Brokerage account: o ye mun ye ani a bɛ baara kɛ cogo di? Tarifu dɔgɔyali siratigɛ la, bankiw ka tɔnw ka wari bilalenw kan, sɔrɔko pasif sɔrɔyɔrɔw bɛ ka ɲinini sɔrɔ min bɛ se ka keleya. Kɔsa in na, jamanadenw bɛ ka ɲininkali kɛ ni diyanye ye wari bilali kɛrɛnkɛrɛnnenw na bolomafaraw la ani lakanafɛnw baaracogo kɛrɛnkɛrɛnnenw kan. A nafa ka bon an k’an hakili to a la ko jamanadenw ni sariyatigiw ka sendonni sannifeere in na k’a ɲɛsin u yɛrɛ ma, o tɛ se ka kɛ. Walasa ka wari bila ani ka jago kɛ bolomafara sugu la, i bɛna a ɲini ka dɛmɛ ɲini cɛmancɛla ŋana dɔ fɛ – dilanbaga dɔ (jɛkulu min ka lase bɛ se ka don diɲɛ wari falenfalen suguw la).

Barokun bɛ kunnafoni di wari sɔrɔcogo kan brokerage jatebɔsɛbɛn kan k’a sɔrɔ i ma kɛ nanbarakɛlaw ka bɔnɛ ye ani ka nafolo sɔrɔ min bɛ nafa sɔrɔ.

Barokun bɛ kunnafoni di wari sɔrɔcogo kan brokerage jatebɔsɛbɛn kan k’a sɔrɔ i ma kɛ nanbarakɛlaw ka bɔnɛ ye ani ka nafolo sɔrɔ min bɛ nafa sɔrɔ.

- Brokerage account ye mun ye – daɲɛ nɔgɔmanw na complexe ko la

- Brokerage jate suguya jumɛnw bɛ yen?

- Ka kɛɲɛ ni bolomafaraw hakɛ ye

- Ni jɛkafɔ kɛcogo ye ni broker sosiyete dɔ ye

- Saracogo fɛɛrɛw fɛ

- Danfara min bɛ IIS ni ɲɔgɔn cɛ

- A bɛ baara kɛ cogo di?

- Mun na ka brokerage compte da wuli

- Cogo di ani yɔrɔ min na a ka fisa ka brokerage jatebɔsɛbɛn da wuli Risi jamana na san 2022 kɔnɔ, ka kɛɲɛ ni sariya jumɛnw ye broker dɔ sugandira, misali kɛrɛnkɛrɛnnenw

- Brokerage jatebɔsɛbɛn dabɔcogo

- Brokerage ka jatebɔsɛbɛn asiransi

- Ɲininkaliw ni jaabiw

- Farati jumɛnw bɛ a la?

Brokerage account ye mun ye – daɲɛ nɔgɔmanw na complexe ko la

Mɔgɔ yɛrɛ ka kiliyan ka jatebɔsɛbɛn min dabɔra dilanjɛkulu dɔ fɛ, n’a labɛnna jago papiyew ni wari hakɛw marali kama, o bɛ wele ko dilanbaga jatebɔsɛbɛn. A bɛ kɛ ka waribon suguya caman (

stocks ,

bonds ,

futures , options, forwards, a ɲɔgɔnnaw) sanni ni feereli baara kɛ jamana kɔnɔ waribonw kan ani jamana kɔkan suguw kan. Investisseur tɛ sababu sɔrɔ ka securités san bourse la. Aw mago

bɛ broker la– cɛmancɛla mɔgɔ min ka lase sɛbɛnnen don ka bɔ Banki Sentɛrɛli la. Brokerage sosiyete bɛ jatebɔsɛbɛn dɔ dabɔ, waritigi bɛ warimaralenw bila min kɔnɔ. Dilanbaga bɛ sababu sɔrɔ ka lakanafɛnw san ani k’u feere wari bilabaga tɔgɔ la.

