For the successful development of a business, it is necessary to take into account not only income, but also costs. Costs are divided into one-time and fixed. Often they involve the purchase of new equipment, the expansion of products. Entrepreneurs have long been operating with such terms as OPEX and CAPEX, in order to understand what it is about, it is recommended that you familiarize yourself with some of the features.

What is OPEX (operating expenses, operational expenditure) – general information

Many aspiring entrepreneurs do not know what OPEX is, which is why they make mistakes when decrypting. The terminology implies operating costs, which include costs that a company cannot ignore in its operations. For example:

- payment for rent of premises/equipment;

- payroll for employees;

- purchase of raw materials;

- insurance payments, taxation;

- payment of utilities, other operating expenses.

In addition to OPEX include payment for the services of outsourcing specialists. For example, it can be lawyers, programmers. Unlike CapEx, operating expenses are subject to full deduction from the income side of a particular period, which is due to the regular nature.

CAPEX and OPEX – the difference

Considering CAPEX and OPEX, the difference between them is as follows:

- Cost indicators . As a rule, payments for capital expenditures imply significant amounts when compared with OPEX.

- Frequency of payments made . It is important to understand that operating expenses include monthly transfers, capital – once a quarter, a year.

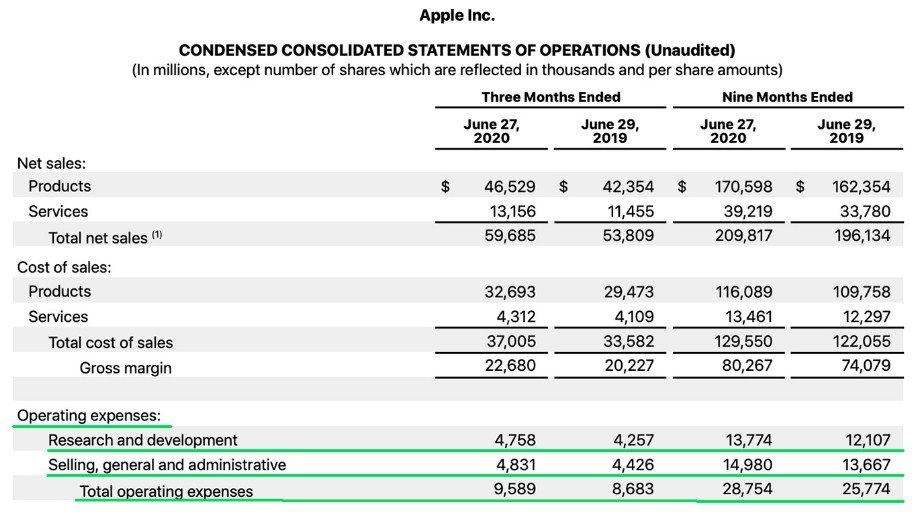

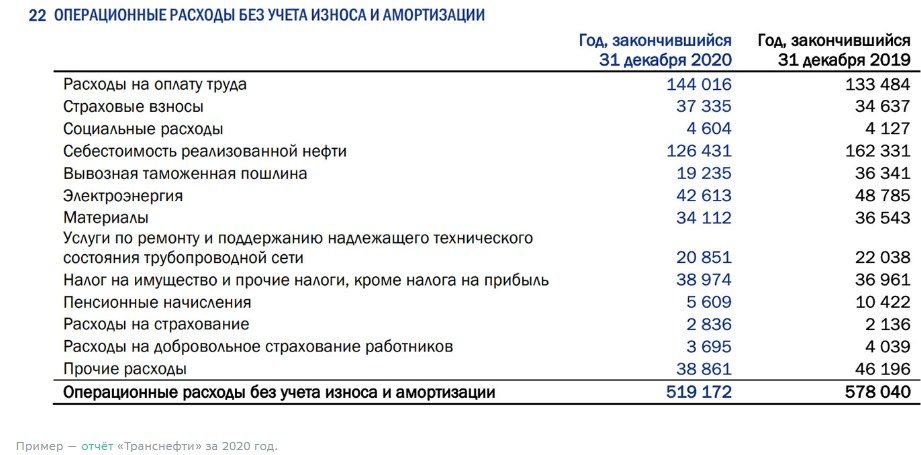

- Display in reporting . Capital expenditures are systematically transferred to the price of assets and duplicated in the section of the balance sheet “Capital and reserves”. At the same time, Opex is listed in the Profit and Loss section.

