Working in the securities market, traders or investors face high risks associated with the uncertainty of further market changes. The possibility of obtaining high profits is inextricably linked with the acceptance of significant risk. In the course of work, all available measures are taken in order to reduce it. However, there is a group of companies on the stock exchange whose shares have been growing steadily for not only years, but decades. For holders of such securities, the risk of losses becomes minimal. This quality is important, but not the only one in order to classify the company as a “blue chip”. It is important that at the same time it regularly pays dividends, successfully develops the business and has some other features.

The term blue chips comes from the high-value casino chips, which are traditionally blue chips in the United States. The analogy between casino chips and the most reliable stocks of companies ends with the fact that the same color is mentioned. In most cases, such securities can be considered as the least risky exchange-traded assets.

Blue chips can be seen as market leaders in their country. In addition, they characterize the level of economic health of the state. Usually their shares are included in the index of the leading exchanges. With the growth of this indicator, they conclude that the national economy is growing steadily, and with a decrease in cost, they conclude that development is slowing down and look for its causes. Often “blue chips” are referred to the first echelon of securities, which are compared in terms of key indicators with the second and third.

- Signs of “blue chips”

- Strengths and Weaknesses of US Blue Chip Stocks

- How investors work with blue chip stocks

- American stock market blue chips – which stocks show positive dynamics at the end of 2021

- Johnson & Johnson

- Berkshire Hathaway Inc.

- JPMorgan Chase & Co

- 3M Co

- The Walt Disney Co.

- How to buy US blue chip stocks

Signs of “blue chips”

There is no exact and formal criterion that allows unequivocally assigning a company to the category under consideration. However, in most cases it is clear to everyone who the blue chips include in a particular country. In most cases, they include companies that are included in the indices of the most important exchanges in a particular country. For example, in the US we will talk about the S&P500. In most cases, blue chip firms are those with the following characteristics:

- Significant capitalization indicates a more reliable financial position of the company. Specific requirements may vary from country to country.

- Good liquidity makes it easy to buy or sell such securities. Associated with this characteristic is the free-float parameter. It expresses the volume of shares that have free circulation on the exchange market. If it is large, then this indicates the availability of securities for investors.

- Regular high daily trading volume .

- Stable financial performance over the years .

[caption id="attachment_3432" align="aligncenter" width="963"]Blue chips always have transparent reporting that is published openly. Anyone who wants to can form their own opinion about the characteristics of the business.

Strengths and Weaknesses of US Blue Chip Stocks

Working with the shares of such companies, you can enjoy the following advantages:

- You can count on their high liquidity because there is always a demand for them.

- In the case under consideration, speculators have very limited opportunities to manipulate prices.

- By working with these shares, investors in most cases receive a steady income over the years from the growth in value and due to regularly paid dividends.

- Trades use a relatively smaller spread. This makes transactions with such securities more profitable for both short-term and long-term investors.

- The stability of dividend payments allows us to expect that their value will not decrease significantly in the future, but most likely will remain at the same level or grow slightly.

- Smoother price movements reduce the risk of trading in such shares.

- Although the risks are minimal when working with them, they nevertheless exist. However, although such papers can cause losses, they are in high demand, making it easy to find buyers for them, allowing you to exit the transaction with minimal losses.

- The high demand for such shares leads to the fact that they bring insignificant profits, and also here, as a rule, they pay relatively small dividends.

- Although there is a small chance of a stock crash, it is still possible. To avoid problems of this kind, you need to carefully monitor the fundamental indicators.

- It cannot be ruled out that the company will leave the stock exchange.

It is almost unbelievable to find market events that provide explosive growth in the value of blue chip stocks. As a rule, they grow slightly, but steadily over a long period of time.

How investors work with blue chip stocks

Changes in quotes for these securities are smoother. This makes them promising for both beginners and experienced investors. To predict possible price movements, methods of both fundamental and technical analysis can be used, but the former are considered the most effective. Blue chips are especially beneficial for long-term investors. In most cases, they show long-term gradual growth and at the same time regularly pay dividends. The steady and long-term growth of the business allows us to count on its continuation in the future, however, when working with these companies, it is necessary to constantly monitor fundamental indicators. This avoids surprises (such as stock crashes), which are possible even in the case under consideration.

In portfolio investment, it is important to ensure the most rational composition of the portfolio. At the same time, it should contain a certain proportion of exceptionally reliable shares. Usually they try to keep it at the level of 30% -35%, but the exact value is determined by what type of portfolio is used.

