Exchange robots as an auxiliary tool in trading.

Exchange robots make transactions, helping the trader to avoid emotional financial losses and make clear algorithmic decisions. A special algorithm has advantages, but is not without drawbacks. Like any computer program, a trading robot has strengths and weaknesses.

What are exchange robots

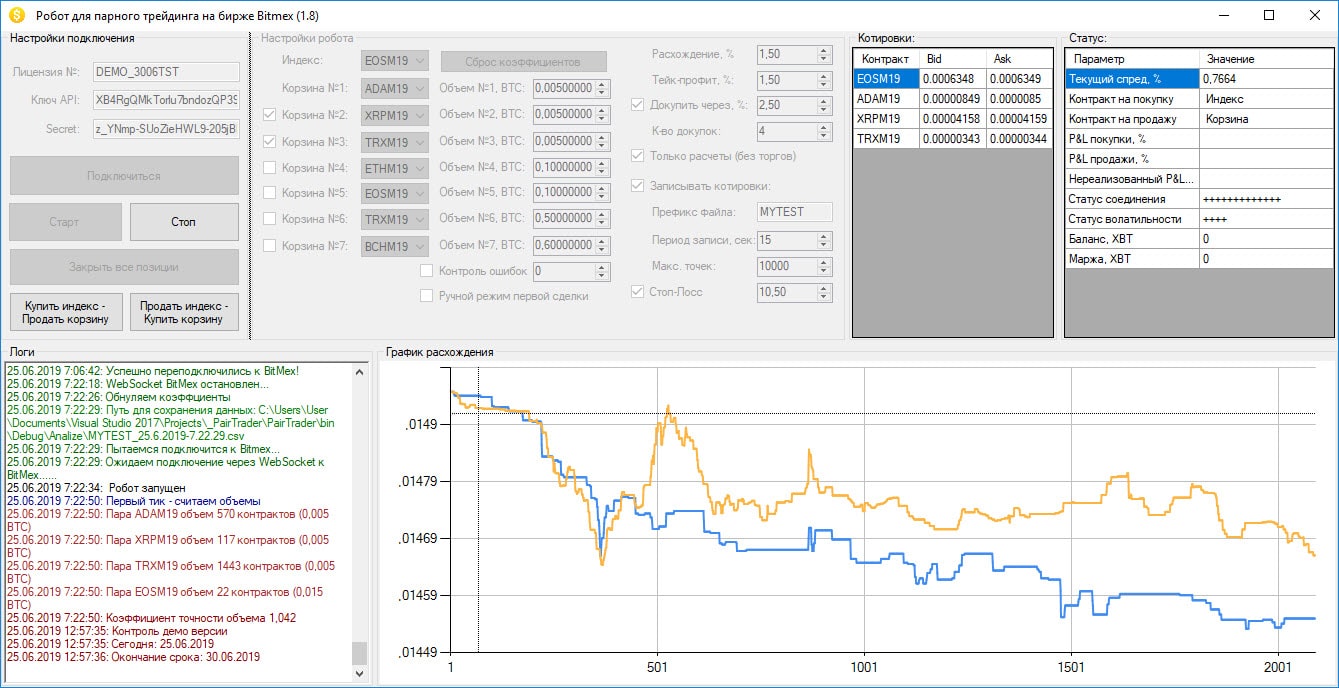

An exchange robot is a program that can make transactions on the exchange using a certain algorithm of actions. An automatic trader is able to completely replace a person, tracking important indicators necessary for making a decision. To use a specific trading bot, you need to find the official website where the robot is presented. It can be offered for free or paid. After that, a similar assistant is installed and implemented directly in the

trading terminal . Some expert advisors work automatically, for others you need to specify advanced settings. Below is just a short list of bots for algorithmic trading on forex and stock exchanges of the world (all profitability data from advertising statements).

