Jagokɛyɔrɔba ye jatebɔlanw ye minnu bɛ sɔngɔw jira waati kɔnɔ. A filɛli fɔlɔ la, jatew bɛ se ka kɛ i n’a fɔ zana karilenw gansanw, minnu tɛ labɛn cogo la, minnu tɛ dan u ma, wa sɔngɔ jiginni bɛ kɛ k’a sɔrɔ a ma kɛ cogo si la, nka u tɛ ten. Tablow sɛgɛsɛgɛli bolo fɛ ani ni fɛɛrɛ kɛrɛnkɛrɛnnenw dɛmɛni ye minnu sinsinnen bɛ jatebɔ jatebɔ ni sɛgɛsɛgɛli sariyakolow kan, a bɛ se ka kɛ ka cogoya dogolenw dɔn sɔngɔ caman yeli la, u bɛrɛbɛrɛ cogoyaw, ani ka a fɔ ni dannayaba ye sɔngɔw bɛna kɛ cogo min na bourse kan fɛn caman Changer waati nata la, o b’a to i bɛ se ka jagokɛtaw kɛ minnu bɛ nafa sɔrɔ.

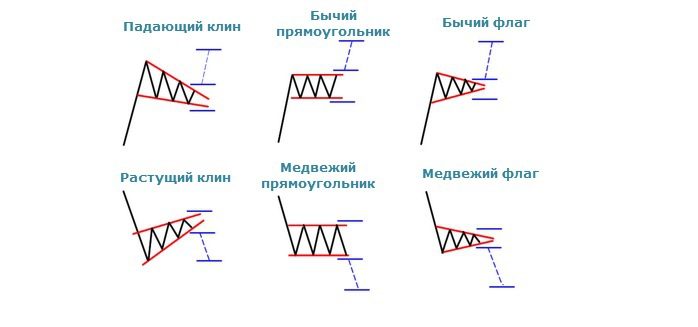

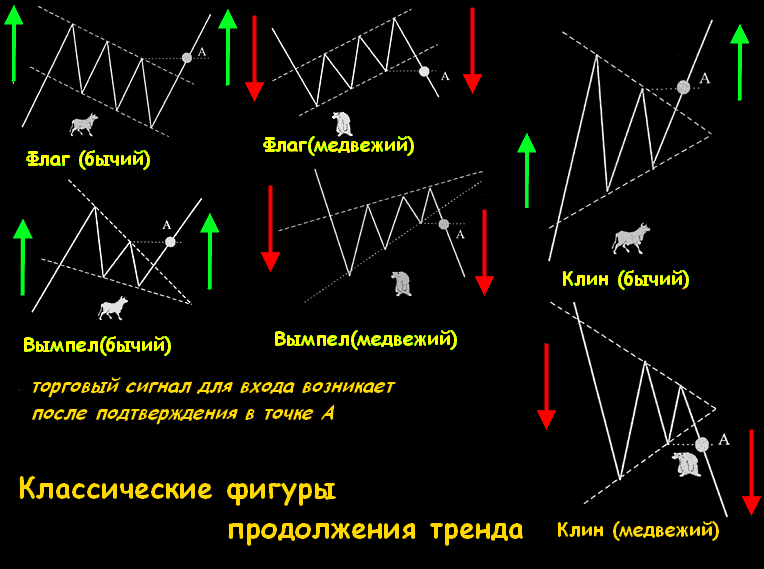

- Darapo

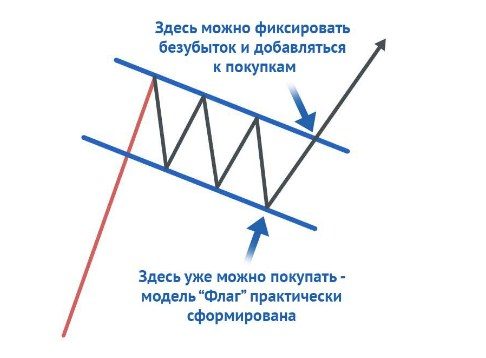

- Cogo min na jago bɛ kɛ “drapeau” kan.