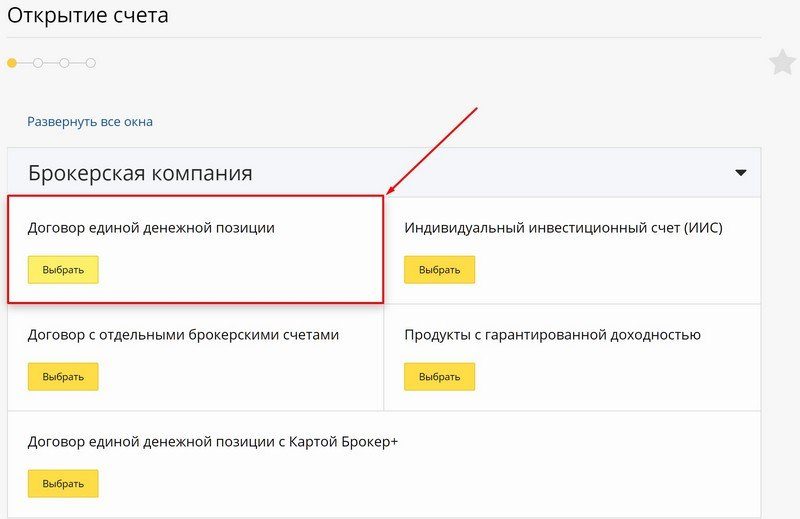

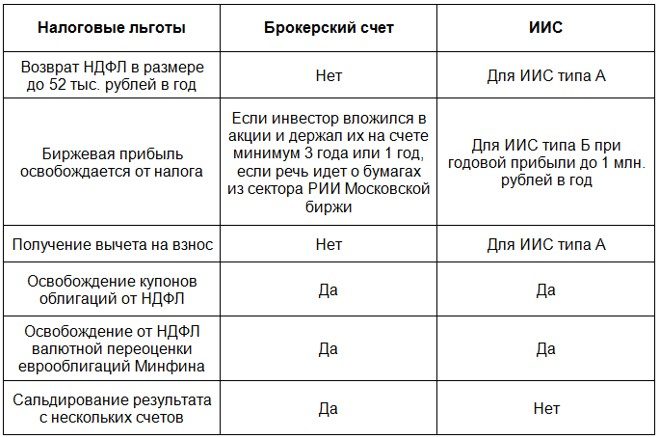

Danfara min bɛ IIS ni ɲɔgɔn cɛ

Investissement jatebɔ kelen-kelen (da wulilen Risi jamana na, o bɛ se ka kɛ kabini san 2015), i n’a fɔ brokerage jatebɔ suguya dɔ, o b’a to i bɛ se ka jago kɛ bourse la, nka ni dan dɔ ye. Danfaraba wɛrɛ min bɛ yen, o ye impositi nafaw sarali ye jamana ka tɔnw fɛ. Siga t’a la, tigi ka sɔrɔ bɛ kɛ ka caya n’an ye jateminɛ kɛ deposit ni brokerage waribɔlanw na. A bɛ se ka jagokɛlaw ni gɔfɛrɛnaman ka tɔnw ka nafolo san. IIS bɛ se ka bankiw, brokerage ani management sosiyetew dabɔ. Investisseur ka kan ka jatebɔsɛbɛn kelen dɔrɔn da wuli ani ka broker kelen dɔrɔn da wuli. Hakɛ min bɛ ci kalo 12 kɔnɔ, o man kan ka tɛmɛ Risi wari miliyɔn 1 kan (wari wɛrɛw tɛ se ka baara kɛ ni u ye). Takisi nafa sɔrɔli bɛ se ka kɛ ni waribɔsɛbɛn bɛ baara la san 3 la dɔgɔmannin. Nafolo maralenw bɔli tɛ se ka kɛ sanni ɲinini waati ka ban.

Aw ka kan k’a dɔn! Sɔrɔ bɛ se ka sɔrɔ jamana kɔnɔ bolomafaraw dɔrɔn de la (Moskow, Sent Pɛtɛrsburg). Nafa sarali ye wari bɔli ye sɔrɔ ni bolomafaraw la.

Danfara min bɛ IIS ni brokerage jatebɔsɛbɛn cɛ – ɲɛfɔli daminɛbagaw ye: https://youtu.be/YwC1EVhNvHo

A bɛ baara kɛ cogo di?

