The Fibonacci sequence is a numerical sequence in which each next term is the sum of the two previous ones:

1,1,2,3,5,8,13,21,34,55,89, … These figures are connected by a number of interesting relationships. Each number is approximately 1.618 times the previous one. Each use case corresponds to approximately 0.618 of the following.

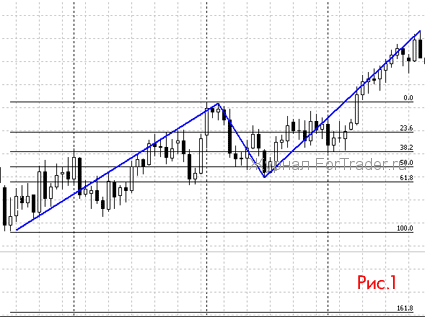

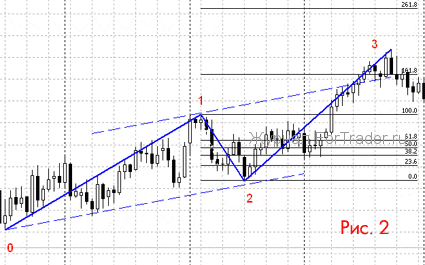

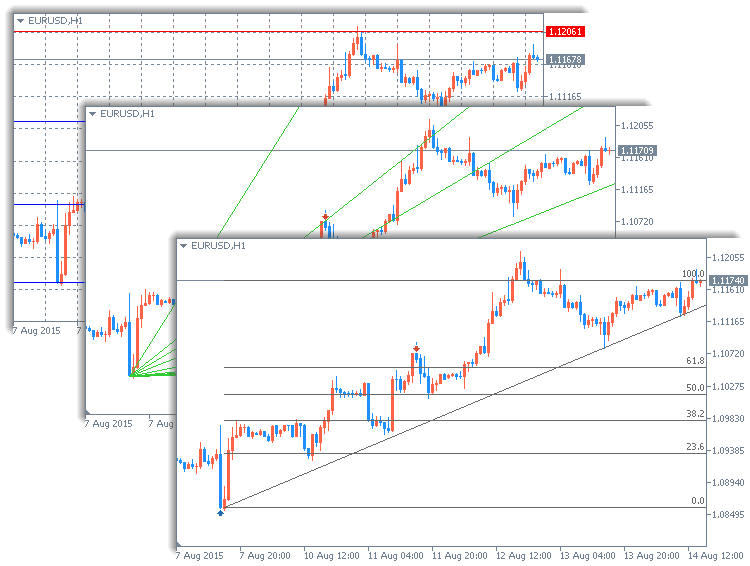

It turns out that when analyzing the market, several basic levels are used: 0.0%, 23.6%, 38.2%, 50.0%, 61.8%, 76.4%, 100.0%, 161.8% , 261.8% and 423.6%, the most active. of which 61,%.

These seemingly ordinary numbers make a lot of sense, and let’s see how to use them. Fibonacci patterns are best used in conjunction with other patterns and indicators. They often indicate a more general approach. The Fibonacci Expansion will give you a specific price target, but that doesn’t make sense unless you know a breakout is likely. The Fibonacci price assessment test requires a triangular pattern, volume confirmation, and an assessment of the overall trend. By combining indicators and charts with the many Fibonacci tools available, you can increase the chances of a successful trade. Remember that there is no single metric that would show everything perfectly (if there was one, we would all be rich). However, when many indicators point in the same direction, you can get a good idea of where price is heading.

- determine the time for price correction and consolidation;

- precise determination of when the general trend changes;

- an overview of the most favorable times for opening orders;

This indicator is easy to use, but it can significantly improve the accuracy of any trading system.

How to build a Fibonacci channel in the terminal and on your own?

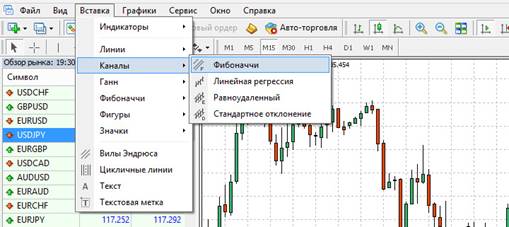

To create Fibonacci channels in the MetaTrader4 terminal, select: “Insert” – “Channels” – “Fibonacci”:

How to use Fibonacci channels?