| The name of the trading robot | Income per year | Functional | pros | Minuses |

| Yetti Godset | 140% | Universal scalper | High yield | The need for fine tuning |

| Rich Team Ringer | 127% | Simple trading bot | Increased yield | Downturns are possible |

| ZeroBot | 70% | passive income | High income | Functionality should be controlled |

| MaxBot | 19% | Automated bot | Ability to trade with a minimum deposit | High price |

| TradeMegaBot | fifteen% | Unique algorithm to work | Impressive experience | Work only in multicurrency markets |

| WTF | 33% | Robot on 3 strategies | Multifunctionality | The need for customization |

| TRD | 2% | Automated robot for the stock exchange | Can be used by newbies | small income |

| DaVinci | 3% | Automated robot for different strategies for the stock exchange | Stable work | The need to choose a strategy |

| Smart FX Bot | 6% | Forex robot | Possibility of automatic operation | Client defines settings |

| Infinity Pro | ten% | Fully automatic bot | Passive income opportunity | Unstable indicators |

| Trade Ringer | one% | Universal robot | Used on the exchange without additional help. | small income |

| Trade Fox | one% | Automated bot | Possibility of full automation | Relatively low income |

| Nixon Bot | one% | Adapted to work on the stock exchange | Easy control | No guarantee of profitability |

| skynet | 5% | Stable trading | Guaranteed Correct Settings | Careful tuning required |

| shooter | 2% | Modern approach to settings | Newbie adaptability | floating result |

| NeoFX Bot | one% | Robot for beginners and professionals | Versatility | Low rate of return |

| Quaestor | 0.5% | Great training bot | Suitable for beginners | Low probability of profit |

| Archie 2.0 | one% | Robot for flexible settings | Ability to correct work | The need to be able to configure the bot |

| RoboTrend | one% | Automated trading process | Operation without operator intervention | small profit |

| skydiver | one% | Unique opportunities for experienced professionals | Difficulty with setting | Insignificant income |

Types of exchange robots

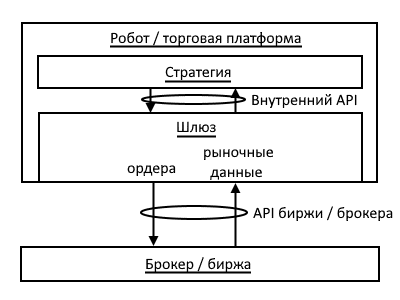

Exchange robots are of several types, depending on the functionality. The first group is represented by mechanical intermediaries. They are the link between the program module and the

exchange terminal . Written as an external program, exchange robots are connected to a deal where an order is entered. The internal programming of the terminal allows you to write a transaction import bot. For example, the Quik exchange terminal analyzes price dynamics, performs transactions with securities, and tracks changes in investments. It is the basic program popular among users, used by investors and brokers. A lot of robots are installed on it, in particular, written in LUA and

QPILE languages .

