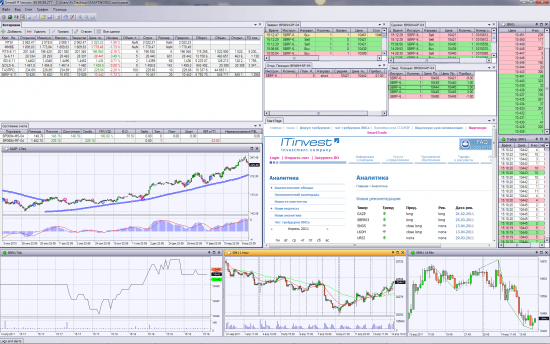

Algorithmic trading at the facilities of ITI Capital – creation of robots, platforms. ITI Capital cares about its clients and offers a wide range of services. Specialists apply an individual approach to each trader. A company that uses advanced technologies in its activities is perfect for users who prefer to trade using robots and connect to the exchange directly. Algo traders can use SMARTcom, which is an open application programming interface (API), and SMARTx, which is considered the best trading terminal equipped with the option to create your own trading algorithms, in their activities. Partners of ITI Capital are the best software vendors that create trading robots for clients’ requests. If necessary, algorithmic traders can use their services.

- API and software for algorithmic traders

- Direct connection (DMA) for HFT traders

- HFT Fare Builder

- SMARTgate service for direct connected clients

- Colocation and equipment rental

- Option number 1

- Option number 2

- Option number 3

- Option number 4

- Creation of trading robots

- SmartCOM: features, installation and configuration

- Features of trading in the MatriX system

- Removing the SmartCOM interface

API and software for algorithmic traders

Algo traders who install robots for trading can use SMARTcom, an open application programming interface (API) using a component object model. Thanks to the use of the SMARTcom interface, traders independently:

- dock their own trading systems with a trading server;

- create automated systems;

- develop trading terminals;

- create trading bots that can communicate directly with the broker’s trading server.

The main advantages include:

- Possibility of direct connection of the robot to ITI Capital servers bypassing client interfaces . Thus, traders quickly receive information about the status of the account and trades. The robot sends trading orders directly “to the market” and controls their execution.

- Ensuring fast processing of orders and distribution of quotes from the exchange . As an example, consider users connecting from Moscow. The average roundtrip of the application will be 55 ms. At the same time, similar solutions do not have time even for 200 ms.

- The ability to track all orders and positions generated by the bot / in the company’s trading terminals (SMARTweb / SMARTx / personal account). This advantage will be especially relevant if it is necessary to debug the robot.

- Connection to ITI Capital trading servers of mechanical trading systems on various software platforms that support this technology, which is possible due to the use of a component object model. For example, Java/C++/ Visual Basic/Visual Basic for Application, etc.

In cases where there are problems with connecting SMARTcom, it is worth contacting the customer service department for help.

Note! In order to achieve the correct operation of the software, the user will need to take care of creating an additional login for the trading account.

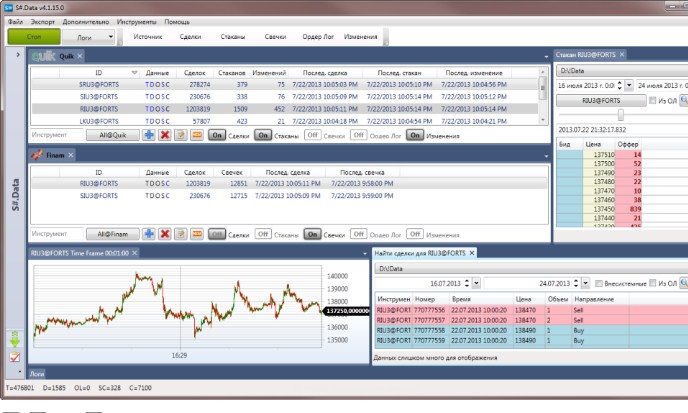

A number of trading applications of ITI Capital partners are compatible with the SMARTcom API, namely:

- StockSharp , which is a free platform for trading bots and automation of the full cycle of algorithmic trading;

- TSLab , which is considered a modern exchange terminal with an embedded environment necessary for the development of MTS (mechanical trading systems);

- QScalp is a trading drive that is designed for ultra-precise analysis (with short-term / high-frequency trading on the exchange, high-speed operations are performed);

- Volfix , which is a powerful trading decision support tool, the latest data structurer, analytics service with popular options for submitting/processing quotes;

- LiveTrade Scalping SMARTcom is a terminal suitable for traders who prefer active trading (scalping).

