The transparent policy of entrepreneurs helps investors eliminate bias in the choice of partners. Companies spend profits based on objectives. They invest in development, optimizing regular expenses.

What is CAPEX – in simple words about the complex

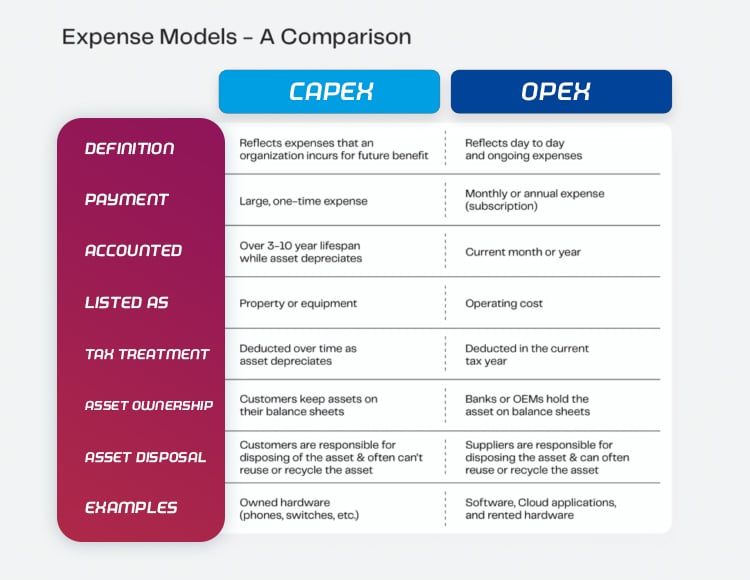

Capital expenditure (CAPEX ) is the capital expenditure of an enterprise aimed at the purchase of non-current assets that are valid for more than one year. Long-term financing provides for the acquisition of fixed assets. The result of business investments is to make a profit when investing in capital-intensive industries. These are oil and gas, energy, mining sectors, metallurgy. There are also labor-intensive costs, which include spending on services, retail goods. The main volume of investments is in the products sold. Investments in the means of production, their modernization, must maintain the target direction of profitability, be calculated for the future.

CAPEX and OPEX – what’s the difference

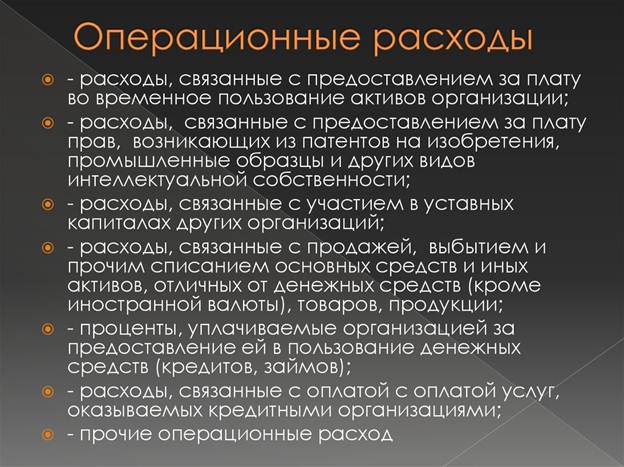

In contrast to capital expenditures, OPEX is the cost of running operations. Operating expenses are related to the cost of goods, administrative, commercial needs of the enterprise. The significance of OPEX for the company is generally recognized, it is determined by the need for the reporting period. Uninterrupted operation of the enterprise is possible with uniform planning of operating expenses, which are written off in the form of depreciation sequentially, after capitalization on the balance sheet. The organization pays for the rent of the premises, delivery, utilities. Workers receive wages. The money goes to the cashier, to the current account as revenue. Profit decreases if OPEX increases. The company’s economists strive to minimize operating costs in order to increase profits.

- The amount of expenses . Capital investments involve significant spending.

- Payment frequency . Operating expenses are made regularly, capital every few years or annually.

- Reporting is carried out on different sections of the balance sheet . OPEX is reflected in the operating payments, CAPEX is contained in the cash flow statement.

- Various sources of funding .

It is important for a private investor to know the indicators of the expenses under consideration in order to calculate the ratio of the value of assets to the net profit of the company.

