Increasingly, traders use

trading robots in the process of trading stocks and bonds on the stock exchange . Automatic trading systems are capable of making more than 1000 transactions per minute, which is undoubtedly a significant advantage. The use of advisors allows you to significantly save time and eliminates the possibility of making a rash transaction. Below you can find the principle of operation of trading robots and an overview of the best advisors.

- What is a trading robot, what is the principle of the adviser

- How algorithmically trading bot works

- Modern algorithms

- Modern trading robots are the best advisors for the end of 2021-beginning of 2022

- DAXrobot

- Executor

- Interactive Advisors

- betterment

- VTB: robot advisor

- How to choose a trading robot depending on the tasks

What is a trading robot, what is the principle of the adviser

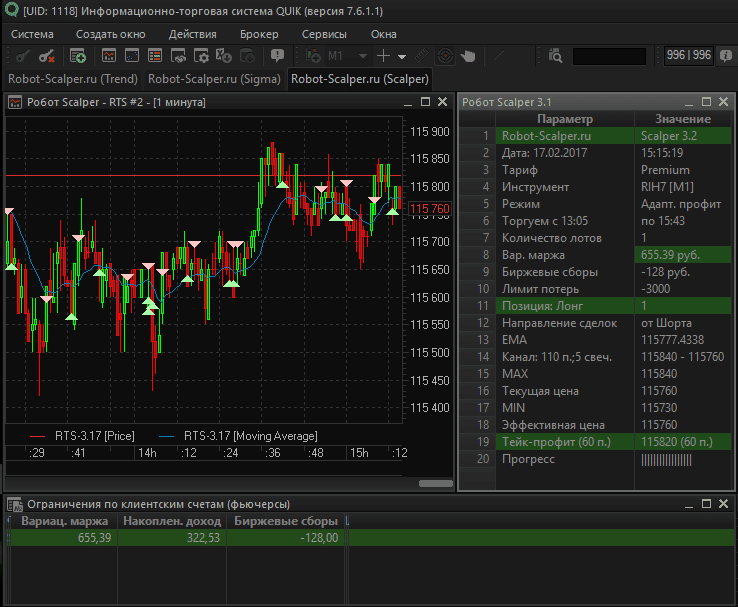

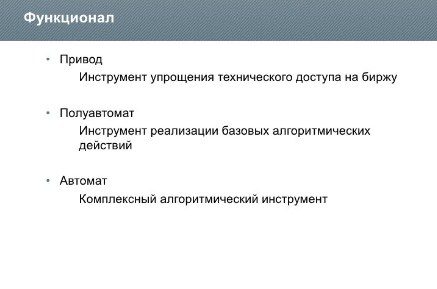

A trading robot is an automated program that is able to independently make transactions on the stock exchange. The main task of a trader will be to set certain parameters, for example, opening / closing positions, fixing income, etc. Developers create fully or partially automatic Expert Advisors. Choosing the first option, the trader does not need to perform additional actions in the course of work. The semi-automatic adviser will send a notification about each transaction so that the trader can decide whether to buy or sell stocks/bonds.

How algorithmically trading bot works

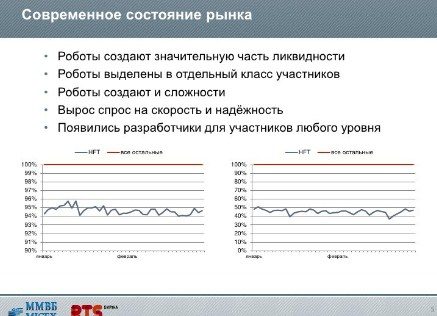

Modern robots are able to independently assess the situation on the market due to the presence of technical indicators based on a certain strategy. Before installing the robot, the trader must set the size of the position to be opened. The program automatically opens transactions for the purchase / sale of shares or bonds at the moment when all conditions are met. At the same time, asset price movement charts, financial performance of companies and even political events should be taken into account – that is, everything that is included in their algorithm. It is also important to take into account the amount of the trading deposit and the leverage used.

Note! The trading robot closes deals on its own if all the conditions within the framework of the strategy used are met.

Modern algorithms

Developers use modern algorithms in the process of creating trading bots. Thanks to their efforts, users can use the following types of robots in their activities:

- On neural networks equipped with artificial intelligence . Robots of this type have not yet been perfected, so bots are endowed with not only advantages, but also disadvantages. In the course of work, the robot will combine technical and fundamental analysis, however, if a trader enters incorrect information into the system, the calculations will turn out to be erroneous, which will entail losses.