The popular trading terminal EasyScalp is also compatible with the SMARTcom API, which will be an excellent option for scalping and

intraday trading .

Direct connection (DMA) for HFT traders

Algo traders and HFT traders have the opportunity to use a wide range of solutions aimed at providing direct access to the financial market.

- the stock market, which is the largest stock market in the CIS/Eastern and Central Europe;

- derivatives market, considered the leading platform for trading derivative financial instruments in Eastern Europe and the Russian Federation;

- the foreign exchange market, which is the most significant segment of the financial market of the Russian Federation.

To perform a direct connection, the user will need hardware capacity, which will be sufficient to connect to the exchange.

Note! If you wish, you can engage in independent software development or purchase software from company partners.

The table below shows the protocols supported by the Moscow Exchange.

| Market | Protocols | ||

| Submission of orders | Get quotes | Submission of orders and receipt of quotes | |

| Stock market | FIX | FAST | TEAP |

| Derivatives market | FIX, TWIME | FAST | Plaza 2 |

| Currency market | FIX | FAST | TEAP |

Using FAST and FIX for placing orders/getting a market date is considered the fastest option for trading in the currency and stock markets. If the user plans to trade on the derivatives market, experts recommend using the TWIME+FAST protocols. The FIX+FAST option in this case will work a little slower. Plaza 2 is the most versatile option, but the speed of this protocol is much slower than the previous options. The broker’s trading system synchronizes orders and positions formed in the course of work through a direct connection. Thanks to this, the merchant will be able to control the operations that are performed through mobile applications / personal account and SMARTx. If the user has decided to develop his own software, then before starting to work with the exchange, it is worth taking care of passing certification on the exchange according to the standard scheme. Subscription software is certified. No additional certification is required.

HFT Fare Builder

Below you can find the tariff plans of the brokerage company ITI Capital:

- The “Try” tariff plan is an ideal option for beginners in the field of algorithmic trading who have an account on the platform, but have not made any transactions on it for 12 months. The starting deposit amount is 50,000 rubles. Margin lending reaches 15% per annum. In cases where the trade turnover does not exceed 20,000,000 rubles. per month, the commission for trading operations will be 0.5-0.15% per transaction (depending on the market).

- Tariff plan “Stock” . In this case, the commission percentage will depend on the daily trading volume. The amount of deductions will be 0.017% -0.035% of the transaction amount.

- Tariff plan “Urgent” . The commission percentage is in the range of 20-100% of the exchange commission. The amount of deductions will depend on the trading turnover per day.

- Tariff plan “Currency” . The broker’s commission will be 0.004% -0.013% of the transaction amount.

- Tariff plan “Commodity” . The broker’s commission is in the range of 20% -100%. To calculate the amount of deductions for a swap agreement, you need to multiply 0.004% by the number of days between the first transaction and the date of the second transaction. For forward contracts, the commission is 0.25% of the transaction amount.

- Tariff plan “OTC” . The amount of commission deductions will depend on the tariff package: over-the-counter term/borrowed/spot. The commission percentage will be 0.15 to 0.2% of the amount.

In cases where the amount of net assets at the end of the month exceeds 50,000 rubles, no fee will be charged for servicing accounts. If the requirement is not met, the trader will have to pay 300 rubles. monthly account maintenance.

