Features of the Alfa Direct trading platform, trading and investment in the terminal, brokerage services, the Alfa Direct trading terminal, and connecting robots Alfa Direct is a trading platform from the Alfa-Bank banking organization that provides advice and access to trading on the stock and over-the-counter markets . It also enables depositors to control and direct their financial instruments in the right direction in real time from any corner of the planet.

- Investments and trading with Alfa-Direct

- Brokerage service from Alfa Bank

- How to open an account with a broker in Alfa-Direct?

- How to register in the Alfa-Direct/Alfa-Investments personal account?

- Personal account: how to register and create an account

- Functionality of the personal account “Alfa-Direct”

- Tariff plans and conditions

- Individual investment account in Alfa-Investments: program conditions and its advantages

- What is the meaning of the service

- Advantages

- Mobile app for trading

- Trading terminals “Alfa-Investments”

- How to connect a robot to the Alfa Direct terminal

- Step 1

- Step 2

- Step 3

- Step 4

- Step 5

- Answers to frequently asked questions

Investments and trading with Alfa-Direct

Alfa Direct is an updated investment and trading application with a new name – Alfa Investments https://alfabank.ru/make-money/investments/.

- The home screen is now subject to adjustment according to various parameters: from now on, here you can add what is used most often.

- In the “Portfolio” section, we introduced analytics on financial instruments and general statistics on cash transactions and payments.

- We expanded the recommendation line and made the heading “Investment ideas” more ambitious. All this is in the “Forecasts” section.

Brokerage service from Alfa Bank

A broker is one of the main persons in investment activity, which is an intermediary between a trading participant and its market. Its main task is to purchase / sell currency, shares, bonds and other securities at the direction of the investor for a certain, previously stipulated fee. Advantages of brokerage services in Alfa-Direct:

- a brokerage account is opened within 5 minutes, there is no need to personally visit a bank branch;

- replenishment of a brokerage account from Alfa-Bank plastic is carried out without a commission fee;

- service is free;

- a convenient program for the Alfa-Investments mobile device: all the necessary tools for investment and trading are collected here;

- a brokerage account can be opened in four currencies and quickly replenished through a mobile application;

- You can withdraw funds from your account at any time, except for a technical break: from 00:00 to 2:00 the bank is closed;

- You can start an investor’s activity at any time by investing any amount. The commission fee for the operation performed varies from 0.014% to 0.3%;

- exchange trading participants with large savings have access to the “Personal Broker” service, within which professionals will help balance a portfolio of securities;

- a wide range of financial assets: a wide range of securities and admission to the market of the Moscow Exchange and the St. Petersburg Stock Exchange;

- the necessary information on the brokerage account and financial assets is always available in the online application; you can also contact the hotline with any questions or write a letter to the chat with professional traders.

How to open an account with a broker in Alfa-Direct?

To open a brokerage account, an investor needs to visit an Alfa-Bank branch in person or use the online options at https://alfabank.ru/make-money/investments/brokerskij-schyot/

How to register in the Alfa-Direct/Alfa-Investments personal account?

Before registering his personal account on the Alfa Investments trading platform, the client must obtain an electronic digital signature. You can get it at a bank branch by signing an agreement on an agreement on opening a brokerage account, after which you can replenish it by making the first replenishment. You can also receive an EDS on your own, without a visit to a bank branch. To do this, the user must download the Alfa-Direct program on the PC from the link https://alfabank.ru/make-money/investments/terminal-alfa-direct/ and generate a digital key. Next, you should sign an application to open an account with a broker.

