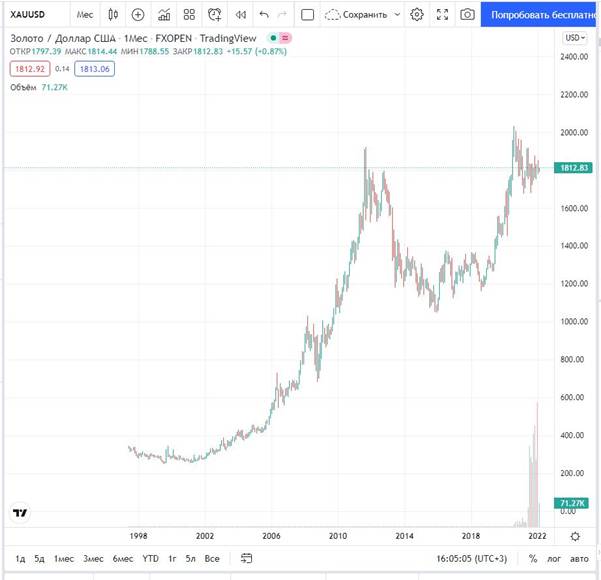

ETF FXGD – online chart, composition of the fund in 2022, quotes and profitability.

ETFs and

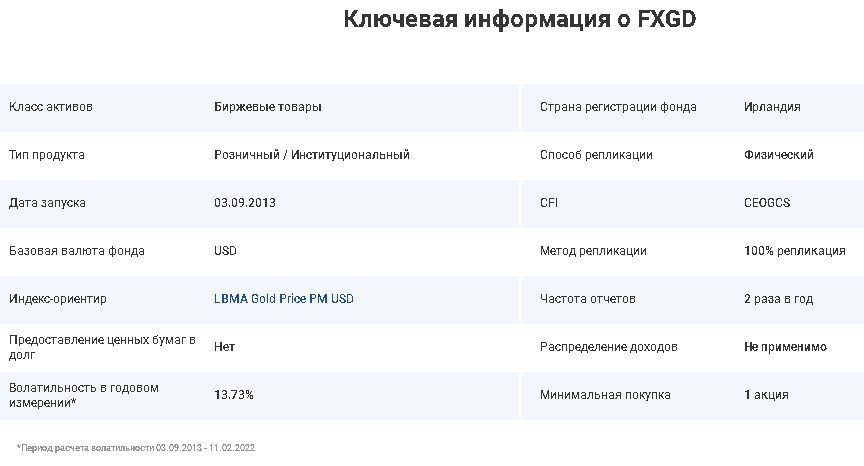

mutual funds are funds that invest in securities – stocks and bonds, commodities or metals. They repeat the dynamics of the benchmark as accurately as possible, the tracking error does not exceed 1%. FXGD is an ETF from Finex. registered in Ireland, which allows you to protect yourself from inflation by investing in physical gold.

Composition of the FXGD ETF

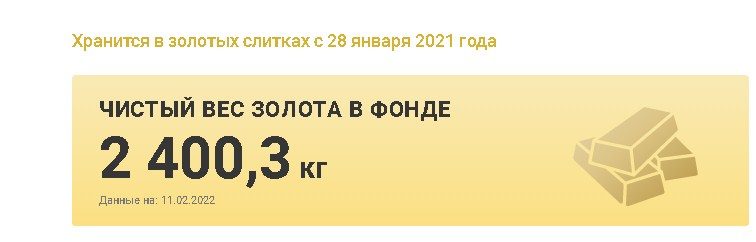

The fund was founded in 2013, initially it invested in physical gold (bars were purchased). After 2 years, in 2015, it was decided to change the investment strategy and the fund began to track the price of physical gold using synthetic replication. Investors were wary of such changes, and in 2021 the fund returned to buying bullion. The Fund daily updates information on the amount of physical gold as of February 11, 2022, 2400.3 kg of gold are stored in the FXGD ETF.