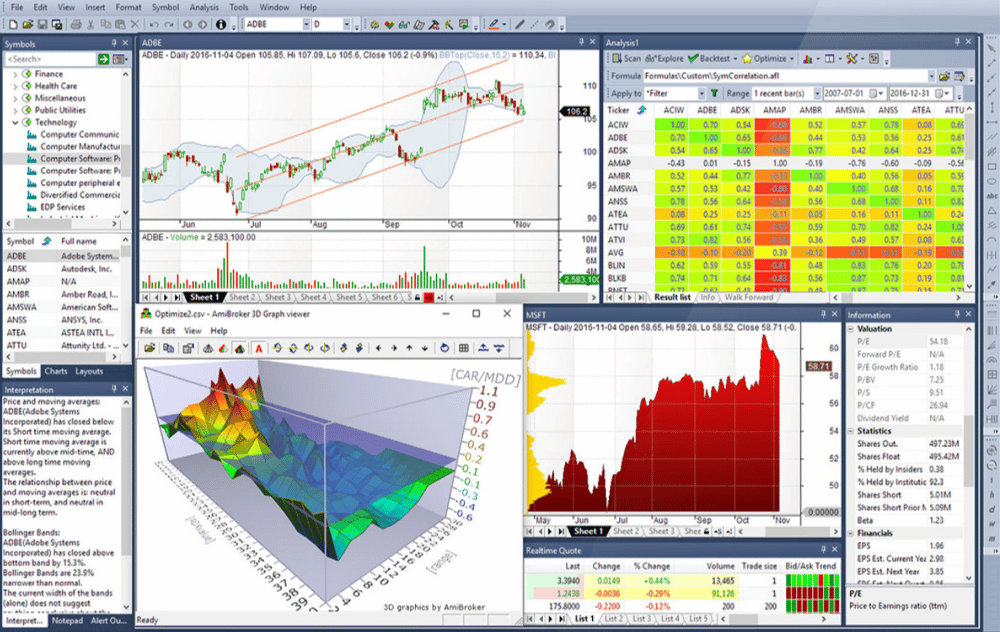

is programmedbased on technical analysis. The simplest automaton or a complex mechanism with many artificial intelligence neural systems enters one system to prompt the user. Special applications with an internal programming language show the trader or investor how to act, placing orders in the right place, indicating what to buy on the exchange market. The program must be used skillfully, without relying on a successful result in automatic mode. Complex exchange robots are prefabricated solutions that include an algorithm for generating a trading signal and transferring it to the exchange terminal. The automated process allows the user only to follow the process of the transaction, to analyze the dynamics of the trading account. At first glance, the type of robot is ideal for the job, but there is a risk of unpredictable actions, requiring human intervention. The use of exchange robots is possible within one trading session, for quick transactions. The process is characteristic of a speculative selling style involving high volume. With a deep trading process, exchange robots are used to conduct technical analysis, as an assistant in human activities. Programming a trading robot based on real-time technical analysis: https://youtu.be/JGofLCnwfXk

Does an exchange robot need a trader/investor

The use of an exchange robot provides advantages in the work of investors/traders. The automatic algorithm does not fail, is not subject to psychological pressure. He makes decisions based on mathematical calculations, objective data analysis. But not everything is as simple as it seems at first glance. According to the Moscow Exchange, the struggle for profit is carried out in conditions of fierce competition, about 60% of participants lose money, only 10% make a profit. In speculative trading, there is no stability that allows you to earn for a long time.

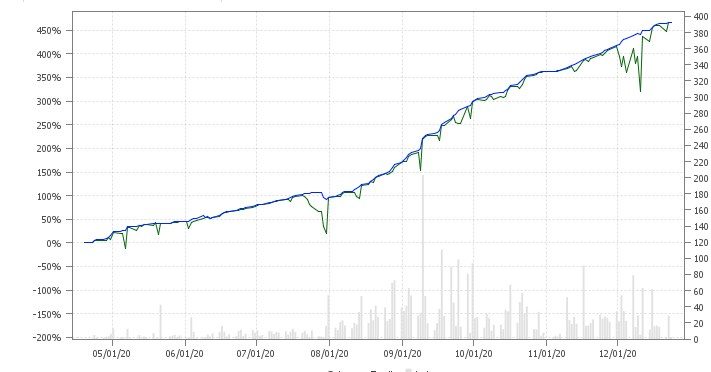

- The level of average annual profitability for the specified period.

- The decline of capital from the highest value to the lowest.

- Time period of maximum loss.

- Sharpe ratio, Sortino, using a measure of risk in the form of a negative deviation from the standard.

The performance of an exchange robot as a result of working on a live market may differ significantly from historical results. If we take a longer period as a basis, then the percentage of disagreements should not be more than 50%. Full compliance of the data is possible, which proves the existence of objective results when conducting a qualitative analysis, with the competent use of an exchange robot.