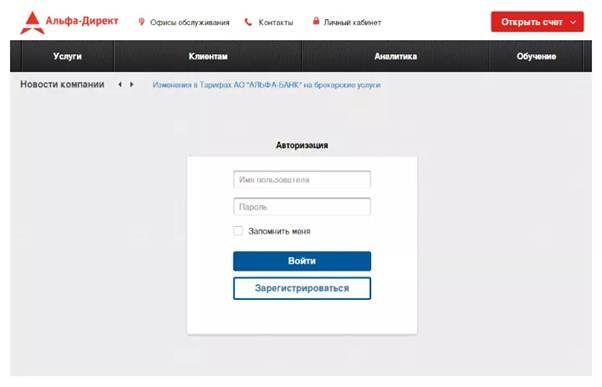

Personal account: how to register and create an account

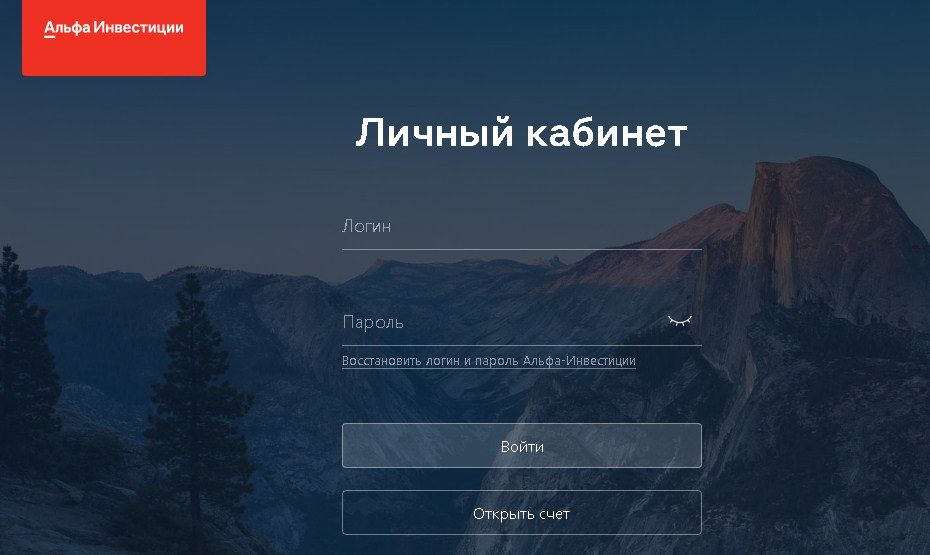

The client registration procedure is carried out on the official Alfa-Direct trading platform.

- surname, name and patronymic;

- valid e-mail address;

- smartphone contact number;

- details of the identity document.

This is how the Alfa Direct personal account looks like in 2022 at the link https://lk.alfadirect.ru/:

Note! It is important to indicate a valid phone, as it will receive an SMS with a code that must be entered to confirm the number.

After registering an account, the user needs to go through the procedure for generating a key container and leave a request for a certificate in the “User Questionnaire” section.

Important! All papers in the account are confirmed by an electronic digital signature. If the EDS key is lost by the user, it cannot be restored. You will have to create a new one and connect it to your personal account.

Functionality of the personal account “Alfa-Direct”

The Alfa-Direct personal account is equipped with all the necessary tools for round-the-clock investment activity. With it, the client can:

- issue tasks;

- change the secret code from the account;

- withdraw or deposit funds to a brokerage account;

- remotely control and manage documents;

- analyze the financial transactions carried out, build forecasts for the following investment transactions;

- view the history of operations and transactions for the entire time of work on the exchange market at any time;

- get valuable tips and advice from stock trading experts.

Tariff plans and conditions

Alfa-Direct investment platform offers its clients several tariff programs with favorable conditions.

| Tariff plan | Brokerage service | Commission fee for transactions with securities | Commission fee for currency transactions |

| Investor (suitable for those who place less than 80,000 rubles on their account per month) | Is free | 0.3% | 0.3% |

| Trader (suitable for those who are actively involved in market transactions, the more financial transactions, the lower the commission fee) | 199 rubles / 30 days if financial transactions are made, if not – free of charge | from 0.014% to 0.3% | from 0.014% to 0.3% |

| Expert Advisor (suitable for those who have a large portfolio, but want to get advice on balancing it) | From 0.5% per annum of the total amount of invested capital | 0.1% | 0.1% |

| Personal Broker | Is free | from 0.014% to 0.3% | from 0.014% to 0.3% |

Individual investment account in Alfa-Investments: program conditions and its advantages

