ETF FXGD – ɛntɛrinɛti jatebɔsɛbɛn, nafolosɔrɔsiraw sigicogo san 2022 kɔnɔ, quotations ani nafa sɔrɔcogo.

ETF ani

mutual funds ye nafolo ye min b wari bila securities la – stocks ani bonds, commodities walima metals. U bɛ segin dantigɛlikan dinamiki kan ka ɲɛ i n’a fɔ a bɛ se ka kɛ cogo min na, tuguni fili tɛ tɛmɛ 1% kan. FXGD ye ETF ye min bɛ bɔ Finex fɛ. min tɔgɔ sɛbɛnna Irlandi jamana na, o b’a to i bɛ se k’i yɛrɛ tanga nafolosɔrɔbaliya ma, i kɛtɔ ka wari bila sanu farikoloma la.

FXGD ETF ka baarakɛcogo

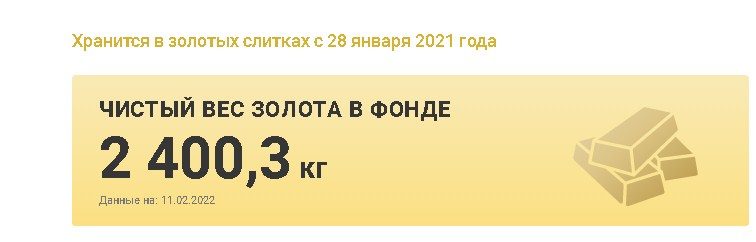

O bolofara in sigira senkan san 2013, a daminɛ na a ye wari bila sanu farikoloma la (baraw sanna). San 2 tɛmɛnen kɔfɛ, san 2015, a latigɛra ka waridoncogo caman sɛmɛntiya ani ka nafolosɔrɔsiraw y’a daminɛ ka sanu farikolo sɔngɔ nɔfɛtaama ni sintetiki ɲɔgɔndan ye. Investisseurs (waridonnaw) tun bɛ u janto o fɛn suguw caman ɲɔgɔnna caman na, wa san 2021, nafolo in seginna ka taa waribon sanni na. Fondo bɛ kunnafoniw kuraya don o don sanu farikolo hakɛ kan ka se san 2022 feburuyekalo tile 11 ma, sanu kilo 2400,3 bɛ mara FXGD ETF kɔnɔ.