Why is it important for an investor to consider CAPEX

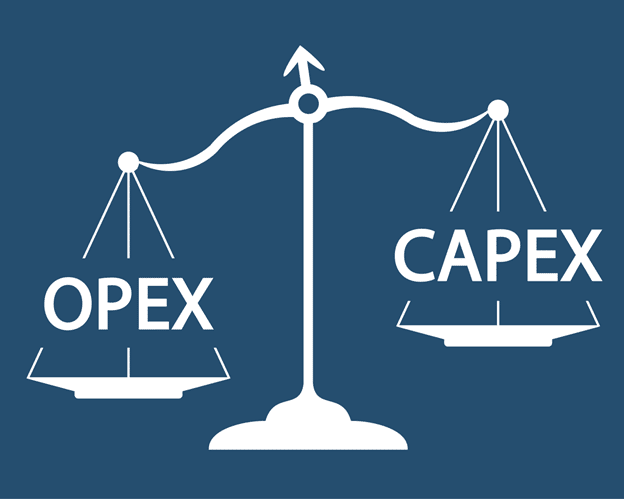

CAPEX can give information to investors about capital investment plans, the availability of free money that the company intends to use for the development of production. The company distributes profits by paying dividends or by financing the acquisition of fixed assets. The increase in capital expenditure reduces the regular, decreases the value of shares. Accordingly, investors review their portfolios. Note! CAPEX are aimed at the development of the enterprise, increasing profits in the future. Decreasing dividends occurs in order to obtain greater profits in the future. Negatively long-term investments are considered if there are doubts about their expediency, there is a risk of losing money. For example, with a return on capital of 15%, it is not rational to invest in less profitable projects. Such actions will lead to a revision by investors of their plans, aimed at acquiring shares. Financiers are interested in increasing the efficiency of the company with which they cooperate. Their opinion may not coincide with the management of the company if there are disagreements on the future development of the industry. CAPEX is necessary for enterprises to upgrade equipment, maintain production capacity. If you do not reconstruct fixed assets, then there is a depletion of resources, a decrease in production in the future. Therefore, it is important to maintain a balance between CAPEX and OPEX. What is CAPEX and OPEX in simple words, formula and calculation, explanation in simple words: https://youtu.be/cPwlp3-NHZI if there are disagreements on the future development of the industry. CAPEX is necessary for enterprises to upgrade equipment, maintain production capacity. If you do not reconstruct fixed assets, then there is a depletion of resources, a decrease in production in the future. Therefore, it is important to maintain a balance between CAPEX and OPEX. What is CAPEX and OPEX in simple words, formula and calculation, explanation in simple words: https://youtu.be/cPwlp3-NHZI if there are disagreements on the future development of the industry. CAPEX is necessary for enterprises to upgrade equipment, maintain production capacity. If you do not reconstruct fixed assets, then there is a depletion of resources, a decrease in production in the future. Therefore, it is important to maintain a balance between CAPEX and OPEX. What is CAPEX and OPEX in simple words, formula and calculation, explanation in simple words: https://youtu.be/cPwlp3-NHZI

CAPEX or OPEX, what to attribute to – an example

Many companies prefer to rent office space. Not all rented areas meet the needs of the company. Managers make decisions about improvement, a project of transformations is being developed. Let’s consider an example of investments of a small manufacturing enterprise producing dietary supplements. The expansion of Neovit required an increase in staff. The number of accountants has increased. To ensure the quality work of employees, it was necessary to install additional doors and partitions. After the end of the rental period, dismantling will not be possible. The question arises how to take into account the costs of the enterprise, where to reflect the costs. Consider compliance with the requirements of IAS 16 to see if the costs can be attributed to CAPEX.

| Parameters of the main means of production | The object of study is the improvement of the accounting office on the rented area | Compliance with fixed asset criteria |

| 1. Purpose of the premises | The office is necessary for the work of accountants | Yes |

| 2. Duration of use | The entire lease period of 10 years. | Yes. |

| 3. Acquisition of benefits for the enterprise | High economic benefit is associated with an increase in the efficiency of the area for the work of an increased composition of the accounting department | Yes. |

| 4. Estimated cost of the object. | Costs of 1 million rubles are justified from an economic point of view, confirmed. | Yes. |

Neovit can classify the costs under CAPEX as they meet the requirements of IAS 16. The cost of constructing partition walls and purchasing and installing doors is defined as an expense for the renovation of property, plant and equipment. The IFRS cash flow statement shows the company’s CAPEX. Consider the subsection of investment activity by capital expenditures, divided into fixed assets and intangible assets by years. The amounts are in millions of US dollars.

| Investment activities | 2018 | 2017 | 2016 |

| Purchase of fixed assets | 653 | 560 | 494 |

| Purchase of intangible assets | 35 | 31 | 31 |

| Acquisition of investments | 23 | 137 | 227 |

| Sale of branches | – | 42 | 3 |

| Gain on disposal of long-term assets | fifteen | fifteen | 7 |

| Proceeds from disposal of investments | 210 | 36 | eighteen |

| Interest | 16 | 54 | 61 |

| Dividends | four | one | – |

| Return on investment | 466 | 580 | 663 |

The main goal of entrepreneurial activity is to make a profit. The costs of CAPEX and OPEX should be carried out in such a way as to regulate each other, not allowing a negative financial result in the work of the enterprise.