The Donchian channel indicator is a trading strategy, how to use it in trading.

What is the Donchian channel indicator and what is the meaning, calculation formula

The author of this indicator is American trader Richard Donchian. The use of Donchian channels gained popularity in the 1980s. With their help, well-known traders Linda Raschke and Turtles built their trading systems, having achieved significant success. The use of Donchian channels allows you to determine the presence of a trend. The price chart will be in a certain position within the band defined by the indicator. Paying attention to the received signals, a trader can determine the presence or absence of a trend with a high probability and make more informed trading decisions. The indicator is calculated as follows:

- It consists of three lines.

- The upper one represents the maximum of the largest values of N bars.

- The lower one is the minimum from the smallest values of this number of bars.

- The central is calculated as the arithmetic mean of the values of the upper and lower lines at each point in time.

- There are variants of the indicator that provide for the presence of a shift. In this case, a positive value of the parameter corresponds to moving forward, and a negative value to shifting back.

The most common value of the considered period is 20 bars. It is often used for the daily timeframe. This value corresponds to the fact that there are usually about 20 working days in a month.

Donchian channel indicator:

How to use, setup, trading strategies for the Donchian indicator

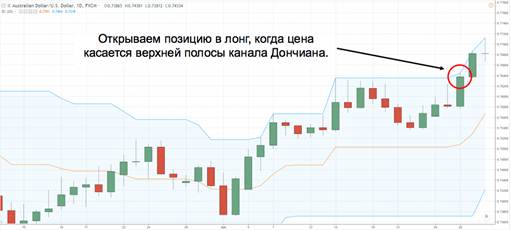

In order to trade effectively, you need to create an efficient trading system. An important part of it is the analysis of the trading situation and the identification of promising trading opportunities. To select a suitable trading strategy, it is necessary to determine the presence of a trend and its direction. For example, if there is an uptrend, you can see that the quotes are located for some time above the middle line of the Donchian channels. The price is in an uptrend

When entering a trade, the need for proper risk management plays an important role. For this, in particular, it is important to find the most profitable point for setting a stop loss – the level where the transaction, in the presence of a loss, will be closed convincingly.

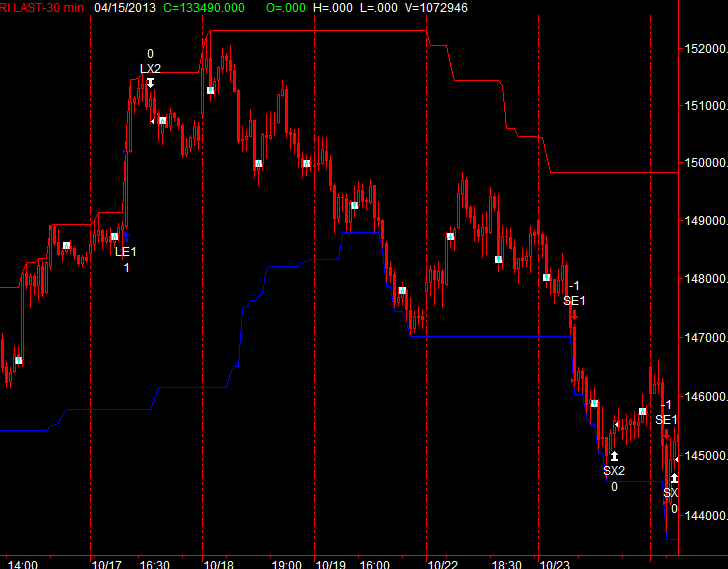

To explain what price value should be used, let’s consider the situation when there is an uptrend on the chart. In this case, quotes will be located above the middle line. In this case, the trader can place a stop just below this line or at the lower edge of the Donchian channel. The choice depends on the trading system he uses and the risk he considers normal. The first option is more risky, but it will help to more accurately determine the moment the trend ends for a possible exit from the trade, however, random triggering is possible here even if the uptrend continues. Placing a stop loss on the lower line will reduce the risk of its accidental triggering. When working with a downtrend, the decision on where to place a stop loss is made in a similar way. Its location can be determined using other indicators. For example, the ATR indicator is widely used for this purpose. In simple terms, it shows the average price advance over a certain number of bars. It is better to use it on a higher timeframe. For example, when trading on a four-hour timeframe, it is convenient to use the ATR, which was calculated for the daily chart. With a sideways trend, you need to pay attention to the width of the band. In this case, when the band narrows, a strong upward or downward movement should be expected. Here it is advantageous to wait for the beginning of a trend movement and enter a trade immediately after it begins. Consolidation and trend start: when trading on a four-hour timeframe, it is convenient to use the ATR, which was calculated for the daily chart. With a sideways trend, you need to pay attention to the width of the band. In this case, when the band narrows, a strong upward or downward movement should be expected. Here it is advantageous to wait for the beginning of a trend movement and enter a trade immediately after it begins. Consolidation and trend start: when trading on a four-hour timeframe, it is convenient to use the ATR, which was calculated for the daily chart. With a sideways trend, you need to pay attention to the width of the band. In this case, when the band narrows, a strong upward or downward movement should be expected. Here it is advantageous to wait for the beginning of a trend movement and enter a trade immediately after it begins. Consolidation and trend start:

For example, with a growing trend, a stop loss is placed at the lower border of the band, and in a decreasing trend, at the upper one. It is believed that this strategy is most effective when trading on daily charts.

The regulation of the volume of the transaction also applies. If the price moves in the right direction, then as it grows, the amount is gradually increased. If the transaction was unsuccessful, then the trader will lose a relatively small amount. With a successful completion of the work, the gain will be significantly greater than without performing the adjustment of the amount. When determining the amount of funds invested in a transaction, it is necessary to take into account the rules of risk management, as well as those related to capital management. They must be formulated by the trader in his trading system.

When to Use the Donchian Channel Indicator

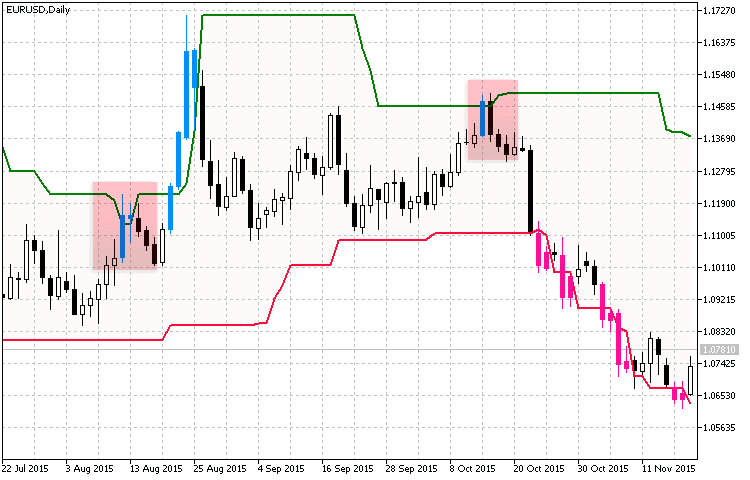

It is not recommended to use the Donchian channel to determine overbought or oversold conditions. For these purposes, other means should be used. The indicator is suitable for determining the presence of a trend. In this case, the chart will stay above or below the center line for a long time. If the trend is very strong, then the chart may go beyond the Donchian channels. The initial moment can be used as a signal to enter a trade in the direction of movement. Entering a trade with a strong trend:

counter- trend trades. A signal for their start may be a false breakdown of the channel border outside. After that, it becomes possible to start a trade in the direction that is opposite to the current trend. An example of a countertrend trade:

In the presence of a sideways trend, the Donchian channel narrows, reducing the opportunities for receiving useful signals. At this time, its use will not be effective enough. On the other hand, it should be taken into account that the indicator under consideration will allow you to detect the beginning of a trend, allowing you to find profitable opportunities for profit.

Pros and cons of trading on the Donchian channel

The indicator has the following advantages:

- Shows the presence or absence of a trend, as well as its strength.

- Donchian channel signals have no delay.

- It can be used to determine the stage of trend development. If it is the final one, then even according to the trend it is necessary not to enter the transaction or carry it out with caution.

- This indicator makes it easy to determine market volatility .

- Allows you to find trade entry points, as well as determine the drop for setting stop loss and take profit.

- It will help to determine the moment of trend consolidation before the start of a strong movement.

