Yintoni iFXRL ETF, ukwakhiwa kwengxowa-mali, itshathi ye-intanethi, uqikelelo lwe-2022.

Ii- ETF kunye nee

– BPIFs ziimali ezirhweba ngokutshintshiselana ngemali kwimarike yemasheya, izixhobo zentengiso yemali, iintsimbi ezixabisekileyo okanye iimpahla. Balandela isalathiso esithile okanye bakhe ipotfoliyo esekwe kwisicwangciso esidumileyo. I-FXRL yingxowa-mali yotshintshiselwano esuka kwinkampani ye-Finex, ebhaliswe e-Ireland, equlethe izabelo ngokulinganayo kwi-RTS index yaseRashiya. Abatyalomali banokuthenga iFXRL ngeeruble okanye iidola.

Ukuqulunqwa kweFXRL ETF yowama-2022

I-RTS Index iqulethe izabelo ze-43 iinkampani ezinkulu zaseRashiya kwaye zifakwe kwiidola. Iinkampani ezikwicandelo lamandla (i-oyile negesi) zikwinqanaba eliphezulu, zilandelwa yimali kunye nemathiriyeli. Kodwa i-Finex, ndiyathembisa ukuphinda amandla e-RTS, inelungelo lokungabi namaphepha athile kwipotifoliyo. Inyaniso kukuba isalathisi se-RTS sibandakanya izabelo eziphantsi kolwelo, kwaye ukuba ingxowa-mali iyazithenga okanye izithengise, oku kunokuchaphazela iikowuti. Ke ngoko, izabelo ezimanzi kakhulu zithengwa endaweni yoko. Izabelo zobunini bezibambiso zengxowa-mali zahluke kancinane kwisalathiso se-RTS. Kuthiwa akunamsebenzi kangako, impazamo yokulandela umkhondo yi-0.5% ngonyaka. Inkampani yoLawulo lweFinex ipapasha ukubunjwa ngokuchanekileyo kwepotfoliyo yonke imihla kwiwebhusayithi yayo

https://finex-etf.ru/products/FXRL .

Ingxowa-mali yeFXRL yembuyekezo yexesha lonke [/ caption] Nokuba umtyali-mali uyayithenga iFXRL ngeeruble okanye iidola, amandla engxowa-mali axhomekeke kumyinge wotshintshiselwano lweruble ngokuchasene nedola. Isalathiso sibandakanya izabelo zaseRashiya, ezibalwe kwii-ruble, kodwa zifakwe kwiidola. Kufuneka kukhunjulwe engqondweni ukuba ngexesha lokuhla kwe-stock market, izinga lokutshintshiselwa kwe-ruble liwela ngokukhawuleza kwaye i-RTS index iyancipha ngaphezu kwe-MICEX index. Ngethuba lokukhula kwemarike yemasheya, izinga lokutshintshiselwa kwe-ruble linokunyuka kunye nokuwa, kwaye i-RTS index iya kukhula ngokukhawuleza kune-index yaseMoscow Exchange. Utyalo-mali kwi-RTS luya kuzithethelela ngokupheleleyo kwimeko yokukhula kwangaxeshanye kwezabelo kunye nokukhula kwezinga lotshintshiselwano lwe-ruble. Zizonke iindleko zokuba ne-TER mali yi-0.9% ngonyaka. Oku kubandakanya iimali zolawulo, iimali zomlondolozi, ukuhlengahlengisa imirhumo ye-brokerage, kunye neendleko zolawulo. Iindleko ezithile zento nganye azichazwanga, eyona lahleko inkulu yomtyali-mali ibonisiwe. Le mali ayihlawulwanga ukongezwa, kodwa itsalwa kwiikowuteshini. Kuxelwe ukuba i-TER ihlawulwa yonke imihla, kodwa itsalwa kwii-asethi zengxowa-mali ngekota. Umtyali-mali kufuneka ahlawule iindleko kungakhathaliseki ukuba kukho ingeniso ekubambeni i-ETF.

