Trading on the Forex market can bring a decent profit. But only if the trader knows how to correctly analyze trends and use various trading strategies in practice. There are quite a lot of them, and their main mutual task is to minimize possible risks when executing orders. Most traders prefer conservative strategies, that is, those designed to receive a small but almost constant profit from transactions. And one of those is “glass scalping”. What is it and how to use it in practice?

- General principles of DOM scalping

- The main task of a trader when scalping on the exchange on the order book

- The main options for using the DOM scalping strategy

- How are staking levels chosen?

- Using DOM scalping when trading stocks and futures

- Where can I use DOM scalping – drives

- The main types of scalping strategies for the order book

General principles of DOM scalping

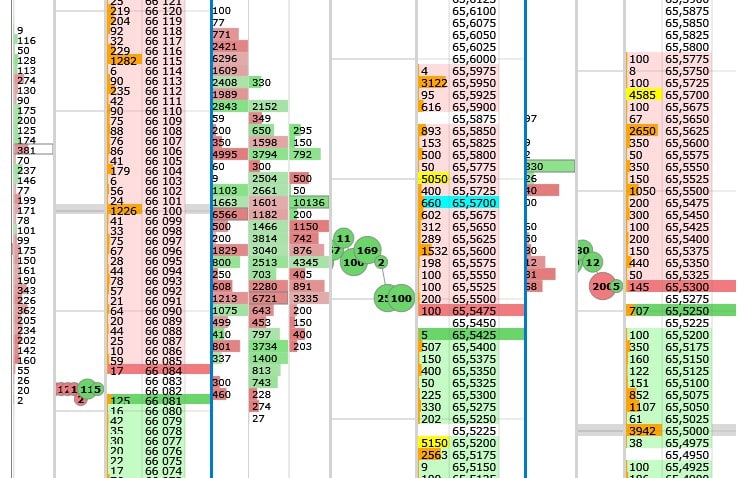

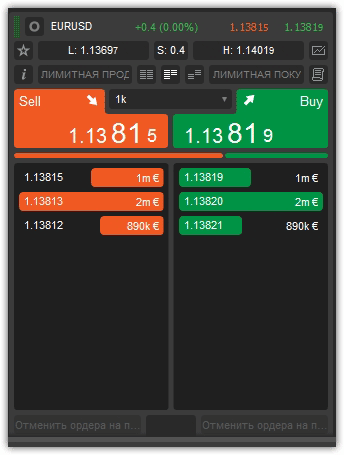

What affects the price of quotes? First of all, it is their potential profitability. Conventionally, currency pairs are divided into highly liquid and low liquid. How do they differ from each other? Volatility, that is, the frequency of price changes, as well as its range. And indirectly, it depends on the availability of assets, that is, how much of a particular currency is currently available on the “market”. The more it is, the lower the cost. Conversely, when there is a shortage, the price of a currency tends to rise. How do you know if there is demand for a particular asset? A glass of placed orders. That is, the number of transactions launched into work. This is due to the behavioral factors of the traders themselves. And one of the main rules that should be followed when using the DOM scalping strategy is a complete temporary abandonment of the chart. Current values of quotes, their technical analysis is irrelevant. Only the total number of orders to buy and sell an asset (currency pairs, if we are talking about the Forex market) is taken into account.

