Jerin Fibonacci jerin lambobi ne wanda kowane lokaci na gaba shine jimillar abubuwan da suka gabata guda biyu:

1,1,2,3,5,8,13,21,34,55,89,… An haɗa waɗannan alkaluman. ta yawan alaƙa masu ban sha’awa. Kowace lamba tana kusan sau 1.618 na baya. Kowane yanayin amfani yayi daidai da kusan 0.618 na waɗannan abubuwan. [taken magana id = “abin da aka makala_307” align = “aligncenter” nisa = “696”]

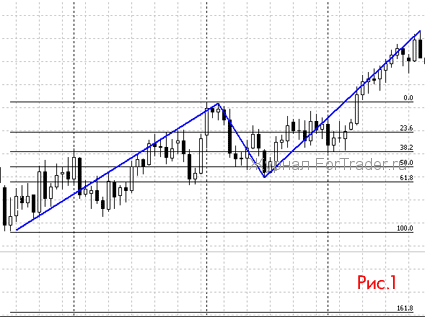

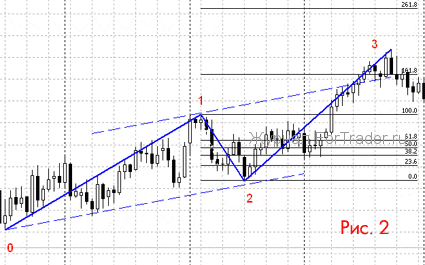

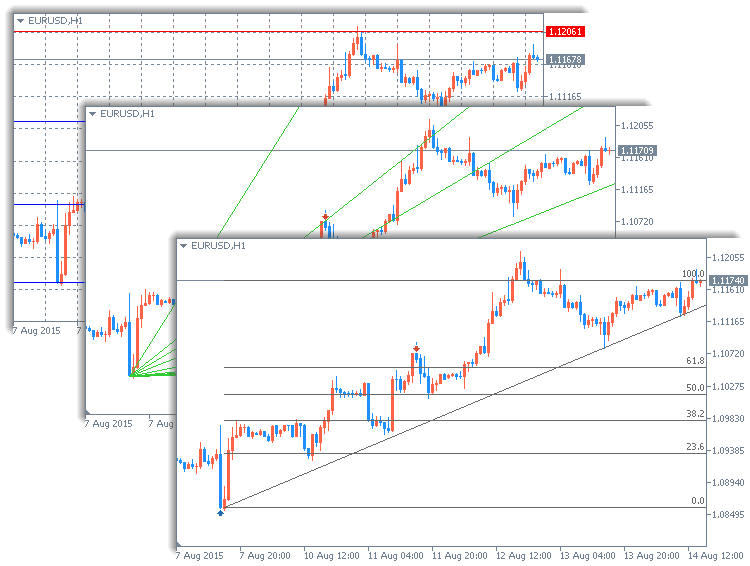

Ya bayyana cewa lokacin da ake nazarin kasuwa, ana amfani da matakan asali da yawa: 0.0%, 23.6%, 38.2%, 50.0%, 61.8%, 76.4%, 100.0%, 161.8% , 261.8% and 423.6%, mafi yawan aiki. wanda kashi 61.%.

Waɗannan lambobi masu kama da na yau da kullun suna da ma’ana da yawa, kuma bari mu ga yadda ake amfani da su. Fibonacci alamu sun fi amfani da su tare da wasu alamu da alamomi. Sau da yawa sukan yi nuni ga wata hanya ta gaba ɗaya. Ƙarin Fibonacci zai ba ku takamaiman farashin farashi, amma ba shi da ma’ana sai dai idan kun san yiwuwar fashewa. Gwajin kimanta farashi na Fibonacci yana buƙatar tsari mai kusurwa uku, tabbatar da ƙara, da kimanta yanayin gaba ɗaya. Ta hanyar haɗa alamomi da sigogi tare da yawancin kayan aikin Fibonacci da ake da su, zaku iya haɓaka damar ku na cin nasara mai nasara. Ka tuna cewa babu wani ma’auni guda ɗaya da ke nuna duk abin da yake cikakke (idan akwai, duk za mu kasance masu arziki). Duk da haka, lokacin da yawancin alamomi ke nunawa a hanya guda, za ku iya samun kyakkyawan ra’ayi na inda farashin ke tafiya. [taken magana id = “abin da aka makala_306”

- ƙayyade lokacin gyaran farashi da ƙarfafawa;

- nuna lokacin da yanayin gabaɗaya ke canzawa;

- sake duba mafi kyawun lokuta don buɗe umarni;

Wannan mai nuna alama yana da sauƙin amfani, amma yana iya inganta daidaiton kowane tsarin ciniki.

Yadda za a gina tashar Fibonacci a cikin tashar tashar kuma da kan ku?

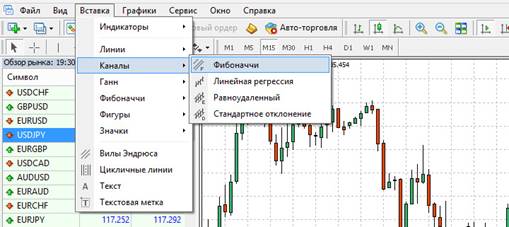

Don ƙirƙirar tashoshi na Fibonacci a cikin tashar MetaTrader4, zaɓi: “Saka” – “Tashoshi” – “Fibonacci”: [taken magana id = “abin da aka makala_308” align = “aligncenter” nisa = “509”]

Yadda ake amfani da Tashoshin Fibonacci?

