activities on the stock exchange.

- Taking into account the interests and preferences of the depositor, the brokerage company can buy and sell various financial assets at his expense.

- The investor submits an application for the purchase or sale of securities / currency units, and the intermediary concludes a deal.

- The proceeds from the transaction (after the transfer of commission payments specified in the agreement) are sent to the investor’s account.

- The broker can also fulfill other obligations: to conduct analytical analysis, give recommendations to the investor regarding trading strategies, check documents for compliance with the criteria of the law.

Brokerage account insurance

Brokerage account insurance is necessary to preserve the depositor’s assets in the event that the intermediary becomes bankrupt or loses a confirmed license. The investor’s financial instruments must be kept in the form of deposits, after which they are credited to the account of another brokerage company.

- Collaborate only with large companies . They are not threatened by bankruptcy and loss of license. On the official website of the Moscow Exchange Market, the list of extensive organizations is updated monthly.

- Don’t trust all your savings to one firm . If the capital is significant, it would be logical to distribute it among several brokerage wallets. For example, between several state banking organizations and one international one.

- Have documentary confirmation of transactions . The broker must provide the depositor with reporting documents on financial transactions, as well as a deposit statement listing all assets. A useful solution if there are worries about bankruptcy.

- Do not keep free funds on the wallet . Without investing in profitable stocks, it makes no sense to save huge sums of money in brokerage and individual investment accounts.

- Create a separate account . This is not a panacea for security, but such a wallet is protected from the bankruptcy of a brokerage firm. But there is a caveat: its maintenance can be more expensive. In addition, not all companies offer such services.

https://articles.opexflow.com/brokers/brokerskoe-obsluzhivanie-v-rossii.htm

Questions and answers

What else should you know about a brokerage account.

| Question | Answer |

| Is it possible to have two brokerage accounts in different banks? | This is not prohibited by applicable law. However, this rule does not apply to individual investment wallets. |

| At what age can you open a brokerage account? | From 18 years old. There may be exceptional cases where a citizen inherits assets. Then it is allowed to create a common brokerage account. However, transactions can be made only with the consent of legal representatives. |

| How much does a brokerage account cost? | The minimum rate negotiated by brokers is 30,000 Russian rubles. |

| Term Brokerage Account: What is it? | This is a component of the exchange market, in which agreements are concluded at a certain interval. We are talking about options contracts and futures. |

| The financial instrument is not available for trading on your accounts. What does this mean? | Various financial instruments on the Moscow and St. Petersburg stock exchanges have a special schedule (start and end times of trading). Perhaps the trading session for the asset has ended. Then the application will fail. |

| How to delete a brokerage account? | On the private page, you will need to click on the “Account” tab, then select the “Close account” option. An online application form will appear to be filled out. |

| How is money withdrawn from a brokerage account? | Withdrawing savings from an ATM is not possible. They should first be withdrawn to a bank wallet. |

| What happens if you don’t use a brokerage account? | Termination of the use of the account (without the option of closing) does not exempt the depositor from commission payments. As a result, the balance may become scarce, and you will have to repay the debt to the brokerage company. |

| How to transfer money from one brokerage account to another? | It is better to sell securities in the old brokerage account, withdraw the savings to a debit card and replenish the account with a new intermediary. |

| Can I open a brokerage account for another person? | In such a situation, you need to tell the mediator about the problem and ask for help. You can open a brokerage or individual investment account in the name of another person, then draw up a power of attorney for the first person to make financial transactions. |

| What is a brokerage account number? | The account number of each account holder. Used to avoid confusion and simplify user identification. |

| Brokerage commission calculation. How is it carried out? | Brokerage commission – a percentage of the total amount of the deal. Its size is specified in the agreement. |

What are the risks?

Risks are one of the important issues that arise on the eve of the decision to make a deal with an intermediary. The following “pitfalls” are implied:

- Long-term business is not possible without a diversified portfolio of Russian and international assets. This, in turn, involves paying for expert advice.

- The main source of income for brokerage firms is commission payments for concluded financial transactions. For this reason, intermediaries motivate investors to regularly purchase or sell financial instruments.

- You will have to pay well for professional analytical analysis. Brokers do not disclose such information free of charge.

- We must not forget to be careful. Fraudsters often hide under the guise of experienced and friendly brokers.