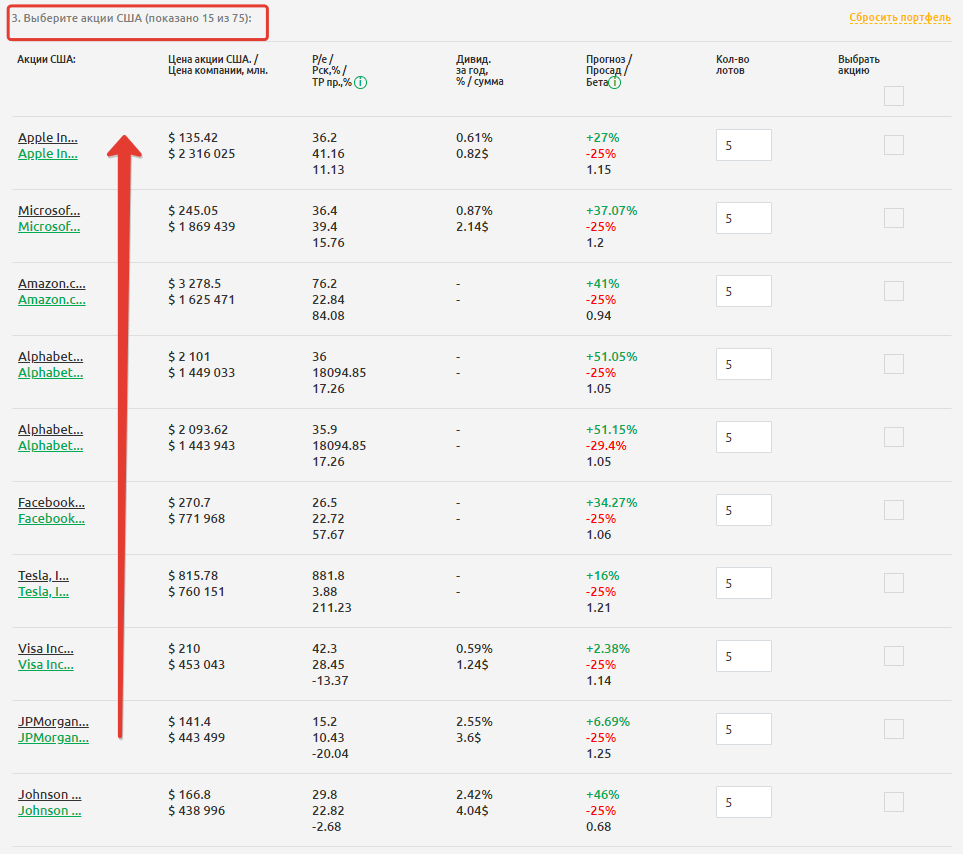

American stock market blue chips – which stocks show positive dynamics at the end of 2021

The following is a more detailed account of some of the most significant American companies that have earned the right to be considered “blue chips” by their long-term activity. Each of them is told why they are considered the most significant in the US economy. Is it worth investing in US blue chip companies: https://youtu.be/1z3EBspzAFM

Johnson & Johnson

This company is engaged in the production of goods from the consumer and medical sectors. It is known for being well diversified. The firm was founded in 1886. Now the value of its capitalization is 747 billion dollars. The three major rating agencies have given this company the highest possible AAA rating. At the same time, it should be taken into account that the government of the United States has such a rating provided by only two of them. The amount of dividends paid is 2.4% per annum. The yield per year averages 15% -16%.

Berkshire Hathaway Inc.

The capitalization of this company has reached 650 billion dollars. This investment company demonstrates high stability not only during periods of economic growth, but also during serious economic crises. Investors who purchase its shares receive a yield of 23% since the beginning of the year.

JPMorgan Chase & Co

With a capitalization of $474 billion, this bank is the largest in the United States. In the second half of the year, it showed significant growth, which is explained by the recovery of the American economy after the pandemic. At the same time, the use of debit and credit cards is growing rapidly, and the volume of loans issued is increasing. The bank demonstrated a yield of more than 24% during the year.

3M Co

This industrial giant is worth $110 billion. The company was founded in 1902 and since then has been showing growth almost all the time. During the past year, its divisions in the areas of transport, electronics and healthcare have been particularly successful. The company is known for its strategy to ensure that products manufactured in the last 4 years account for at least 30% of sales. She considers even the personal projects of employees to be important, providing at least 15% of her working time to work on them. The firm pays a dividend of 3.1%. Profitability since the beginning of the year is at the level of 13% -14%.

The Walt Disney Co.

This giant of the entertainment industry began its work in 1923. The development of the company has slowed down in recent years due to the crisis caused by the pandemic. Now she is rapidly recovering her position. For example, Disney+, ESPN+, and Hulu video services have combined subscribers to 173 million and continue to grow.

How to buy US blue chip stocks

To gain access to American blue chips, you can use the following options:

- Work with securities of the most significant US companies is available through the St. Petersburg Stock Exchange . Shares of companies included in the Dow Jones and Nasdaq indices are available here.

- If a Russian broker has a subsidiary operating on an American exchange , then you can access American trading through it.

- You can trade through a foreign broker who has access to the desired exchange.

However, it is necessary to take into account the difficulties that may arise in such trading. When buying shares of certain firms, a minimum amount may be set, which can be significant. Such a requirement reduces the availability of foreign assets. When looking to work with companies included in the index, it must be remembered that the compilation of such a portfolio may require significant investments that may exceed the ability of some investors. What are blue chips, the best blue chips of the US and Russian markets: https://youtu.be/G_WLzGbxfN4 The entire list of current US stock market blue chips can be found at: https://fin-plan.org/lk/actions_usa/all /blu/