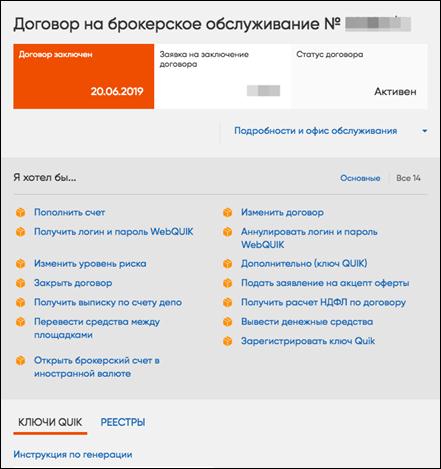

Nin wale ninnu bɛ ɲɛfɔli kɛ brokerage jatebɔsɛbɛn bɛ baara kɛ cogo min na:

- Investisseur bɛ kuma broker (organisation min ka lase) fɛ, ka bɛnkan dɔ kɛ walasa ka jatebɔsɛbɛn dɔ da.

- Depositeur bɛ fɛnw maralenw bila wari bilalen na.

- Baara kɛli ni porogaramu ye, feerekɛla b’a ka kapitali ɲɛnabɔ. Ni a kɛra wajibi ye ka lakanafɛnw san, a bɛ ɲinini dɔ lawuli o jago in na (telefɔni nimɔrɔ fɛ, baarakɛminɛn dɔ fɛ walima telefɔni selilɛri fɛ).

- Brokerage sosiyete bɛ o jago in dafa cogo labɛnnen na. Nafolodonni ni komisiyɔn hakɛw bɛ bɔ wari bilalen na, o kɔfɛ, kiliyan bɛ kunnafoni sɔrɔ ko wariko nafolo bɛ a bolo sisan.

Mun na ka brokerage compte da wuli

Brokerage account ye min ye, o ɲɛfɔli bɛ kɛ ni nuances caman ye. Brokerage jɛkulu bɛ cogo di waridonna ma a ka don wari falen-falen sugu la, ka jago daminɛ ka ɲɛsin lakanafɛnw sanni ni feereli ma. Komisiyɔn sara bɛ yen o baara in na. A nafa ka bon fana ko cɛmancɛ-baarakɛlaw dɔrɔn de ka se ka u sen don jago la. O b’a to jɛ-ka-baara bɛ nafa sɔrɔ, wa a nafa ka bon kosɛbɛ. Investisseur bɛ ɲɛfɔ ka ɲɛ a bɛ baara kɛ ni brokerage account ye cogo min na.

Nafama! Brokers tɛ baara kɛ n’u yɛrɛ ka warimarataw ye, nka u bɛ wari bilabagaw ka sɔrɔ dɔrɔn de tila. A ka c’a la, waridonnaw b’u mago don ɲininkali la, n’o ye ka dannaya suguya dɔ dilancogo jatebɔsɛbɛn dilan. O kun ye ko nɔgɔn ye: u t’a fɛ dɔrɔn ka taa jagokow ɲɛfɔ bourse la. O kɔfɛ, cɛmancɛ-tɔn hɔrɔnyalen don ka latigɛw kɛ a yɛrɛma wariko minɛnw sanni walima u feereli kan.

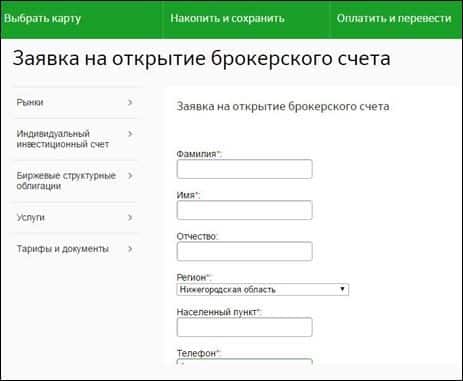

Cogo di ani yɔrɔ min na a ka fisa ka brokerage jatebɔsɛbɛn da wuli Risi jamana na san 2022 kɔnɔ, ka kɛɲɛ ni sariya jumɛnw ye broker dɔ sugandira, misali kɛrɛnkɛrɛnnenw

