Investing using an individual investment account is one of the ways to effectively invest money. Many banks provide the opportunity to open IIS. One of them is Tinkoff-Bank. In this article, we will talk about what Tinkoff IIS is, how to register and use an individual investment account from Tinkoff, as well as the terms of use, advantages and disadvantages.

- What is IIS Tinkoff

- How to apply for an IIS Tinkoff – what data is needed to open an individual investment account with Tinkoff

- Who can open IIS?

- Configuring and Selecting Controls

- How to get an IIS deduction from Tinkoff bank types A and B

- Investing through IIS Tinkoff – conditions

- Commissions and tariffs in IIS Tinkoff Investments

- What is the difference between a brokerage account and IIS Tinkoff?

- Where can I find a Tinkoff individual investment account?

- What are the disadvantages of an individual investment account

- What is IIS for?

- Feedback on investing in IIS Tinkoff

What is IIS Tinkoff

An individual investment account is a special type of brokerage account. Using this account, you can buy stocks, bonds, currencies. The main difference is the ability to receive a tax deduction, which is not possible with a regular brokerage account. Also, the state can establish restrictions and benefits in relation to IIA. Depending on the type of management, two types are distinguished: independently controlled and through a management company. Tinkoff-Bank provides an opportunity to register IIS with favorable conditions. Training video – what is IIS Tinkoff, how to invest and make money on it in 2022: https://youtu.be/YUp_Fw8CPks

How to apply for an IIS Tinkoff – what data is needed to open an individual investment account with Tinkoff

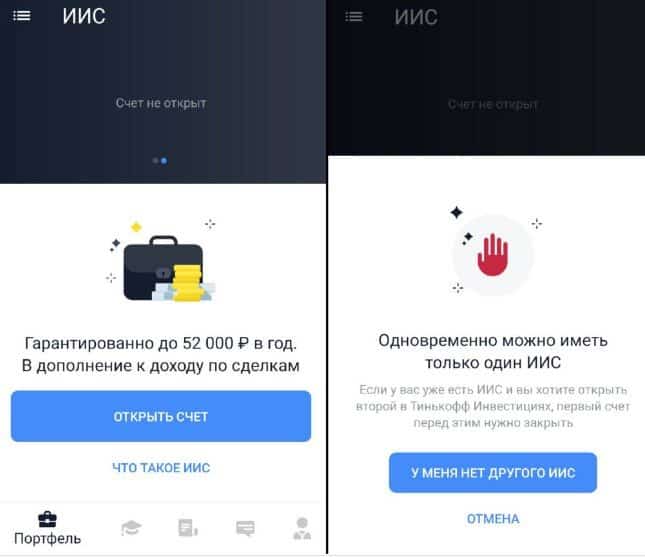

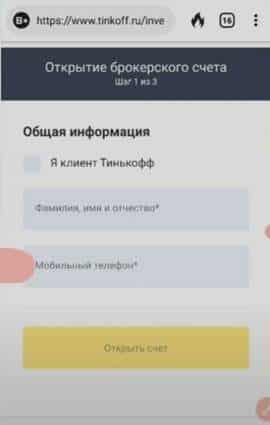

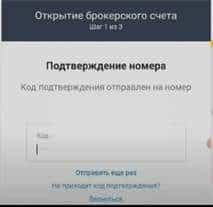

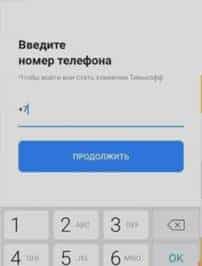

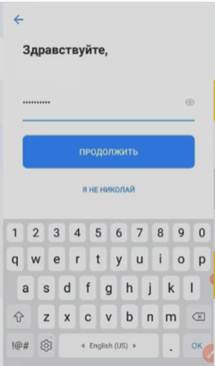

You can open the IIS by following the link https://www.tinkoff.ru/invest/iis/ For registration, you need to fill out the form on the bank’s website. At the first step, you will need to indicate your full name and contact phone number.

Who can open IIS?

Only an individual who is a tax resident and citizen of the Russian Federation and has reached the age of 18 has the right to open an account. To be a tax resident of the Russian Federation, you need to be on the territory of the Russian Federation at least 183 days a year. IIS can be opened by an individual entrepreneur, self-employed, civil servant, retired, military.

Civil servants and military personnel do not have the right to own foreign assets and assets, the possession of which would lead to a conflict of interest.

