Professional intraday trading is used by traders to increase the profitability of transactions. However, the margin strategies used by them are characterized by high risk. Mostly in day trading, technical analysis is used, which is preferred over fundamental factors that affect the market in the long term.

- What is intraday trading and why / in what cases is day trading more profitable than other strategies

- Intraday stock trading – features, strategies, pros and cons

- Day trading futures – features, strategies, pros and cons

- The better intraday trading – stocks vs futures

- Risks of intraday trading in stocks and futures contracts

What is intraday trading and why / in what cases is day trading more profitable than other strategies

Traders in the US were allowed intraday short-term trading in 1996. On the NASDAQ exchange, the volume of such short-term transactions made by individuals is 15% of their total number. However, 70% of intraday traders lost their investments by making intraday trades. Despite this, such trading is the basis of the market and is considered its engine. There is intraday trading on the exchange of highly liquid assets. To understand how to trade intraday, you need to follow the basic principles:

- choosing a highly liquid instrument , since it has a large trading volume and traders can afford to sell many lots without affecting stock quotes. A high level of liquidity combined with a significant turnover makes it easier to exit a trade and enter a position;

- volatility – it is necessary that the selected instrument be characterized by large price fluctuations within the day, otherwise it will not work to make money on such transactions;

- correlation with other instruments , which makes the trading process predictable, since the growth of the selected asset will be accompanied by an increase in the price of other commodities or stocks.

Intraday trading is about opening many short-term trades in order to make quick profits.

Intraday stock trading – features, strategies, pros and cons

Stocks are traded intraday through the stock exchange, taking into account a number of key features. A trader needs to develop a strategy within which there is a clear and understandable algorithm of actions. It is necessary to have technical analysis skills and analytical thinking in order to predict the expected results.

Emotional stability and the ability to control oneself are extremely important.

The main activity of this kind are intraday trading strategies used by traders to make transactions on the stock exchange. There are several basic techniques that allow you to systematically open positions and profit from a sufficient number of transactions to maintain a positive trading balance:

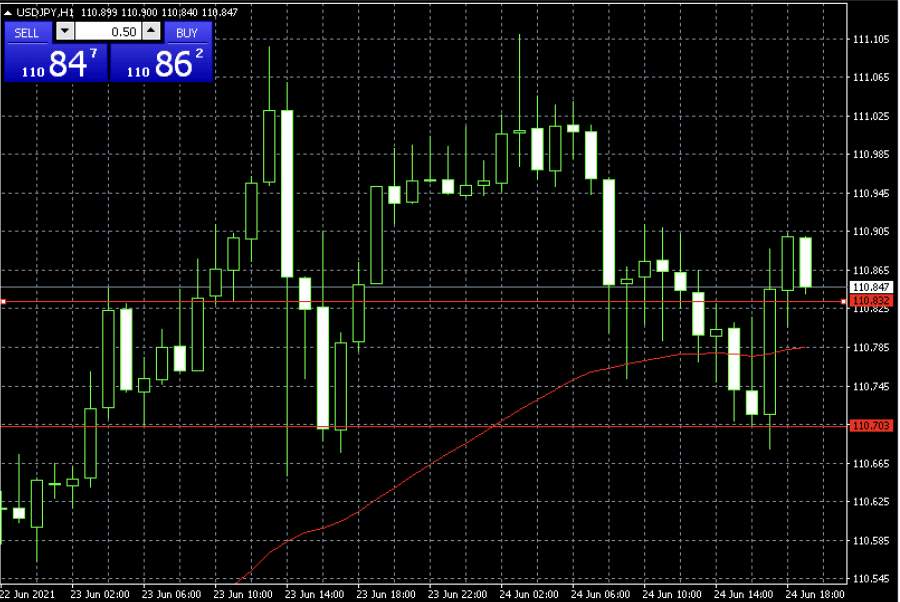

- Breakout trading – in the intraday market, large participants set limit orders. If the price, pushed by high trading volumes, pushes through the formed level, then a breakdown occurs. This triggers protective orders set by traders, causing the price to go up or down sharply. It is on this movement that they earn inside the day. The strategy is to place a pending order behind the highs or lows formed during false breakouts of the level. When the price reaches a predetermined level, the order is triggered and a deal is opened. Stop loss is placed behind the broken level in order to close the position with minimal losses in case of a false breakout. Take profit is 3 stop loss values.

