Necessary knowledge about trading for beginners – what beginners need to know in order to consistently make money on the exchange, basic strategies, approaches, mistakes and fears of novice traders. Today, almost everyone has heard about trading and the amounts that can be earned in the securities market. However, few people seriously think about the reverse side of this process. In this article for beginners, we will tell you what trading is, whether it is worth starting to engage in it, we will consider in detail the principles and types of trading, as well as what it is based on.

What is trading – the basics for beginners

The term trading (trading) means the analysis of the situation on the securities market, including their purchase and sale by an investor / trader. In the above example, the term market appears – this is a kind of place that unites all transactions from participants in the process from anywhere in the world. The securities market works with stocks, bonds, options and futures.

Should I start trading?

Trading can be considered a full-fledged business. Trading conditions will often be set against a trader, where there are no rules, no restrictions, only those who want to earn and the securities market. It would seem that the absence of restrictions means more opportunities, but this is not entirely true. Such an environment is associated primarily with the unlimited risks of losing one’s own savings.

Trading is worth it for people who are resistant to their own emotional influences, have critical thinking, are able to make cold-blooded decisions with a vision of the future, and are not afraid to lose money, because any investment is a risk.

Trading Principles

You should start with the understanding that trading is changeable. What rises in price today may fall below the purchase price tomorrow. The current value of an asset is influenced by both external factors and the traders themselves. For example, the stock of a high-tech company will react to negative news about domestic politics or rumors about a change in leadership. Traders will start selling their assets in order not to go negative, as a result of which the market value of the company’s shares will also fall. A trader who wants to make a profit from his investments must initially predict the movements in the value of an asset. To do this, they usually use different trading strategies that form two main trends:

- Bulls are market participants who are confident in the growth in the value of an asset. Such traders pursue the goal of selling securities when their value reaches its peak.

- Bears – these traders, on the contrary, believe in the imminent fall of a particular security, so they try to sell existing assets. The ultimate goal is to buy stocks, bonds, or other securities when the market is in a stable bottom position.

Experienced players in the securities market may call it bullish or bearish. This is an established association with animals. The bear puts pressure on the value of assets and lowers them lower, while the bull, on the contrary, throws it up with its powerful horns. This association helps beginners to remember basic terms faster.

[caption id="attachment_15745" align="aligncenter" width="600"]

technical analysis , which is based on charts and indicators, and there is a

fundamental analysis based on current news and events of a particular company. But even this is sometimes not enough, which is why new tools appear that make the trading process easier for both professionals and beginners.

High frequency trading

Since this type holds the position open for less than a second, we can conclude that they are opened by automated software –

trading robots . They work according to a pre-programmed trading strategy and help the trader earn more without significant effort. https://articles.opexflow.com/trading-training/algoritmicheskaya-torgovlya.htm In order to use this type for work, you must either purchase or create the appropriate software yourself. Pros:

- the robot can provide a stable and absolutely passive income;

- you don’t have to spend time looking for and analyzing an asset for trading.

Minuses:

- the cost of software and the complexity of self-creation;

- time spent on optimization and robot tests;

- the presence of the necessary conditions – a high-speed connection to the Internet, uninterrupted power supply and some other nuances (non-compliance can lead to a complete loss of the bank);

- the robot may not work with all exchanges, because some limit the frequency of transactions or increase commissions;

- automated software may lose its relevance if, for example, there is a change in the nature of the market.

https://articles.opexflow.com/trading-bots/opexbot-besplatnaya-platforma-dlya-algotrajdinga-na-tinkoff-investicii.htm

scalping

This type of trading has introduced a new concept to trading – the scalper. This is a person who is engaged in scalping. The strategy of scalpers is in small transactions, or rather in their number. The ultimate goal is to close the trading session with a satisfactory result. Scalping cannot be called a stable way to

make money on trading , since the main activity of a scalper is catching small impulses. They can be caused by various factors, for example, the sale of a large number of assets by a large player. Scalping will no doubt be to the taste of novice traders, as it affects the overall development in the field of trading. Scalping pros:

- allows you to quickly gain experience;

- learn to recognize the internal tools of the exchange and infographic indicators;

- become more restrained and not make radical decisions if the market starts to go down sharply;

- significant investments are not required – a couple of tens of dollars will be enough to start scalping on one of the online exchanges;

- simple understanding and the earnings scheme itself;

- it is enough just to create a general trading plan;

- a huge number of entry signals every day.