Dabarun amfani da tashar na iya zama daban-daban, ƙananan haɗari zai zama siyan oda a cikin al’amuran yau da kullum lokacin da lokaci ya tashi daga layin da aka kammala duk ginin. Ya kamata a rufe odar lokacin da farashin ya kai matakin kuma akwai alamun saurin juyawa. Me yasa amfani da alamar fasaha daga ƙungiyar oscillators ko dabarun Ayyukan Farashi ba tare da mai nuna alama ba? Zaɓin na ƙarshe ya fi kyau saboda yana ba da ƙarin daidaito. Dangane da dabarun amfani, tashoshi ba za su bambanta da matakan Fibonacci ba, amma ana iya amfani da su don ƙungiyoyi masu tasowa na duniya da kuma rashin ƙarfi. Mahimman kayan aikin bincike na fasaha na tashar Fibonacci – gini, fassarar sakamako, aikace-aikacen aiki a cikin ciniki: https://youtu.be/izX0GDoupGA

Dabarun marubucin don amfani da tashar Fibonacci

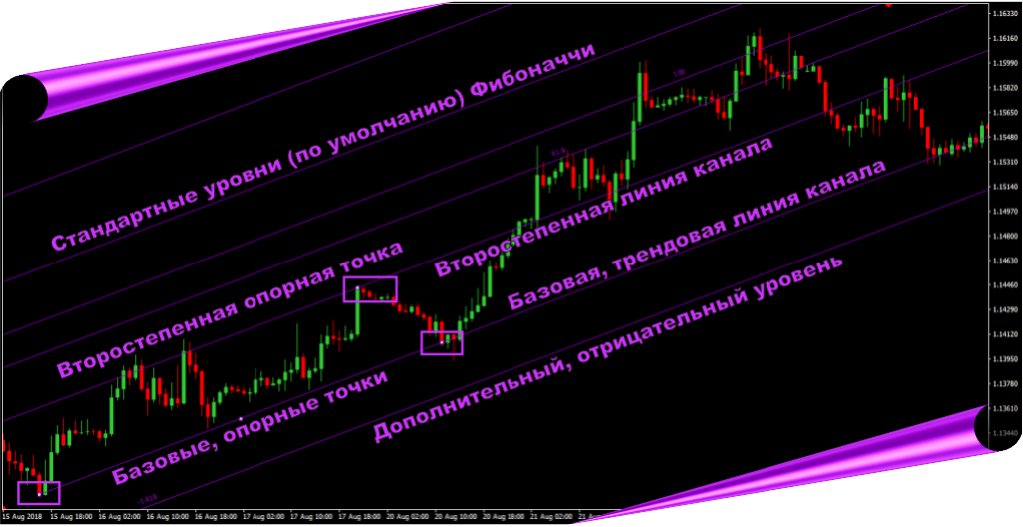

Ɗaya daga cikin dabarun yin amfani da tashar Fibonacci shine gwada siginar sa ba nan da nan ba, amma ta hanyar canza yanayin motsin farashin. Idan kadarar ta kasance a cikin haɓakawa, tashar Fib ba za ta shimfiɗa sama ba (kamar yadda aka nuna a cikin labarun gefe a sama), amma ƙasa, kamar dai yana cikin ƙasa. A wannan yanayin, ana aiwatar da ginin bisa ga matsananciyar ƙimar motsin farashin, wanda ke samar da “gabas” iri ɗaya waɗanda ke iyakance ginin ginshiƙi. Lokacin da aka karya layukan ginin, ana samun matakan motsi don tabbatar da canjin shugabanci da ƙayyade ainihin lokacin umarnin buɗewa:

Tashar da ta dace tasha ce da aka tsara akan manyan maki biyu ƙananan da biyu. Duk da haka, a aikace sau da yawa yakan faru cewa bayan tabbatarwa, tashar ta canza hanya.

Bari mu gwada hasashen motsin farashi a tashar gaba. Matakan Fibonacci zai taimake mu a nan.

Matakan gyare-gyare bisa Fibonacci

Wannan shine mafi sauƙin amfani da lambobin Fibonacci. Sun dogara ne akan gaskiyar cewa ana iya raba yanayin zuwa sassa 6, kuma kowane bangare zai sami ƙimar ƙima. Don gina grid na Fibonacci (wani lokaci ana kiranta matakan), kuna buƙatar nemo ingantaccen tsari sama ko ƙasa kuma ja grid daga farko zuwa ƙare.

Ribobi da fursunoni na kayan aikin Fibonacci

Babban fa’idodin mai nuna alama shine ikon:

- hango hasashen riba da kuma dakatar da asarar daidai;

- aiwatar da umarni masu jiran aiki da sauri;

- yi amfani da hanyoyin da ake amfani da su da kuma hanyoyin da za a magance su;

- aiki a kowane lokaci, duka a tsakiyar yini da kuma a cikin dogon lokaci.

Babban rashin amfani mai nuna alama:

- bai dace da ƙananan TF ba;

- yana da wahala a gina dabarun algorithmic bisa ga Fibonacci fiye da sauran alamomi. Saboda wannan, yana da wuya a gwada a kan babban adadin kayan aiki don gano ainihin alamun Fibonacci a cikin ciniki;

- wahala wajen tantance wurin farawa (farkon yanayin);

- rashin amfani mai nuna alama akan filaye.

Bayan nazarin duk ribobi da fursunoni, za mu iya yanke shawarar cewa za a iya amfani da Fibonacci a matsayin ƙarin fasaha don ƙayyade matsayinmu, amma kawai a matsayin ƙarin. Kada ku saya ko sayar da 50%, 61.8% a bazuwar kuma kuyi tsammanin sakamako na dogon lokaci – kasuwannin suna da rikitarwa don jagorantar ƙimar Fibonacci ɗaya.