- Universal bots , which the investor will be able to configure on their own, setting and controlling especially important parameters. However, it is worth remembering that the market is changing rapidly, so traders do not always have time to reconfigure the program, which leads to negative consequences.

- Copyright robots created by programmers in collaboration with professional traders. Depending on the underlying algorithms, the level of aggressiveness/risk/reward ratio will differ.

Developers in the process of creating a program set a specific algorithm (set of instructions) for placing a deal, which is based on time/price/quantity or some kind of mathematical model.

Note! The algorithmic trading system automatically monitors prices and charts in real time. Transactions are made at the most favorable prices. Transaction costs are reduced.

Algorithmic trading (trading with the help of robots), how it works, principles, prospects for the market of advisers: https://youtu.be/xlTrS7sfb04

Modern trading robots are the best advisors for the end of 2021-beginning of 2022

Below you can find a description of modern trading robots that can be used to trade stocks and bonds on the stock exchange.

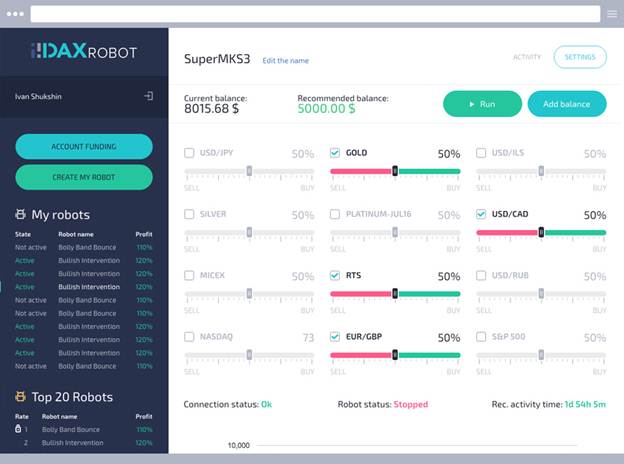

DAXrobot

DaxRobot is a popular trading bot that generates signals based on a variety of algorithms and pattern recognition systems. Thanks to this, the program determines the correct signals and uses them to make a profit. The minimum deposit is $250. The strengths of DaxRobot, traders include:

- A simple and user-friendly interface that makes it easy to master trading. Even beginners will find it easy to understand what’s what.

- Timely customer support.

- Reliability.

It’s frustrating that the demo version lasts only 60 seconds, after which the trader needs to make a minimum deposit of $250. It is also worth considering that DaxBase is the only broker with which the platform can be integrated, which greatly limits traders.

Executor

Executor is a modern stock trading robot/bot. The program operates on the basis of the Sterling Trader Pro infrastructure. The browser provides access and control. Users choose a direction and set risk parameters, after which the bot starts trading stocks using universal entry/exit points. The Executor is able to close a huge number of trades at the same time, independently controlling the risk and doing all the work of entering/exiting positions.

Note! When choosing a position volume, the Executor supports fractional lots.

The Executor waits for the pattern specified to it for the entry point. Outside the specified price range, the bot will not trade. The program is controlled through a browser. The resistance to technical failures is good. Simultaneous control from several devices is possible.

Interactive Advisors

Interactive Advisors is a popular robot for trading stocks and bonds. Users can switch to a universal account at any time that allows them to trade stocks, bonds, options and ETFs. Commission rates are low. According to traders, the advantages of the Interactive Advisors bot include:

- a wide range of portfolios;

- the ability to consolidate and track personal financial accounts;

- the possibility of obtaining a loan under your own unmanaged accounts (at relatively low interest rates).

Most Interactive Advisors portfolios include baskets of stocks, not ETFs. Until the transaction is completed, it will be impossible to know the full amount of commissions.

betterment

Betterment is a robust trading bot with a mobile-optimized process. As part of setting up accounts, users will be required to fill in personal information, including their own age, annual income, and purpose. There are no standard questions related to risk. Instead, Betterment sends an asset allocation proposal and associated risk, which can be modified if necessary by adjusting the percentage of equity versus fixed income in the portfolio. Betterment offers five types of portfolios, allowing users to change strategies after a portfolio has been funded. The platform informs users about the occurrence of any tax consequences.

- quick and easy account setup;

- the ability to synchronize external accounts with individual goals;

- simple process of changing portfolio risks/switching to another type of portfolio;

- adding a new goal at any convenient time and an easy process of tracking your progress.

Traders who use Betterment in their activities pay attention not only to the advantages, but also to the disadvantages of the bot. The disadvantages of a trading robot include:

- a systematic reminder that it is time to replenish the account;

- the opportunity to consult with a financial planner costs $199-299.