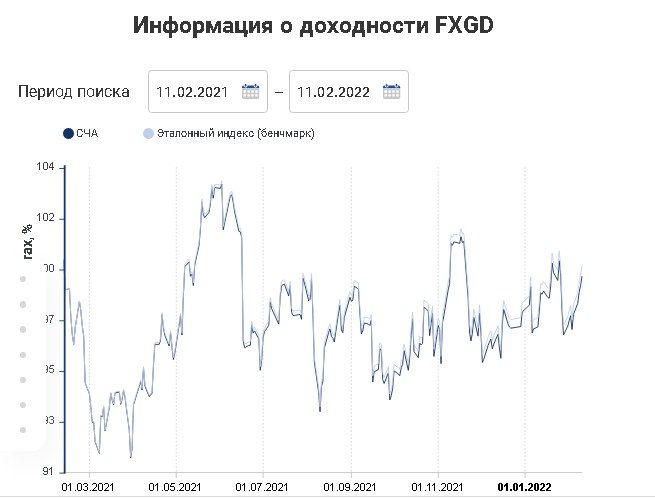

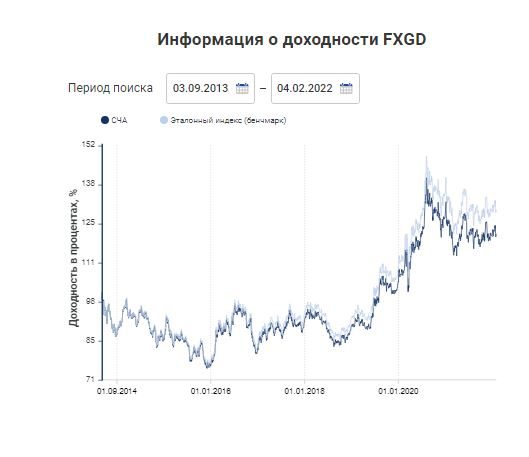

FXGD fund returns

The dynamics of FXGD ETF depends on fluctuations in the price of physical gold in the global market. LBMA Gold Price PM USD is declared as a benchmark – an indicator that gold producers and funds around the world are guided by, calculated by the London Bullion Market Association. FXGD ETF is not a 100% analogue of buying metal, the cost is affected by commissions of a broker, fund, exchange spreads. This is one of the cheapest funds for an investor – the investor’s cost of owning an ETF is only 0.45% of the NAV. This is almost 2 times less than the average market commission among the funds traded on the Moscow Exchange. There is also a non-market risk – Finex is a foreign company and may, for some reason, stop operating in the territory of the Russian Federation or go bankrupt. This is the oldest fund that has been operating in Russia for 8 years, and this risk is minimal, but it cannot be ignored.

- taxes – when buying, you do not need to pay VAT;

- gold bars do not need to be stored and worries about theft or deterioration from time to time;

- compared to OMS, smaller exchange spreads.

Gold is a commodity and the investor cannot count on periodic payments, but it is possible to earn on the difference in the rate.

But passive investors, when buying gold, do not count on profit – just on saving capital from inflation and reducing the volatility of a portfolio of stocks and bonds. It is worth noting that although gold is considered a protective asset, it is still a rather risky instrument. FXGD ETF has a risk level of 4 on a 7 point scale. Phinex estimates FXGD fluctuations at 13.74% on an annualized basis. Since the launch of the fund, the yield has been 181.06% in rubles and 21.17% in dollars, the average annual growth in US dollars is 2.11%. FXGD ETF on the Moscow Exchange can be bought for rubles or dollars. On the world market, gold is pegged to the US dollar, and Russian investors, if the ruble exchange rate falls, can receive additional ruble profits.

How to buy FXGD ETFs

Buying FXGD RTF will not be a problem, you need a

brokerage account with access to trading on the Moscow Exchange. It is provided by many brokers, with a list recommended by Finex, you can find it on the official website in the “buy ETF” section at https://finex-etf.ru/oformit-seychas.

Beginners are advised to choose a broker that does not charge a monthly commission for maintaining an account. The status of a qualified investor is not required to purchase shares of the fund, some brokers may ask you to pass a simple test on knowledge of the theoretical foundations of investing in exchange-traded funds.