Ingxowa-mali yeFXRL yembuyekezo yexesha lonke [/ caption] Nokuba umtyali-mali uyayithenga iFXRL ngeeruble okanye iidola, amandla engxowa-mali axhomekeke kumyinge wotshintshiselwano lweruble ngokuchasene nedola. Isalathiso sibandakanya izabelo zaseRashiya, ezibalwe kwii-ruble, kodwa zifakwe kwiidola. Kufuneka kukhunjulwe engqondweni ukuba ngexesha lokuhla kwe-stock market, izinga lokutshintshiselwa kwe-ruble liwela ngokukhawuleza kwaye i-RTS index iyancipha ngaphezu kwe-MICEX index. Ngethuba lokukhula kwemarike yemasheya, izinga lokutshintshiselwa kwe-ruble linokunyuka kunye nokuwa, kwaye i-RTS index iya kukhula ngokukhawuleza kune-index yaseMoscow Exchange. Utyalo-mali kwi-RTS luya kuzithethelela ngokupheleleyo kwimeko yokukhula kwangaxeshanye kwezabelo kunye nokukhula kwezinga lotshintshiselwano lwe-ruble. Zizonke iindleko zokuba ne-TER mali yi-0.9% ngonyaka. Oku kubandakanya iimali zolawulo, iimali zomlondolozi, ukuhlengahlengisa imirhumo ye-brokerage, kunye neendleko zolawulo. Iindleko ezithile zento nganye azichazwanga, eyona lahleko inkulu yomtyali-mali ibonisiwe. Le mali ayihlawulwanga ukongezwa, kodwa itsalwa kwiikowuteshini. Kuxelwe ukuba i-TER ihlawulwa yonke imihla, kodwa itsalwa kwii-asethi zengxowa-mali ngekota. Umtyali-mali kufuneka ahlawule iindleko kungakhathaliseki ukuba kukho ingeniso ekubambeni i-ETF.

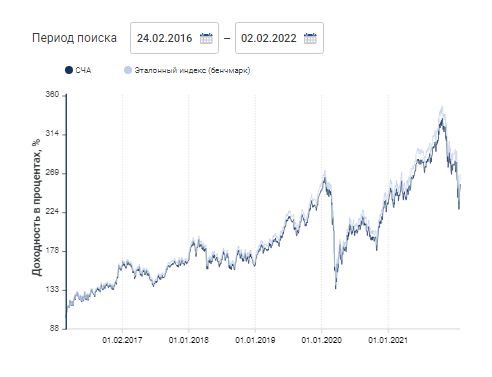

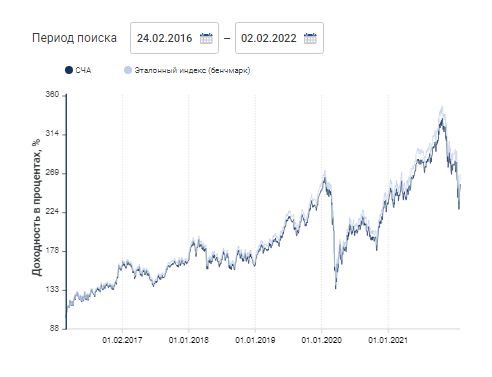

Le ngxowa-mali yasekwa kweyoMdumba ka-2016. Eli lixesha elihle kwimarike yemasheya yaseRashiya. Isalathiso se-RTS kunye ne-FXRL zibonisa i-bullish eyomeleleyo. Isivuno salo lonke ixesha lokujonga sasiyi-154,11% kwi-ruble kunye ne-151.87% kwiidola, kwi-2021 13.64% kwii-ruble kunye ne-10.26% kwiidola. Kwakukho izilungiso ezininzi ezinkulu, kwezinye iimeko ezihlala iinyanga ezi-3-4, zilandelwa ngumgangatho omtsha. Utyalo-mali kwi-FXRL lunomngcipheko ophezulu, ingxowa-mali ayinayo ibhondi, kwaye ngoko ke i-volatility ye-stock market. Kuyafaneleka ukutyala imali kwiFXRL ukuba:

Le ngxowa-mali yasekwa kweyoMdumba ka-2016. Eli lixesha elihle kwimarike yemasheya yaseRashiya. Isalathiso se-RTS kunye ne-FXRL zibonisa i-bullish eyomeleleyo. Isivuno salo lonke ixesha lokujonga sasiyi-154,11% kwi-ruble kunye ne-151.87% kwiidola, kwi-2021 13.64% kwii-ruble kunye ne-10.26% kwiidola. Kwakukho izilungiso ezininzi ezinkulu, kwezinye iimeko ezihlala iinyanga ezi-3-4, zilandelwa ngumgangatho omtsha. Utyalo-mali kwi-FXRL lunomngcipheko ophezulu, ingxowa-mali ayinayo ibhondi, kwaye ngoko ke i-volatility ye-stock market. Kuyafaneleka ukutyala imali kwiFXRL ukuba:

- kholelwa ukuba ukukhula okuqinileyo kwe-stock market yaseRashiya kuya kuqhubeka;

- baza kwenza utyalo-mali kangangeenyanga ezi-3 ubuncinane;

- ufuna ukutyala imali kwiidola zaseMelika;

- unemali encinci kwaye awukwazi ukuqokelela iphothifoliyo yesitokhwe saseRashiya;

- babe nepotifoliyo eyahluke kakhulu ngokodidi lwe-asethi kunye nejografi;

- ndiyoyika ukuthenga ikamva kwisalathiso se-RTS, ngenxa yonikezelo oluzenzekelayo olunikelweyo.

Yintoni enenzuzo ngakumbi i-ETF FXRL okanye i-BPIF SBMX: https://youtu.be/djxq_aHthZ4

Uzithenga njani ii-ETF zeFXRL

Ukuthenga i-ETF ye-FXRL kwi-Finex, kufuneka ube ne-akhawunti ye-brokerage kunye nokufikelela kwi-Moscow Exchange. Ukuba ngaba awunayo i-akhawunti, unako ukuvula enye usebenzisa ikhonkco kwiwebhusayithi esemthethweni Phinex Thenga ETF. Ukuze ugweme ukuhlawula irhafu, kufuneka uthenge iFXRL kwi-akhawunti yotyalo-mali lomntu okanye kwi-

akhawunti ye-brokerage eqhelekileyo ebambe ubuncinane iminyaka eyi-3. Ungafaka zombini iiruble kunye needola kwi-akhawunti ye-brokerage ukuthenga ingxowa-mali. [caption id = "incamathiseli_13186" ulungelelwaniso = "aligncenter" wide = "795"]

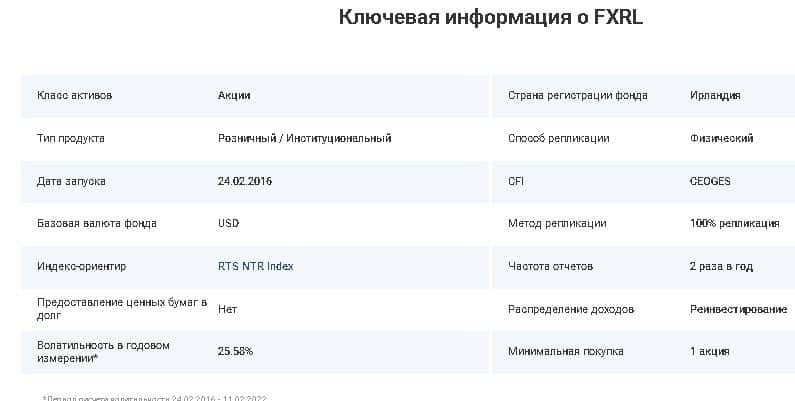

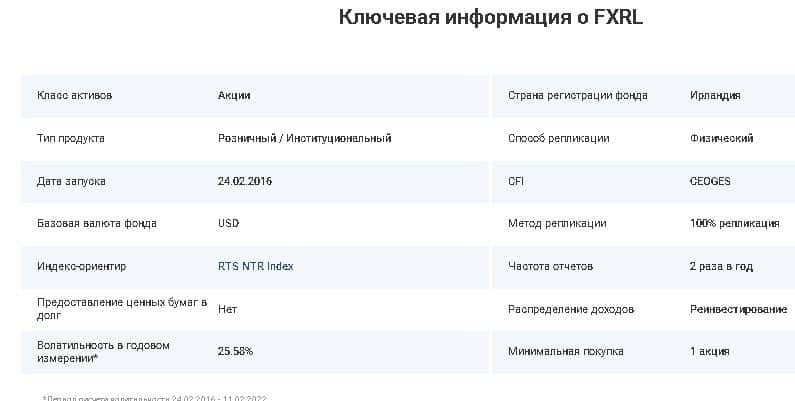

Ulwazi oluphambili kwi-ETF FXRL Ingxowa-mali inokufumaneka kwiwebhusayithi yomthengisi okanye ngesicelo esikhethekileyo ngokufaka ithikha “FXRL” okanye ikhowudi ye-ISIN IE00BQ1Y6480. Emva koko, faka inani elifunekayo lezabelo, isicelo siya kubonisa ngokuzenzekelayo iindleko zentengiselwano, kwaye uqinisekise ukusebenza. Ixabiso lesabelo esinye kuphela i-ruble ye-39.2, ngoko ungayithenga ngediphozithi encinci. Ngenxa yeendleko eziphantsi, kunokwenzeka ukubala ngokuchanekileyo kakhulu inani elifunekayo lezabelo zobunzima obufunekayo kwipotfoliyo.

