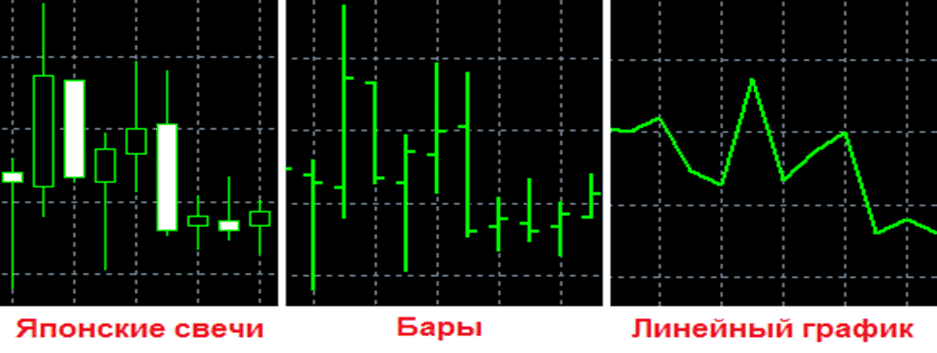

Inside and outside bars in trading – how to read, decoding. One of the simplest strategies in the market is inside and outside bar trading. They are easy to find on the chart, the risk is clearly understood, and signals are worked out well on large timeframes. The indoor and outdoor bar is one of the most popular Price Action models. A trading strategy can be built both on the “pure” application of the inside and outside bar, and using filters. They can also be used as an additional signal in other strategies.

What is an inside bar

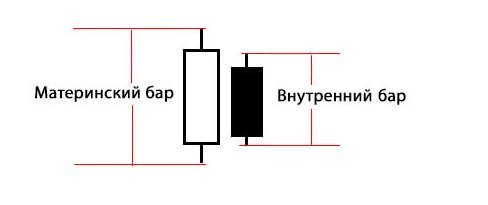

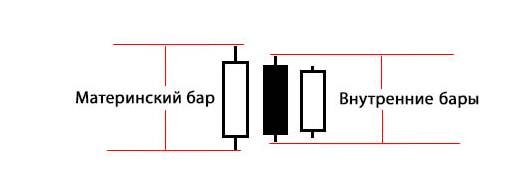

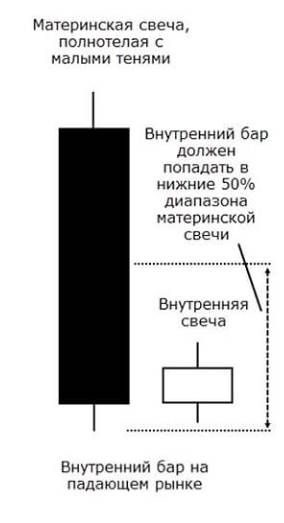

An inside bar is a pattern consisting of two candles, one of which (signal) is completely in the body of the other (mother). It is found in a trending market. in lateral movements, channels, they can end a long trend.

The appearance of an inside bar should make the trader tense, this is a signal for a possible reversal or trend strengthening.

What is an Outside Bar

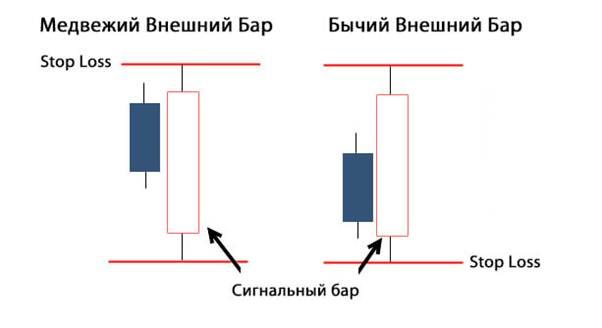

An outside bar is a candle that completely covers the price range of the mother candle. Candlestick extremes are allowed to coincide.