Configuring and Selecting Controls

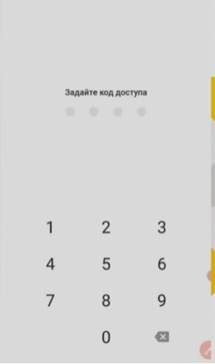

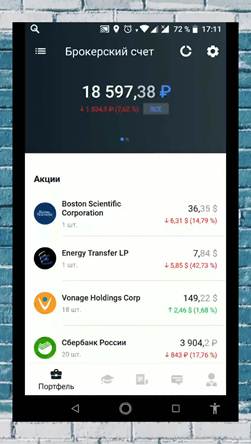

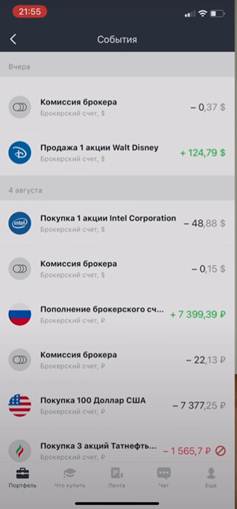

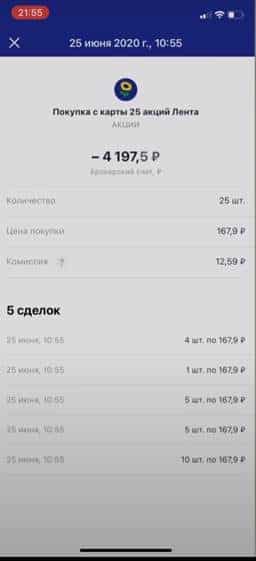

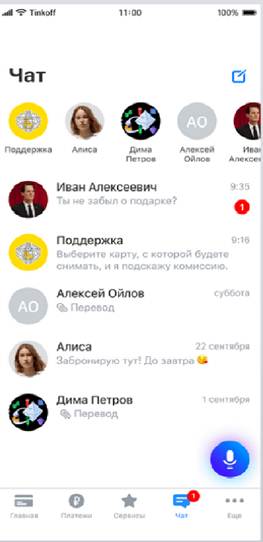

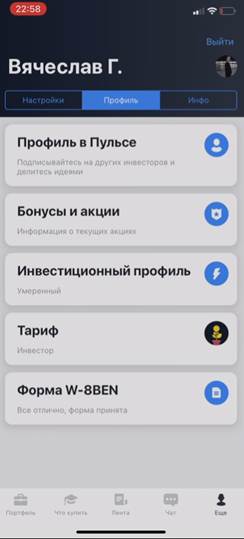

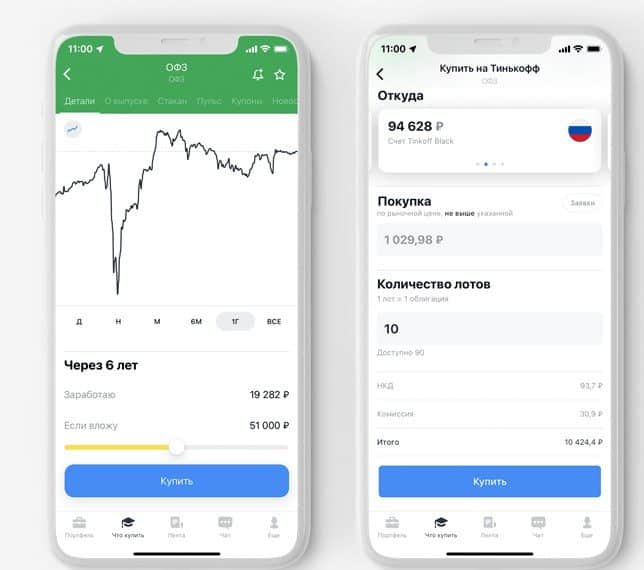

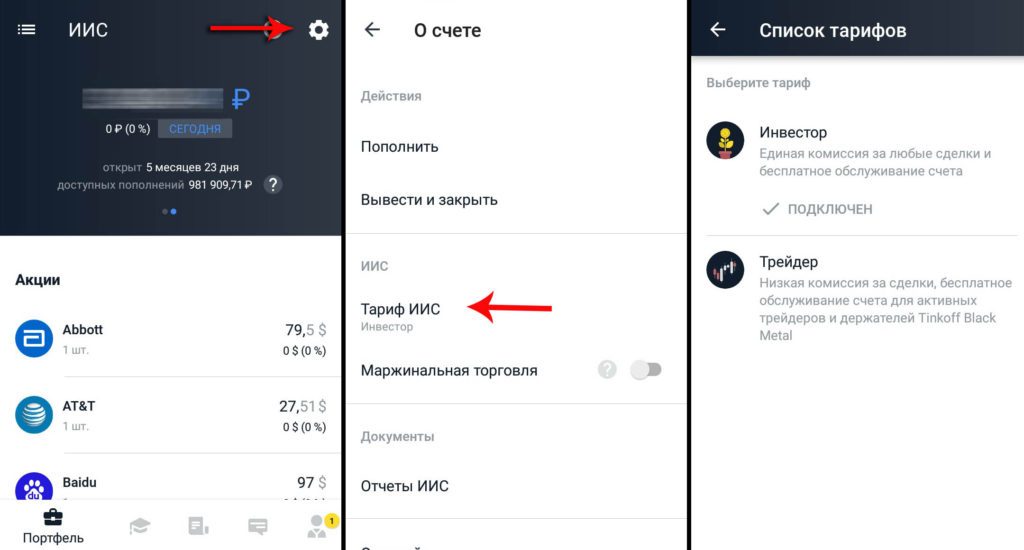

Investments can be managed both through the mobile application and through the Tinkoff Investments terminal. For more details, follow the link https://help.tinkoff.ru/terminal/ The mobile application includes 5 main sections: “Portfolio”, “What to buy”, “Feed”, “Chat” and “More”. The “Portfolio” section includes information about the account and acquired financial assets. In this section, you can top up your balance and find out about active and completed transactions.

If you trade foreign assets without filling out the form, the tax will be 30%. Once completed, the tax can be reduced to 13%.