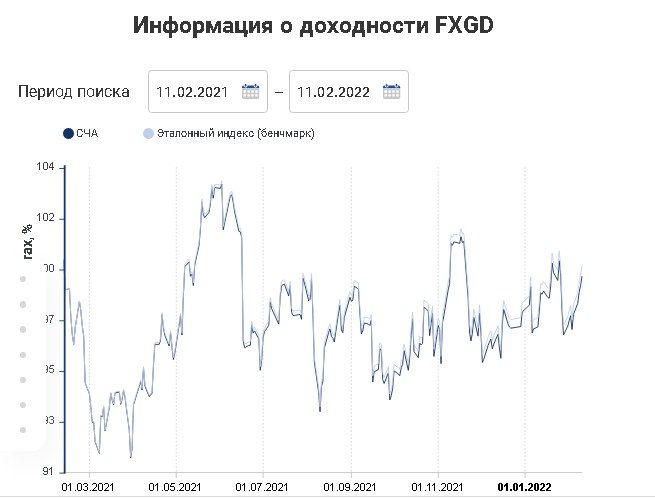

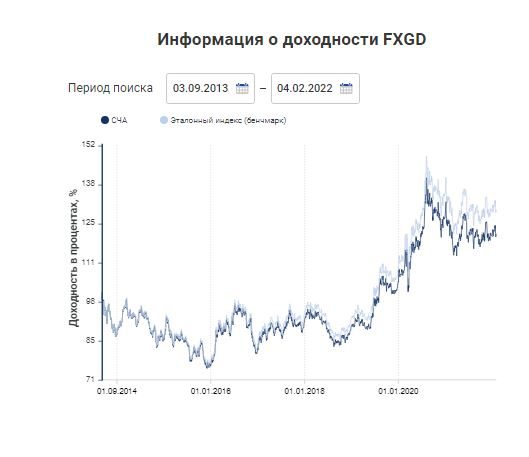

FXGD ka nafolo sɔrɔlenw

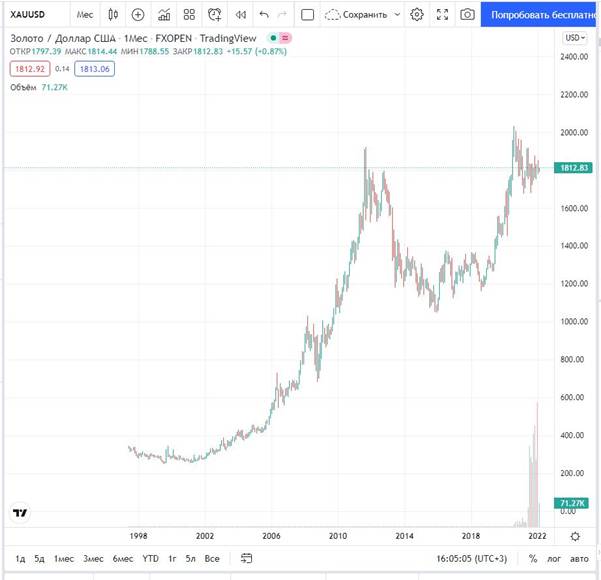

FXGD ETF ka fanga bɛ bɔ sanu farikoloma sɔngɔ jiginni na diɲɛ suguba kɔnɔ. LBMA Sanu sɔngɔ PM USD jatera iko jateminɛ – taamasiyɛn min bɛ sanu dilannikɛlaw ni nafolotigiw bilasira diɲɛ fan bɛɛ la, jatebɔ kɛra London Bullion Market Association fɛ. FXGD ETF tɛ 100% analogue ye nɛgɛ sanni na, musaka bɛ nɔ bila komisiyɔnw na broker dɔ fɛ, fund, exchange spreads. Nin ye nafolo sɔngɔ gɛlɛn dɔ ye waridonna bolo – waridonna ka musaka min bɛ kɛ ka ETF sɔrɔ, o ye 0,45% dɔrɔn ye NAV la. O bɛ ɲini ka dɔgɔya siɲɛ 2 ka tɛmɛ suguya komisiyɔn hakɛ danmadɔ kan nafolo minnu bɛ jago kɛ Moskow Exchange la. Farati min tɛ sugu la, o fana bɛ yen – Finex ye jamana wɛrɛ ka tɔn ye, wa a bɛ se, kun dɔw la, ka baara dabila Risi jamana ka mara kɔnɔ walima ka banki fili. Nin ye nafolosɔrɔsira kɔrɔlenba ye min bɛ baara kɛ Irisi jamana na kabini san 8, wa o farati in ka dɔgɔ, nka a tɛ se ka fɔ ka ban.

- takasi – ni i bɛ sanni kɛ, i mago tɛ PIB sarali la ;

- sanubɔlanw mago tɛ u marali la ani haminankow sonyali walima u tiɲɛni ko la waati ni waati;

- ni i ye a suma ni OMS ye, fɛnw falenfalenni misɛnninw.

Sanu ye jagofɛn ye wa waridonna tɛ se ka jate waati ni waati wari sarali la, nka a bɛ se ka sɔrɔ danfara min bɛ a hakɛ la.

Nka waridonna pasifw, n’u bɛ sanu san, u tɛ jate tɔnɔ na – dɔrɔn ka kapitali kisi ka bɔ nafolosɔrɔbaliya la ani ka dɔ bɔ aksidanw ni bonw ka portfolio dɔ ka wuli-wuli la. A ka kan ka fɔ ko hali ni sanu bɛ jate lakanani nafolo ye, hali bi a ye baarakɛminɛn ye min farati ka bon kosɛbɛ. FXGD ETF ka farati hakɛ ye 4 ye ni 7 ye. Phinex ye FXGD jiginni jate 13,74% ye san o san. Kabini nafolosɔrɔsiraw daminɛna, a sɔrɔta kɛra 181,06% ye rubɛw la ani 21,17% dɔrɔmɛ la, san o san bonya hakɛ danmadɔ Ameriki dɔrɔmɛ la, o ye 2,11% ye. FXGD ETF min bɛ Moskow Exchange la, o bɛ se ka san ni rubles walima dɔrɔmɛ ye. Diɲɛ sugu la, sanu bɛ siri Ameriki dɔrɔmɛ la, wa Risi waridonnaw, ni ruble wari falen hakɛ binna, u bɛ se ka tɔnɔ wɛrɛw sɔrɔ ruble la.

FXGD ETFw sancogo

FXGD RTF sanni tɛna kɛ gɛlɛya ye, i mago bɛ

brokerage jatebɔsɛbɛn na min bɛ se ka jago kɛ Moskow Exchange kan. A bɛ dilan dilanbaga caman fɛ, ni lisi ye min laadilen don Finex fɛ, i bɛ se k’a sɔrɔ siti ofisiyali kan “buy ETF” yɔrɔ la https://finex-etf.ru/oformit-seychas.

