What is swing trading, examples of strategies, swing trading in trading in the realities of 2022. The purpose of trading is the same for all techniques – to buy cheap and sell expensive. The differences are only in the approach to market analysis, entry and exit points. When trading

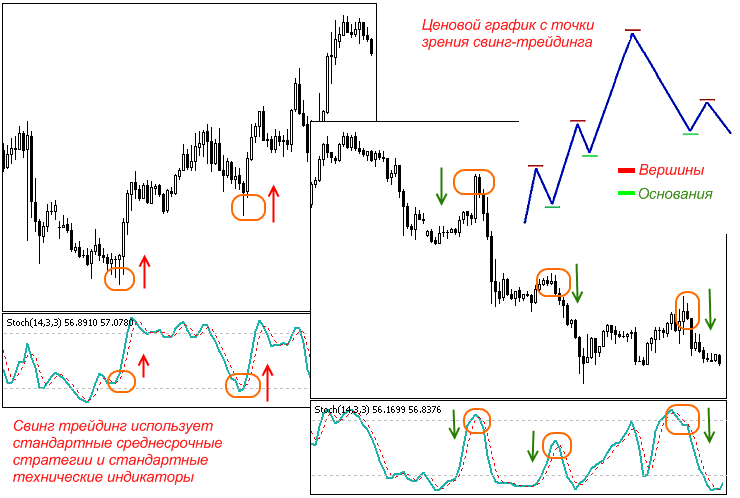

intraday , situations arise when a trader enters at the very beginning of an emerging trend. According to intraday trading conditions, trades must be closed overnight, even if the trader expects the movement to continue. In swing trading, positions are held as long as the trend continues. Each trader can have his own set of indicators and rules for entering and exiting the market. And all this will still be swing trading. This term does not mean a specific strategy, but an approach to the market.

Principles of swing trading

This trading strategy has become widespread. It does not require as much time to spend at the terminal as day trading. With the right approach, it is less risky and brings more income than investing. There are parts of the market when the price is moving sideways on the daily chart. The investor does not receive income from the growth of quotes – the price fluctuates near his entry point. A swing trader during this time can make profitable long or short trades several times. The swing trader’s working timeframe is 4h or daily. For an accurate entry, he switches to the hour or m15. A correct entry into a position is characterized by a small drawdown – a swing trader sets a stop loss no more than 2% of the asset’s movement and moves it to a profitable zone behind the market. The trade is held until the target is reached or the trend breaks.

Swing trading strategies

The main goal of swing trading is to capture a wave, a “swing”. To do this, a trader must have a trading strategy – a checklist for entering a position, holding it and exiting it. A trader’s arsenal may include:

- wave analysis – the founders believe that the market is cyclical and waves replace one another;

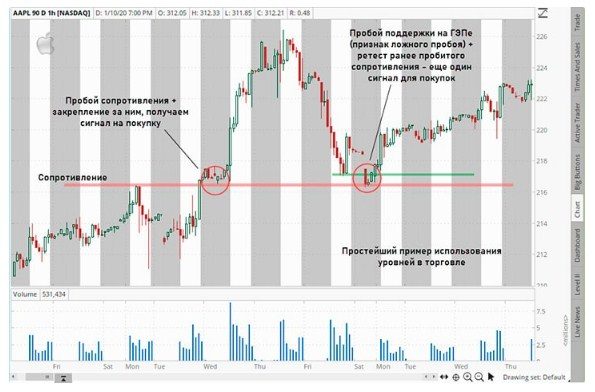

- support and resistance levels – a trader decides to enter a position, hold and close according to how the market reacts to the levels;

- graphic patterns – a trader pays attention to reversal patterns (head, shoulders, double or triple tops) and trend continuation patterns ( triangle , flag );

- volumes – especially near important levels;

- indicators – moving averages, Bollinger bands , oscillators;

- market analysis on different timeframes .

