What is FXCN ETF, return as of 2022, fund composition, online charts, forecast.

ETFs and

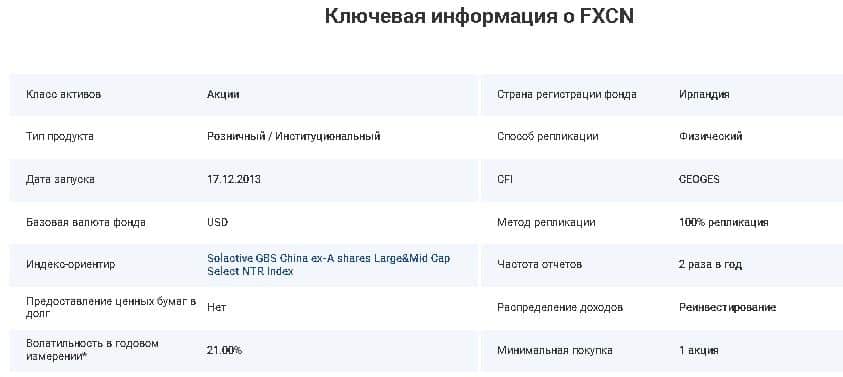

mutual funds are funds that invest in securities, metals or commodities. They follow a specific index or product as closely as possible. An index fund is one of the best ways for a passive investor who wants to invest in the country’s economy. There are exchange-traded funds that are collected based on a popular investment strategy. FinEx China UCITS ETF – (ETF FXCN) is the only ETF on the Moscow Exchange that allows you to participate in the growth of the Chinese economy.

The composition of the ETF FXCN fund on shares of China

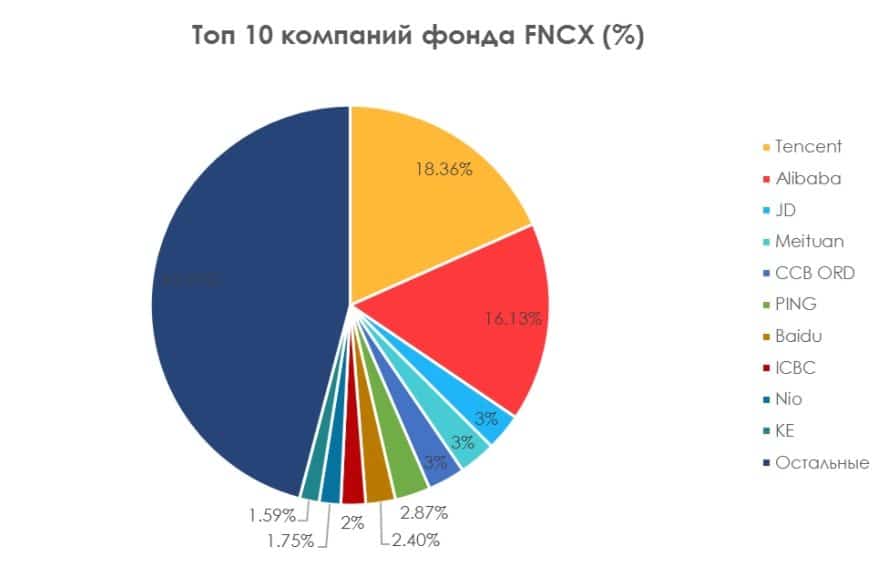

The management company undertakes to repeat the composition and structure of the Solactive GBS China ex A-Shares Large & Mid Cap USD Index NTR index. This is not an index of China, but a reference index of the American provider Solactive for tracking the behavior of stocks in developed and developing countries. This index tracks the dynamics of quotations of companies with large and medium capitalization. It covers approximately 85% of China’s shares (not including China’s A-shares). The index is calculated as an index of total return, weighted by market capitalization, the currency of the index is US dollars. Dividends are fully reinvested. At the beginning of 2022, the index includes 225 Chinese companies. The FXCN ETF indicates that there are 233 securities in the portfolio, 6 of which have a zero stake. The companies with the highest weight in the index are the most important. We see in the top ten companies, well-known Chinese giants. Half of the securities have a stake of less than 0.2%.

- TENCENT ORD – 17.21%;

- ALIBABA GROUP HOLDING ADR REP 1 ORD – 11.3%;

- MEITUAN DIANPING-CLASS B – 5.38%;

- CCB ORD H – 3.36%;

- COM ADR REP 2 CL A ORD – 3.31%;

- PING AN ORD H – 2.3%;

- ICBC ORD H – 2.24%;

- BAIDU ADR REP 1/10 CL A ORD – 2.13%;

- NETEASE ADR REP 25 ORD – 1.86%;

- WUXI BIOLOGICS CAYMAN INC – 1.66%.