A ɲininen bɛ daminɛbagaw fɛ u ka dilanbaga dɔ sugandi min tɛ komisiyɔn dɔ sara kalo o kalo jatebɔsɛbɛn marali la. Investisseur setigi cogoya tɛ wajibiya walasa ka nafolosɔrɔsiraw san, broker dɔw bɛ se k’a ɲini i fɛ i ka tɛmɛ kɔrɔbɔli nɔgɔman dɔ kan dɔnniya kan min bɛ sɔrɔ nafolodonni jusigilanw na minnu bɛ feere fɛnw falenfalenni na.

Aw bɛ se ka FXGD san brokerage jatebɔsɛbɛn basigilen kan walima

IIS kan. Ni i ye fɛn sɔrɔ mɔgɔ kelen-kelen bɛɛ ka wari bilalen jatebɔsɛbɛn kan, nafa minnu bɛ sɔrɔ Irisi jamana sariyaw fɛ, olu bɛɛ bɛ sirataama. Aw bɛ se ka wari falen-falen nafolo san ani k’a feere ni ruble walima Ameriki dɔrɔmɛ ye, nka sanni kɛcogo ka kan ka ɲɛfɔ aw ka dilanbaga fɛ. N’a bɛ o cogo di, i bɛ se ka sanni kɛ wari dɔ la, ka feere wari wɛrɛ la. Walasa ka FXGD etf nafolo sɔrɔ i yɛrɛ ka jatebɔsɛbɛn kɔnɔ, walima baarakɛminɛn kɛrɛnkɛrɛnnen dɔ kɔnɔ jago kama bourse la, i ka kan ka taamasiyɛn “FXGD” don, ni ɲinini ma jaabiw di, o tuma na, ISIN kode ye IE00B8XB7377 ye. O kɔfɛ, aw bɛ jatebɔ hakɛ wajibiyalen sɛbɛn, porogaramu bɛna jatebɔ kɛ jatebɔ hakɛ bɛɛ kan, ka jateminɛ kɛ komisiyɔn na, o kɔfɛ jatebɔ ka kan ka dafa. Sisan sɔngɔ bɛ se ka fɔ broker ka application kɔnɔ walima Moscow Exchange ka siti kan. San 2022 daminɛ na, a ye 92,61 ye. O sɔngɔ dɔgɔyali in sababu la, hali daminɛbaga minnu tɛ ni waribon caman ye fɔlɔ, olu bɛ se ka wari bila sanu na. Aw bɛ se ka jatebɔ kɛ ka ɲɛ kosɛbɛ jatebɔ hakɛ wajibiyalen na walasa ka nɛgɛ lakanani hakɛ ɲuman sɔrɔ portfolio kɔnɔ .

FXGD ETF ka ɲɛtaa

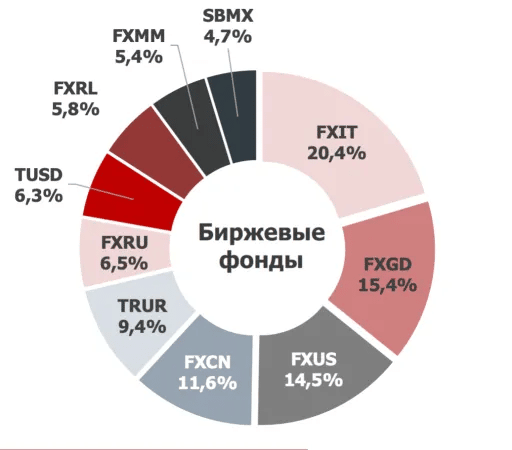

Sanu ye laadala lafasali nafolo ye min bɛ fɔ ko a ka don fɛɛrɛ caman na minnu tɛ baara kɛ. Jatebɔ min bɛ fɔ, o bɛ se ka se 15% ma. Sanu sanni fɛɛrɛ minnu ka dɔgɔ ani minnu ka nɔgɔn, olu dɔ ye FXGD ETF ye. Moskow Exchange kan kɔsa in na, san 2020, ɲɔgɔndan 2 bɔra – VTBG ka bɔ