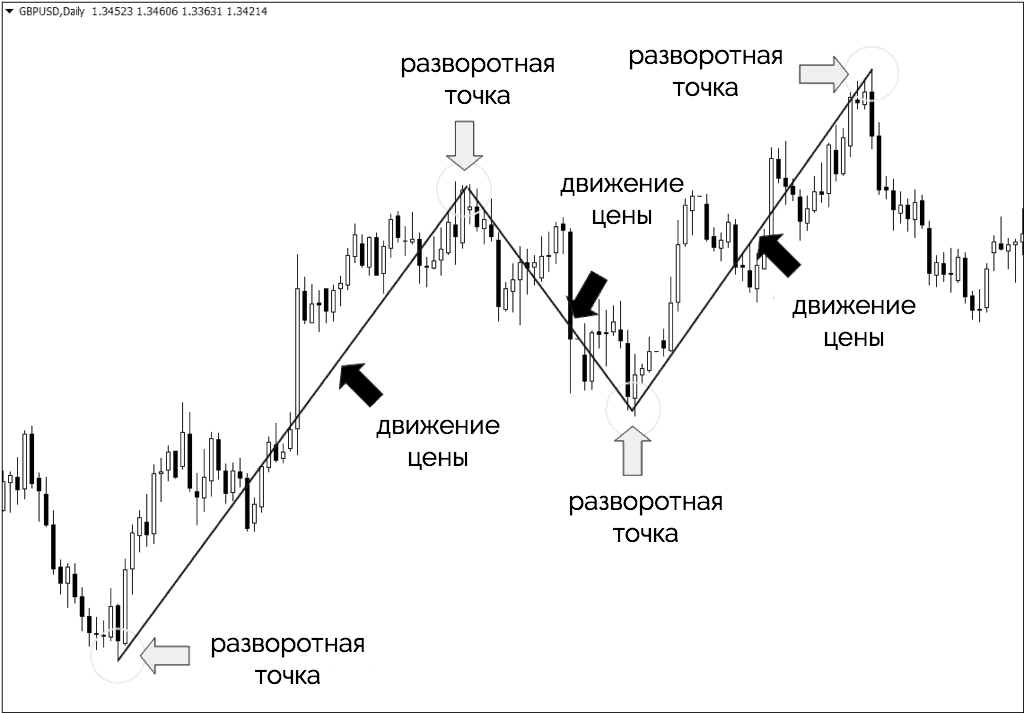

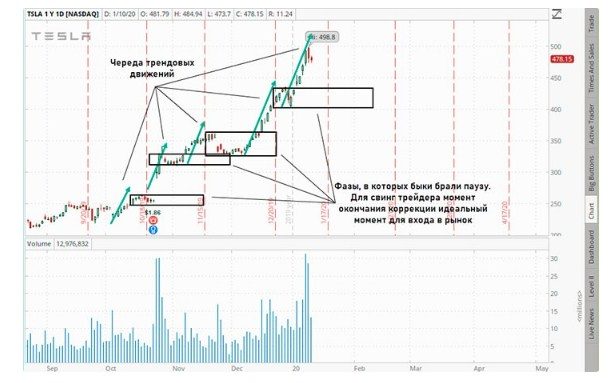

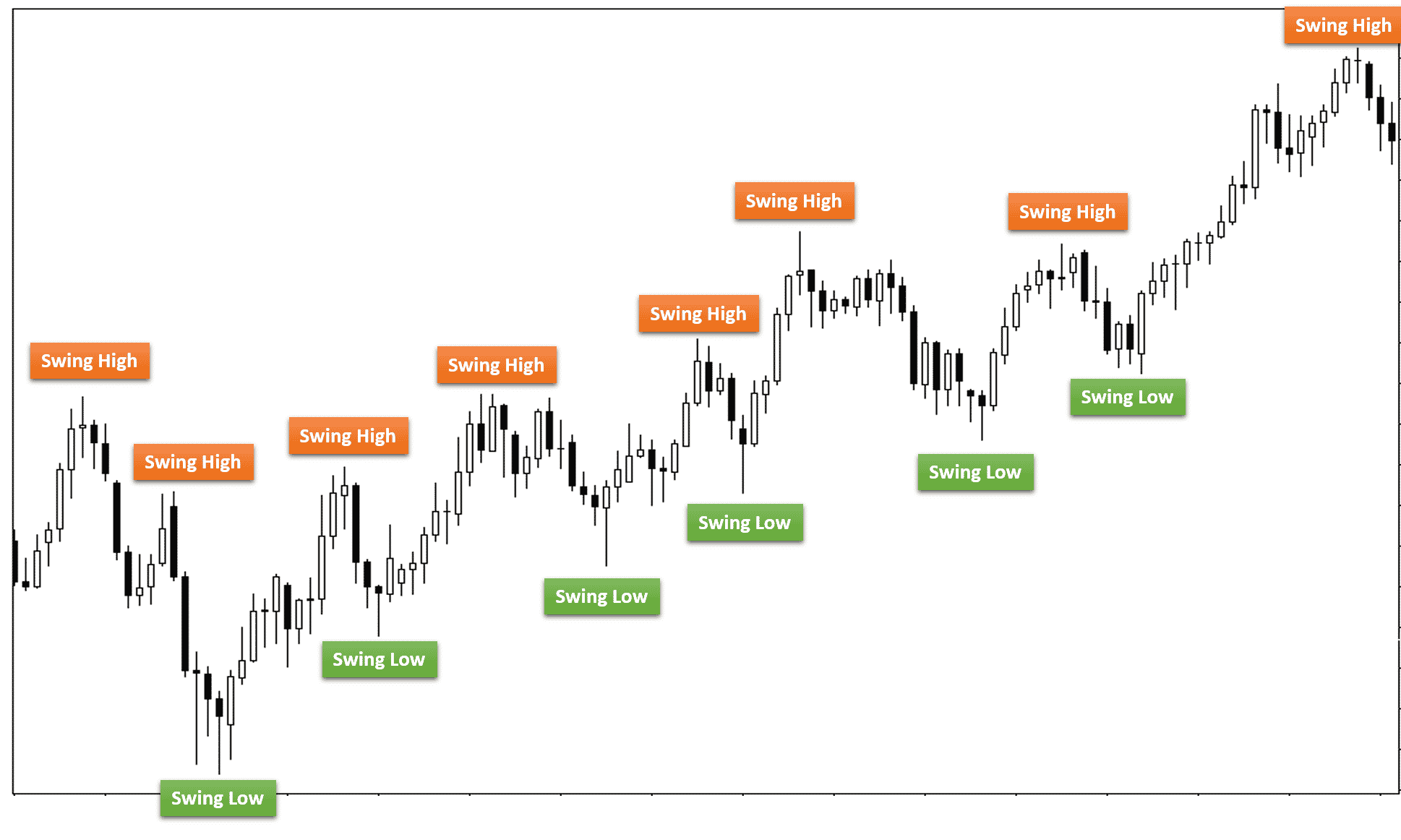

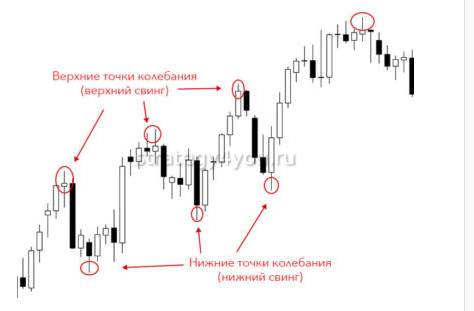

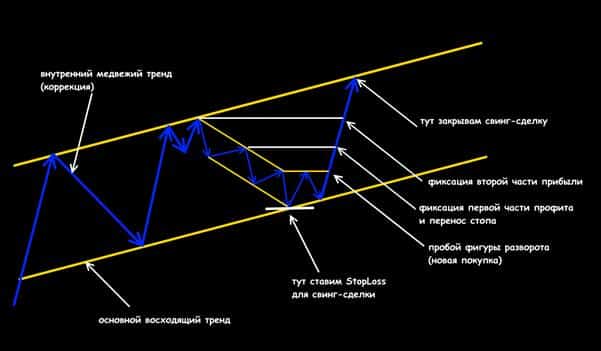

https://articles.opexflow.com/analysis-methods-and-tools/figury-texnicheskogo-analiza-v-trajdinge.htm The market moves in waves – trend movements are replaced by corrective ones. The task of the swing trader is to find a trend movement and open a trade at the very end of the correction wave. When analyzing trend and corrective movements, the following features should be taken into account:

- volumes are growing in a trend;

- when the volume fades, the market moves by inertia, which means that soon the direction of price movement will change;

- volumes are reduced in corrective waves;

- if there is uncertainty on the market, you should move to a higher timeframe, where the trend will be visible.

Entering the market and closing deals

Swing trading strategies are trending. After the formation of a signal – the intersection of moving averages, the formation of a reversal pattern, the rebound from the bottom of the channel – the trader opens a long or short. A trader should not open positions if there is no confidence in a reversal. Additional confirmation is needed, a signal of indicators, a breakdown of resistance and its transformation into support, etc. If the chart clearly shows a flat trend on a higher timeframe, it sets a take profit on resistance or support. In other cases, take profit is not set. Stop loss moves following the price movement. You can trail by extremums or moving averages. The exit from the market is carried out at the moment of breaking the trend. The deal is closed manually if an impulse movement has not formed by the end of the day.

Risk management

The position volume depends on the stop loss. The trader pre-sets the level at which he will exit the market with a loss. In weak signals, he risks no more than 0.5% of the depot, in medium ones – 1-2%, in strong signals he can risk up to 5-7% of the depot. Take profit must be at least 3 times the stop. In ambiguous situations, when the trader is not sure about the continuation of the movement, he closes half of the position. The rest is closed by a stop, which is in the profitable zone. A trader cannot put short stops, he must withstand significant moves against himself. This limits the use of leverage. Significant capital is required to make a tangible profit in rubles.