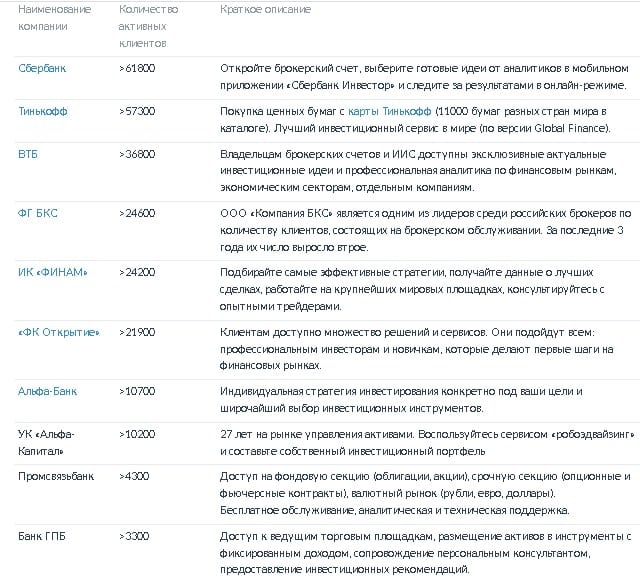

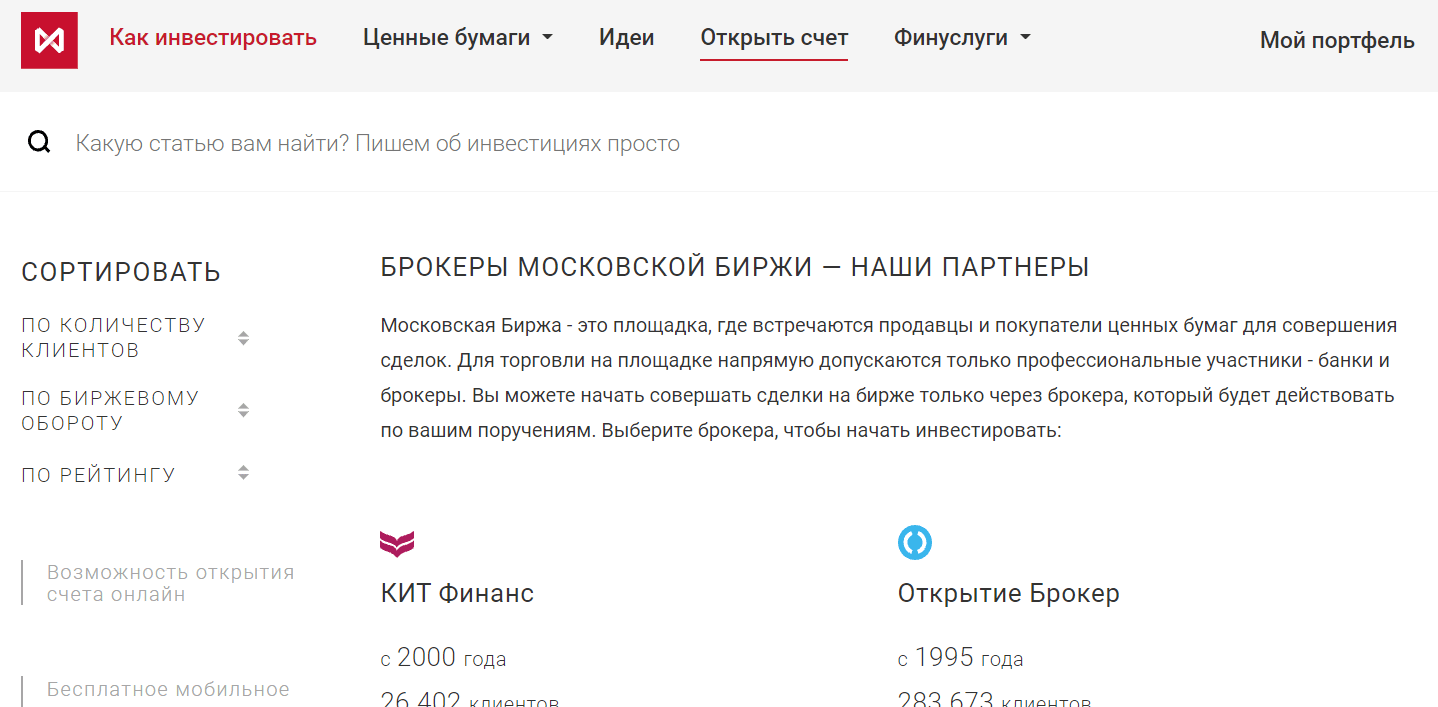

Nin waati in na, jamanadenw ni jɛkuluw bɛ se ka brokerage jatebɔsɛbɛn da wuli Risi banki dɔ fɛ walima ni cɛmancɛlamɔgɔw ye. Dilanbaga min bɛ se ka da a kan, o ka kan ka kɛ ni lase sɛbɛn ye ka bɔ Banki Sentɛrɛli la, ka baara kɛcogo sɔrɔ min ka ca ni san 15 ye (walasa ka se ka sɔrɔko fɛn caman wuli) ani ka jɔyɔrɔ sɔrɔ Moskow ka fɛnw falenfalen sugu la. Olu ye sariyaw ye minnu b’a to i bɛ se ka cɛmancɛ-tɔn dɔ sugandi min bɛ se ka da i kan. Moskow Exchange ka jatebɔ la, nin dilanbaga ninnu bɛ ɲɛfɛ baarakɛlaw hakɛ ni jagokɛlaw hakɛ la.

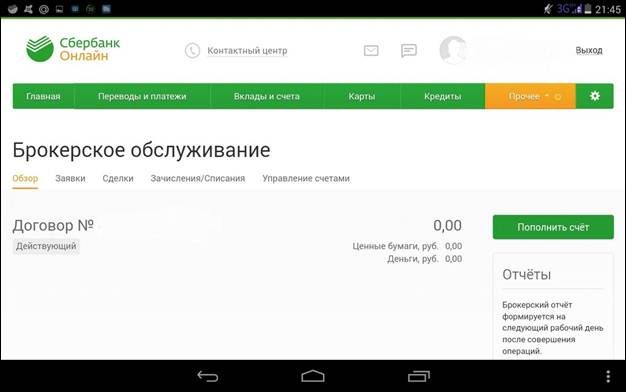

