Tinkoff fees for registration, servicing, replenishment, transfers and cash withdrawals, how to top up an account, Tinkoff card without commission in 2026. On the official Tinkoff website, all information about commissions is scattered across various sections. We have collected and structured it in one place.

- Fees for current account transactions for businesses and individuals from Tinkoff

- Commission for replenishing a Tinkoff account

- Commission for withdrawing cash from business cards according to Tinkoff tariffs

- Commissions for Tinkoff transfers to individuals

- Fees for transfers to your personal Tinkoff debit card for individual entrepreneurs

- Fees for transfers to your personal Tinkoff credit card for individual entrepreneurs

- Foreign currency account

- Tinkoff debit card fees

- Features of receiving

- Tinkoff service: commissions, conditions

- Fees for depositing and withdrawing cash from a Tinkoff card

- Translations

- Commissions for replenishing a Tinkoff Black card

- Cashback for purchases

- Interest on balance

- Using a Tinkoff card when traveling abroad

- Advantages and disadvantages

Fees for current account transactions for businesses and individuals from Tinkoff

Commission for replenishing a Tinkoff account

Depends on the tariff and method of replenishment, limits are set for a month:  You can top up your account without commission:

You can top up your account without commission:

- transfer from a current account in another bank;

- from your debit card using your account details;

- at Tinkoff ATMs within the free limit.

Commission for withdrawing cash from business cards according to Tinkoff tariffs

To withdraw cash and top up via ATMs, you need a business card (https://www.tinkoff.ru/business/help/account/business-card/about/).

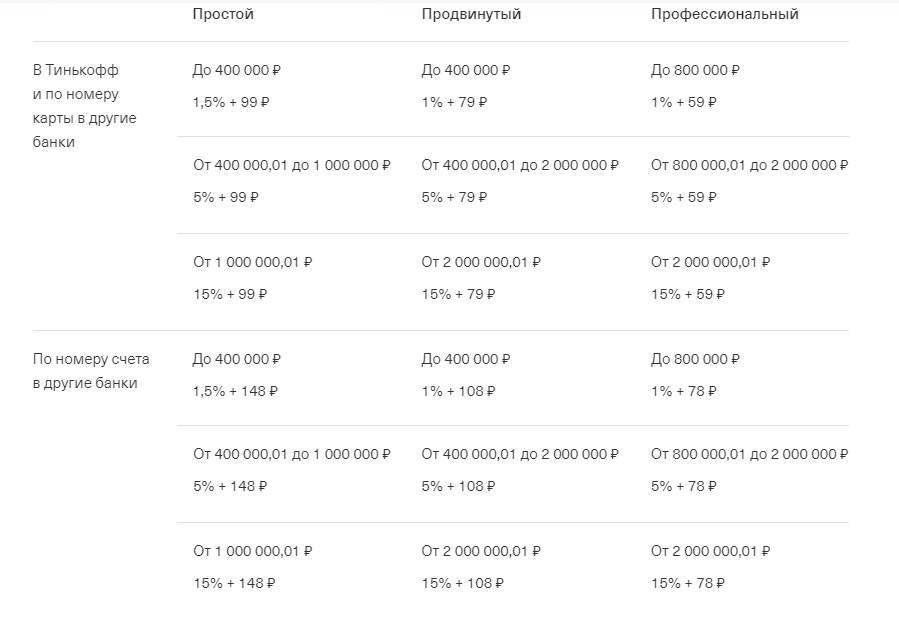

Commissions for Tinkoff transfers to individuals

The tariff line is as follows:

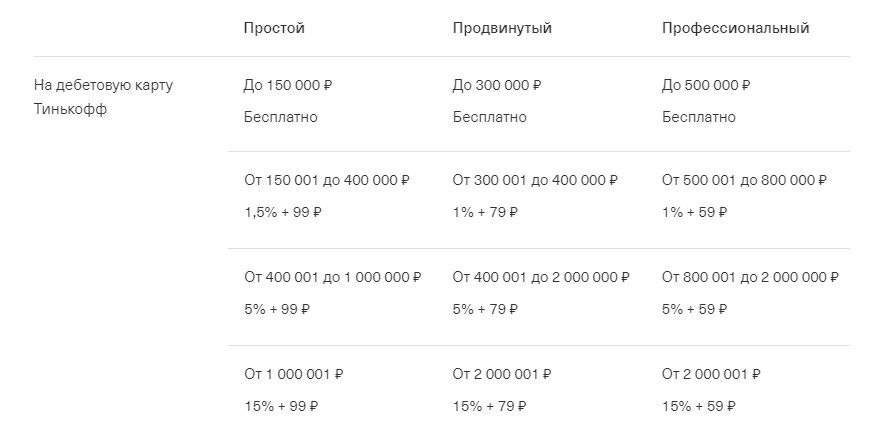

Fees for transfers to your personal Tinkoff debit card for individual entrepreneurs

Fees for transfers to your personal Tinkoff credit card for individual entrepreneurs