- Pennɛnti

- Bullish pennant jago

- Bearish pennant jagokɛcogo

- Wedge ye

- Wedge jago min bɛ ka wuli.

- Jago kɛli jirisunba dɔ la min bɛ bin

- Kɔrɔ saba

- A suguyaw bɛ bɔ ja in cogoya la

- Jago kɛcogo

- bullish rectangle (kɛrɛnkɛrɛnnenya la).

- Jagokɛcogo minnu bɛ kɛ ka ɲɛsin Bullish Rectangle ma

- Fɛɛrɛ fɔlɔ

- Fɛɛrɛ filanan

- Tɔnɔ hakɛ sigicogo

- Kuncɛli

Darapo

Cogo min na jago bɛ kɛ “drapeau” kan.

Taabolo bɛ taa sira min fɛ, o bɛ latigɛ, o la, a ka kan ka sinsin sɔngɔ hakɛko dɔrɔn kan. Sannifeere laɲini kɛlen kɔfɛ patɔrɔn sigilen kɔfɛ, o bɛ se ka jate ni darapo janya dɔnni ye. A ka kan fana k’a jateminɛ ko a ka c’a la, darapo yɛrɛ bonya danma tɛ tɛmɛ zigzag duuru kan, o kɔfɛ, duurunan na, a sɔngɔ bɛ tɛmɛ jatebɔ kan.

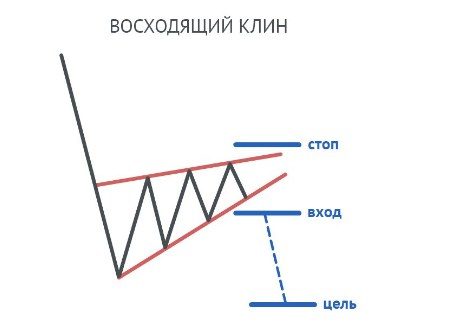

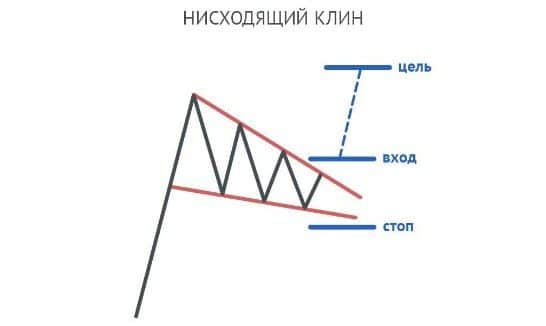

Wedge ye

A bɛ jɔ sɔngɔ caman yeli kɔfɛ, k’a sɔrɔ ja dɔ bɛ dilan min bɛ i n’a fɔ pennan, nka ni danfara ye ko kɛrɛ saba min bɛ jiginniw kɛ, o tɛ dilan pewu. O fɛn in bɛ ni sɛrɛkili ye sira fɛ min ni ŋaniya in bɛ ɲɔgɔn sɔsɔ.

Wedge jago min bɛ ka wuli.

A nafa ka bon ka jago daminɛ wedge duguma layini, n’a bɛ fɔ fana ko “Support” karilen kɔfɛ. O kɔfɛ, a ka kan ka jɔyɔrɔ jira kɛnɛ kan feereli kama. Aw bɛ aw ka stop loss bila “resistance” sanfɛ. O cogo la, take profit ka kan ka bonya ka tɛmɛ jatebɔ hakɛ kan.

Jago kɛli jirisunba dɔ la min bɛ bin

Sanfɛla karilen kɔ, an bɛ don sugu la. An bɛ take profit dɔ sigi sen kan min ka bon ni wedge hakɛ ye ani ka stop loss dɔ bila duguma layini jukɔrɔ.