- Sberbank ye . Ni Sberbank Investor mobili baarakɛminɛn sigilen don, baarakɛlaw bɛ sababu sɔrɔ ka brokerage waribɔlan dɔ dilan, ka fɛɛrɛw dɔ sugandi minnu labɛnna sɛgɛsɛgɛlikɛlaw fɛ minnu bɛ se kosɛbɛ, ka sɔrɔw kɔlɔsi waati yɛrɛ la.

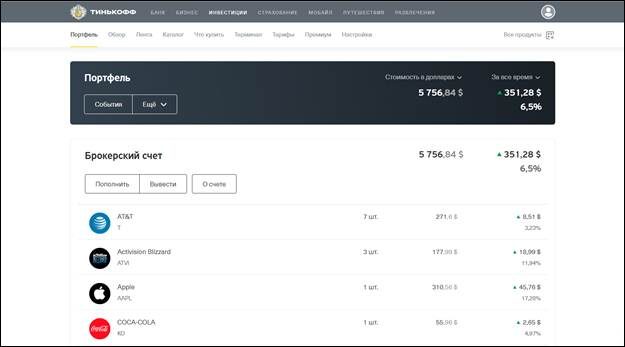

- Tinkofu ye . A bɛ jate baara ɲuman ye warimaralaw fɛ diɲɛ kɔnɔ (ka kɛɲɛ ni tubabukan na wariko gafe Global Finance ye). Lakanalifɛnw sanni bɛ se ka kɛ ni Tinkoff ka karti ye. Nafolo 11 000 ni kɔ bɛ o gafe kɔnɔ.

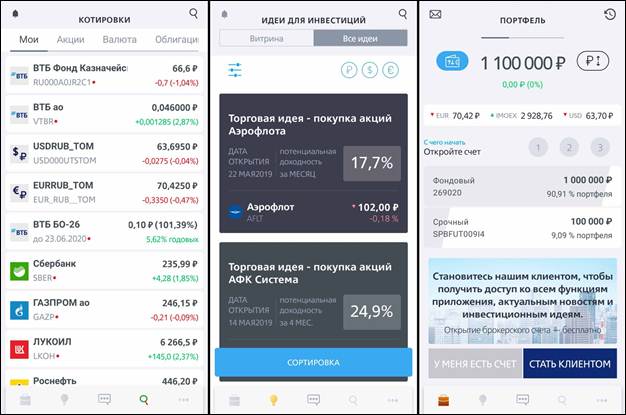

- VTB ye . Brokerage ani mɔgɔ kelen-kelen ka waridon jatew tigiw bɛ se ka waridonnaw ka hakilina labanw sɔrɔ ani ka baarakɛlaw ka sɛgɛsɛgɛli sɛgɛsɛgɛli kɛ bolomafara suguyaw kan, sɔrɔko bolofara kɛrɛnkɛrɛnnenw, tɔnw, ani baarakɛda minnu bɛ yen.

