How the St. Petersburg Stock Exchange works: index, stocks, SPB Exchange quotes. PJSC “St. Petersburg Exchange” https://spbexchange.ru/ru/about/ is a platform that from the very beginning of its foundation organizes trading in financial instruments, gradually absorbs and expands other areas that allow it to compete with equal or larger exchanges.

- The history of the foundation and development of PJSC SPB

- The principle of operation of the St. Petersburg Stock Exchange: the structure and participants of exchange trading

- Exchange functioning system

- Liquidity on the exchange

- PJSC SPB: what is traded on the basis of the exchange?

- The process of registration on the site of PJSC SPB and the start of trading

- How can a participant of exchange trading connect to the trading process

- Registration procedure

- Trading calendar

- Clearing and Settlement

- Participants in the stock market

- Rating of participants in the trading process on the site of PJSC SPB

- Documentation and reporting

- Technological solutions

- Interfaces

- Tariffs

- Quote charts

- Index

The history of the foundation and development of PJSC SPB

The St. Petersburg Stock Exchange dates back to the founding of the city itself. In 1703, Peter 1, inspired by stock trading while traveling, ordered to recreate something similar in the capital of Great Russia. Within two years, the building was diligently erected and the first financial transactions were carried out. In 1997, the system was replenished with automated trading formats, where all financial instruments subsequently moved. In 2009, the company, which was non-commercial in nature and was Leningrad, becomes a joint-stock company and changes its name to the St. Petersburg Stock Exchange. Since 2013, concluding a contract with the

Moscow Stock Exchange”, the city on the Neva conducts all financial transactions, and the capital system takes over the tasks of the clearing center. Two years later, an analytical service joined the structure of the St. Petersburg Stock Exchange. Its task was to provide participants in exchange trading with information on foreign financial assets in Russian. The service processes foreign instruments and is responsible for educational and explanatory lectures in the field of financial literacy. In the middle of the next year, the site adopted a technology that provided access to international liquidity. From now on, traders and investors from Russia could make financial transactions immediately after trading was opened on foreign exchange niches. Today, PJSC SPB cooperates both with the stock market and with its derivatives area, simultaneously conducting a public sale of goods,

Reference! Previously, instruments of only Russian companies were put up for auction, however, in 2014, the market of foreign assets joined the exchange and actively began its trading.

The principle of operation of the St. Petersburg Stock Exchange: the structure and participants of exchange trading

The organization of trade in PJSC SPB is quite large-scale and includes the following industries:

- securities market founded in 1998; since 2014, a foreign market has joined the Russian niche, today the number of elements exceeds more than 1000;

- futures market ; started its work with futures, the contract for which was first signed in 1994, but since 2014, activities in this area have been suspended.

Exchange functioning system

The trading process on the site of PJSC SPB is carried out daily from 10:00 am to 01:45 am according to the time zone of the capital. Until noon, the speed of sales is small. It increases when the process is launched in the United States, then the liquidity of the foreign exchange is added to the liquidity of Russian instruments, prices increase to the modules established by foreign markets.

Note! On days when state ceremonies are celebrated in the United States, the trading process on the site is suspended.

Liquidity on the exchange

Instruments of foreign companies are sold and bought for dollars, Russian assets, respectively, for rubles. One object of the offer is equal to one financial instrument. This is a practical solution for beginners in stock trading who have little capital. For the trading process, the exchange uses the same services as the capital market. This also includes the QUIK trading

system , mobile programs for gadgets are supported. Some brokerage companies provide an opportunity to carry out trading operations on the basis of PJSC SPB with

leverage (leverage is an auxiliary tool, when trading funds exceed equity, the broker lends an additional amount of them to complete a transaction) and perform short financial transactions.

Note! The list of financial instruments that support the above add-ons is different for each broker.

The trading process is carried out in the T + 2 format: acquiring assets at the beginning of the week, the investor receives it in his hands two days later – on Wednesday, when the settlement of the financial transaction is completed.

PJSC SPB: what is traded on the basis of the exchange?

On the basis of PJSC “St. Petersburg Stock Exchange” financial transactions are carried out for the purchase / sale of shares, bonds, derivatives and other instruments. In addition, work is underway with elements of the commodity exchange (this includes raw materials, expensive metals, including ferrous and non-ferrous, food and non-food products, products of the chemical and agricultural industries, as well as construction components). All financial instruments together form a list of instruments admitted to trading. The list is divided into 3 categories:

- Quotation list of the 1st category . In order to be listed here, an asset must meet a set of stringent trading volume and liquidity requirements. Not only financial instruments are evaluated, but also the values of the organization that forms and issues these securities.

- Quotation list of the 2nd category . Here, more loyal conditions are imposed both on assets and on the issuer.

- Unquoted side of the list . This part contains all other types of papers.

