Pennant a cikin ciniki a cikin bincike na fasaha – abin da yake, yadda yake kallon ginshiƙi, dabarun ciniki.

ciniki na yau da kullun . Babu shakka, ba shi yiwuwa a yi hasashen kasuwa da cikakkiyar daidaito, amma idan kun yi kasuwanci mai tsawo, za ku iya ɗaukar nau’o’i daban-daban

waɗanda ke zama sigina a bayyane na motsin farashin duniya mai zuwa. Kai da kafadu, kofi da alkalami, da alƙalami wasu daga cikin abubuwan da ‘yan kasuwa ke amfani da su don gano haɓakar farashi ko ƙasa. Don haka, bari mu ci gaba da yin cikakken nazarin wannan batu.

- Wani irin nau’in adadi, bayanin

- Yadda ake ƙididdige ƙirar Pennant akan ginshiƙi

- Abubuwan da ke tattare da siffa mai ƙima

- Ƙirƙirar ƙirar ƙira a cikin bincike na fasaha a cikin ciniki, bullish and bearish pennant, m

- Nau’in Pennant

- bijimin bijimin

- ƙwanƙwasa

- Bambanci daga tuta da lambobi masu kusa

- Yaya ake amfani da shi a cikin bincike na fasaha?

- Ciniki akan musayar ra’ayi – dabaru masu amfani da misalai tare da kwatancen da bayanin hoto

- #1 Misali ta amfani da daidaitaccen dabarun ciniki

- #2 Pfizer LTD Misalin Kasuwancin Sa’a

- Ribobi da rashin amfani

- Kuskure da kasada

- Ra’ayin masana

Wani irin nau’in adadi, bayanin

Pennant wani nau’i ne na musamman na tsarin ci gaba da ginshiƙi. Pennants sun yi kama da tsarin jadawalin tuta domin suna da layukan haɗuwa cikin tsawon lokacin ƙarfafawa. Yana wakiltar wani nau’i na dabi’a na ginshiƙi, wanda akwai gagarumin motsi a cikin farashin hannun jari, bayan haka lokacin ƙarfafawa ya fara, sa’an nan kuma ci gaba da yanayin da ake ciki. Pennant sanannen tsari ne wanda aka yi amfani da shi sosai a cikin bincike na fasaha. Ana samun wannan adadi akai-akai akan sigogin ciniki na kusan duk nau’ikan kuɗi. Hankali! Samar da wannan tsari yana ɗaukar makonni ɗaya zuwa uku.

Yadda ake ƙididdige ƙirar Pennant akan ginshiƙi

Kowane ginshiƙi yana da ƙimar tsinkaya mafi girma lokacin da yake nuna wasu halaye. Don tsarin ci gaba kamar tutoci da alamu, kasancewar tsarin da kansa yana nuna yuwuwar yunƙurin kasuwa mafi girma a nan gaba. Don mai ƙima ya yi aiki azaman mai hasashen motsin farashi na gaba, halayen kasuwa masu zuwa da abubuwan aikin farashi dole ne su kasance:

- Motsin farashin jagora . Motsi na ƙarshe na farashin ko ikon zana yanayin dangi shine yanayin da ya zama dole don samuwar abin ƙima.

- Ƙarar . Shiga muhimmin kashi ne na kasuwa mai tasowa. Ƙarfin da aka ɗora a lokacin ƙaddamarwar farashin farko yana ƙara tabbatar da yiwuwar ci gaba da yanayin. Za a iya fassara ɗan ƙaramin ƙara a lokacin samuwar pennant a matsayin alama mai kyau cewa mahalarta kasuwar ba za su bar kasuwa ba, amma suna shagaltuwa da neman madaidaicin wurin shiga don ci gaba da yanayin da ya gabata.

- tsawon lokaci . Ana ɗaukar Pennants ɗaya daga cikin mafi saurin samar da sifofi. Idan samuwar ya ɗauki tsawon lokaci dangane da lokacin, to ana tambayar ingancinsa.

[taken magana id = “abin da aka makala_14767” align = “aligncenter” nisa = “643”]

Lokacin da ya dace don shiga kasuwa shine lokacin da farashin ya karya layin Pennant, wanda ke samar da triangle a cikin hanyar babban yanayinsa dangane da sandar tuta.