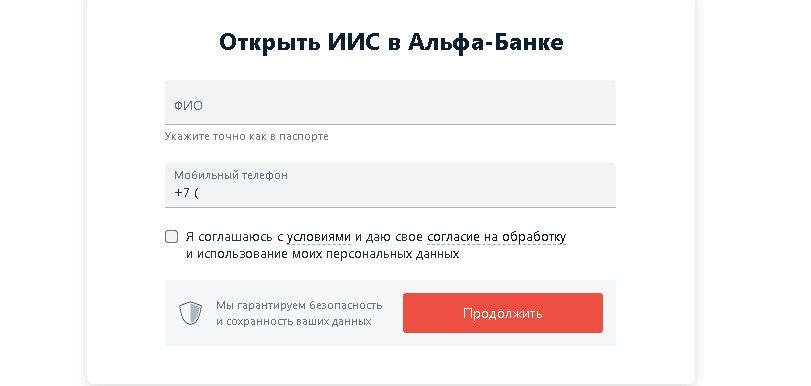

Individual Investment Account (IIA) is a program offered to its clients by Alfa-Capital financial and credit organization. Using this service, citizens can invest their savings in the bank’s investment projects.

Note! When opening an IIS in Alfa-Bank, it is important to take into account that the user will not have direct access to the exchange, and therefore the purchase of financial instruments is the concern of the managing organization.

What is the meaning of the service

The essence of the work of an individual investment account is as follows: a potential participant in exchange trading opens an IIS and selects one of the investment strategies offered by the bank.

Note! Newcomers to the field of investment should first consult with an expert of the department in order to understand which option will be most beneficial for them.

IIS in Alfa Bank has the following advantages:

- The managing organization is active in the exchange market, buying and acquiring financial assets, thereby earning money for the ward.

- After recalculating the total amount earned and deducting the commission fee, the individual receives his share of the profits from the work performed.

- The account is replenished with the minimum available amount (from 10 thousand to 1 million rubles).

You can open an IIS in Alfa Bank at the link https://alfabank.ru/make-money/investments/iis-broker/

Advantages

The strengths and advantages of opening an IIS for clients who have already used this service at Alfa Bank are:

- benefits regarding taxes from the state;

- practicality – the managing organization saves the time of its ward, performing not only the main functions of investment activities – buying / selling securities – but also analyzing the market for more efficient work;

- the validity of the account is 3 years, after their expiration, the bank simply offers to issue a new one and continue cooperation.

Mobile app for trading

Alpha Direct is an application specially designed for

mobile devices so that traders and investors can continue their activities at any time and under any circumstances.

- the minimum deposit of funds at interest is 10 thousand rubles;

- the amount of the financial transaction is not limited;

- transmission of current actual prices;

- chat with investors and traders to discuss investment strategies and other issues;

- the Alfa-Direct mobile application has a thematic section where news and current information of the exchange market are published, as well as tips and ideas for active traders;

- program for mobile device users: both for iOS https://apps.apple.com/ru/app/id1187815798 and for Android https://play.google.com/store/apps/details?id=ru.alfadirect .app.

Note! To replenish an account or withdraw earned money, you can use an Alfa Bank card or a bank account.

Trading terminals “Alfa-Investments”

The Alfa Direct trading application is convenient because it allows you to use not only various tools, control and manage financial transactions, but also choose the most convenient trading terminal for work. The client is offered a choice of three terminals:

- Banking (pocket) program . Suitable for those who conduct investment activities through a mobile device operating on the basis of iOS or Android.

- Alpha Investments . The program, aimed at experienced investors and traders, is installed on a personal computer or laptop under Windows OS.

- QUIK . The terminal includes a standard package of services that is downloaded to a computer with Windows OS.

How to connect a robot to the Alfa Direct terminal

Let’s understand the process of connecting a trading robot using the example of the Step by Step strategy in the PC program Alfa Direct.