Minuses:

- it is necessary to spend a whole day at the computer in order to catch the most successful entry point;

- the probability of missing out on more profitable earning opportunities on other timeframes;

- The scalper’s income is directly related to the commissions of the exchange, so the profit from one transaction should be as high as possible;

- the need for a high-speed internet connection.

day trading

The main goal of a day trader is to make money trading securities within one day and session. He makes a profit for making a large number of transactions, and severely limits the loss for unsuccessful decisions. The method is quite complicated, since not all day traders close profitable deals. The first months of such trading are completely unprofitable for most beginners – SEC statement. Pros:

- the day trader independently builds a working schedule,

- there is enough information on the network that will help you start making money on day trading;

- no risks during inactive periods – nights or weekends;

- this method helps to quickly get used to the world of trading, as well as gain the necessary knowledge in practice.

Minuses:

- day trading requires full daytime employment – in fact, working hours set the exchange schedule, but it is the trader who chooses the days;

- it is necessary to use the latest strategies and tools, since the method in question is popular among robots and professionals in the securities market;

- this type of earnings also requires constant monitoring of profitable entry signals;

- large commissions of stock brokers, which must be taken into account;

- insufficient preparation, the wrong approach, poor emotional state, discipline problems and a bunch of other factors can lead to significant losses.

swing trading

The main advantage of swing traders is that there is no need to devote a lot of free time to trading. The transaction can last up to several months, and anyone with sufficient investment capital can try swing trading. Pros:

- an open position is held for many days or even weeks, which is more likely to close it with a profit higher than, for example, in day trading;

- swing trading is not a full-time activity, which allows the trader to do other things in parallel;

- this method is not demanding on equipment and Internet connection speed, so even a weak computer or smartphone will do;

- usually swing traders do not consider trading as the only source of income and have others that are able to cover possible losses.

Minuses:

- any type of trading is associated with risks in one way or another, the considered one was no exception, since it requires holding positions for a longer time;

- swing traders cannot boast of the best entry prices, since they enter the exchange a maximum of a couple of times a day, and scalpers or day traders monitor the market constantly;

- you have to wait a long time for a signal before entering a position.

Medium term trading

Those who focus on the average term can hold positions ranging from a few months to years. This is not considered a common term, as some traders believe that this is what trading for a couple of days is called.

The most suitable asset for medium-term trading is equities, since others have an increased volatility index over several months or years.

Pros:

- the trader does not worry about a short-term loss of value, has the ability to analyze the situation in the securities market in detail, and is also not amenable to radical decisions;

- there is no need for modern technologies – a powerful computer, Internet connection, analysis tools and others;

- the commissions that the broker receives do not have a decisive influence on the outcome of the transaction;

- this type does not require a significant investment of time;

- you can work with little-known brands, companies and even little-known markets.

Minuses:

- at least fundamental skills in conducting market analysis are required;

- it is difficult to make a choice between a large number of assets, especially when it comes to little-known stocks;

- medium-term trading is not suitable for traders who want to trade actively, as positions are held for months and sometimes years.

Long term investment

Investors who work with long-term holdings of securities are usually willing to wait about 10 years. This period is considered the most successful – this is evidenced by statistics. Such people do not think about falling assets, do not think about the short term, and the investors themselves say that they will never sell their securities – most likely this is just a metaphor that has a psychological impact. Pros:

- trading does not have any psychological impact, since the investor is deprived of the obligation to track the value of his assets;

- long-term investments often do not require detailed analyzes, and therefore save a significant amount of time;

- there is no need to study strategies, analysis tools, platforms and other references;

- in many countries there are preferential conditions for income from long-term investments – they usually begin to work after several years of holding assets;

- You can earn not only on the growth in the value of securities, but also on dividends – companies pay out part of the income for a certain period of time to shareholders.

Minuses:

- long-term trading requires good start-up capital, which will be locked up for years to come;

- a trader must remain calm if the company that was chosen for investment has temporary difficulties – not everyone succeeds;

- long-term investment must be started from an early age, because it will take a lot of time.

What is trading based on?

In addition to knowledge of the basics and terms, a novice trader must have other important basics. There are many pitfalls in trading, charts, instruments and terms that are incomprehensible at first glance. Let’s take a look at five components that form a complete picture of trading.

Knowledge

Today, there are many books from popular investors who have managed to make a fortune. Such sources can tell about approaches, methods, human qualities, strategies and other materials that helped to achieve such success. Some say that it is their books that will help you learn how to make money in the securities market. https://articles.opexflow.com/trading-training/larry-williams.htm TOP 5 books for a beginner investor:

- The Smart Investor – Benjamin Graham

- The Smart Investor’s Guide – John Bogle

- How the economy works – Ha Joon Chang;

- Ten main rules for a novice investor – Burton Malkiel;

- Investment appraisal – Aswat Damodaran.