Abubuwan da ke tattare da siffa mai ƙima

Pennants suna da abubuwa masu mahimmanci da yawa waɗanda ke nan ba tare da la’akari da kowane yanayi ba. Babban abubuwan da ke cikin adadi:

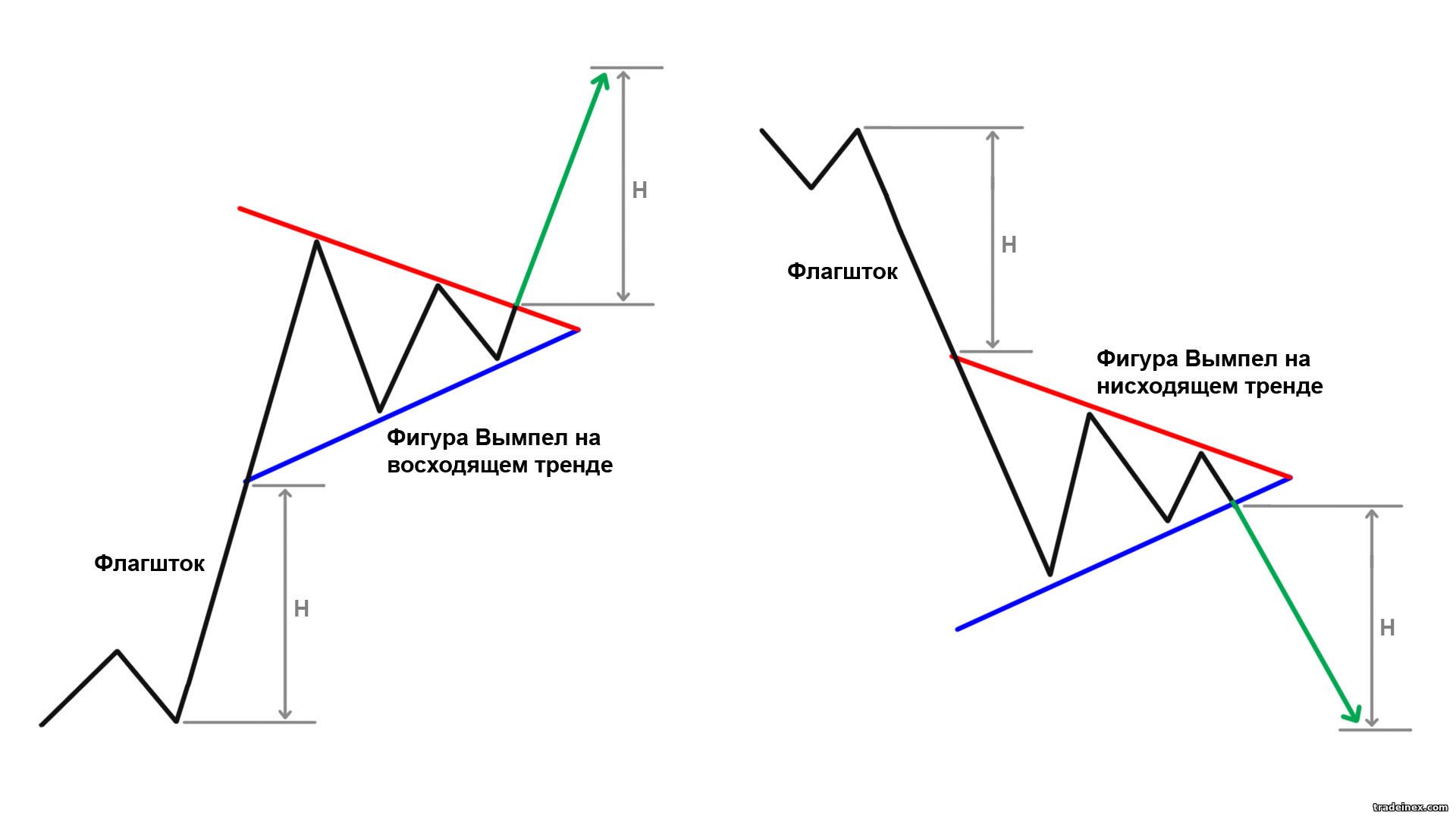

- Tuta . Yana wakiltar yanayi (sama ko ƙasa). Wannan ita ce nisa daga farkon motsin farashin da aka jagoranta zuwa iyakarsa ko mafi ƙanƙanta.

- Triangle . Yana aiki azaman jita-jita na pennant kuma an gina shi ta hanyar zana layukan ci gaba biyu masu haɗuwa (layin juriya da tallafi); ɗayan yana haɗa mafi girman kewayon haɓakawa ɗayan kuma yana haɗa ƙasa. Layukan da suka dace guda biyu suna haɗuwa don samar da triangle.

- karkata . An ayyana shi ta hanyar layukan alwatika dangane da sandar tuta. Triangle yana karkatar da yanayin kuma an rarraba shi azaman mai ban sha’awa ko mara kyau, dangane da ko yanayin farko ya tashi ko ƙasa.