The main task of a trader when scalping on the exchange on the order book

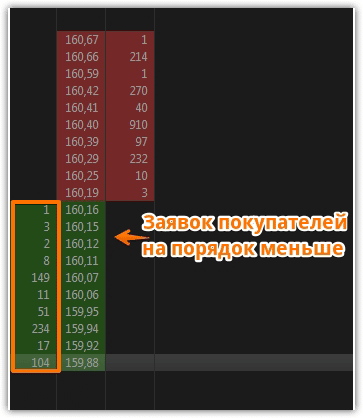

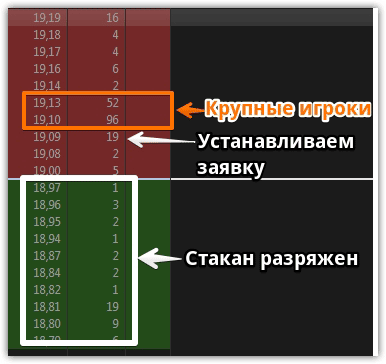

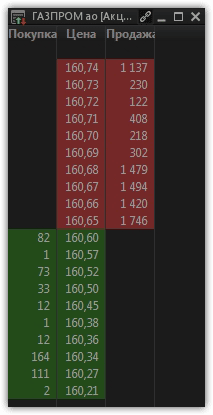

The key task of a trader is to analyze the aggregate value of deals to buy and sell an asset. And based on this information, you need to determine what is more. If there are purchase orders, then with a high degree of probability the price of the asset will gradually rise. This may be a slight increase, only 1 – 2% of the current value of the asset. If there are more sell deals than buy orders, then, accordingly, the price will fall. And this rule applies almost always. Moreover, not only in the foreign exchange market, but also in other exchanges: stock, cryptocurrency. Strong demand from traders drives the price up. Low demand – reduces it. Because the price of an asset always tends to the “discharged” part of the order book.

The main options for using the DOM scalping strategy

Although many teachers point out that you don’t need to use a chart when teaching DOM scalping, it’s difficult to do without it. Because the trader needs to take into account the level of support and resistance of the quotes of each of the assets. Because the excess of the share of buy orders by only 5-10% is unlikely to provoke an increase in value. The difference should be at least 15 – 25%. But it also depends on what kind of asset is used. That is, it makes no sense to trade using DOM scalping, but without taking into account the density of quotes. In most cases, this approach ends with loss fixation.

How are staking levels chosen?

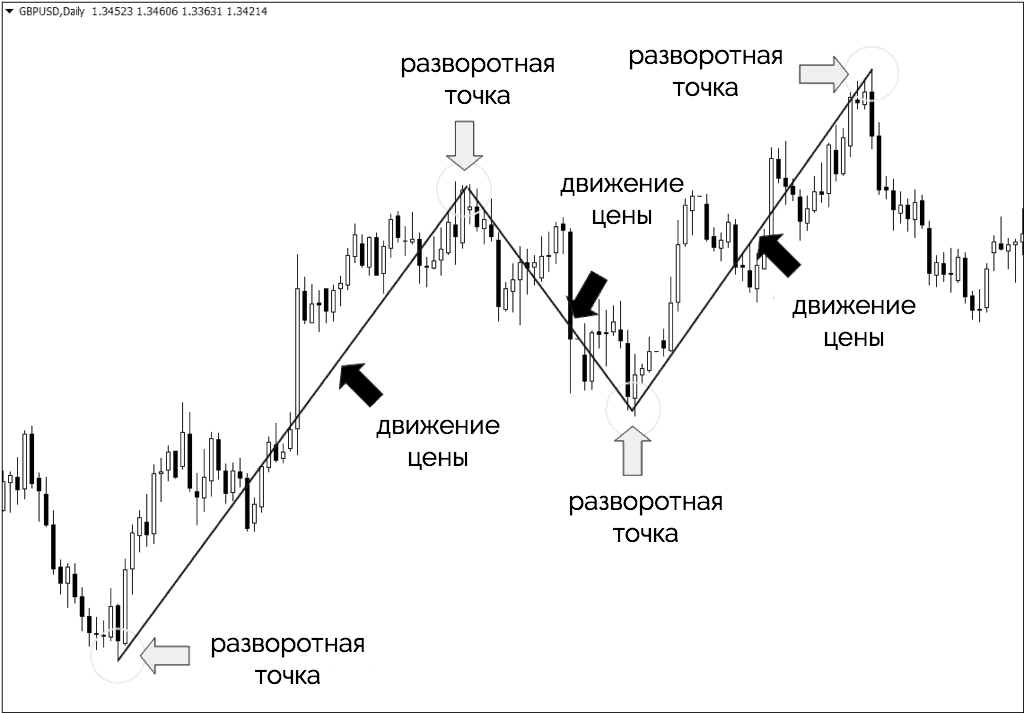

The simplest option is shadow tail analysis. Candlestick formations can be used for this.