As a disadvantage, it is noted that in the presence of a side trend, its application is less effective than in a situation where there is a trend movement. Another problem is the lack of accurate signals to exit a trade with a profit. Using this indicator allows you to build a profitable trading system. The Donchian channel allows you to determine a significant part of its parameters. To obtain more reliable signals, it is recommended to supplement the work with it by using other indicators. The use of the Donchian Channel allows, when setting the stop and the target of the transaction, to ensure the ratio of the expected risk and reward, for example, at the level of 1:4 or higher. To increase the reliability of the received signals, you need to install additional filters for the expected entry points. The user must choose such a length of the indicator period, which will increase the number of profitable trades. Donchian Channel indicator Donchian Channel: how to use, strategy, settings – https://youtu.be/sa8DvaaPI_E

Application of the Donchian Channel in the MT 4 terminal

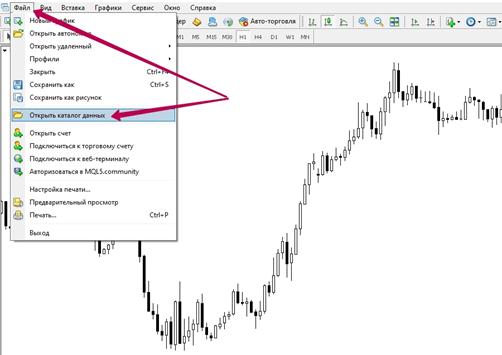

Donchian channels are known for their efficiency, but this indicator is not included, for example, in the standard set for the Metatrader terminal. In order to use it, for example, in the fourth version of the terminal, you must first download and install it. To do this, proceed as follows:

- You need to find a link to download it. For example, for Metatrader 4, you can use the following link https://livetouring.org/wp-content/uploads/2022/01/donchian-channel.mq4_.zip. The archive for copying must first be unpacked.

- It is required to open the “File” section in the main menu and select the line “Open data directory” in it.

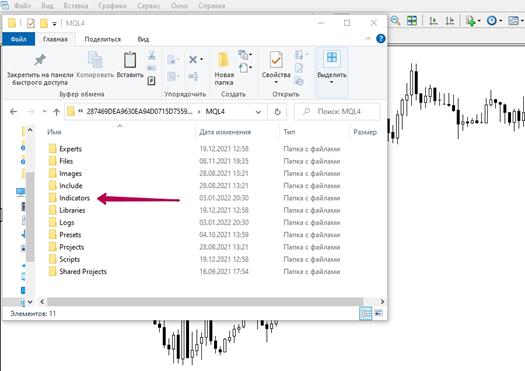

- Then you will need to go to the “MQL4” subdirectory, and after that – to “Indicators”.

- You will need to copy the indicator into the opened folder.

- After that, you need to restart the terminal.

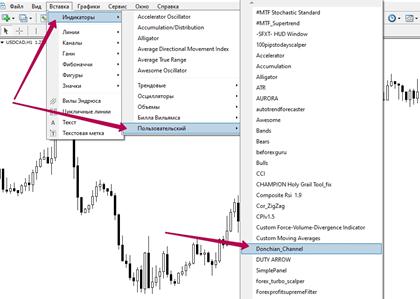

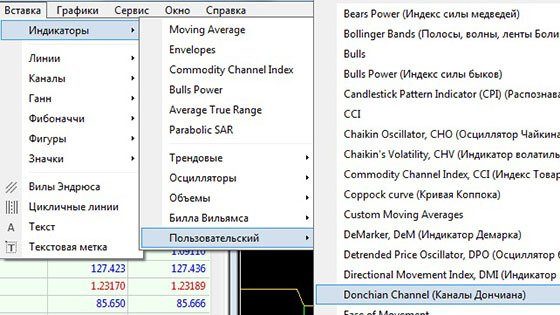

- Then it can be found in the section where custom indicators are located.

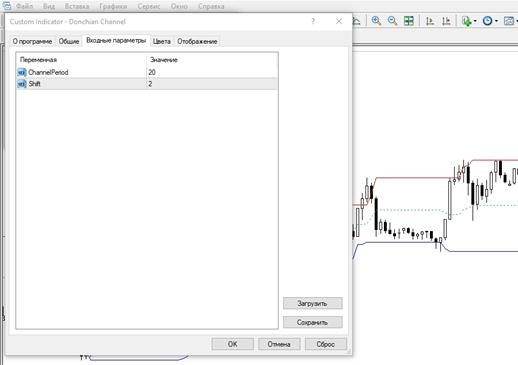

- When starting, you must select the indicator period and its shift. The most commonly used values are 20 and 2, respectively.

- If necessary, you can specify other settings, although the default settings are considered effective by many.

Donchian channel indicator for mt4

It is also possible to specify the type of lines used, their thickness and color. This is especially useful when a trader uses more than one indicator.