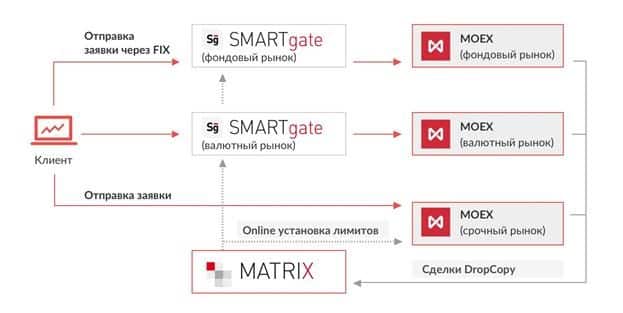

SMARTgate service for direct connected clients

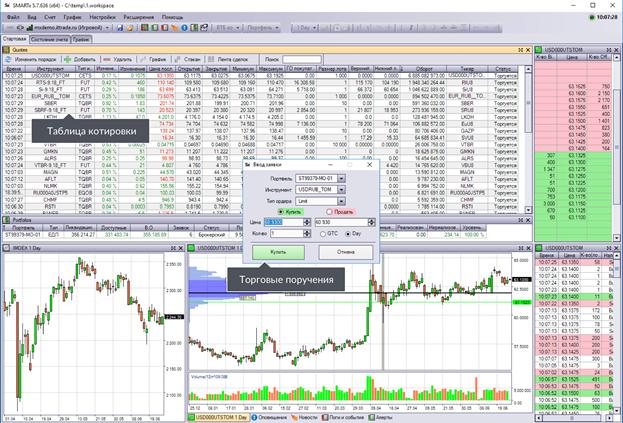

SMARTgate is a special limiting proxy server that is installed between the exchange gateway and the direct connection trading robot. Bots see the proxy server as an ordinary exchange gateway. There is no need to make additional modifications to the program. Using a unique technology, algo traders have the opportunity to trade through a direct connection from a single account on all markets of the Moscow Exchange. Thanks to this, you can save a lot by cross-margining correlated instruments. In the image below, you can see the SMARTgate direct connection diagram.

- TWIME/Plaza II/FIX is a suitable option for the derivatives market;

- FIX is a type of connection for the currency and stock markets.

To connect SMARTgate, users should contact the technical support department. Support phone number – 8 (495) 933-32-32. If you call from the region, you need to dial the number 8 (800) 200-32-35.

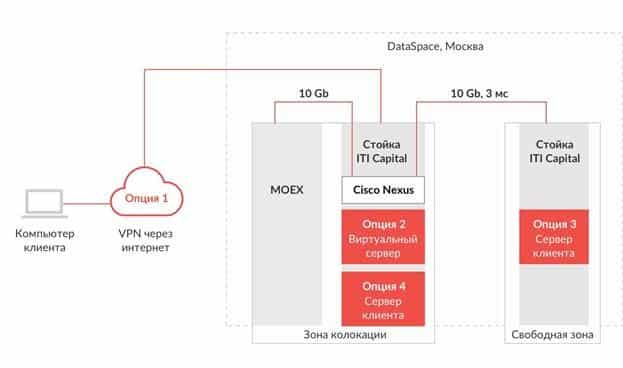

Colocation and equipment rental

To connect directly to the exchange, an algorithmic trader will need not only reliable equipment, but also a good connection. There are several direct connection options. Below you can learn more about each of them.

Option number 1

In this case, the connection to the exchange network is established via VPN. Through a secure VPN gateway ITI Capital, operating on modern Cisco equipment, the user’s bot connects to the exchange. This option will please with an acceptable cost, but will upset the speed. It should be borne in mind that during the signal passing through the Internet from the algorithmic trader to the data center of the exchange, there is a major delay in speed. In the Moscow region, this indicator is in the range of 10-12 ms.

Option number 2

Using the second option involves renting a virtual server in the exchange’s collocation zone. The user will need to take care of renting an ITI Capital virtual server. Due to the fact that the equipment on which these servers are installed is located in the collocation zone, orders will be delivered to the exchange as quickly as possible. This option is fault-tolerant. This configuration will be appreciated by algorithmic traders using Linux.

Option number 3

Using the third option to connect, you should take care of placing the server in the free zone. The server will be located in the data center of the DataSpace exchange, in the next room from the colocation zone. This option will save you a lot. Note! The duration of the delay when the signal passes to the area where the servers are located does not exceed 3 ms.

Option number 4

The most expensive option is considered to be the placement of the user’s server in the collocation zone. This method allows you to achieve maximum speed and reliability. ITI Capital racks in the colocation area are connected to the exchange using a 10Gb/s optical channel. At the same time, high-quality Cisco Nexus switches are used. Algo traders get the opportunity to use:

- VPN for managing the server;

- technical support of the best specialists of ITI Capital;

- remote management via IP management port;

- channel to the exchange;

- the ability to connect to a backup power channel.

It should be borne in mind that there are requirements for servers that were placed in the colocation zone. There must be at least 2 power supplies. Models of network cards with an optical input are suitable for operation. You will also need a rack version of the server (19 inches).

Advice! To find out more detailed information about the direct connection, you should contact the experts. To do this, just dial the number 8 (495) 933-32-32.

https://articles.opexflow.com/brokers/iti-capital.htm

Creation of trading robots

The ITI Capital team has worked fruitfully on the development of the SMARTcom open software package, which allows you to create your own bots for trading on the stock exchange. In addition, SMARTcom facilitates the integration of ready-made mechanical trading systems with the trading server. ITI Capital has reliable partners, who can be contacted by each trader to place an order for the creation of a trading robot. If you wish, you can purchase a ready-made bot. When choosing or ordering a robot, traders should focus on their own trading strategy. Also taken into account:

- the speed required for trading;

- service cost;

- acceptable way to connect.