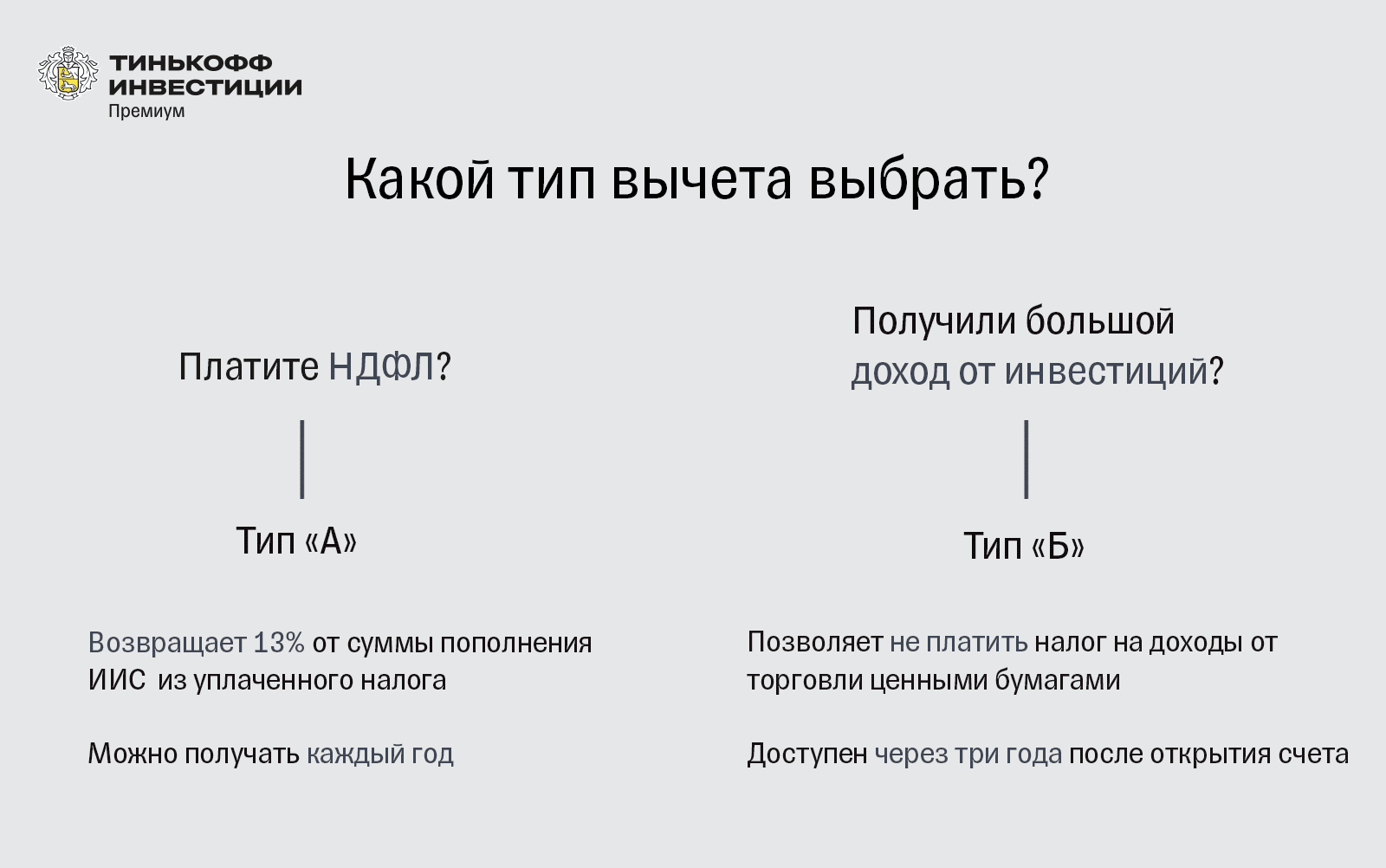

How to get an IIS deduction from Tinkoff bank types A and B

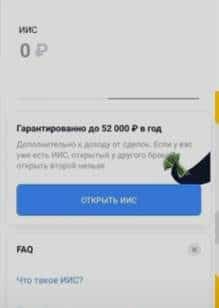

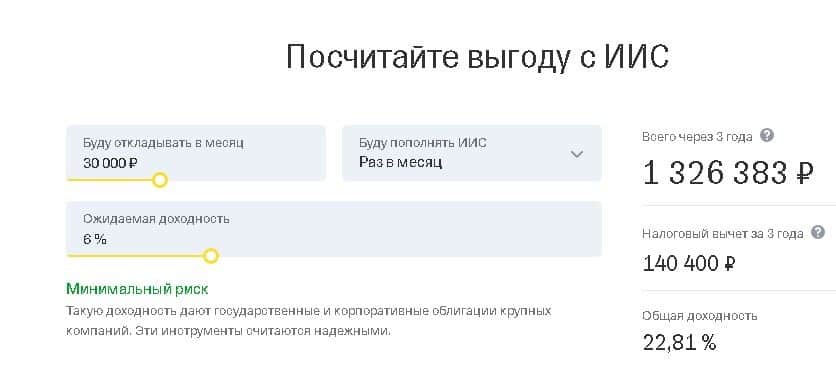

IIS from Tinkoff Bank provides for tax deductions of type A and B. In the first case, 13% of the deposited amount can be returned annually. The top-up amount must not exceed RUB 400,000 per calendar year. By deduction of type A, you can get up to 52,000 rubles per year. To receive income, the owner must have income taxable with personal income tax. If the official income is RUB 30,000, the largest deduction is RUB 46,800.

- 3-NDFL declaration, filled out online on the FTS website.

- Certificate 2-NDFL for the year of depositing funds to the investment account. She will confirm the fact of receipt of income and payment of tax at a rate of 13% in the tax period. It is issued by the accounting department for each place of work.

You can wait for 2-NDFL certificates on the website of the tax service, and then upload them when filling out the 3-NDFL declaration. They are usually posted after April 1 of each year.

- Broker documents. Tinkoff-Bank will prepare them after the end of the calendar year of the account. You will need to download them in the Tinkoff Investments application or in your personal account on the tinkoff.ru website, and then upload them to the form on the FTS website.

Tinkoff-Bank will provide a report on transactions and operations, if required by the tax office. To do this, you need to write to the support chat in the application or on the tinkoff.ru website. The document is prepared within 10 working days and sent by mail to a convenient address.

A type B deduction can only be obtained when the account is closed. With this deduction, you can profit from your investment without paying tax. This type of deduction cannot be received earlier than 3 years after opening the account.