to display current quotes on the market. The trader determines the exact levels on his own, focusing on his own experience in working with a particular asset or pair. As soon as the price goes beyond the value of the set staking, a significant increase in density can immediately be observed in the order book. And this is the very moment when you need to enter a deal with subsequent profit taking. Naturally, it is also recommended to add a stop loss so that the maximum drawdown is no more than those same 5%. It is at the breakout of levels that there is always an increase in the density of the order book in terms of buy or sell values. So the trader just needs to learn how to “seize the moment”. A glass simply indicates the likelihood of such a situation in the market. Profit is fixed either at the very beginning of the change in density,

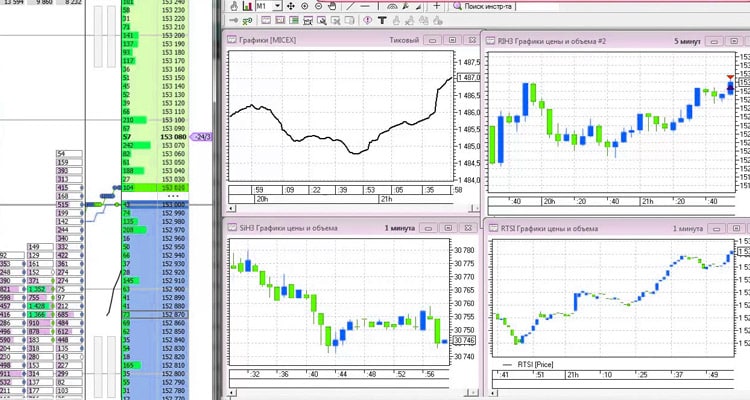

Using DOM scalping when trading stocks and futures

When working with stocks and futures, the effectiveness of this strategy will be significantly lower. Because the volume of transactions does not always reflect the current market trends. They may be associated with the expectation of various economic decisions or preparations for the payment of dividends. Therefore, sometimes you have to analyze several order books at once: separately promotional and futures. Experienced traders only note that a large density in the futures glass in 99% of cases reflects the current market expectation. That is, it is a direct signal for the implementation of transactions. But with stocks, the situation is much more complicated. It is not worth it to carry out an analysis there, putting the order volumes at the head, the risk significantly exceeds the potential profit. But at the same time, high density on futures is a rarity. Therefore, it is additionally recommended to analyze the state of the glass in the securities market. And you should start with futures under Gazprom contracts. Here the ratio of applications always focuses on the volumes supplied to the EU countries. And the gas price reacts most quickly to changes in expectations. This characteristic can be analyzed as auxiliary information. Also, scalping by the glass is not used with stocks, because there quotes are highly dependent on the information background. Roughly speaking, if news about the company is not published (although everything is in order in terms of profitability), then the price will gradually fall. And the glass has almost no effect. Other traders are also aware of this. Therefore, they can artificially influence the information field, creating an invalid hype.