A trader can earn 50-100% of the deposit per year, but this will not change his life if the capital is only 20-30 thousand rubles.https://articles.opexflow.com/trading-training/risk-management.htm

Swing Trading Strategy Examples

The main timeframe for work is daily and weekly, to clarify the entry, you can switch to smaller timeframes.

moving averages

For analysis, a set of

moving averages with a small and long period -13, 41, 90, 200 is used. Exponential MA is used – in calculations, recent candles have more weight, on long periods, early values practically do not affect the value of the indicator. The scheme of work is as follows:

- evaluate the position of the movings. If they intersect and look like a ball, deals are not opened. We are waiting for the moving averages to line up in the correct order – short ones over long ones for a long trade;

- we wait for the price to come into the zone between the moving averages;

- move to a smaller timeframe and wait for the end of the correction. Any signal will do;

- we are waiting for confirmation. Correction on a smaller period looks like a trend. The signal to break it is a breakdown of resistance/support and a test of the level or trend line.

- after entering the position immediately put a stop. No more than 2% price movement. You can put a take if the goal is intuitive. Or a trailing stop is used;

- We are expecting a termination, the deal will be closed by stop or take.

Trading without indicators

Many traders promote trading on a clean chart. The scheme of work is the following:

- we start the analysis of the asset with a daily or weekly chart, we build price channels. There should be a strong trend on the higher timeframe;

- find corrective movements and build Fibonacci levels;

- at the moment of touching the level and rebound, we switch to a shorter period, 1 hour or m30;

- we are looking for confirmation of a reversal on a smaller period – an hour, m30 or m15. This will shorten the stop;

- take profit is set on the opposite trend line. If the price breaks the channel in the direction of the deal, set aside the channel width and move the take profit;

- stop loss moves with the market;

- if the price rolls back more than 23% or bounces off an important level, close half of the position.

Tips for swing trading

A trader should remember the following rules when working with this system:

- The rollback can last for 3 or 5 or more candles. You shouldn’t pay attention to it. If the trend continues for more than 8-12 candles, a pullback is highly likely;

- do not be nervous and close the deal ahead of time without good reason;

- it is necessary to work with history, the depth is at least 3-5 years;

- the approach should be comprehensive, do not focus on only one indicator;

- in isolation from other indicator signals and market context, moving averages do not provide useful information;

- it is recommended to skip the signals that appear before important news or on Friday after 17:00.

Pros and cons of swing trading

Like any other, the swing trading strategy has its pros and cons. Advantages:

- a trader can make money in any market – it doesn’t matter if the market is rising, falling or flat;

- little time and emotional stress;

- if used correctly, it can bring good profit – 50-100% of the deposit per year.

Disadvantages:

- a trader trades on large intervals, transactions are rare, he cannot take large leverage. Therefore, the capital must be large;

- requires a good knowledge of technical analysis, the correct definition of the phase of the market and trend movement.

Risks

Swing trading is a low risk strategy. Trading is carried out on large timeframes, so the trader is not affected by price noise. The position is held for several days – the risk of a significant more than 5% gap against the deal is growing. According to historical data, such price gaps occur mainly along the trend, so the probability of making a lot of money quickly is higher than losing a lot. Otherwise, everything depends on the trader’s ability to determine the trend, hold a profitable position and close on a signal, regardless of the financial result. The transaction can be closed both in plus and in minus. Features of swing trading, working strategies, swing trading in trading: https://youtu.be/_mDBvAMbdqA

Who is swing trading for?

A swing trading strategy in the right hands can bring big profits with little time and effort. But at the same time, certain qualities are required from the trader:

- patience – you need to wait a few days;

- keeping calm in all situations – when the price rolls back, the trader may be afraid of a larger loss and close the position prematurely. In this case, the price will not reach the cancellation level;

- it is required to analyze charts for 2-3 hours every day and at the same time not make deals;

- trading results can be assessed only after long periods of time – at least 3 months.

Swing trading is a strategy that deserves attention. The strategy is not suitable for people who want to make a profit every day, are not able to sit out losses, and are worried about the slightest price movement against the position. It is suitable for many people who combine investment with their main activity. It is less risky and more profitable. But unlike investing, it does not require knowledge of fundamental analysis. Trades are opened, held and closed according to technical analysis signals. When combining two approaches – fundamental and technical analysis can bring profit.