Ulwazi oluphambili kwi-ETF FXRL Ingxowa-mali inokufumaneka kwiwebhusayithi yomthengisi okanye ngesicelo esikhethekileyo ngokufaka ithikha “FXRL” okanye ikhowudi ye-ISIN IE00BQ1Y6480. Emva koko, faka inani elifunekayo lezabelo, isicelo siya kubonisa ngokuzenzekelayo iindleko zentengiselwano, kwaye uqinisekise ukusebenza. Ixabiso lesabelo esinye kuphela i-ruble ye-39.2, ngoko ungayithenga ngediphozithi encinci. Ngenxa yeendleko eziphantsi, kunokwenzeka ukubala ngokuchanekileyo kakhulu inani elifunekayo lezabelo zobunzima obufunekayo kwipotfoliyo.

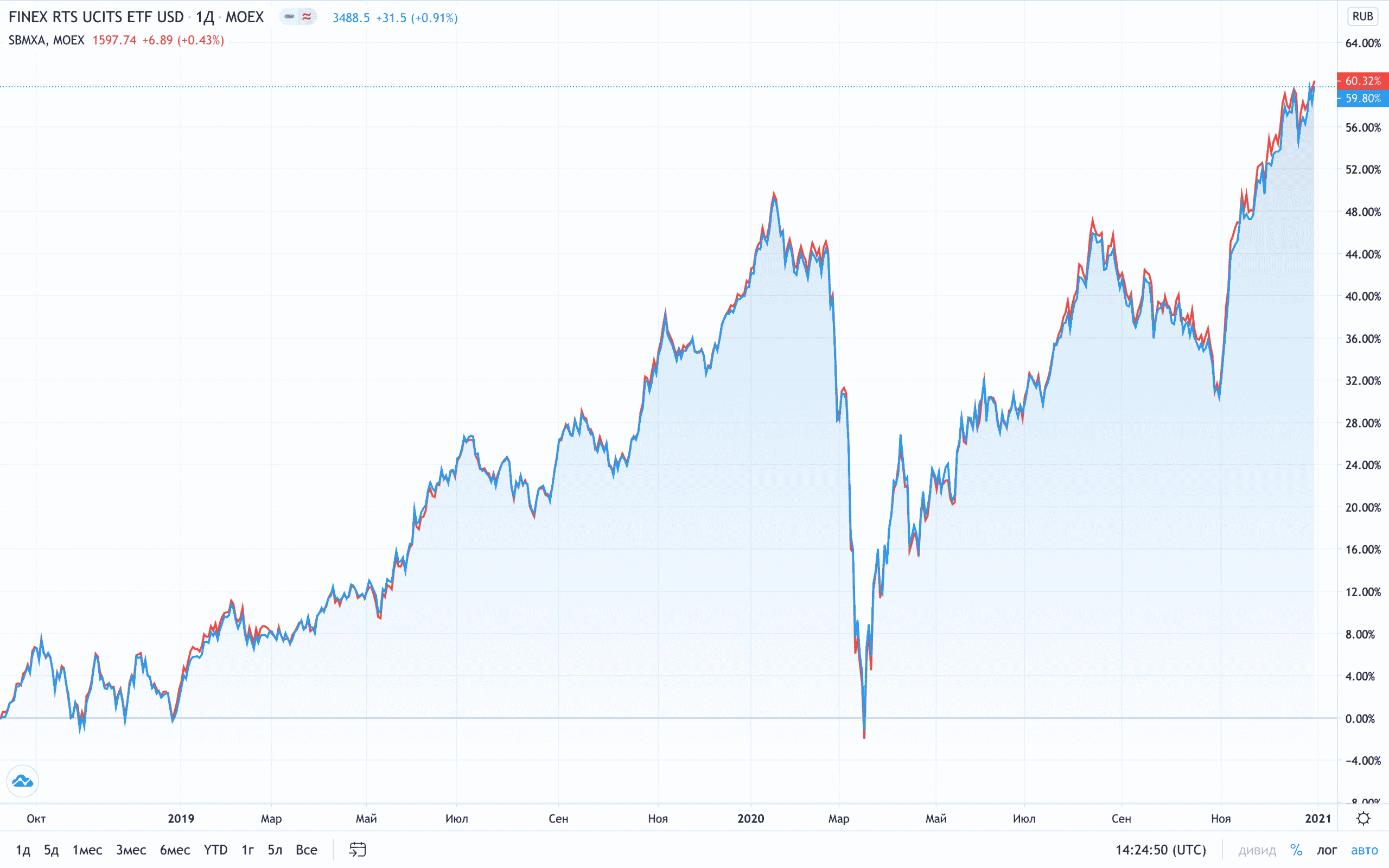

FXRL ETF imbonakalo

I-FXRL ilandela ngokuchanekileyo ibhentshi, umgangatho wolawulo lweFinex yenye yezona zinto zibalaseleyo eRashiya. Ikhomishini yengxowa-mali ithathwa njengephakamileyo kwimarike yehlabathi, kodwa eRashiya iphakathi. Le yenye yeendlela ezilungileyo zokutyala imali kuqoqosho lwaseRashiya. Nangona kunjalo, ukubanakho kotyalo-mali lwexesha elide kwi-stock market yaseRashiya kuyathandabuzeka. Utyalo-mali luphantsi kwemingcipheko yezopolitiko nezoqoqosho, iRussia ibisoloko iphantsi kwesoyikiso sezohlwayo ezinzima ukusukela ngo-2014. Imarike yemasheya yaseRussia yenye yezona zivuno ziphezulu zezahlulo kwihlabathi, kwaye isencinci kakhulu xa ithelekiswa nenzuzo yenkampani. Oku kubonisa ukuthambekela kokukhula kwithuba elingaphezu kweminyaka eyi-10.

Ezi zinto zimbini zikhokelela kwinto yokuba amaxesha okukhula okukhawulezayo athatyathelwa indawo zizilungiso ezinzulu ukuya kuthi ga kwi-25%. Ukuwa kweemarike kungenxa yeengxelo zezopolitiko malunga nezigwebo ezintsha, izisongelo zesenzo somkhosi, ukulungiswa kwimarike yase-US okanye ukuwa kwamaxabiso eoli. Le nto kufuneka ithathelwe ingqalelo xa utyala imali kwi-FXRL ETF, ungayithengi