Of course, this TOP will differ for each person, but it is these books that will help you understand the basics of trading and investing. No less interesting is the biography of the authors of the presented materials. However, books are not the only source of up-to-date knowledge in the field of trading. Today, both private authors and highly specialized organizations are ready to offer individual training or courses on trading both in the stock markets and on cryptocurrency exchanges, such as Binance. https://articles.opexflow.com/trading-training/knigi-po-algotrajdingu.htm

Capital

Novice investors often ask the same question – how much money do you need to start earning or trading in the stock market? You can start with a dozen dollars, but the chosen type of trading will help you answer this question most accurately. For example, for medium-term and long-term investments, capital does not really matter, but for scalping, or high-frequency trading, you need an amount that can cover costs – commissions and other expenses. The optimal amount for beginner traders is a few hundred dollars. There is no point in risking large amounts if a beginner does not even understand the fundamentals. This amount will help to master the functionality of the exchange practically, gain experience and try out the first trading strategies. It is not worth counting on some kind of income at first, but it is still possible. https://articles.

Technical part

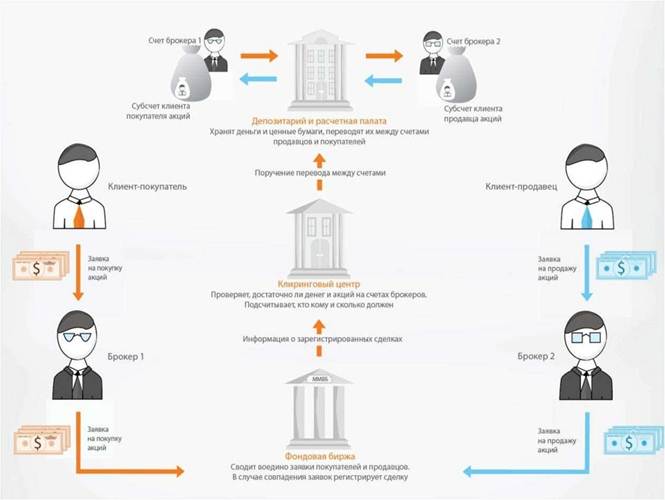

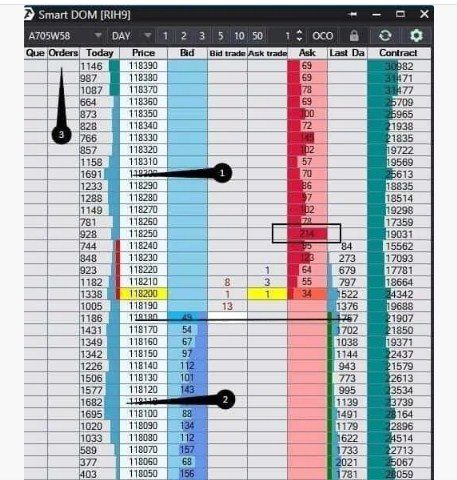

In 2022, anyone can trade. Trades are carried out through an intermediary – a broker, and all transactions are carried out through a

trading terminal – specialized software. Programs are available for almost every device, such as a personal computer or mobile phone. Each broker tries to improve the opportunities for traders to earn commissions from the sale / purchase of assets. However, trading on a stationary device will always be preferable due to more options and a stable internet connection.

Strategies

Novice traders often do not understand what trading strategies are. They are often confused with the types and styles of trading discussed above, but they have almost nothing in common. Strategies can be closely related to charts and volatility, or vice versa, they can focus exclusively on company news. For example, if a company reported an increase in profitability for a certain quarter, then the acquisition of assets would be considered a strategy. The same works with trends, technical and fundamental analysis and other indicators.

Simply put, a trading strategy is a sequence of events, the trader’s personal rules, trading style, market situation and a bunch of other variables, on the basis of which a certain strategy is developed. Professional traders combine stable working strategies with their own experience, which often leads to impressive results.

Broker

The choice of an intermediary between a trader and an asset seller is an important part for every player in the securities market. The right choice will allow you to trade on comfortable terms, and some brokers are loyal to beginners and offer interesting bonuses, for example, on the first deposit. It is also worth noting that it is especially important to choose a broker for a specific trading style. For example, for long-term investments, it is better to choose a time-tested intermediary, and for scalping, a broker that offers a minimum commission for a transaction is ideal.