Note! Investment portfolio owners most often invest in exchange-traded funds (ETFs).

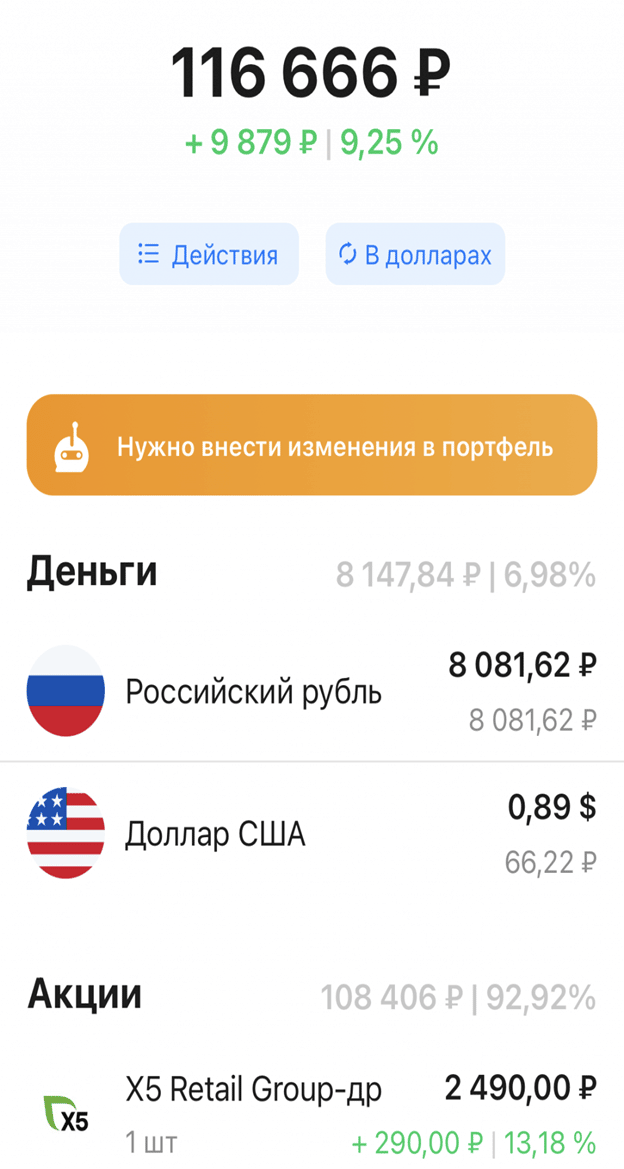

VTB: robot advisor

VTB is a popular robot that offers its clients the most suitable strategies in a particular case. Once the EA knows the user’s investment profile and financial goal, it starts offering 4-6 options that are ideal for the trader. The bot-advisor sends recommendations on the features of portfolio management: which stocks to buy and which to sell, when and for what period it is necessary to replenish the account in order to achieve your financial goal on time. However, each user has the opportunity to make their own decision – to follow the advice or do it their own way. The robot-advisor will not perform any actions with the account until the trader confirms his actions.

- reliability;

- operational work of the technical support service: online chat is available 24/7 on the mobile phone and on the website;

- quick and easy process of connecting an adviser.

Judging by the reviews of traders, the robot-advisor is also not without its shortcomings. Significant disadvantages of the bot are:

- lack of access to US futures;

- systematic failures in trading programs;

- increased risks.

It is also a little frustrating that there is no single account for all markets, and there is no demo account at all.

Note! When choosing a robo-advisor and going to their website / launching their mobile application, the trader will be asked questions about the current financial situation and the future goals that he sets for himself. There will be several questions allowing the algorithm to determine how much investment risk a trader is willing to put up with.

The best trading robots for the end of 2021 – the beginning of 2022, how to choose an adviser for trading: https://youtu.be/JqPXCQEnBSQ

How to choose a trading robot depending on the tasks

When choosing a trading robot, it is important to pay attention not only to the reviews of other traders, but also to other equally important factors, which include:

- Acceptable level of risk/potential return . In cases where deep drawdowns are unacceptable, you should choose bots built on conservative strategies with minimal risk. However, it must be understood that the potential return in this case will be low.

- Bot type . A trader needs to consider their own trading style and personal preferences. For example, a scalping bot will not be the best option to use on currency pairs that show a steady trend.

- Possibility to test the bot . It is extremely important for a trader to debug the parameters and make the final settings in the strategy test before the Expert Advisor is placed on a live account.

After the trading bot is selected, the trader needs to test it. If the adviser pleases with the results of its work, you can safely move on to placing the robot on a real account.