Types of trading advisors

There are the following types of bots:

- Scalping robots make several hundred trades a day. Algorithm settings allow you to automate the process, reducing time costs. The increase in profits occurs due to the number of transactions.

- Flat robots work in a flat, the trader chooses the price corridor on his own. This type involves long-term work, determining the trend with the help of indicators.

- Multicurrency robots track multiple currencies or their pairs.

- Martingale – robots add volume to low positions in order to benefit.

- Arbitrage robots monitor the quotes of several banks, identifying price gaps. They help to earn on the difference in prices, may be prohibited for brokers on the stock exchange.

- News robots are programmed to draw up a corridor according to information. Certain information about the interest rate or the construction of new facilities, the number of jobs affects the behavior of the robot in opening a long or short position in the asset market.

- Indicator robots use technical indicators: Bollinger bands , ichimoku and others.

- Indicatorless algorithms do not use indicators, they work at support or resistance levels.

- turning on or off;

- positions entered manually should not intersect with the automatic algorithm;

- the time parameter must take into account local time;

- allowable drawdown and others;

Reasons for use

The popularity of using robots is growing. This is due to a number of reasons, for example, the complexity of trading algorithms for manual control. To generate a buy signal, a deep analysis of statistical data is required, as well as the construction of probabilities for the development of events. Tracking indicator lines manually is almost impossible due to the complexity of the process, the variety of branches, and the large amount of information. All operations can be programmed by creating a trading algorithm for a robot that helps a person.

Paid and free trading bots

Most of the time-tested robots are used on a paid basis. Free algorithms are possible thanks to:

- the inexperience of the creator, who gives his product to win the image;

- testing an already proven robot in order to confirm the effectiveness of its work;

- deficiencies that have an insignificant impact on the operation of the entire system, are short in time or imply low profitability;

- payment for the product by the broker, distribution to its customers.

When choosing a trading robot, it is necessary to pay attention to possible risks based on the functionality of the program.

Pros and cons

The advantages of trading bots include the absence of emotions and feelings. Indifference, fearlessness allow you to act objectively, focusing on the given parameters. They are not characterized by the feeling of greed that arose as a result of temptations to buy more profitable, which eliminates the risk of financial losses. The most brilliant person is not able to process the amount of information that a robot can handle. The program does not get tired of long-term work, does not require reinforcements, and can trade on several sites at the same time. The disadvantages of the exchange robot include shortcomings in the basic analysis. The news algorithm is not able to take into account unforeseen factors, such as the development of a vaccine, statements by heads of state, and others. In the modern world, there is no ideal artificial intelligence that could take into account all the nuances of making transactions on the stock exchange. Users must be sure of the quality of the purchased product. Many non-licensed programs contain viruses that can cause irreparable harm. When choosing a trading robot, it is necessary to determine not only profitability, but also the degree of risk. The popularity of using algorithmic trading programs is growing. A high-quality exchange robot will help to form a portfolio if a person decides to buy assets on the exchange on his own. But it should be remembered that when drawing up a program algorithm of actions, experts took into account the scale of the activity. An exchange robot needs space, large investments for reliable forecasts.

- use of certain Internet sites;

- deposit limit;

- the development of a development strategy is based on a specific algorithm;

- settings are changed in the required sequence;

- various mechanisms of shorts, stop-losses are typical for a particular model.

Robotization occurs in the world in all branches of human activity. Market trading is changing due to the expansion of opportunities for traders that affect profits. Speculative strategies are not complete without the use of exchange robots. The use of special programs by investors makes it possible to assess the value of companies and analyze complex financial indicators. Traders use basic models when making forecasts on the stock market, monitor the account. The smart system is updated taking into account the current situation, is able to close and open transactions. Simple installation allows you to start according to the instructions or with the help of specialists. The use of exchange robots justifies itself as an auxiliary tool in trading. The trader must have a clear understanding of the operation of a particular model,