Inside bar trading strategy

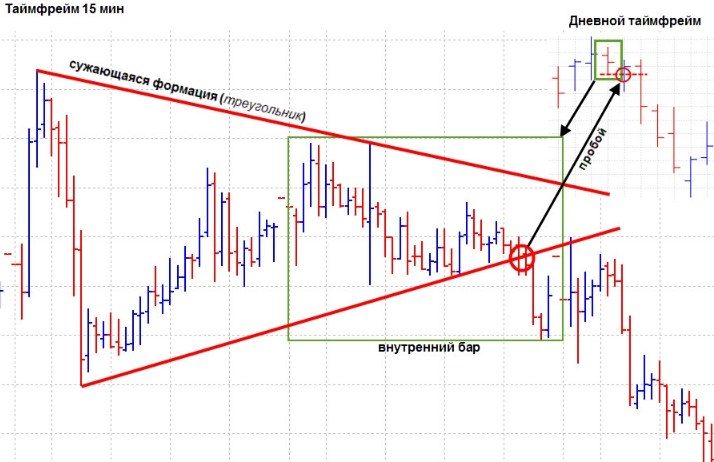

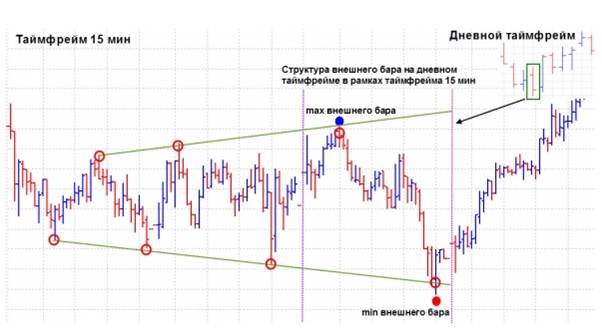

When viewed on smaller timeframes, inside bars (especially 2 or 3 bars) look like converging formations, often in a triangle pattern. When an inside bar appears on large timeframes (day, week), it is recommended to switch to lower periods and monitor the breakdown of the triangle (ascending or descending).

Reversal trading

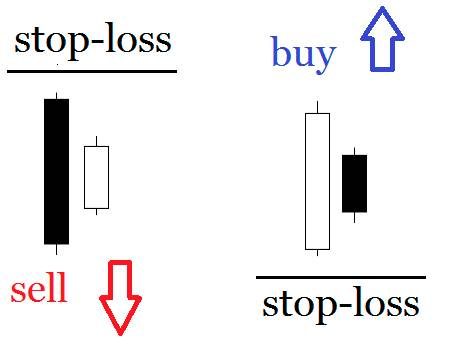

- We find the inside bar, its price should be more than 50% of the mother candle. Only bars at the top or bottom of the movement are considered – we are looking for a reversal.

- A stop order is placed slightly below the extremum in the opposite direction from the previous direction.

- After the order is triggered, a stop is placed behind the extremum of the inside bar or the breakout candle.

Inside bar trade (continuation)

- The user is in a position, sees a large candle in the direction of the deal.

- Identify an inside bar.

- The price range of the inside bar must be less than 50% of the mother candle.

- The stop loss moves to the low of the inside bar (if we are long).

- A long order in case of breakout of the extremum is placed several pips above the high.

If the trend continues, the trader increases his profit, and in case of a reversal, he takes the profit and prepares to enter a reversal. The inside bar is a figure of uncertainty, the participants are not sure about the further movement. The breakout of an extremum means determining the direction, so when the breakout is in the direction of movement, the price accelerates. But the breakout is not always true, there are false breakouts, the price consolidates near the inside bar. The trader always knows exactly where to place a reasonable stop (after the price is reached, holding the position loses its meaning) and limits losses in case of an erroneous entry.

Filters

A trader can enter a position more confidently if he receives additional confirmation. As a filter for inside bars can be:

- trend lines – it’s good when the inside bar is part of some other model in a given direction;

- moving averages – a trader considers long trades only if an inside bar is formed;

- oscillators – MACD, stochastic, RSI – the inside bar is considered only in overbought and oversold areas;

- divergence and convergence – inside bars are considered after the appearance of a divergence between the indicator and price readings.

Outside bar trading strategy

It is not recommended to enter a new position when an outside bar appears. During such periods, the foot breaks, it is extremely difficult to put a short stop.