- Juyawa . Ana auna ta ta hanyar kirga saman ko ƙasan sandar tuta daga sama ko ƙasa na abin da kanta. Sau da yawa, ana amfani da kayan aiki irin su Fibonacci retracements tare da haɗin gwiwar gyare-gyare don tantance yiwuwar da girman yiwuwar fashewa.

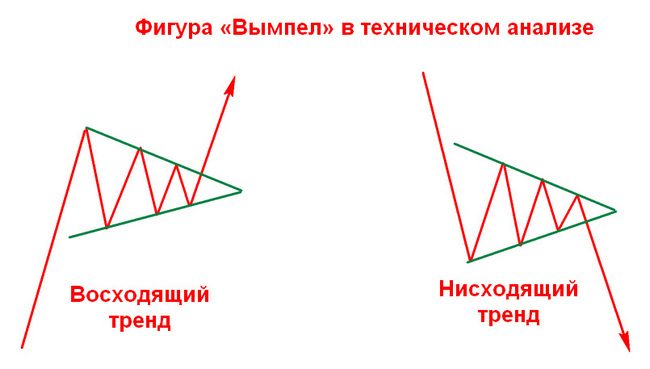

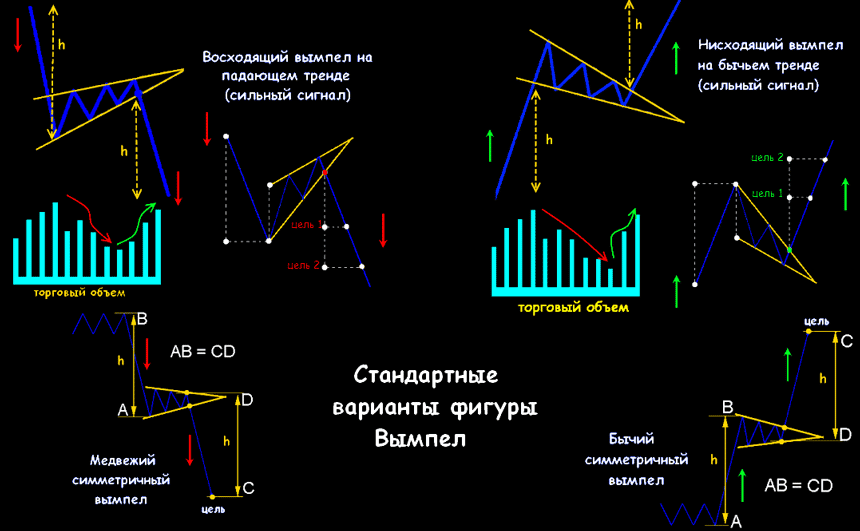

Ƙirƙirar ƙirar ƙira a cikin bincike na fasaha a cikin ciniki, bullish and bearish pennant, m

Tsarin da ke kan ginshiƙi yana farawa tare da tuta a cikin nau’i na kyandir da ke tafiya a hanya guda. Zai iya zama yanayin yanayi ko saurin farashi mai sauƙi. Ci gaba da lura da kasuwa nan da nan bayan kai ga kasan yanayin bearish (mafi girman matsayi na yanayin bullish) yana ba mu damar ƙayyade samuwar sashin ƙarshe na samfurin – triangle mai mahimmanci. Lura cewa samfurin yana samuwa da sauri. A wannan lokacin, lokacin da layukan biyu da ke wucewa ta cikin highs da lows suka haɗu da juna sosai, suna yin ƙaramin alwatika, za mu iya magana cikin aminci game da samuwar Vympel.

Nau’in Pennant

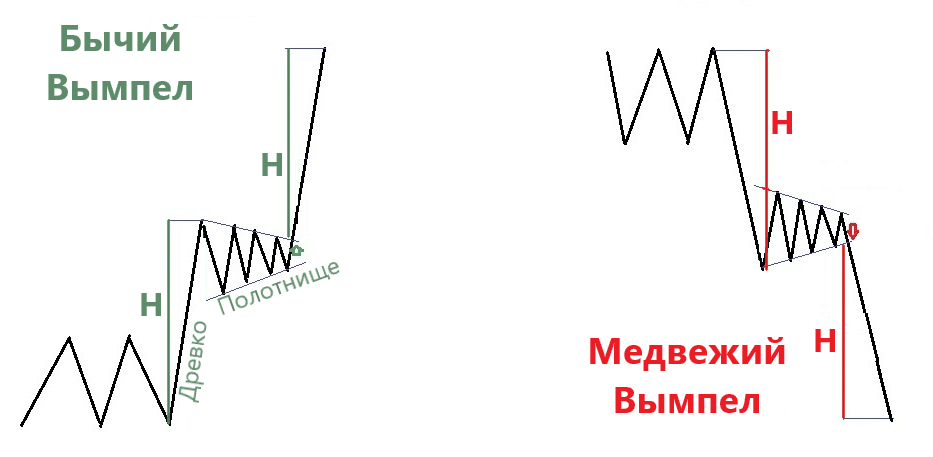

Pennants iri biyu ne:

bijimin bijimin

Wani tsari mai ban sha’awa yana tasowa bayan haɓakar farashin hannun jari. Bayan tsayi mai tsawo, ‘yan kasuwa suna ƙoƙari su rufe matsayin su, suna zaton za a sake dawowa. Farashin ya fara haɓaka yayin da ‘yan kasuwa suka fara fita daga hannun jari. Amma a lokaci guda, lokacin da sabbin masu siye suka fara siyan haja, hakan kan sa farashin ya tashi daidai da haɓakar da aka yi a baya.

ƙwanƙwasa

An kafa tsarin ne bayan raguwar farashin hannun jari. Bayan dogon lokaci, ‘yan kasuwa suna ƙoƙari su rufe wuraren sayar da su, suna zaton za a sake dawowa. Farashin ya fara haɓaka yayin da ‘yan kasuwa suka fara fita daga hannun jari. A wannan lokacin, sababbin masu sayarwa sun fara sayar da hannun jari, suna sa farashin ya tashi a cikin hanya ɗaya kamar lokacin da aka yi a baya.

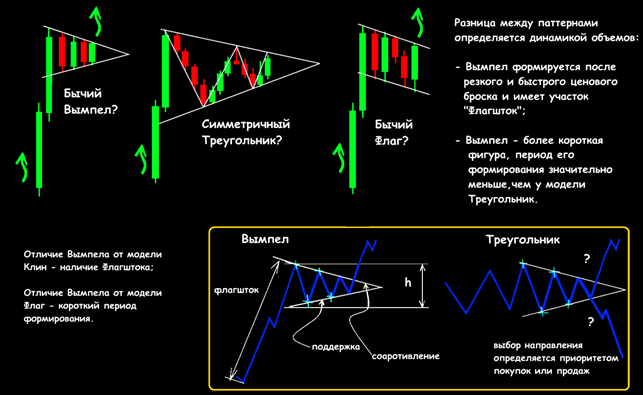

Bambanci daga tuta da lambobi masu kusa

Tsarin da aka lasafta ya yi kama da tsarin tuta, kawai bambanci shi ne cewa tsarin haɗin gwiwar ƙirar ƙirar yana da alaƙa da haɗar layukan ci gaba maimakon layi ɗaya. Babban bambanci daga sauran lambobi masu kusa – “Symmetrical Triangle”, “Hawan Alwatika Mai Saukowa” shine iyaka da sikelin. Pennant ƙaramin nau’i ne a cikin iyaka da tsawon lokaci, wanda ke gaba da ko dai ƙayyadaddun farashi ko faɗuwar faɗuwa.

Yaya ake amfani da shi a cikin bincike na fasaha?

Lokacin ciniki ta amfani da tsari, kuna buƙatar la’akari da waɗannan abubuwan:

- Bayan ƙaƙƙarfan motsi ko dai sama ko ƙasa, farashin ya kamata ya matsa zuwa lokacin haɓakawa.

- Girman ciniki ya kamata ya ƙaru akan motsi na farko na wannan ƙirar ƙira, sannan ta hanyar raunana girma sannan kuma ƙara girma akan fashewa.

- Farashin ya kamata ya motsa a hanya guda bayan fashewa.

Ciniki akan musayar ra’ayi – dabaru masu amfani da misalai tare da kwatancen da bayanin hoto

#1 Misali ta amfani da daidaitaccen dabarun ciniki

Wannan misalin sigar bearish ce ta ƙirar ƙira a cikin kasuwar kuɗi. Jadawalin da ke ƙasa yana nuna aikin farashin kuɗin Yuro-Yen bisa ga ƙayyadaddun lokaci na mintuna 480.