The unquoted side of the list, in turn, is divided into 2 more categories:

- Voskhod – a group formed for organizations that use capital to carry out activities in the Far East;

- qualified trader – this includes elements defined for experienced participants in exchange trading.

The process of registration on the site of PJSC SPB and the start of trading

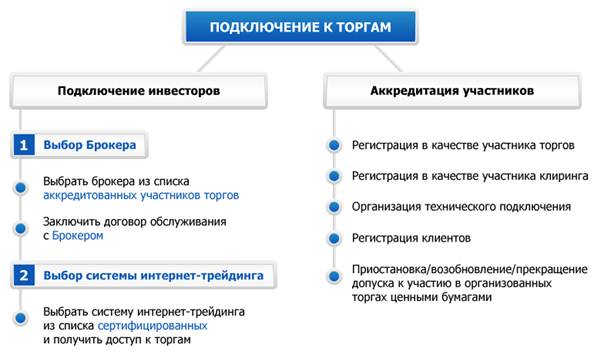

How can a participant of exchange trading connect to the trading process

First of all, you need to decide on a brokerage company:

- Choose a broker from the list of accredited participants in the trading process.

- Carefully read the terms of the contract for brokerage services and put your signature, agreeing to all the terms and conditions.

https://articles.opexflow.com/brokers/brokerskoe-obsluzhivanie-v-rossii.htm

Registration procedure

To complete the registration procedure as a participant in exchange trading in organized trading in financial instruments, the St. Petersburg Exchange PJSC should collect and provide the necessary paperwork for this:

- confirmation of the investor’s admission to the trading process, signed by the applicant;

- documents, including an application by a legal entity with a request to register a ward as a participant in exchange trading;

- the original application form of the applicant;

- two copies of the contract for the provision of services for the implementation of an organized trading process in assets;

- original power of attorney or a copy certified by a notary, which indicates the powers of a potential investor;

- the original of the previously signed consent to the processing of personal data by the site of PJSC SPB.

Trading calendar

A trading (economic) calendar is a kind of up-to-date news source that collects data on economic events taking place around the world. Calendar includes:

- publication of various reporting documents on certain indicative elements;

- indication of weekends, holidays and working days;

- a written announcement of any events, laws and regulations that have entered into force that relate to the economic sphere of life;

- other important events.

Clearing and Settlement

The process of non-cash settlements between the parties to the transaction is carried out by the clearing center of the Moscow Stock Exchange. The Clearing Center performs the duties of the Central Agent. In the process of non-cash exchange in a transaction, the organization performs:

- Defines equal requirements for transactions made in the period from 7 pm on the first day to the same time of the day Т0.

- Identifies risk elements for assets on the next day of trading.

- Recalculates margin for open positions, taking into account new risk elements.

- Recalculates collateral taking into account new risk elements.

Based on the results of the work of the clearing center, reporting sheets are generated in the appropriate format. The Clearing Member is obliged not later than 4 pm Moscow time zone on the day of settlement to fulfill the obligations – to deposit funds or financial instruments in the required amount to the trading account. If the participant has not fulfilled its obligations sufficiently, the clearing organization starts the non-delivery settlement procedure.

Participants in the stock market

The list of all accredited trading participants on the stock market is presented on the official website of PJSC “St. Petersburg Exchange”. In the table you can find all the relevant information about the participants:

- full name of the company;

- TIN;

- city of registration;

- Contact details;

- date of admission to the trading process;

- category.

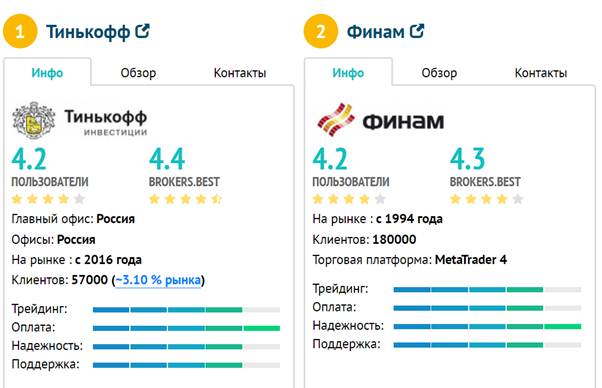

Rating of participants in the trading process on the site of PJSC SPB

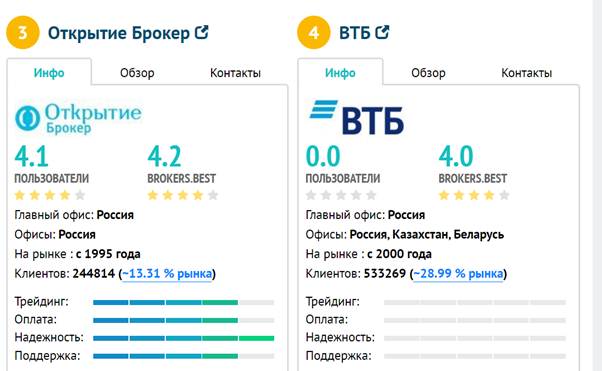

Summary of the best companies trading on the PJSC SPB platform for April 2022:

| Name | Number of clients | Grade |

| Tinkoff Investments | 57 000 | 4.4/5 |

| Finam | 180 000 | 4.3/5 |

| Opening Broker | 244 814 | 4.2/5 |

| VTB | 533 269 | 4.0/5 |

Documentation and reporting

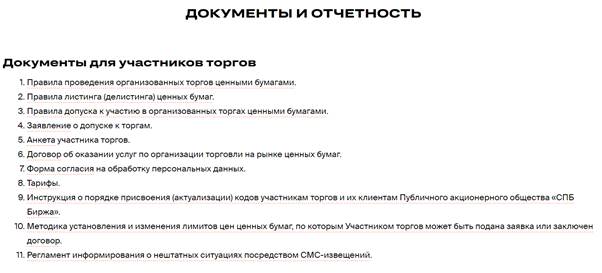

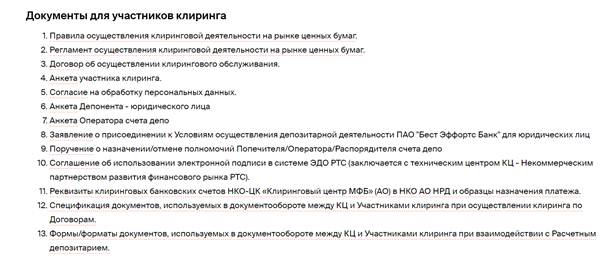

The official website of PJSC “St. Petersburg Exchange” provides all relevant information on the reporting and documentation of the organization, divided into the following categories:

- Documents for bidders.

- Documents for clearing participants.

- Documents for the organization of technical access.

Technological solutions

Technical and network services are provided by NP RTS. PJSC “Saint Petersburg Exchange” provides its participants in exchange trading with a software and hardware complex that directly leads to financial markets:

- dedicated channel.

- Encrypted channel over the Internet “network-to-network”.

- Internet connection using a VPN client.

Interfaces

The marketplace has network hardware and software available in various interfaces. This includes:

- Transactional trading gateway . Submits trading tasks and receives report sheets on them.

- Risk Management Gateway . Changes limits, risk elements, as well as translations of positions and additional sources.

- Market Data Broadcast Gateway . It reflects the current state of the market and actual data on bought/sold items.

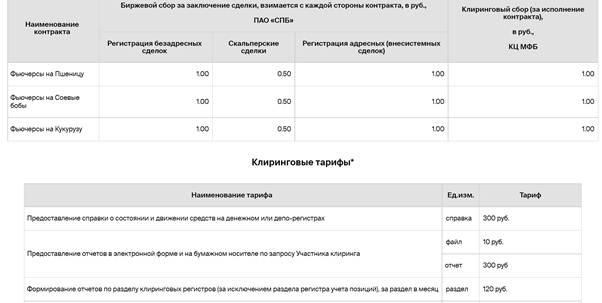

Tariffs

Tariff plans and all conditions for them can be found on the official website of PJSC “St. Petersburg Exchange”.

Note! It is recommended to choose a tariff plan depending on the style of trading. If you practice active trading, a tariff with a minimum commission fee will be more profitable; for collecting an investment portfolio and investing capital, an option with a minimum cost for account maintenance and a free depository is suitable.

Quote charts

The schedule of expected prices is formed on the basis of the “Current market price” indicator:

- The “Current market price” indicator shows the level of price modules for foreign assets and financial instruments collected during the trading process on the PJSC SPB site and the prices set on the foreign market where the foreign instrument was first listed.

- The indicator is calculated periodically – from the moment of opening to the moment of closing the trading process on the site for all auction financial instruments of foreign issue.

- The “Current Market Price” is calculated in order to convey up-to-date information to exchange traders and is not a tool that can be used to suspend the trading process on the basis of the legislation of the Russian Federation.

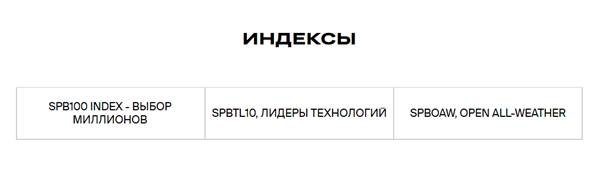

Index

The exchange (stock) index is an indicator indicating the state of the financial instruments market, calculated on the basis of the market capitalization of the companies included in it, based on the average price level at the end of the trading process on the exchange. These indicators make it possible to assess the state of the exchange as a whole, to identify at what period in the economic cycle the market is located.