- Consider how to trade stocks intraday using price pullbacks , which happens after a sharp rise or fall in the value of an asset. Here you should also place a pending order in the area of the previously broken level, in the hope that the existing trend will continue and the price will resume moving in the same direction after a rollback. Stop-loss is placed behind the nearest low below the level, and take-profit is placed at the level of the maximum reached as a result of the previous movement.

- When choosing trading strategies for short-term and intraday trading, be sure to pay attention to scalping . This technique consists in opening many short-term positions with the expectation of making a small profit on price fluctuations. This strategy is chosen by novice traders who are not ready to immediately invest a lot of money.

To understand how to trade stocks intraday correctly, you need to study the dynamics of the instrument, note the main historical levels of support and resistance, and the specifics of the stock’s behavior. The advantages of daily trading are as follows:

- Opportunity to make a profit quickly.

- Lots of options for entering a trade.

The cons are as follows:

- High risks.

- You need to track many assets at the same time.

Intraday trading in stocks, teaching intraday trading in the stock market: https://youtu.be/aiou4DPiBHQ

Day trading futures – features, strategies, pros and cons

There is intraday trading in futures with a starting capital of $3,000 if you plan to buy and sell contracts such as the S&P 500. Transactions open New York time at 9.30 – 16.00. It is popular to use a premarket, when a contract is bought or sold an hour before the markets open. The specific trading time is chosen depending on the type of contract. For example, if we are talking about ES, then it is best to open positions at 15.00-16.00 or at 8.30-10.30. When preference is given to commodity futures contracts, for example, for oil associated with the markets of Asia and Europe, they try to open positions outside the operating hours of the American stock exchanges. It will not work here, as in the case of stocks, to trade many assets. You will have to choose one type of futures contract, as most traders do.

- Scalping – it is supposed to make a lot of transactions within one session on the main and correlated instruments. To analyze the market, traders use the glass of quotes, volumes, analyze the chart and the tape of transactions. It is assumed that traders should enter a position when the price momentum is formed.

- When choosing trading strategies for intraday trading, many prefer intraday trading on an intraday trend . This technique involves opening positions in the direction of the intraday trend, while the transaction is not transferred to the night. It is necessary to perform technical analysis and monitor the publication of relevant news that can affect volatility.

- Swing trading is an identical technique, with the difference that the trade can be moved overnight if it makes sense and there is a possibility of additional profit.

Intraday trading in a professional language – the basics of intraday stock trading: https://youtu.be/atmjjA2zM9k

The better intraday trading – stocks vs futures

Within the day, it is better to give preference to technical instruments, which include stocks. Here it is necessary to use technical analysis associated with the search for price levels. This technique allows you to more accurately find the right positions of large market participants. Traders can analyze the stocks of dozens of companies and find many entry points using various strategies. Futures contracts for intraday trading are less attractive, as they are more tied to the news, and their volatility may be due to various factors that will have to be taken into account when opening positions. Securities of companies rise and fall in price depending on the current profit, the reports of which must be studied to analyze the current price dynamics. This is enough to predict the growth of quotations in the short term.

Risks of intraday trading in stocks and futures contracts

Intraday trading of any instrument carries certain risks. This is due to the unpredictability of the market and possible errors in technical analysis. This is especially true for traders involved in scalping, as they trade in large volumes. Futures contracts are a riskier instrument due to the specifics of trading. Regardless of which one you choose, intraday trading can be attractive to an investor.