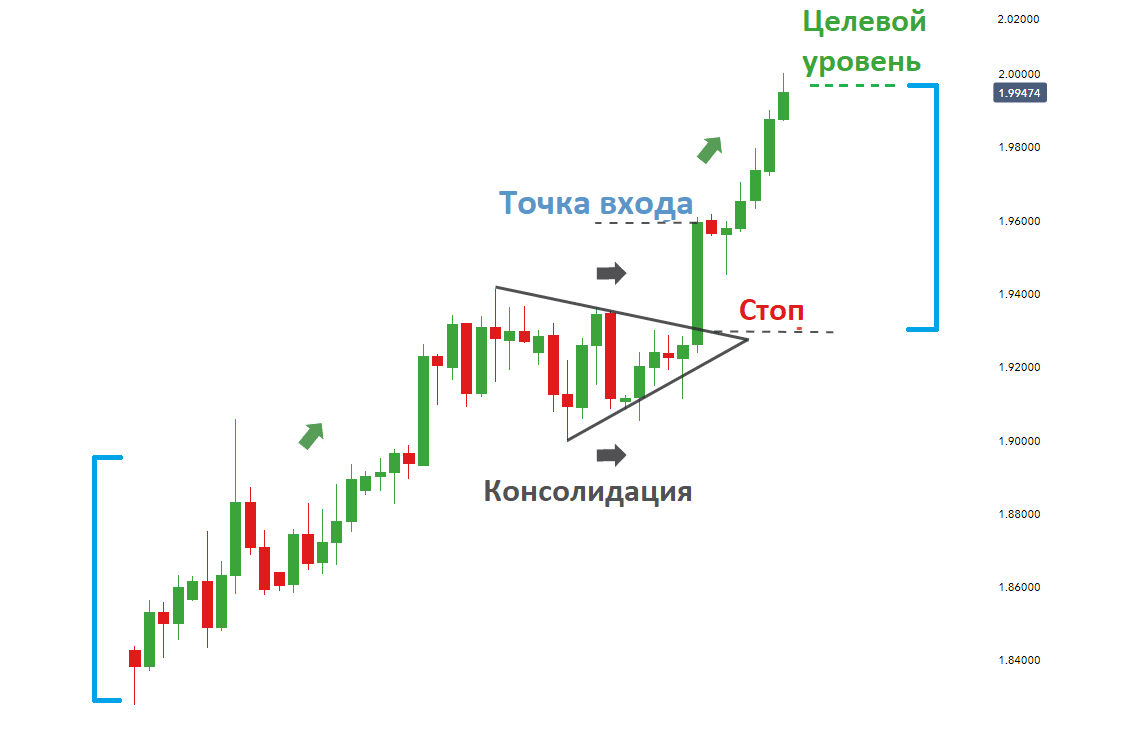

#2 Pfizer LTD Misalin Kasuwancin Sa’a

Misalin da ke ƙasa yana nuna samuwar tsari akan jadawalin sa’a na Pfizer Ltd. Bayan haɓakawa, farashin ya koma cikin yanayin haɓakawa, yana samar da Pennant, sa’an nan kuma an fara fashewa, sannan ci gaba da haɓakawa. An saita matakin asarar tsayawa a mafi ƙasƙanci na ƙirar. An saita farashin da aka yi niyya don ƙididdigewa ta hanyar auna tsayin farko na sandar tuta har zuwa inda farashin ya rabu da abin da aka ƙima.

Ribobi da rashin amfani

Daga cikin fa’idodin wannan adadi za a iya lura:

- Mafi dacewa ga yan kasuwa masu farawa kamar yadda tsarin yana da sauƙin ganewa.

- Ya dace da mulkin zinariya na ciniki – “buɗe kawai tare da yanayin.”

- Samar da sauƙi, abubuwa masu sauƙi don tunawa da mahimmanci.

Daga cikin illolin:

- Akwai babban haɗari na shiga cikin “tarko” da kama karya karya.

- Ba kasafai ake samu ba.

Kuskure da kasada

Mafi yawan kura-kurai a tsakanin ‘yan kasuwa su ne “tarko” da suke fada a ciki. Akwai babban matakin ƙima na ƙima, kamar yadda aka nuna a cikin misalin da ke ƙasa:

Ra’ayin masana

Bisa ga “sharks” na ciniki, alal misali, Carl Icahn, Julian Robertson, pennannts suna da sauƙin ganewa da alamu. Yawancin karatu sun nuna cewa tsarin ci gaba ya dace don cinikin rana. Daban-daban dabarun ciniki ta yin amfani da wannan tsari sun dogara ne akan amincewa da masu biyan kuɗi, mafi yawansu suna da babban damar samun riba. Duk da haka, ƙirƙira ƙira na iya zama da wahala a gane a ainihin lokacin, kuma manyan abubuwan da ke faruwa da haɗin gwiwa suna buƙatar babban jari don kasuwanci da kyau. Daga ƙarshe, ya rage ga mai ciniki ya yanke shawarar ko ya haɗa da amfani da pennants a cikin tsarin ciniki.