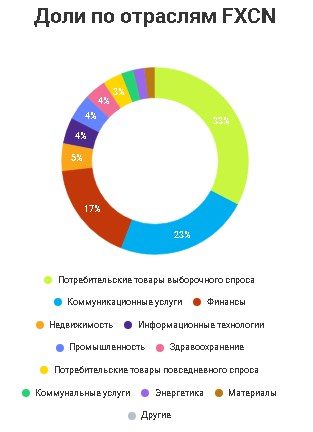

In total, the top ten stocks make up about half of the portfolio. The situation is the same in the distribution by industry, a third of the portfolio – shares of consumer goods of selective demand, almost a quarter of communication services, 17% given to the financial industry.

A-shares are shares that are traded only on the Chinese stock exchange, purchases by investors from other countries are limited. It is considered to be a very risky investment.

The index (and hence the fund) includes more conservative stocks:

- H-shares/Red Chips (Hong Kong Exchange);

- ADR/N-shares (USA);

- B-shares (Shanghai and Shenzhen).

Time to make money in China, China ETF fund FXCN from Finex, is it worth buying, review: https://youtu.be/xmDyKfYUWGI

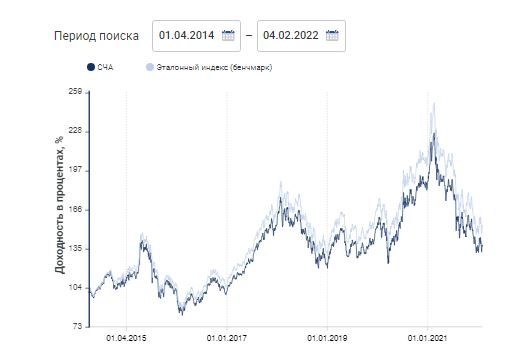

FXCN fund returns

Investor’s cost of investing in FXCN ETF 0.9% of NAV (net asset value) per year. This amount includes all expenses of the fund, the company guarantees that this is the maximum amount that the investor will pay. This amount is not additionally deducted from the brokerage account, this is taken into account in quotes. For Russia, such commissions are considered average, while in the United States, most funds charge ten times less. It may not seem significant, but with a passive investment of 10-30 years, every 1% can be worth 10-30% of lost returns. You should also take into account the broker’s commission for the purchase and sale of shares and taxes.

- The dynamics of quotations included in the index of Chinese stocks.

- dividend policy.

- Exchange rates.

Let’s take a closer look at the last point. The Chinese companies that make up the index are oriented to the Chinese yuan, but the Solactive GBS fund is traded in US dollars. An investor on the Moscow Exchange can buy the fxcn fund both for rubles and for dollars. He can buy for dollars and sell for rubles, or vice versa. If the ruble falls against the dollar, the investor can make a profit in rubles, even if the price of the fund in dollars decreases. This point is worth considering. The fund has been trading since December 2013. During this time, the fund showed 204.66% in rubles and 29.66% in US dollars. Such a large difference is due to the fall of the ruble in 2014.

How to buy FXCN ETF

To invest in the Chinese economy through the FXCN ETF from Phinex, you need to have a

brokerage accountwith access to the Moscow Exchange. For beginners, there is a Buy ETF section on the Phoenix official website, where you can choose a broker and open an account. Investors can buy FXCN ETFs with either regular or individual brokerage accounts. To be exempt from taxes, you need to keep the fund for more than 3 years on a regular account, or choose IIS type B. To purchase, you need to deposit rubles or dollars into the account. And you can do both. To find the FXCN fund on the broker’s website or in the trading application, you need to enter the ticker “FXCN” if the search does not return ISIN code IE00BD3QFB18. Next, enter the desired number of shares, get acquainted with the amount of the transaction and confirm the transaction. The current price can be checked in the broker’s application or on the Moscow Exchange website