Where can I use DOM scalping – drives

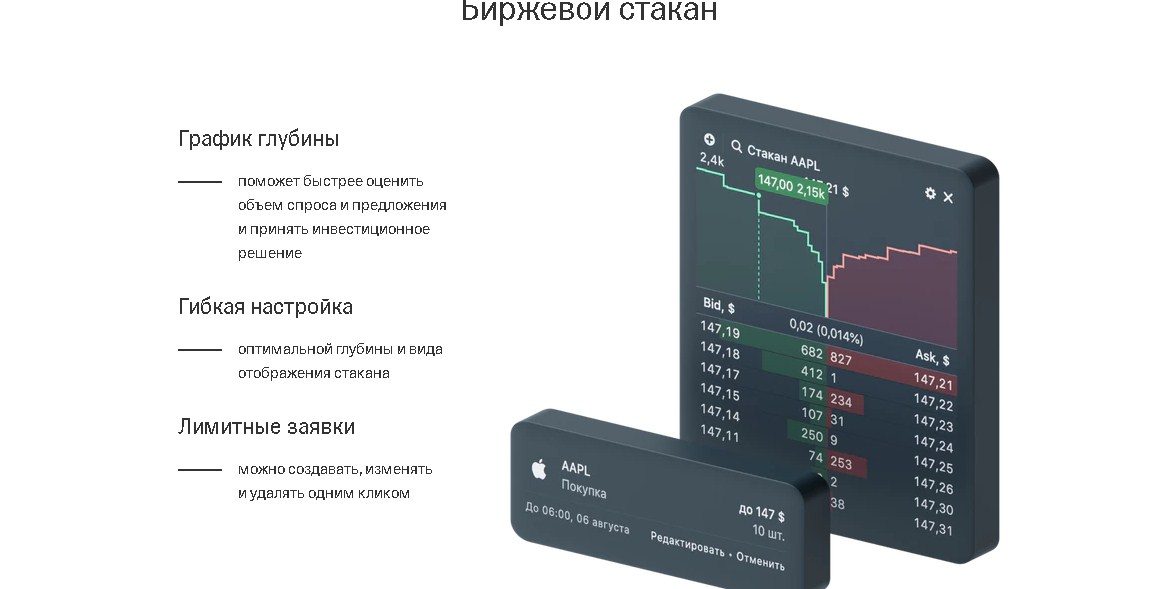

In fact, DOM scalping can be used on any

exchange where the broker provides relevant information. Now almost all software platforms support the formation of a summary table by the volume of orders. Scalping on the

QUIK glass is actively involved .

also provides information about the current volume of transactions. There, the DOM for scalping is even easier to analyze, since the terminal actually conducts technical analysis and indicates the probability of a rise or fall in the quote. But this is a purely technical analysis that does not reflect the mood of the market.

The main types of scalping strategies for the order book

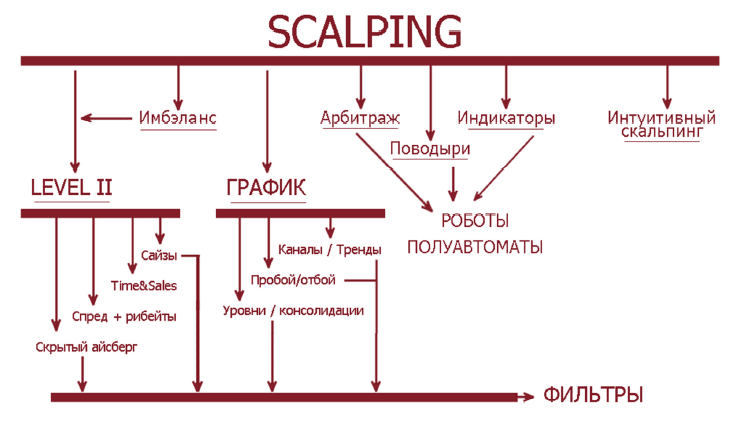

There are the following options for determining entry points when scalping on the order book:

- Catching kickbacks . This is exactly the option when a trader needs to detect a situation in which the density in the order book changes dramatically. That is, the number of transactions for the sale or purchase of a pair, an asset increases. Stop loss must be placed not only on the “lower” value, but also on the “higher” one. It is only necessary to wait for the peak value of the issuance of contracts. Immediately after that, contracts begin to actively “eat up”. This same tactic can be used when trading futures.

- Trend scalping . A simpler option, which takes into account the total volume of open orders. And immediately on it, the trader makes a forecast for the growth or fall of quotes, fixing a new order. There are many scripts in Forex for finding “trend points”. Beginners can use them. More experienced traders, as a rule, refuse them.

DOM scalping, pipsing, trading on Binance: https://youtu.be/msiz39fdnc4 In total, DOM scalping of stocks, futures, and other assets is one of the most common conservative trading strategies, where the potential risks for the user are minimal. You should not count on large profits, the number of published contracts is important here. The ideal option is to work with 5-10 assets at the same time. This will be more than enough to fix the total profit of 3 – 5%.