The strategies for using the channel can be different, the less risky it will be to buy an order in the direction of the current trend when the timeline bounces off the line along which the entire construction is completed. The order should be closed when the price reaches the level and there are signals about its rapid reversal. Why use a technical indicator from a group of oscillators or a Price Action strategy without an indicator? The latter is better because it provides more precision. Depending on the strategy of use, the channels will not differ from the Fibonacci levels, but can be used for global trend movements and high volatility. The essence of the Fibonacci channel technical analysis tool is construction, interpretation of results, practical application in trading: https://youtu.be/izX0GDoupGA

The author’s strategy for using the Fibonacci channel

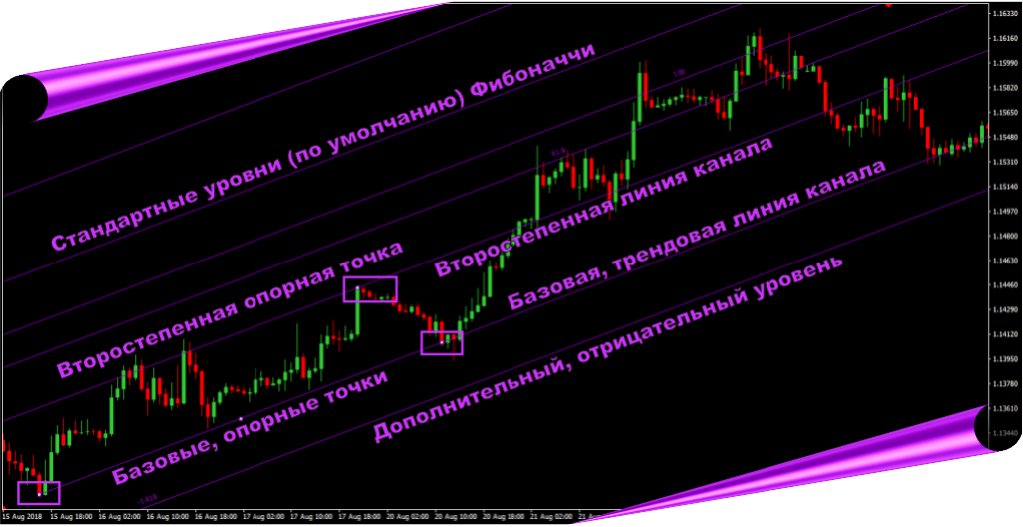

One of the strategies for using the Fibonacci channel is to test its signals not immediately, but by changing the direction of price movement. If an asset is moving in an uptrend, the Fibo channel will not stretch higher (as shown in the sidebar above), but lower, as if it were working in a downtrend. In this case, the plotting is carried out at the extreme values of the price movement, which form the same “banks” that restrict the plotting of the chart. When the construction lines are broken, movement levels are obtained to confirm the change in direction and determine the exact time of the opening commands:

A justified channel is a channel organized at two low and two high points. However, in practice, it often happens that after its confirmation, the channel changes direction.

Let’s test the forecast of the price movement in the future channel. Fibonacci levels will help us here.

Retracement levels based on Fibonacci

This is the simplest use of Fibonacci numbers. They are based on the fact that a trend can be divided into 6 parts, and any part will have a certain value. To build a Fibonacci grid (as levels are sometimes called), you need to find a fairly clear trend up or down and drag the grid from start to finish.

Pros and cons of the Fibonacci tool

The key advantages of the indicator are the ability to:

- accurately predict profit targets and stop losses;

- promptly execute pending orders;

- use trend and anti-trend strategies;

- work at any time, both in the middle of the day and at long intervals.

The main disadvantages of the indicator:

- not suitable for small TF;

- It is more difficult to build algorithmic strategies using Fibonacci than using other indicators. Because of this, it is more difficult to test on a large number of instruments in order to find out the true Fibonacci rates in a trade;

- the difficulty of determining the starting point (the beginning of the trend);

- uselessness of the indicator on flat.

Having analyzed all the pros and cons, we can conclude that Fibonacci can be used as an additional technique to determine your positions, but only as an additional one. Don’t buy or sell 50%, 61.8% at random and expect positive long-term results – the markets are overly difficult to drive with a single Fibonacci reading.