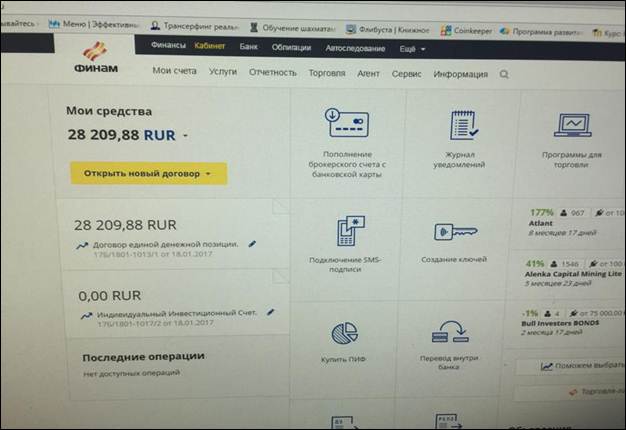

- Finam Investissement Holding ka baarakɛyɔrɔ JSC . Aw bɛ se ka fɛɛrɛ tigɛlenw sugandi minnu bɛ tiɲɛ kosɛbɛ, ka kunnafoni sɔrɔ bɛnkanw kan minnu bɛ nafa sɔrɔ, ka baara kɛ fɛnw falenfalennibaw kan, ka lajɛ kɛ ni jagokɛla tɔgɔba dɔw ye.

- Promsvyazbank ye . Fasodenw bɛ se ka don aksidan (bon, aksidan) ani kɔrɔtɔko (futures) yɔrɔw la, ka fara wari suguya kan.

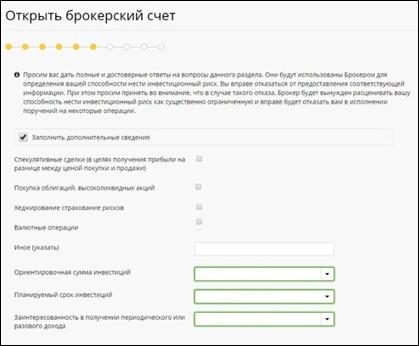

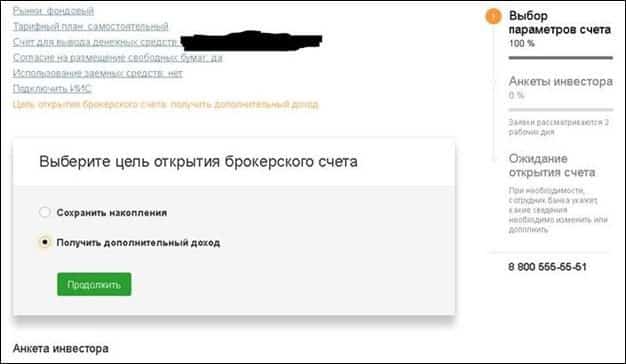

Brokerage jatebɔsɛbɛn dabɔcogo

Jɛɲɔgɔnya min bɛ dilanbaga ni kiliyan cɛ, o bɛ kɛ nin cogo in na.

- Dilanbaga bɛ jago jatebɔsɛbɛn dɔ dabɔ feerekɛla ye, min kɔnɔ, a bɛ se ka baara kɛ bourse la.

- Ni wari bilala ka nafaw n’a diyanyekow jateminɛ, dilanbaga bɛ se ka wariko nafolo suguya caman san ani k’u feere a ka musakaw la.

- Investisseur bɛ sɛbɛn dɔ di ka ɲɛsin securities / warimarayɔrɔw sanni walima u feereli ma, ani cɛmancɛla bɛ bɛnkan dɔ kuncɛ.

- Nafolo min bɛ sɔrɔ o jago la (komisiyɔn sarataw jiginni kɔfɛ min kofɔlen don bɛnkansɛbɛn kɔnɔ) o bɛ ci waridonna ka jatebɔsɛbɛn na.

- Dilanbaga bɛ se ka wajibi wɛrɛw fana dafa : ka sɛgɛsɛgɛli kɛ, ka ladilikanw di waridonna ma ka ɲɛsin jagokɛcogo ma, ka sɛbɛnw lajɛ walasa ka sariya sariyaw labato.