ngenyanga okanye ngekota, kodwa emva kokulungiswa okubalulekileyo. I-RTS Index yenye yezalathisi ezikhula ngokukhawuleza zehlabathi. Ukususela ekuqaleni kokurhweba kwi-1995 ukuya kwi-2022, wongezelela i-1400%. Ukuthelekisa, isalathisi se-US SP500 sexesha elifanayo sibonise ukwanda kwe-590%. Kodwa ngokungafaniyo nemarike yase-US, apho ukukhula kwitshathi yeveki kubonakala kufana nomgca kwi-angle ye-45 degrees, i-RTS isiqhwithi. Ukusukela ngoko, iRussia iye yafumana iingxaki ezininzi eziye zathoba utyalo-mali. Ukuba umtyali-mali wayethenge isalathisi se-RTS kwiindawo eziphakamileyo ngentwasahlobo ka-2008, wayengeke aphinde abuyele kwi-drawdown. ukuba awudlulisi isithuba.

Ezi zinto zimbini zikhokelela kwinto yokuba amaxesha okukhula okukhawulezayo athatyathelwa indawo zizilungiso ezinzulu ukuya kuthi ga kwi-25%. Ukuwa kweemarike kungenxa yeengxelo zezopolitiko malunga nezigwebo ezintsha, izisongelo zesenzo somkhosi, ukulungiswa kwimarike yase-US okanye ukuwa kwamaxabiso eoli. Le nto kufuneka ithathelwe ingqalelo xa utyala imali kwi-FXRL ETF, ungayithengi ngenyanga okanye ngekota, kodwa emva kokulungiswa okubalulekileyo. I-RTS Index yenye yezalathisi ezikhula ngokukhawuleza zehlabathi. Ukususela ekuqaleni kokurhweba kwi-1995 ukuya kwi-2022, wongezelela i-1400%. Ukuthelekisa, isalathisi se-US SP500 sexesha elifanayo sibonise ukwanda kwe-590%. Kodwa ngokungafaniyo nemarike yase-US, apho ukukhula kwitshathi yeveki kubonakala kufana nomgca kwi-angle ye-45 degrees, i-RTS isiqhwithi. Ukusukela ngoko, iRussia iye yafumana iingxaki ezininzi eziye zathoba utyalo-mali. Ukuba umtyali-mali wayethenge isalathisi se-RTS kwiindawo eziphakamileyo ngentwasahlobo ka-2008, wayengeke aphinde abuyele kwi-drawdown. ukuba awudlulisi isithuba.