Let’s say an investor opened an account at the beginning of 2020 and deposited 300,000 rubles there. The investment was successful, and the shares in which he invested added in value. In early 2023, the investor decided to sell shares and close the account. The invoice after the sale of shares amounted to 900,000 rubles. Income after deducting commissions was 600,000 rubles, the tax on it was 78,000 rubles.An application for a Type B deduction is submitted through a broker just before closing an account or with the tax office. It can be submitted in person or online. The broker will not deduct tax on investment income when submitting an application. But if the investor decides to submit an application to the FTS, the broker will write off the tax payment, then the FTS, after verification, will charge a deduction to the investor’s card.

Investing through IIS Tinkoff – conditions

Tinkoff-Bank offers the following investment conditions:

- Investment management is quite convenient – using an application on a smartphone. It has an intuitive interface that is convenient for both beginners and experienced investors.

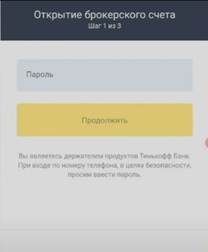

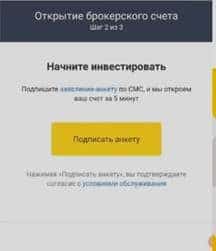

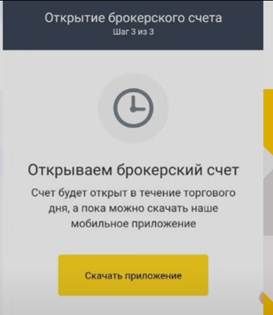

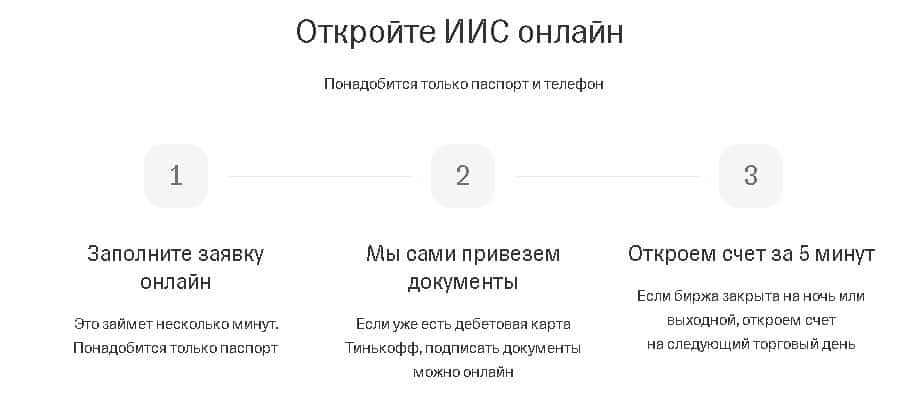

- The application on the website can be completed in a few minutes. A bank representative will arrive with the necessary documents at a convenient time and place. The owner of the Tinkoff Bank card can sign documents with a code from SMS, after which an account will be opened immediately. The IIS will be opened on the next business day if the application is left after 19:00 Moscow time or on the stock exchange on a day off.

- You can even invest with 10 rubles in your account. This is the cost of one share of Eternal Portfolio funds from the Tinkoff Capital management company. Most of the bonds are priced at RUB 1,000.

- The “What to Buy” section contains a selection of assets and information about the most attractive companies. The investor will be right with the choice of stocks.

- Tinkoff Investments offers a wide range of stocks and bonds of both Russian and foreign companies. Service users can invest in 8 major world currencies.

- On any day of the week, you can get support in your personal account or in the chat of the application.

]