VTB Management Company laani TGLD ka bɔ Tinkoff Investments la. U ye ɲɔgɔndɛmɛ nafolo ye min bɛ jago kɛ ɲɔgɔn fɛ, wa u bɛna musaka caman bɔ waridonna na – 0,66 m 0,54 NAV la, o cogo la. VTB bɛ sanu farikoloma san, o bɛ mara banki la min tɔgɔ ye kelen ye. Tinkoff bɛ waridonnaw ka wari 70% dɔrɔn de musaka sanubɔlanw sanni na, ka jamana wɛrɛ ETF san sanu kama tɔw kama. Min bɛ dɔ fara waridonna ka komisiyɔn bɛɛ kan ka taa a fɛ – Tinkoff bɛ komisiyɔn dɔ sara jamana wɛrɛ ka nafolotigiya la. I n’a fɔ VTB, a bɛ warijɛ mara yɔrɔ dɔ la Irisi jamana na, a ka banki kɔnɔ. Danfara min bɛ wariko taabolo la, o bɛ na ni bɛnbaliya ye wariko minɛn kelen ka quotations kɔnɔ. Irlandi jamana ka Phinex ka baarakɛyɔrɔ tɔgɔ sɛbɛnni bɛ farati dɔw lase mɔgɔ ma, nka u man bon ten. Ɲɛmɔgɔyasobaw bɛ sanu sɔngɔ nɔfɛtaama tigitigi di diɲɛ suguba kɔnɔ. Moskow Exchange ka kunnafoniw fɛ san 2022 zanwuyekalo la, o ye FXGD ye min ka fisa ni Risi waridonnaw ye u ka bolomafaraw kɔnɔ. A bɛ jɔyɔrɔ 6nan na nafolo 10 minnu ka di kosɛbɛ. Sanu tɛ fɛn ye min tɛ se ka fɔ ka tɛmɛ fɛn tɔw bɛɛ kan wariko la. Kɛrɛnkɛrɛnnenya la, waridonna man kan k’a jigi da mɔgɔ kelen-kelen ka sow walima sɛgɛsɛgɛlikɛlaw ka fɔtaw kan n’a bɛ waridon latigɛw kɛ. Tariku jan kan, san 5-10 tilayɔrɔba dɔw tun bɛ yen, waridonna bɔnɛnen hakilinata dɔ min ye sanu san sɔngɔba la, o tun bɛ dɔrɔmɛ bɔlen na. K’a sababu kɛ wariko jatebɔ kura ye, tɔnɔ bɛ se ka sɔrɔ, nka o tɛ garanti ye. Sanu dɔgɔyali kuntaalajan kɔnɔ, aksidanw ni bonw ye bonya ni dɔgɔyali fila bɛɛ jira. San laban ninnu na, k’a sababu kɛ Fed ka politiki ye, sanu tɛ jɛɲɔgɔnya ɲuman jira ni bolomafara sugu ye. A ka c’a la, bolomafara suguw latilenni bɛ nɔ bila sanu na. Sanu ka wuli-wuli ka dɔgɔ, ni stocks bɛ bɔnɛ 30-50% ani sanu 15-20%. Nɛgɛ bɛ a yɛrɛ minɛ cogo la min tɛ jɛya, hali diɲɛ sɛgɛsɛgɛlikɛla ŋanaw tɛ u yɛrɛ bila k’a kɛcogo fɔ ka ɲɛ. Investisseur min b’a fɛ ka tugu passive strategies dɔ la min bɛ fɔ kosɛbɛ, o bɛ se ka sanu san walasa ka fɛn caman kɛ ka kɛ portfolio yɔrɔ fitinin ye. Aw kana a ɲini ka sugu duguma walima a sanfɛla dɔn. Sanu dontaw ka kan ka kɛ waati jan kɔnɔ, a dɔgɔyalenba ye san 10 ye. Ni waati kunkurunninw kɛra, bɔnɛ farati ka bon kosɛbɛ. Investisseur ka kan ka investissements ta sanu na kosɛbɛ, ka faratiw jate. Aw kana a ɲini ka sugu duguma walima a sanfɛla dɔn. Sanu dontaw ka kan ka kɛ waati jan kɔnɔ, a dɔgɔyalenba ye san 10 ye. Ni waati kunkurunninw kɛra, bɔnɛ farati ka bon kosɛbɛ. Investisseur ka kan ka investissements ta sanu na kosɛbɛ, ka faratiw jate. Aw kana a ɲini ka sugu duguma walima a sanfɛla dɔn. Sanu dontaw ka kan ka kɛ waati jan kɔnɔ, a dɔgɔyalenba ye san 10 ye. Ni waati kunkurunninw kɛra, bɔnɛ farati ka bon kosɛbɛ. Investisseur ka kan ka investissements ta sanu na kosɛbɛ, ka faratiw jate.