A speculator versus a reasonable investor, or how is a trader different from a long-term investor? A novice participant in the stock market is faced with an investment and speculative approach. The difference between them is not obvious, which makes it seem that you can skip the study of the issue, which is a big mistake. This is the basics of the stock market that you need to understand in order to avoid new questions, serious mistakes and loss of money. So what is the difference between trading and investing – let’s start with the basics.

Speculative approach of a trader

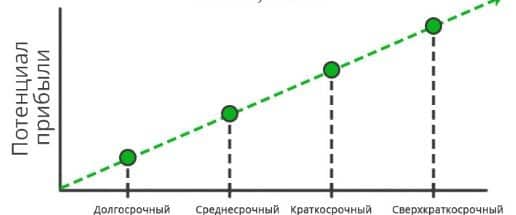

The speculative approach is used by traders who make money on short-term market fluctuations, having seen the right situation, make a deal that lasts from a few seconds to one year. A trader who enters into second deals uses the scalping method, literally cuts off small profits on large volumes of the asset. A person engaged in hourly trading is called an intraday trader, he practically does not transfer transactions to the next day. Transactions with a range of several days are called swing trading, such a transaction can be postponed for months, but up to one year.

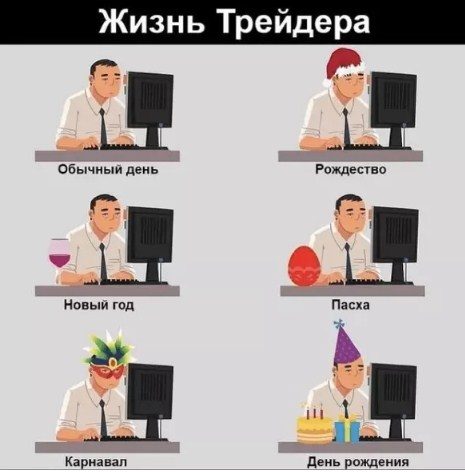

It should be borne in mind that before the trader really made all transactions with his hands and of course this profession was considered very exhausting. Now the situation is changing, because manual trading is being replaced by machine trading –

algorithmic trading. This is a situation when transactions on the stock exchange are made by robots, but a person first draws up his own trading system, according to which he will write a trading advisor.

There is a human factor here, but such a machine saves the trader’s time. The statistics are surprising: on the New York Stock Exchange, about 95 percent of all speculative transactions are made by robots, that is, today trading is a battle of robots. First of all, trading means trading on the futures exchange market, that is, on the forts market. This may be the derivatives market of the Moscow Exchange, where futures and options are traded, or a foreign market. In addition, trading includes work on the forex market. There are fraudulent companies here, there are companies with a license from the Bank of Russia or foreign licenses. These companies are a little more decent, but even they have a rather sad statistics of traders on the long horizon. This is due to unscrupulous advertising and attracting people to trading who psychologically need to invest.

Investment contribution to the future

Investing is the polar opposite of trading. If a trader earns thanks to short-term fluctuations, then investors do not pay attention to these fluctuations. Their goal is global perspectives and a long-term horizon.

into two main categories: equity investment – this includes shares for shares in a company, debt – a case when an investor lends to the state or a company and receives interest for it – this includes bonds.

If a trader relies on mathematical statistical probability, then the investor’s task is to conduct a competent collection and analysis of information and make the right decision for a long period

How investors analyze information: when they choose a stock to buy, they look in which country this stock is traded, what is the investment climate there, the political, macroeconomic situation, then they choose the industry in which they want to buy a stock, they look at how promising it is, whether it is in decline, there is money and potential for development there. Only then they choose a specific company, analyze the effectiveness of its business model, consider financial indicators, statements, ratios, try to understand how stock quotes of a share correspond to its real value. Investors are trying to choose undervalued, cheap companies with the expectation that now the market simply does not yet understand the value of this company, but over time, quotes will rise. The logic of the investor is that if the business is good, working, promising, then sooner or later the quotes of the company will catch up, and the investor knows how to wait. When making decisions, investors are guided by fundamental analysis, but technical analysis is not alien to them. The investor looks at the chart to choose the right entry point.

Fundamental analysis is a complex time-consuming process, but today it has become easier thanks to technological progress. Now there is no need to draw lines and indicators yourself. In fundamental analysis, it is not at all necessary to independently calculate all the coefficients – there are special programs, stock screamers that make it easier for an investor to choose an instrument for investment.

What are the benefits of investing?

The fact that, firstly, this is of course a significant time saving compared to trading – and investment may not be the main profession, but some hobby in your spare time. The investment also has disadvantages: first, the money is frozen for a long time, the capital is not mobile. Investing is a labor intensive process. You should not spare time to improve your knowledge, you need to tune in to a long wait and be able to survive the fall of the market and the fall of your own funds. You also need not to stop at one company, but to form a full-fledged portfolio that will meet all personal needs and needs.

Investments vs trading – the difference between an investor and a trader is clear

| Investor | Speculator – trader |

| To select assets, he uses fundamental analysis, along with technical analysis. | Uses technical analysis when choosing assets, sometimes supplementing with fundamental. |

| For successful investing, spends several hours a day | For profit, spends a whole working day |

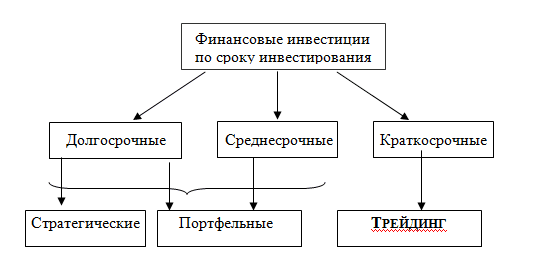

| Investment term from 1 year | A trader makes transactions from a few seconds to one year |

| Profit in the amount of 8-15% per annum from the initial deposit is considered a good result | Profit is unstable, losses and complete ruin often occur. But with good trading, the trader receives 40-100% per annum from the initial deposit. |

The article highlights common points regarding one profession, but with different approaches. A trader and an investor are equally good, each pursues its own goal. Both need to learn and improve themselves so that every trade and every analysis bears fruit. The earnings of an investor and a trader differ, due to their time. We can say that a good profitability of a trader is 30%, but this is not so, this is a good income, and it is above the average for the market. If the trader has not lost, then he has already earned, as they say in professional circles. The investor is more modest and expects to receive 10-15% per annum and many will be satisfied.