In order to create an effective trading system, it is necessary to determine with a high probability the moment that is most favorable for entering a trade. For this purpose, the simultaneous fulfillment of two conditions is used:

- A trend has been determined, in accordance with which the price is changing now.

- A situation arises in which it is possible to enter a trade in the direction of the trend with a small stop and a good potential profit.

One of the traditional ways to determine the trend is to use the average values of a certain number of bars (candlesticks on the chart). For example, an increase in the average (SMA) of the last 24 values on an hourly chart shows the direction in which the chart has changed over the past 24 hours. The main disadvantage of such an indicator is its delay. Thus, a trader, based on his signals, can easily miss the moment that is favorable for entering into a transaction. Technical analysis tools are constantly evolving and, in particular, this has led to the emergence of a special method for calculating averages – EMA. Its difference lies in the fact that when calculating the average, the values are taken with certain weights, and the latter will have more. Thus, the average will show the presence of a trend, but its delay will be less compared to the usual average. The DEMA indicator is a further development of this idea. In this case, first, the EMA is taken from the asset price, and then from the obtained EMA values, it is taken again.

Practical use

The Double Exponential Moving Average can be used directly, but it is more commonly used as follows:

- EMA is calculated from asset price values.

- Calculate DEMA from this indicator.

- Indicator = ( 2 x EMA ) – DEMA.

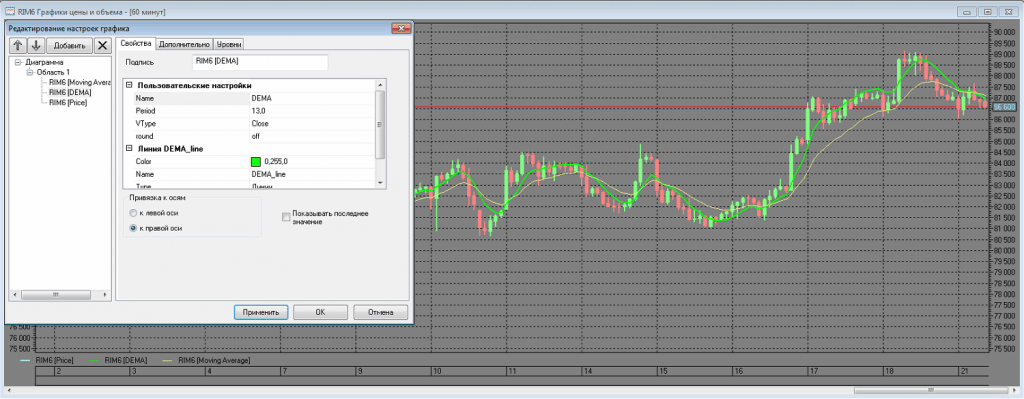

This average can also be used in other ways. Using DEMA allows you to determine the presence of a trend change in price. If the latter is above the indicator, then the trend is up; if it is below, then it is down. This method allows you to objectively evaluate the trend, but the trader needs to choose the order of the average used.

How to use DEMA and how to set it up

To use the DEMA indicator, you must select a period for it. It determines the number of last bars by which it is calculated.

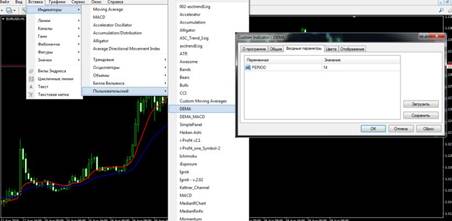

- First, the resulting archive must be unpacked.

- You need to launch Metatrader 4, then open MetaEditor.

- In the main menu, go to “File”, then click on “Open”.

- Select the unpacked DEMA indicator file and open it.

- Then click on the “Save as” line. After that, the file will be saved in the indicators directory.

- Then in Metatrader go to the “View” menu and open the navigator. In the indicator catalog, double-click on DEMA.

- After that, it appears on the chart.

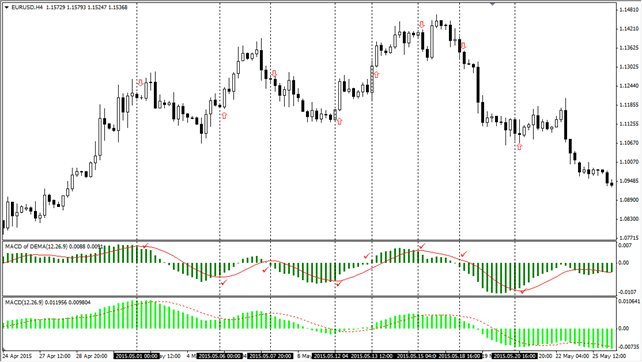

The file downloaded from the link provided here also contains the DEMA MACD indicator. It is installed as described here. The use of the indicator is explained in the attached figure. Using the DEMA MACD:

Difference from related indicators

When using DEMA, the question arises as to whether it is worth further reducing the delay of the indicator by taking EMA from this indicator again (the indicator obtained in this way is called TEMA). At the same time, it should be understood that a relatively slower change in the average helps to more accurately determine the direction of the trend change.