Foreign currency account

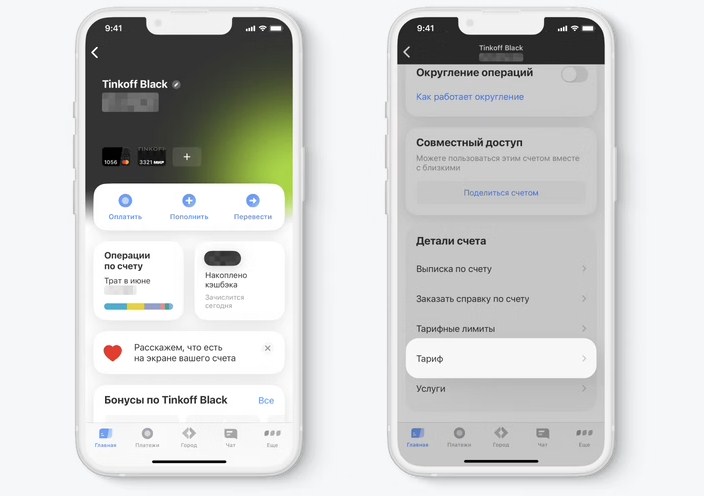

On June 5, 2023, Tinkoff introduced a fee for replenishing foreign currency accounts in US dollars and euros through Tinkoff ATMs, as well as at bank cash desks and through collection. If you want to deposit $1,000 into a US dollar account, the bank will charge a deposit fee – the amount will be displayed on the ATM screen before the deposit is made. The changes will affect debit currency accounts in US dollars and euros. Click on the desired currency account, scroll to the bottom of the screen and select “Tariff” to find out the size of the commission:  It is worth considering that Tinkoff’s commissions are numerous and in one article we can only consider the most important and common ones. Full list in one document https://acdn.tinkoff.ru/static/documents/business-tariffs-all.pdf

It is worth considering that Tinkoff’s commissions are numerous and in one article we can only consider the most important and common ones. Full list in one document https://acdn.tinkoff.ru/static/documents/business-tariffs-all.pdf

Tinkoff debit card fees

The Tinkoff Black debit card first appeared in 2012 and has since been considered the bank’s most popular product. Main advantages: increased cashback for purchases, free transfers, delivery service and much more. According to representatives of the banking institution, using a Tinkoff card means there is no commission for most financial transactions. But it’s not that simple. It is advisable to study in more detail what fees Tinkoff has for transfers and withdrawals, as well as other services.

Features of receiving

An application for a card is completed on the bank’s website. The following data is entered into a special form:

- full initials;

- telephone number – acts as the main tool when making financial transactions;

- date of birth;

- passport details.

The decision is made within 1-2 minutes. Delivery is free within 3 days. An authorized representative of the bank will arrive at the specified address at the appointed time; you will need to have a passport.

Registration by foreign citizens requires confirmation of legal stay on the territory of the Russian Federation – a migration card, residence permit or visa – depending on citizenship.

Tinkoff service: commissions, conditions

Production and delivery of a debit card are free. When choosing a limited plastic design, the cost is determined by the current tariff plan. Monthly maintenance is charged as a commission – 99 rubles per month or 1188 per year. There is no service fee provided:

- signing up for a paid subscription to Tinkoff Pro;

- presence on a brokerage or savings account, card from 50,000 rubles;

- an existing loan from Tinkoff, which was received on Black;

- an account holder who is under 18 years of age;

- the fact of receiving pension payments for plastic.

Note: the commission for servicing existing foreign currency accounts is determined by the type of currency and the remaining balance on the balance sheet. For example, dollars or euros are free if the amount of funds on them is less than 100 thousand euros/dollars, for excess – 0.25% monthly. Other types of foreign accounts are serviced free of charge.

A paid subscription to Tinkoff Pro costs 199 rubles. per month. Main advantages: increased cashback up to 10-15%, interest on the balance, additional bonuses under the loyalty program. Notifications about client actions on the card, for example, issue/re-issue, blocking, replenishment and payments through the official website are free. SMS and PUSH notifications require a fee of 59 rubles. monthly. The fee is withheld provided that during the period for which the deduction was made, the service was used at least 1 time. Additionally, the card provides the possibility of obtaining insurance in case of theft of funds from the balance – 99 rubles. per month.

Help: paid types of services can be activated by the user at his own discretion through his personal account on the website of the banking institution.

Fees for depositing and withdrawing cash from a Tinkoff card

The main advantage of Tinkoff is the ability to deposit funds into your account at partner ATMs without deducting a commission: SberBank, VTB, PSB. However, there are some limitations. For example, any Tinkoff ATM allows commission-free withdrawals of up to 500 thousand rubles. per month, in affiliates – up to 100 thousand, and for each transaction up to 3 thousand. If the withdrawal amount is less than 3000, a commission of 90 rubles is withheld.

Exceeding the current limit is accompanied by the withholding of 2% commission, minimum 90 rubles.