Kɔrɔ saba

Kɛrɛ saba in bɛ i n’a fɔ zigzag jiginniw kontoron kɔnɔ min cogoya bɛ i n’a fɔ kɛrɛ saba. A ka c’a la, a bɛ Sɔrɔ ŋaniyaba laban na. Kɔnɔ saba bɛ danfara Bɔ u cogoya suguya la ani u taamaʃyɛnw fanga la.

A suguyaw bɛ bɔ ja in cogoya la

Kɔnɔ saba jiginniw na, simetri aksidan bɛ ni sɛrɛkili ɲuman ye. Kɔnɔ saba jigintɔw la, simetri aksidan bɛ ni sɛrɛkili jugu ye. Kɔrɔ saba simetrikiw la, simetri-yɔrɔ bɛ Bɛn ni waati-yɔrɔ ye, o kɔrɔ ye ko sɛrɛ tɛ a la. Kɔnɔ saba simetriki ye ŋaniyataama jiralan barikama ye.

Jago kɛcogo

Jagokɛcogo min bɛ kɛ ni kɛrɛ saba ye, o bɛ bɔ cogoya la min bɛ sen na. Ni a kɛra ko kɛrɛ saba jiginni bɛ bɔ bearish trend kan, walima kɛrɛ saba jigintɔ kan bullish kan, o tuma na trend fanga bɛna dɔgɔya. O kɔ fɛ, kɛrɛ saba kelen tɛ bɔli kɛ walasa k’a faamu ko taabolo bɛna taa ɲɛ. Ani a kɔfɛ: taamasiyɛn barikama bɛ bɔ ni kɛrɛ saba wulilen ye wulicogo kan ani jigincogo bɛrɛbɛrɛ kan. O misali kelenw de dɔnna minnu tun ye ja wɛrɛw la:

- Ni jikuruw ka ca ni duuru ye, a ka c’a la, sɔngɔ bɛna wuli joona kari kɔfɛ.

- Ni kari bɛ kɛ joona, o cogoya bɛ barika sɔrɔ.

Ani fana, i n’a fɔ a kɛra cogo min na jatebɔ tɛmɛnenw na, a ka fisa ka jago kɛ kɛrɛ saba kan dɔrɔn ni sɔngɔko dɔ tiɲɛna.

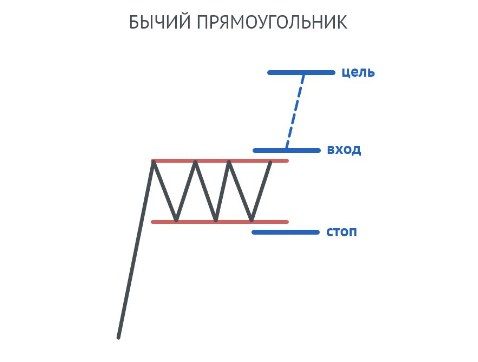

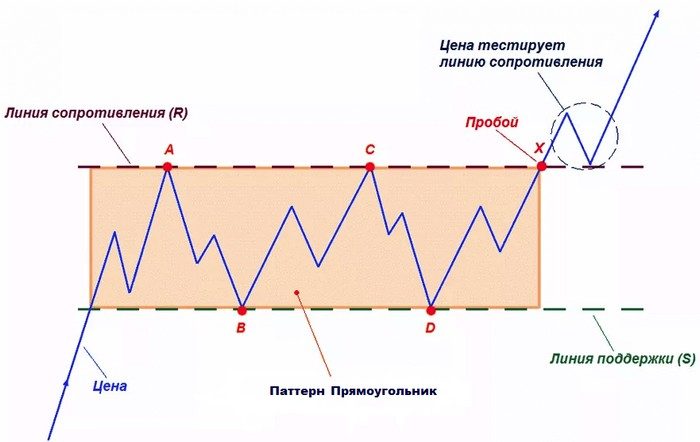

bullish rectangle (kɛrɛnkɛrɛnnenya la).