Brokerage ka jatebɔsɛbɛn asiransi

Brokerage account insurance ye wajibi ye walasa ka wari bilabaga ka nafolo mara ni cɛmancɛlafanga ye banki fili walima ni a bɔnɛna a ka lase sɛbɛnnen na. Investisseur ka wariko minɛnw ka kan ka mara wari bilalenw cogo la, o kɔfɛ, u bɛ don brokerage sosiyete wɛrɛ ka jatebɔsɛbɛn kɔnɔ.

- jɛkafɔ kɛ ni tɔnbabaw dɔrɔn de ye . U tɛ bagabaga ni banki filili ni lase bɔnɛni ye. Moskow Exchange Market ka siti ofisiyali kan, jɛkulubaw ka lisi bɛ wuli kalo o kalo.

- Aw kana da aw ka warimaralenw bɛɛ la , ka da tɔn kelen kan . Ni kapitali nafa ka bon, a bɛ kɛ hakilina ye k’a tila-tila brokerage waribɔlan caman cɛ. Misali la, jamana ka banki jɛkulu caman ni diɲɛ tɔnba kelen cɛ.

- Aw ye sɛbɛnw sɔrɔ minnu bɛ jagokow sɛmɛntiya . Jagokɛla ka kan ka wariko jate sɛbɛnw di wari bilabaga ma, ani wari bilalen sɛbɛn min bɛ nafolo bɛɛ sɛbɛn. Fɛnɲɛnɛma nafama dɔ ni haminankow bɛ banki filili ko la.

- Aw kana wari fu mara waribɔlan kan . Ni i ma wari bila aksidanw na minnu bɛ nafa sɔrɔ, foyi t’a la ka wariba caman mara brokerage ni mɔgɔ kelen-kelen bɛɛ ka wari bilali jatebɔsɛbɛnw kɔnɔ.

- Aw ye jatebɔsɛbɛn dɔ dabɔ . Nin tɛ lakana fura ye, nka o waribɔlan sugu lakananen don ka bɔ dilanbaga dɔ ka banki filili la. Nka lasɔmini dɔ bɛ yen: a ladonni bɛ se ka kɛ sɔngɔba ye. Ka fara o kan, baarakɛyɔrɔw bɛɛ tɛ o baara suguw kɛ.

https://articles.opexflow.com/brokers/brokerskoe-obsluzhivanie-v-rossii.htm Bamako, Mali

Ɲininkaliw ni jaabiw

Aw ka kan ka mun wɛrɛ dɔn brokerage jatebɔsɛbɛn kan.

| Ɲininkali | Jaabi |

| Yala a bɛ se ka kɛ ka brokerage jatebɔsɛbɛn fila sɔrɔ bankiw kɔnɔ minnu tɛ kelen ye wa? | O tɛ bali sariya fɛ min bɛ sirataama. Nka, nin sariya in tɛ tali kɛ waridonna kelen-kelen bɛɛ ka waribɔsɛbɛnw na. |

| I bɛ se ka brokerage jatebɔsɛbɛn da wuli san jumɛn na? | Kabini san 18 la. Ko danmadɔw bɛ se ka kɛ, jamanaden bɛ nafolo ciyɛn ta. O kɔ fɛ, a bɛ Sɔn ka ‘konte jɛlen dɔ Dabɔ. Nka, jago bɛ se ka kɛ dɔrɔn ni sariyatigiw sɔnna o ma. |

| Brokerage ka jatebɔsɛbɛn musaka ye joli ye? | A ka dɔgɔn min bɛ kumaɲɔgɔnya kɛ brokers fɛ, o ye 30.000 ye Risi rublew fɛ. |

| Term Brokerage Account: O ye mun ye? | O ye fɛnw falenfalen suguya dɔ ye, bɛnkanw bɛ kɛ min kɔnɔ waati dɔ la. An bɛ kuma options contracts ani futures kan. |

| Nafolo minɛn tɛ sɔrɔ jago kama i ka jatew kan. O kɔrɔ ye mun ye? | Nafolosɔrɔminɛn suguya caman minnu bɛ Moskow ni Sɛnt Pɛriburugu bolomafaraw la, olu ka waatibolodacogo kɛrɛnkɛrɛnnen bɛ u la (jago daminɛ waatiw ni a laban waatiw). Laala, jagokɛ waati min bɛ kɛ nafolomafɛnw na, o banna. O kɔfɛ, application bɛna dɛsɛ. |