You can buy FXGD on a regular brokerage account or

IIS. When acquiring on an individual investment account, all the benefits provided for by the legislation of the Russian Federation apply. You can buy and sell an exchange-traded fund for rubles or US dollars, but the possibility of buying for dollars should be clarified with your broker. If it provides such an opportunity, you can buy for one currency and sell for another. To find the FXGD etf fund in your personal account, or in a specialized application for trading on the stock exchange, you need to enter the ticker “FXGD”, if the search does not return results, then the ISIN code is IE00B8XB7377. Next, enter the required number of shares, the program will calculate the total amount of the transaction, taking into account the commission, and then the transaction should be confirmed. The current price can be specified in the broker’s application or on the website of the Moscow Exchange. At the beginning of 2022, it is 92.61 rubles. Thanks to such a low price, even beginners who do not yet have a lot of capital can invest in gold. You can very accurately calculate the required number of shares for the optimal proportion of protective metal in the portfolio

FXGD ETF Prospects

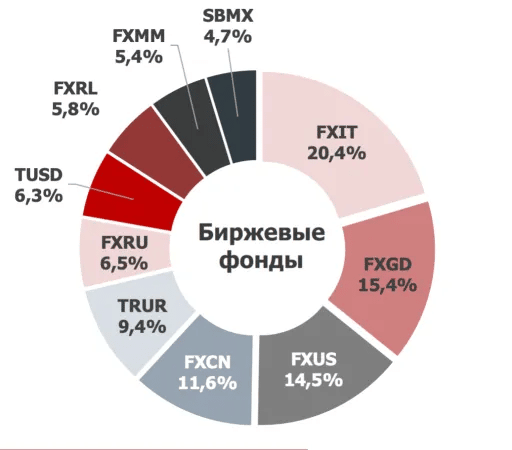

Gold is a traditional defensive asset that is recommended to be included in many passive strategies. The recommended share is up to 15%. One of the cheapest and most convenient ways to buy gold is the FXGD ETF. On the Moscow Exchange relatively recently, in 2020, 2 competitors appeared – VTBG from

VTB Management Companyand TGLD from Tinkoff Investments. They are exchange-traded mutual funds and will cost the investor more – 0.66 m 0.54 of the NAV, respectively. VTB buys physical gold, which is stored in the bank of the same name. Tinkoff spends only 70% of investors’ money on the purchase of gold bars, and purchases a foreign ETF for gold for the rest. What further increases the total commissions of the investor – Tinkoff pays a commission for owning a foreign fund. Like VTB, it partially stores bullion in Russia, in its bank. The difference in the investment strategy leads to a discrepancy in the quotes of the same financial instrument. The Irish registration of the Phinex company introduces some risks, but they are not so high. Management companies provide fairly accurate tracking of the price of gold on the global market. According to the Moscow Exchange data for January 2022, it is FXGD that Russian investors prefer to have in their portfolios. It ranks 6th in the top 10 most popular funds. Gold is not the most unambiguous object for investment. A private investor should not rely on the forecasts of private houses or analysts when making investment decisions. On a long history, there were segments of 5-10 years in which a hypothetical loser investor who bought gold at maximum prices was in the dollar minus. Due to currency revaluation, there could be a profit, but this is not guaranteed. During the long-term decline of gold, stocks and bonds showed both growth and decline. In recent years, due to the policy of the Fed, gold does not show a good inverse correlation with the stock market. In most cases, stock market corrections affect gold. The volatility of gold is lower, with stocks losing 30-50% and gold 15-20%. The metal behaves ambiguously, even the world’s leading analysts do not undertake to predict its behavior. An investor wishing to follow one of the popular passive strategies can buy gold to diversify into a small portion of the portfolio. Do not try to determine the bottom or top of the market. Investments in gold must be long-term, at least 10 years. At shorter intervals, the risk of losses is very high. An investor should take investments in gold seriously, calculate the risks. Do not try to determine the bottom or top of the market. Investments in gold must be long-term, at least 10 years. At shorter intervals, the risk of losses is very high. An investor should take investments in gold seriously, calculate the risks. Do not try to determine the bottom or top of the market. Investments in gold must be long-term, at least 10 years. At shorter intervals, the risk of losses is very high. An investor should take investments in gold seriously, calculate the risks.