Step 1

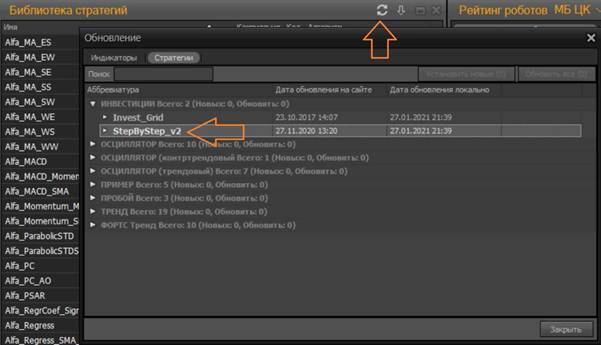

Open the repository of investment strategies, which is located on the main page of the program. Next, we update the library and download the Step by Step investment plan.

Step 2

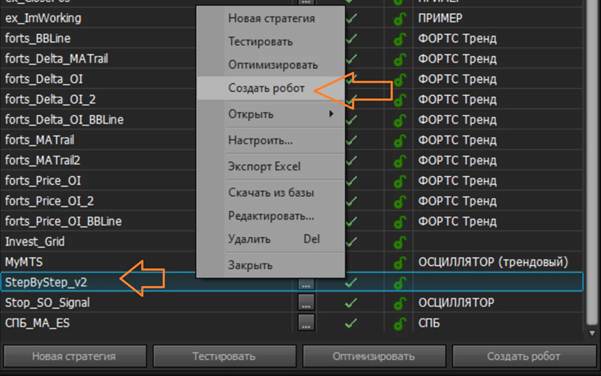

We find the installed plan in the list of downloads and click on the “Create robot” button.

Step 3

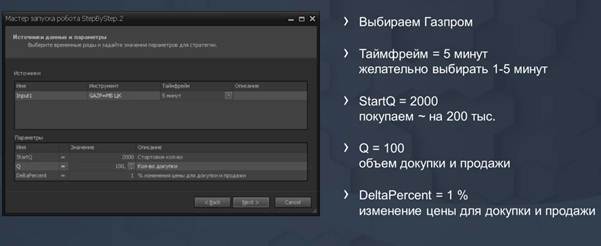

We select Gazprom’s financial instruments and set other parameters.

Step 4

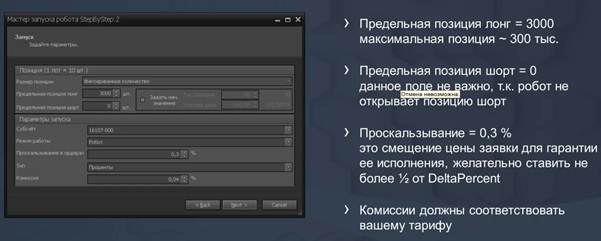

We activate the work of the trading advisor. Go to the “Robot Manager” section and click “Play”.

Step 5

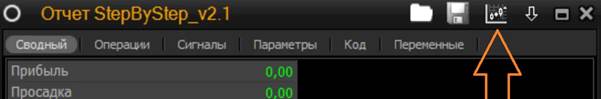

Now let’s make sure that the EA has drawn two lines for buying/selling the previously set volume Q. To do this:

- We open the “Robot Manager” and find our previously formed program. Click “Report”.

- Then find the icon shown in the screenshot and click on it.

- Two red and green lines will appear on the chart.

The robotic system is ready.

Answers to frequently asked questions

How to change the tariff program? Log in to your personal account, and then go to the “Account Details” section. From here we find the “Basic Information” tab – it contains all the information about the current tariff plan. Choose another program, save the changes and sign the document on changing the EDS tariff. The new tariff will take effect from the next day.

Is it possible to run several trading robots-advisers on the platform at once? Yes

Is it possible to run the QUIK trading terminal on several devices?This exchange trading terminal cannot be used when logging in from the same account simultaneously from 2 or more devices. If the session is not completed on one PC, then the other device will not allow you to use the terminal until the current connection is interrupted.