| Cogo di ka brokerage jatebɔsɛbɛn dɔ bɔ yen? | Kɛrɛnkɛrɛnnenya la, i bɛna a ɲini ka “Compte” yɔrɔ digi, o kɔ i ka “Close account” yɔrɔ sugandi. Ɛntɛrinɛti kan ɲinini sɛbɛn dɔ bɛna jira ka dafa. |

| Wari bɛ bɔ cogo di brokerage jatebɔsɛbɛn kɔnɔ? | Ka warimaralenw bɔ ATM la, o tɛ se ka kɛ. U ka kan ka fɔlɔ ka bɔ banki ka waribɔsɛbɛn dɔ kɔnɔ. |

| Mun bɛ kɛ ni i tɛ baara kɛ ni brokerage jatebɔsɛbɛn ye? | Konte baara dabila (k’a sɔrɔ a ma dabila) o tɛ wari bilabaga bɔ komisiyɔn sarali la. O de kosɔn, balansi bɛ se ka dɔgɔya, wa i bɛna juru sara brokerage sosiyete la. |

| Cogo di ka wari bɔ brokerage jatebɔsɛbɛn dɔ la ka taa dɔ wɛrɛ la? | A ka fisa ka lakanafɛnw feere brokerage jatebɔsɛbɛn kɔrɔ kɔnɔ, ka warimaralenw bɔ ka taa debiti karti la ani ka jatebɔsɛbɛn fa ni cɛmancɛ kura ye. |

| Yala ne bɛ se ka brokerage jatebɔsɛbɛn da wuli mɔgɔ wɛrɛ ye wa? | O cogo la, aw ka kan ka gɛlɛya in fɔ cɛsiribaga ye ani ka dɛmɛ ɲini. I bɛ se ka brokerage walima mɔgɔ kelen-kelen ka wari bilalen jatebɔsɛbɛn da wuli mɔgɔ wɛrɛ tɔgɔ la, o kɔfɛ ka avoka sɛbɛn dɔ sɛbɛn mɔgɔ fɔlɔ ye min bɛ wariko jago kɛ. |

| Brokerage ka jatebɔsɛbɛn nimɔrɔ ye mun ye? | Jatebɔsɛbɛntigi kelen-kelen bɛɛ ka jatebɔsɛbɛn nimɔrɔ. A bɛ kɛ walasa ka mɔgɔw bali ka ɲagami ani ka baarakɛlaw dɔnni nɔgɔya. |

| Brokerage komisiyɔn jatebɔ. A bɛ kɛ cogo di? | Brokerage commission – kɛmɛsarada la, bɛnkansɛbɛn hakɛ bɛɛ lajɛlen na. A bonya bɛ fɔ bɛnkansɛbɛn kɔnɔ. |

Farati jumɛnw bɛ a la?

Faratiw ye ko nafamaw dɔ ye minnu bɛ sɔrɔ desizɔn ta don na ni cɛmancɛlatigi dɔ ye. Nin “jaan” ninnu bɛ Fɔ a ma:

- Jago kuntaalajan tɛ se ka kɛ ni Risi ni diɲɛ nafolo caman tɛ yen. O fana bɛ tali kɛ dɔnnikɛlaw ka ladilikanw sarali la.

- Sɔrɔ sɔrɔyɔrɔba min bɛ sɔrɔ dilanbagaw fɛ , o ye komisiyɔn sarali ye wariko baara kuncɛlenw na. O de kama, cɛmancɛlamɔgɔw bɛ waridonnaw bila ka wariko minɛnw san walima k’u feere tuma bɛɛ.

- Aw bɛna a sara ka ɲɛ ka ɲɛsin sɛgɛsɛgɛlikɛlaw ka sɛgɛsɛgɛli ma. Brokers tɛ o kunnafoniw di fu.

- An man kan ka ɲinɛ ka an janto an yɛrɛ la. Namarakɛlaw ka teli ka dogo u yɛrɛ kɛ i n’a fɔ jagokɛlaw minnu bɛ se kosɛbɛ ani minnu ye teriw ye.