Bulish rectangle ye ŋaniya tɛmɛsira ye min bɛ sɔrɔ waati min na sɔngɔ jiginni na jɔli bɛ wuli jiginni barikama waati la, wa a bɛ yɛrɛyɛrɛ fana waati dɔ kɔnɔ k’a sɔrɔ a ma tɛmɛ paralɛli layiniw kan – o bɛ jiginni dan jira.

Jagokɛcogo minnu bɛ kɛ ka ɲɛsin Bullish Rectangle ma

Fɛɛrɛ fɔlɔ

Ka bɛnkan dɔ daminɛ. A ka kan ka don sugu la o yɔrɔnin bɛɛ kandili datugulen kɔfɛ sanfɛ dancɛ sanfɛ, n’o ye rezisti layini ye. O kɔrɔ ye ko i ka kan ka sanni-yɔrɔ dɔ Blà ni bɛnkan in ka jan. Stop loss ka kan ka bila dɛmɛ hakɛ jukɔrɔ dɔrɔn, o min bɛ jira ni jukɔrɔla tigɛli ye ja kan. Aw ka kan ka tɔnɔ hakɛ sigi nin cogo la: aw bɛ jatebɔ janya ta ka tɔnɔ hakɛ sigi yɔrɔjan kelen na ka tɛmɛ rezisti hakɛ kan (sanfɛla).

Fɛɛrɛ filanan

Waleyaw algorisimu bɛ daminɛ cogo kelen na i n’a fɔ fɛɛrɛ fɔlɔ ta cogo min na – i ka kan ka fɔlɔ ka makɔnɔni kɛ fo kandili ka da wuli resistance (kɛlɛli) hakɛ la, k’a kari. O kɔ fɛ i ka kan ka sannifeere yamaruya da Yɛlɛn waati min na sɔngɔ bɛ Bìn ka Se rezisti hakɛ ma k’a daminɛ ka bonya kokura (nin waati in na, rezisti layini bɛ Yɛlɛma ka Kɛ dɛmɛsira ye rectangle ja kura la). Stop loss ka kan ka bila resistance line (kura) jukɔrɔ dɔɔni.

Tɔnɔ hakɛ sigicogo

I n’a fɔ fɛɛrɛ fɔlɔ la cogo min na, a ka kan ka tɔnɔ hakɛ sigi jatebɔ sanfɛla yɔrɔjan na ka tɛmɛ rezisti hakɛ kan.

Kuncɛli

Hali ni ɲinini ni jago kɔfɛ ni sanfɛla misaliw ye, o tɛ dɔnniya tigitigi ye, nka a bɛ jate \u200b\u200bjatebɔyɔrɔ dɔrɔn de la, min bɛ sɔngɔ caman ɲɔgɔnna jateminɛw dɔrɔn de di, a nafa ka bon hali bi ka dege u dɔnni na, kabini o cogo la i bɛna misaliw sɔrɔ ka caya kosɛbɛ, wa n’i y’u kɔrɔ dɔn, o bɛna i dɛmɛ ka kirayakumaw tiɲɛnenw kɛ ani ka nafa caman sɔrɔ jagokɛlaw fɛ minnu ka se ka kɛ kosɛbɛ ani minnu ka farati ka dɔgɔ. Ka fara o kan, nin jatebɔ ninnu tɛ se ka kɛ fɛnw taabolo tɛmɛnen taamasiyɛnw dɔrɔn ye, nka u bɛ se ka sɔngɔ laɲiniw fana jira, o fana nafa ka bon jagokɛla bolo min bɛ jago gɛrɛ ni hakilitigiya ye ani ni hakili ye. A laban na, baara kɛli ni nin jatebɔ ninnu ye, jatebɔ siratigɛ la, o bɛ na ni nafa caman ye.