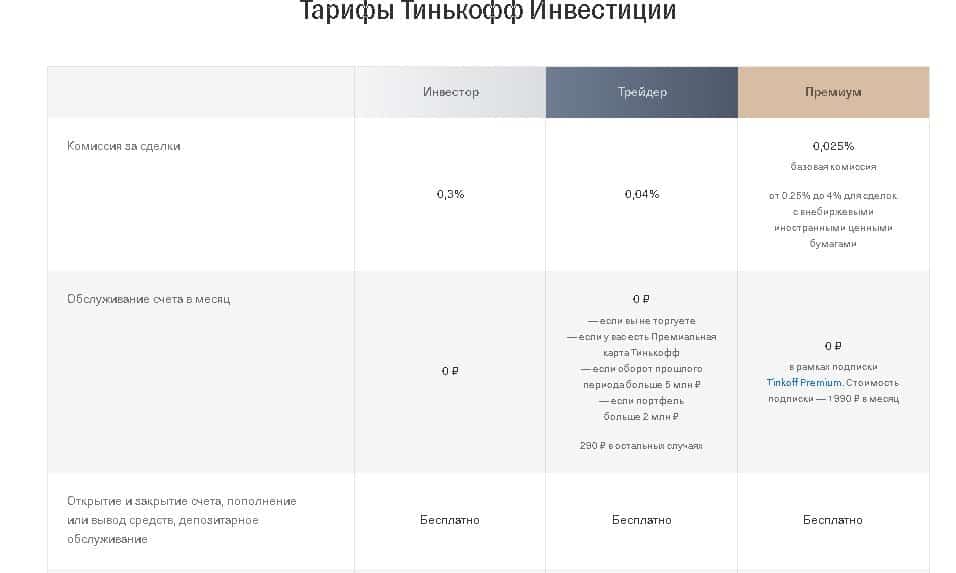

Commissions and tariffs in IIS Tinkoff Investments

There are two tariffs for IIS Tinkoff. If the user rarely trades on the securities market, the “Investor” tariff is suitable for him. On it, only a commission is charged at the conclusion of transactions, and is 0.3%. For those who are professionally engaged in investments, the “Trader” tariff is suitable.

What is the difference between a brokerage account and IIS Tinkoff?

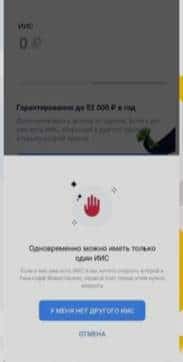

A citizen can open only one individual account, while there can be several brokerage accounts. With the help of IIS, you can get tax deductions on contributions and income. IIS allows you to get a guaranteed income due to tax deduction. Part of the paid personal income tax is returned in the form of an amount up to 52,000 rubles. It is also possible to exclude the payment of tax of 13% on the income from transactions. The tax on transactions is not calculated every year, but only when the IIS is closed.

Where can I find a Tinkoff individual investment account?

You can find all the necessary information, how to open the IIS Tinkoff at the link https://www.tinkoff.ru/invest/iis/

What are the disadvantages of an individual investment account

The minimum period for the existence of an IIS is 3 years, while it is prohibited to withdraw funds before the expiration of this period. Otherwise, the account will be automatically closed, and the user will lose the right to tax deduction. Although it is possible to buy foreign currency with the help of IIS, the account can only be topped up in Russian rubles. The maximum top-up amount is 1,000,000 rubles per year. This limit is updated on January 1st of every year.

What is IIS for?

An individual investment account is an account for trading on an exchange with a preferential tax regime. Like a brokerage account, you can buy and sell currencies, stocks and bonds with the help of IIS.

Feedback on investing in IIS Tinkoff

I was skeptical about stock trading applications. But when I tried Tinkoff Investments, I was pleased with the functionality and convenience. In the application, you can see an overview and indicators for the new asset. The application is stable, quickly switches to free servers. Currencies are entered in minutes to the Tinkoff ATM. I recommend the application to everyone.

This is a top terminal and application. Although they do not respond so quickly in the chat, quick investment is important. For a civil servant, it took too long to get a certificate for the declaration.

The site banki.ru has a review from an investor that tells the story of withdrawing funds from an account. He found a better offer, so he decided to close the account.

On October 31, 2019, he sold all assets in the account and withdrew funds. On November 5, he applied to close the account through the support chat, to which the manager replied that the account would be closed within 30 days.

On November 7, the investor opened another IIA, while confirming that he already has a similar account, which should be closed within 30 days. On December 6, Tinkoff-Bank sent a message to the investor that the account could not be closed.

Noticing this message on December 16, the user tried to find out why the account could not be closed. He received no clear answer.

Due to this incompetence, as of December 16, 2019, the investor risks not receiving tax breaks for 2019. He already has two accounts: with Tinkoff-Bank and with a new broker.

The account user warns other potential investors against using this service.IIS Tinkoff Investments – results of investments in stocks for 10 months, practical experience – video review: https://youtu.be/d2jUT4Laga4 A robot for algorithmic trading is also available for trading on Tinkoff Investments: https://articles.opexflow.com/trading- bots / tinkoff-investicii.htm An individual investment account provides a tax deduction option, but has significant restrictions on its use. Tinkoff-Bank offers quite favorable investment terms for IIS. While Tinkoff Investments is viewed favorably by most investors, there are also service gaps.