Ukususela ngo-2008, isalathisi se-MICEX sibonise ukwanda kwe-100%. Lo mahluko ungenxa yezinga lotshintshiselwano lwemali yelizwe. Ukuqulunqwa kwazo zombini i-indices kubandakanya izabelo ezifanayo kwizabelo ezilinganayo. Kodwa izinga lotshintshiselwano ngedola ngokuchasene ne-ruble liphindwe kabini, lizinze ngokuqinileyo ngaphezulu kwama-ruble angama-75. Emva kweziganeko ze-2014, abahlalutyi abaninzi bathi i-ruble iya kuphinda ibuyele kwindawo yayo kwaye ibuyele kwi-35-45. Okwangoku, abahlalutyi bavame ukuqikelela i-ruble ezili-100 ngedola. Ndiyabulela kumgaqo-nkqubo weBhanki ePhakathi, iingcaphuno zeedola ezichasene ne-ruble ziye zancipha kakhulu ngexesha lokutshatyalaliswa. Kusekuseni kakhulu ukuthetha ngokuzinziswa kwemeko kunye nokuqala kwendlela yokuqinisa i-ruble. Ngexesha elifanayo, isalathisi se-MICEX sinokuqikelelwa ngakumbi, kuba ngokungangqalanga kuxhomekeke kwizinga lemali yelizwe. Iinkampani ezithumela ngaphandle zinyanzelekile ukuba zithathele ingqalelo. Isalathiso se-RTS asiyi kukwazi ukubonisa ukukhula okubonakalayo nangokukhula kwezabelo ze-Moscow Exchange, ukuba izinga lokutshintshiselwa kwe-ruble lifumana enye into eyothusayo. Xa uthenga i-ETF FXRL, kufuneka uvavanye ubungozi obunokwenzeka kwaye wenze i-forecast ye-dynamics yemali yelizwe, ungathenga isabelo esincinci kwi-diversification.

Ukususela ngo-2008, isalathisi se-MICEX sibonise ukwanda kwe-100%. Lo mahluko ungenxa yezinga lotshintshiselwano lwemali yelizwe. Ukuqulunqwa kwazo zombini i-indices kubandakanya izabelo ezifanayo kwizabelo ezilinganayo. Kodwa izinga lotshintshiselwano ngedola ngokuchasene ne-ruble liphindwe kabini, lizinze ngokuqinileyo ngaphezulu kwama-ruble angama-75. Emva kweziganeko ze-2014, abahlalutyi abaninzi bathi i-ruble iya kuphinda ibuyele kwindawo yayo kwaye ibuyele kwi-35-45. Okwangoku, abahlalutyi bavame ukuqikelela i-ruble ezili-100 ngedola. Ndiyabulela kumgaqo-nkqubo weBhanki ePhakathi, iingcaphuno zeedola ezichasene ne-ruble ziye zancipha kakhulu ngexesha lokutshatyalaliswa. Kusekuseni kakhulu ukuthetha ngokuzinziswa kwemeko kunye nokuqala kwendlela yokuqinisa i-ruble. Ngexesha elifanayo, isalathisi se-MICEX sinokuqikelelwa ngakumbi, kuba ngokungangqalanga kuxhomekeke kwizinga lemali yelizwe. Iinkampani ezithumela ngaphandle zinyanzelekile ukuba zithathele ingqalelo. Isalathiso se-RTS asiyi kukwazi ukubonisa ukukhula okubonakalayo nangokukhula kwezabelo ze-Moscow Exchange, ukuba izinga lokutshintshiselwa kwe-ruble lifumana enye into eyothusayo. Xa uthenga i-ETF FXRL, kufuneka uvavanye ubungozi obunokwenzeka kwaye wenze i-forecast ye-dynamics yemali yelizwe, ungathenga isabelo esincinci kwi-diversification.

Kubatyalo-mali abakholelwa ukuba imali yelizwe iya kuqinisa i-ETF FXRL yeyona ndlela ilungileyo yokutyalomali kuqoqosho lwaseRashiya.

Kubatyalo-mali abakholelwa ukuba imali yelizwe iya kuqinisa i-ETF FXRL yeyona ndlela ilungileyo yokutyalomali kuqoqosho lwaseRashiya.