Users have the opportunity to purchase the necessary tools and independently create trading terminals in the SMARTcom system on their own, without resorting to the help of specialists.

SmartCOM: features, installation and configuration

The SMARTcom 3.0 client interface operates in a multi-threaded environment, so client events (Add Trade/Add Porfolio, etc.) can be called from different threads. There is no additional data buffering. Events can be called directly as soon as data is received. When processing these events, experts recommend avoiding long blocking. Any of the interface methods are thread-safe. There is no need to use additional synchronization. Interface methods can be called directly from event handlers. The developers took care of adding the ability to control the asynchronous / synchronous connection mode. It should be borne in mind that using the synchronous connection mode, the trader must wait until the connection is established.

Note! The selected type of connection mode does not affect the ticket roundtrip. The changes will affect only the response time of the command call.

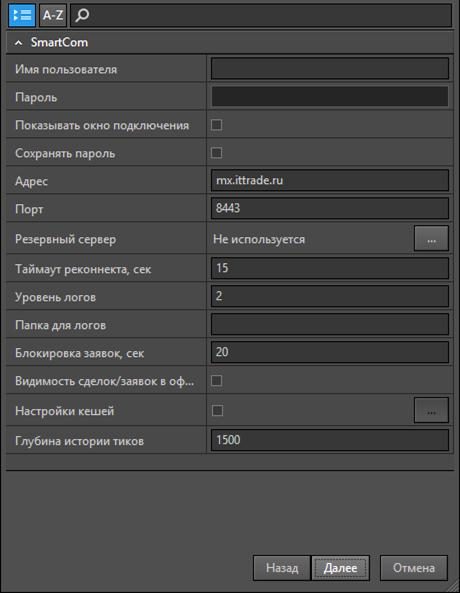

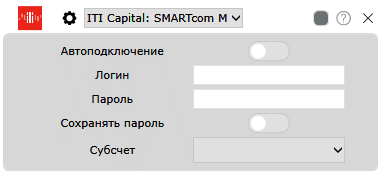

To install the SmartCOM interface, you will need to download and run the software installation wizard (https://iticapital.ru/software/smartcom/). After the settings window appears on the screen, you should start filling in the fields.

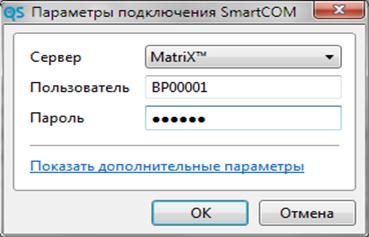

Features of trading in the MatriX system

Clients who are connected to the MatriX trading system have the opportunity to place orders, receive events about orders/deals/positions on position accounts on trading floors.

- MS is the stock market of the Moscow Exchange;

- RF – Moscow Exchange Derivatives Market;

- FX – Moscow Exchange (currency market);

- LS – London Stock Exchange.

Note! Connection method: SMARTcom API (version 3.0 and higher). Address: Server – mxr.ittrade.ru, port – 8443.

It should be taken into account that the MARKET/LIMIT orders transmitted to the exchange systems, the transactions made on these orders and the positions that were opened on these transactions are synchronized during trading sessions.

Note! Synchronization of conditional orders (STOP/STOP-LIMIT/ IQ orders/ trailing stop orders executed on the broker’s server, etc.) between trading systems is not performed.

So that conditional orders that were placed and forgotten on one server do not work unexpectedly for a trader, you should not work with them in cases where there has been a switch from one trading server to another. It is also worth refusing to use GTC orders without the need. At the end of trading, you need to take care of checking the presence of open conditional orders in the trading systems used. After the contract for brokerage services is concluded, and the application is installed, you can place orders for the sale / purchase of shares. The trader will have to wait for the automatic confirmation that comes after the transaction. No more than 0.1-0.5 s elapses from the moment the application is submitted until the message appears on the screen, depending on the quality of the connection.

Removing the SmartCOM interface

If it becomes necessary to remove the interface, the trader will need to click on Start, go to the Control Panel section and tap on the Add/Remove Software category. From the list of applications, select SmartCOM and press confirmation of actions.