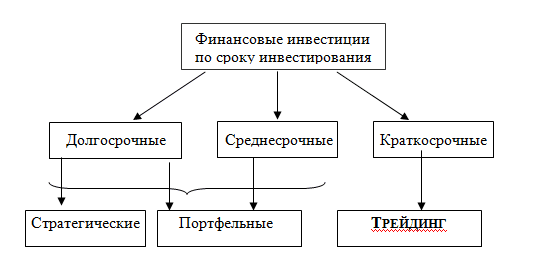

A speculator versus a prudent investor, or how is a trader different from a long-term investor? The aspiring stock market participant is faced with an investment and speculative approach. The difference between them is not obvious, which makes it seem that you can skip the study of the issue, which is a big mistake. This is the basics of the stock market that you need to understand in order to avoid new issues, serious mistakes and loss of money. So what’s the difference between trading and investing – let’s start from scratch.

Trader’s speculative approach

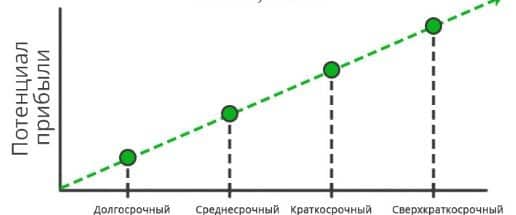

The speculative approach is used by traders who make money on short-term market fluctuations, having seen the right situation, they enter into a deal that lasts from a few seconds to one year. A trader who concludes second deals, uses the scalping method, literally cuts off small profits on large volumes of assets. A person engaged in hourly trading is called an intraday trader, he practically does not transfer transactions to the next day. Trades with a range of several days are called swing trading, such a trade can be postponed for months, but up to one year.

It should be borne in mind that before the trader really made all transactions with his hands and of course this profession was considered very exhausting. Now the situation is changing, because manual trading is being replaced by machine trading –

algorithmic trading. This is a situation when robots perform transactions on the exchange, but a person first draws up his own trading system, according to which a trading advisor will be written for him.

There is a human factor here, but such a machine saves a trader’s time. The statistics are surprising: on the New York Stock Exchange, about 95 percent of all speculative transactions are made by robots, that is, trading today is a battle of robots. First of all, trading is understood as trading on the derivatives exchange market, that is, on the forts market. This can be the derivatives market of the Moscow Exchange, where futures and options are traded, or a foreign market. In addition, trading includes work in the Forex market. There are fraudulent companies here, there are companies licensed by the Bank of Russia or foreign licenses. These companies are a little more decent, but even their statistics of traders on the long horizon are rather sad. This is due to unfair advertising and attracting people who psychologically need to invest in trading.As a result, these people drain their deposits.

Investment investment for the future

Investing is the polar opposite of trading. If a trader makes money from short-term fluctuations, then investors do not pay attention to these fluctuations. Their goal is global perspectives and a long-term horizon. It does not matter for an investor that the share price fell by 20 percent today or increased tomorrow by 30. The

If a trader relies on mathematical statistical probability, then the investor’s task is to carry out a competent collection and analysis of information and make the right decision for a long period.

How investors analyze information: when they choose a stock to buy, they look in which country this stock is traded, what is the investment climate, political, macroeconomic situation, then they choose the industry in which they want to buy the stock, see how promising it is, whether it is in decline, there is money and potential for development there. Only then they choose a specific company, analyze the effectiveness of its business model, consider financial indicators, reports, ratios, try to understand how the stock exchange quotes correspond to its real value. Investors are trying to choose undervalued, cheap companies with the expectation that now the market simply does not yet understand the value of this company, but over time the quotes will grow. The investor’s logic is that if the business is good, working, promising,then sooner or later the company’s quotes will catch up, but the investor knows how to wait. When making decisions, investors are guided by fundamental analysis, but technical analysis is no stranger to them. The investor looks at the chart to select the correct entry point.

Fundamental analysis is a complex, time-consuming process, but today it has become easier thanks to technological progress. Now there is no need to draw lines and indicators yourself. In fundamental analysis, it is not at all necessary to independently calculate all the coefficients – there are special programs, stock screamers that make it easier for an investor to choose an investment instrument.

What are the advantages of investing?

The fact is that, firstly, this is of course a significant saving of time in comparison with trading – and investments may not be the main profession, but some hobbies in their free time. The investment has its drawbacks: first, the money is frozen for a long time, the capital is not mobile. Investing is a laborious process. You cannot spare time to improve your knowledge, you need to tune in to a long wait and be able to survive the fall of the market and the fall of your own funds. You also need not to dwell on one company, but to form a full-fledged portfolio that will meet all personal needs and requirements.

Investing vs trading – the difference between investor and trader is clear

| Investor | Speculator – trader |

| To select assets, he uses fundamental analysis, coupled with technical. | Uses technical analysis when choosing assets, sometimes complementing fundamental ones. |

| For a successful investment, spends several hours a day | To make a profit, spends a whole working day |

| Investment period from 1 year | A trader makes deals from a few seconds to one year |

| A profit of 8-15% per annum from the initial deposit is considered a good result | Profits are unstable, losses and complete ruin often occur. But with good trading, the trader receives 40-100% per annum from the initial deposit. |

The article highlights common points regarding one profession, but with different approaches. Trader and investor are equally good, each pursuing a different goal. Both need to learn and improve for every trade and every analysis to pay off. Investor and trader earnings differ due to their timing. We can say that a good trader’s profitability is 30%, but this is not so, this is a good income, and it is above the market average. If the trader has not lost, then he has already earned, as they say in professional circles. The investor is more modest and expects to receive 10-15% per annum, and many will be satisfied.