Why is it important for an investor to consider OPEX

The owners of any company are interested in a significant reduction in costs in order to reduce the amount of taxation on profits. However, the investor needs to know reliable information about net operating income. Therefore, operating expenses are primarily an analysis of data in terms of costs. Investors consider the company’s activities in terms of analyzing the short-term part of income and its impact on net profit. As a result, a decrease in the coefficient with a simultaneous increase in economic benefits indicates a positive trend in the development of the enterprise. Therefore, there is a need to study the data of management reporting and the appendix to the balance sheet “Profit and Loss Statement”, which indicates the real income indicators.

How to study the OPEX of a particular company, where to find and what to look for

The main task of operating expenses is to form an overall indicator at the same time as the growth rates that do not have a negative impact on the development of the enterprise, while simultaneously reaching the level of operating income. The total amount depends on the following factors:

- the ratio of volumes of produced and sold goods . An increase in production capacity and sales is guaranteed to entail an increase in variable costs, while reducing costs;

- the total value of the operating period is the minimum duration, the shorter it is, the lower the costs for repayment of debt obligations, storage of products, natural loss of raw materials within the company;

- real performance indicators of employees . This directly affects the cost of wages;

- the level of depreciation of production assets .

In addition, it is required to pay attention to external factors, which are usually referred to as:

- the growth rate of product prices in the country;

- the real state of affairs in the domestic market of consumer goods and services;

- rate of increase in monthly rent.

It is also necessary to take into account the increase in tax rates, which automatically entails an increase in the financial burden on the enterprise.

Calculation formula

To determine the value of the net part of operating income, you need to use the formula:

NH u003d VP – OR, in which

- VP – gross profit;

- OR – operating costs.

Gross profit includes revenue without value added tax (VAT). Operating costs do not include:

- available depreciation – included in capital expenditures;

- accrued interest on open loans.

The operating cost ratio is determined by the formula:

Cor = OR / VPx100%. The resulting value reflects the real percentage of the revenue received, which is aimed at organizing the stable operation of the company. The growth of net income entails a decrease in Cor and a simultaneous increase in gross profit. The operating income rate implies a level of profitability that reflects the expressed percentage ratio of operating income to the company’s profit. The financial position and stability of the enterprise as a whole directly depends on the GCD. The calculation is carried out according to the formula:

Nop = OD / VPx100, in which

OD is operating income, providing for the difference between real revenue and operating costs.

Important: operating income and pre-tax benefit are not identical concepts.

To eliminate typical errors, it is advisable to make a calculation on a specific example. The company is engaged in the provision of services for the organization of cargo transportation. Initial data:

- payment for the office (rent) – 1.275 million rubles;

- parking fee under a lease agreement – 637 thousand rubles;

- purchase of spare parts for vehicles – 450 thousand rubles;

- salaries for hired personnel – 6.45 million rubles;

- receiving banking services – 37.5 thousand rubles;

- payment for cellular communication – 412.5 thousand rubles;

- other expenses – 525 thousand rubles;

- gross profit is 12 million rubles.

The calculation is carried out as follows: OD = 1.275 + 0.637 + 0.45 + 6.45 + 0.0375 + 0.4125 + 0.525 = 9.78 million rubles. Based on the obtained data, the coefficient is calculated: Kor = 9.78/12 = 81.5%. In this case, the amount of operating income is: 21.78 million rubles. (9.78 + 12). The norm is 18.4% (21.78/12). Therefore, operating income is set at 18.4% of available gross profit. Thanks to the obtained data, we can confidently say that the remaining 81.6% is used by the company to cover operating costs.

Reference: the process of changing the rate of income is highly recommended to track directly in dynamics. In the case of an increase in the indicator, we can safely talk about the rapid growth of the profitability of a particular business.

In addition, the rate of income directly depends on the scope of the company. In the example under consideration, the indicator does not increase significantly, which is due to the lack of the possibility of existence without operating expenses. As a result, experts point out that the specifics of the work is considered a fundamental factor that needs to be taken into account during the calculations.