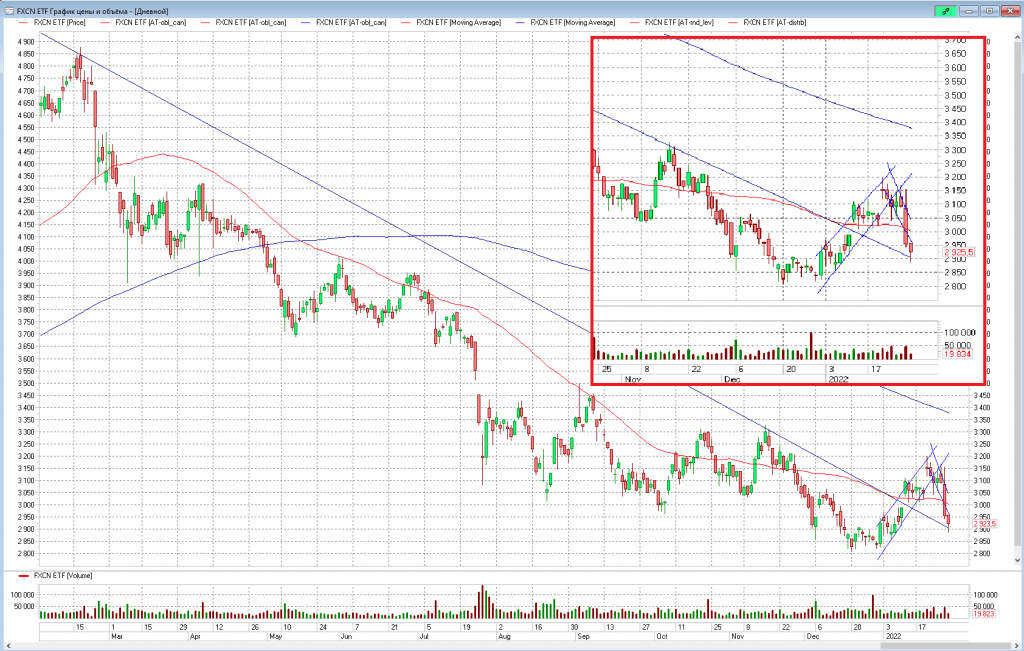

https://www.moex.com/en/issue.aspx?board=TQTF&code=FXCN. At the beginning of 2022, it is 3068 rubles. For 2022, this is the only way to invest in the Chinese economy on the Moscow Exchange.

FXCN ETF Prospects

FXCN ETF is the oldest fund on the Moscow Exchange, traditionally one of the top 10 most popular instruments. According to the Moscow Exchange for 2022, it is on the 3rd line in the top ten funds in the portfolios of Russian private investors. FXCN is purchased both for

portfolio diversification and because of the long-term growth of the Chinese economy. Leading investment houses and analysts, including the World Bank, are positive about the Chinese economy. They believe that in the next 10 years, Chinese companies will show significant growth. Before investing in the Chinese economy, it is necessary to calculate the risks.

FXCN is an equity fund and is highly volatile. You need to buy it in a high-risk portfolio. Investors with low or moderate risk should include no more than 13% of FXCN, the share of bonds should be at least 20%.

Growing GDP in China does not mean that exporting companies will show strong growth. Do not forget that this Middle Kingdom refers to emerging markets. According to the EU requirements, all exchange-traded funds must have investment riskiness labeled from 1 to 7, where higher values mean high risk. FXCN is at level 6. The Russian stock market is considered risky, FXRL is at level 5, tna on US stocks is at level 5. The Chinese economy has many problems that even professionals cannot take into account. Attention should be paid to the confrontation between the US and China, the behavior of the Chinese market depends on the actions taken by the Joe Biden cabinet. There are fewer obvious conflicts between the two countries, but US policy is aimed at destroying the Chinese economy. In 2022, there is a good opportunity to buy cheaper shares of China, counting on a new price high. But it should be borne in mind that the decline may continue and quotes may lose another 15-30%. Purchases should be done in equal parts after certain periods of time, or wait for the upward breakdown of the 200 moving average on the daily chart.

Benefits of FXCN

- The only fund in Russia investing in Chinese stocks.

- Great growth potential in the next ten years.

- Availability – the price of 1 share is small, including fxcn. An investor with any capital can afford. You do not need to be a qualified investor to purchase fxcn.

Disadvantages of FXCN

- The portfolio is highly dependent on the dynamics of giants – Alibaba and Tencent.

- The Chinese market is developing, there are problems, there is a trade war with the United States, it is not known who will be the winner in the end.

- The fund is registered in Ireland, and if problems arise, Russian investors are unlikely to be able to obtain legal protection in the European Union.

- Quite high, for the world’s etf: fund commissions. Managers report that they do not plan to follow the global trend of reducing investor costs. .