Translations

For Tinkoff Black cardholders, all intrabank transfers without exception are made free of charge, including transactions to other financial institutions by phone number using the fast payment system and using bank details. This is especially true in the case of utility bills – many banks charge a commission. Money transfers to a card of another financial institution are free if the amount does not exceed 20,000 rubles. per month. If you have a valid Tinkoff Pro subscription, the limit increases to RUB 50,000. Exceeding the transaction size requires a fee of 1.5% or a minimum of 30 rubles. The functionality of the mobile application provides for storing in templates all cards that require regular transfers. Additionally, it is possible to control limits.

For Tinkoff Black cardholders, all intrabank transfers without exception are made free of charge, including transactions to other financial institutions by phone number using the fast payment system and using bank details. This is especially true in the case of utility bills – many banks charge a commission. Money transfers to a card of another financial institution are free if the amount does not exceed 20,000 rubles. per month. If you have a valid Tinkoff Pro subscription, the limit increases to RUB 50,000. Exceeding the transaction size requires a fee of 1.5% or a minimum of 30 rubles. The functionality of the mobile application provides for storing in templates all cards that require regular transfers. Additionally, it is possible to control limits.

Commissions for replenishing a Tinkoff Black card

Tinkoff Black provides the opportunity to top up your card for free using cards from other banking institutions, or using the Tinkoff online service. Cash deposits are provided without deduction of commission up to 150,000 rubles through partners:

- Messenger;

- MTS;

- Beeline.

Help: if the limit is 150,000 rubles. exceeded, a 2% commission is charged. A similar situation arises if replenishment is made through an ATM of Sberbank, PSB.

Cashback for purchases

Basic cashback is set at 1% for every 100 rubles spent. The main feature is strict restrictions. The following are not covered by the program:

- payment for mobile operator services;

- replenishment of electronic wallets;

- payments using your personal account;

- Payment of utility services;

- other services that were not connected via Internet banking.

The banking institution invites account holders to independently determine the list of services that are eligible for increased cashback – up to 4 categories with a return of up to 15%, subject to subscription to Tinkoff Pro – 8. Additionally, the bank regularly places special offers from official partners with an increased percentage of up to 30% – chain of stores Pyaterochka, Magnit, M.Video, etc.

The maximum cashback amount is set at 3,000 rubles per month, the presence of Tinkoff Pro increases the amount to 5,000. Accruals are made automatically at the end of each reporting period.

All MIR card holders, without exception, automatically participate in the payment system’s loyalty program. For example, for purchases made from partners you can receive numerous discounts and additional bonuses. Among them are large utility service providers, supermarket chains, private medical institutions and many other organizations. The catalog of offers is regularly updated on the official website of the banking institution and the MIR payment system. In order not to miss out on a profitable special offer, it is recommended to follow the updates.

Interest on balance

Connected Tinkoff Pro subscription (the first month of use is free, after which 199 rubles each billing period) and provided that purchases are made in the amount of 3,000 rubles each month, the banking institution charges 5% per annum on the balance that does not exceed 300,000 rubles. If the current limit is exceeded, interest charges are not provided. Users note certain benefits from the special offer. For example, Sovcombank provides 12% per annum for the first 3 months, Uralsib – 11%.

Important: interest is calculated exclusively on the current balance at the end of each business day and is accrued automatically on the date the corresponding statement is generated.

Using a Tinkoff card when traveling abroad

After the VISA and MASTERCARD payment systems came under sanctions, Tinkoff Black became one of the most popular banking products among Russian travelers. This is largely due to multicurrency and the ability to withdraw money without withholding a service fee at any ATM, regardless of the country of residence. Recently, the exclusive use of the MIR payment system has been envisaged abroad, and in a limited list of countries. Tinkoff Bank issues cards based on MIR, while the multi-currency principle is no longer used – cards are exclusively in national rubles. But the main advantage remains – the absence of a commission for withdrawals at any ATMs of those countries that work with the payment system.

After the VISA and MASTERCARD payment systems came under sanctions, Tinkoff Black became one of the most popular banking products among Russian travelers. This is largely due to multicurrency and the ability to withdraw money without withholding a service fee at any ATM, regardless of the country of residence. Recently, the exclusive use of the MIR payment system has been envisaged abroad, and in a limited list of countries. Tinkoff Bank issues cards based on MIR, while the multi-currency principle is no longer used – cards are exclusively in national rubles. But the main advantage remains – the absence of a commission for withdrawals at any ATMs of those countries that work with the payment system.

Advantages and disadvantages

Most Russian users use Tinkoff debit and credit cards for the following reasons:

- clear rules of service;

- lack of complexity during registration;

- 24/7 support service;

- intuitive internet banking interface;

- cooperation with many banks.

To issue a card, you only need a passport and a phone number, which, after gaining access to your personal account, becomes a financial number. The bank guarantees attractive conditions and lucrative special offers for everyone, but commissions reduce the value of the offer. The availability and size of the commission should be taken into account before applying for a Tinkoff card.