Inside bar indicator

A trader must monitor many indicators at the same time. Therefore, some models are left without attention. To facilitate the task of finding inside bars, there are indicators. The Metatrader5 terminal uses the InsideBarSetup indicator. The algorithm marks with a red mark all inside bars on a given timeframe on any instruments. InsideBarSetup can not only find inside bars, but also generate alerts. You can set up automatic trading on the inside bar, the adviser will place the specified stop orders to enter the breakout position.

Features of trading on inside bars

When trading inside bars, there are some features that you need to consider:

- an inside bar is a natural process of the market slowing down, after which there is a strong movement;

- to enter positions, the trader must wait for the breakdown of the range of the inside bar and confirmation;

- inside bars can be both reversal and showing the probability of continuation of the movement;

- the model has a price gap between the parent and signal candles;

- the figure reflects the period of consolidation in the market, by breaking through the range, the trader can understand the future direction of movement;

- the color of the mother and signal candles does not matter;

- the pattern signal does not depend on the color of the candles;

- if the mother bar is 5 times or more higher than the signal one, the pattern is considered invalid. Most likely there will be a powerful rollback soon, the probability of an erroneous entry is high.

Recommendations for trading inside bars

- It is preferable to trade patterns for the continuation of the trend, they have a higher percentage of working out.

- If the inside bar is a doji or a pin bar, it should not be considered for entering the market. You should also skip inside bars with very long shadows. The mother candle may have a long tail, it doesn’t matter.

- Do not work during the Asian session, it is preferable to trade the first half hour after the opening of Europe or during the American session.

- The inside bar should be small – you can put a short stop, there is no strong uncertainty in the market when stops are knocked down in all directions.

- Inside bar signals should be filtered by other methods – moving averages , oscillators, support and resistance levels, trend lines.

- You should track inside bars on large timeframes – at least 4 hours, and enter on a small timeframe.

- Inside bars should not be considered if the market is in a range. There must be a strong trend before an inside bar appears.

- Open an order only after breaking through an important support and resistance level. You should not consider inside bars hanging in the air for trading. He must have a support – forces that need to be overcome. The mother candle may not have support, but the inside bar itself must be at the resistance or support level.

- You can enter both on the breakdown of the mother candle, and on the breakdown of the inside bar. In the first case, the trader will have to put a large stop, but the trade is more confident. In this case, stop loss will be triggered less often. Which entry to choose, the trader decides for himself, depending on the risk appetite, experience and data from other indicators. Newcomers to the market are advised to choose the most conservative trading method.

- Stop loss should be placed behind the nearest level behind the extremum of the inside bar or the mother candle. In the first case, there will be more losing trades, but the total loss will be less. Each transaction will not cause significant harm to the deposit.

- It is recommended to enter at low volatility or during a strong trend.

- As a take profit, you can use:

- nearest resistance level;

- risk-to-profit ratio – it is recommended to place a take not less than 3 stops;

- fixed stop – the average number of points of the trading timeframe for the last 10-20 candles, it can be determined by the ATR indicator;

- using Fibonacci levels , the grid is superimposed on the first impulse, and as a target – the levels of 161% and 261%;

- trailing stop – fixation occurs if the market rolls back from the high by a certain number of points.

https://articles.opexflow.com/analysis-methods-and-tools/fibonacci-channel.htm How to read bars, bar-by-bar analysis in trading: https://youtu.be/_sCq053iAbA Beginners are encouraged to set take profit to the next level.

Advantages and disadvantages of inside bar trading

Inside bar trading has the following advantages and disadvantages. Advantages:

- trading on daily and weekly charts takes a little time, there is time to make a decision;

- there is a place for a reasonable stop – the risk is limited and understandable, and the profit can be impressive;

- if the inside bar breaks through against an open position, this is a great place to take profits;

- it is possible to make a reversal trade at the top of the market or use the pyramiding strategy when trading with the trend.

Flaws:

- the reversal pattern often has a high risk (long stop), the trade ends with a loss;

- in some cases, it is difficult to determine a false breakout of an inside bar, this requires experience.

The inside bar, along with other Price Action patterns – pin bar, miraboso, trend lines and technical indicators is a powerful trading tool. When trading inside bars on a daily chart and refining the entry on m5-m15, a trader can make trades with a ratio of 1 to 5 or 1 to 10 or more. It is important to correctly interpret the inside bar and filter out false signals.