I-Harami – Izinti zamakhandlela zesi-Japanese ezakha iphethini ezinzile, ngokuvamile ebhekwa njengethuluzi lesibili ekuhlaziyeni ukuhlehla kwethrendi. Kodwa-ke, abalulekile lapho ufunda amashadi amanani, amavolumu kanye nokusiza ukwenza izinqumo eziphumelelayo zokuhweba. Izinti zamakhandlela zaseJapan eziyizinhlobo ezimbili:

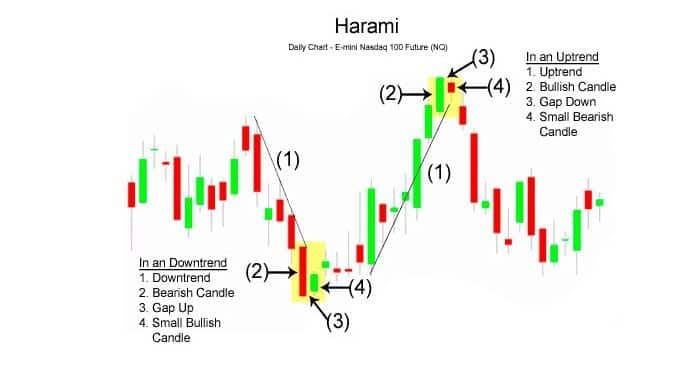

Umqondo wephethini ye-Harami

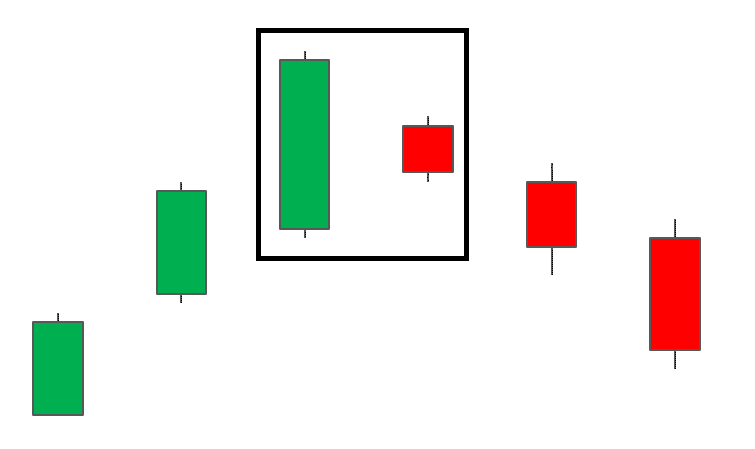

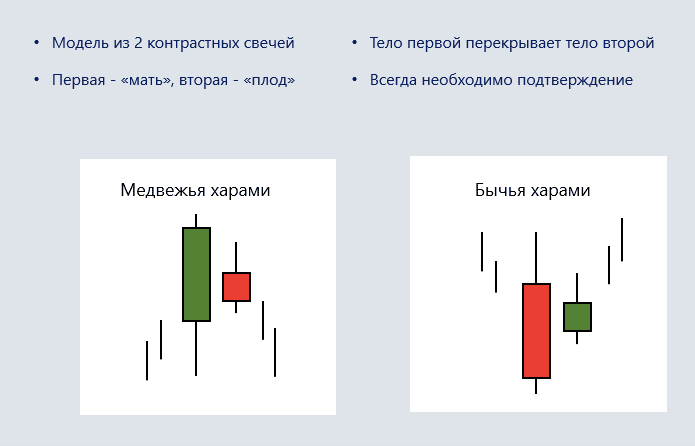

I-Harami iphethini equkethe izinti zamakhandlela zase-Japan ezi-2 ezilandelanayo. Owokuqala mkhulu kunawo wonke, owesibili unomzimba omncane ongadluli uhla lomzimba walowo odlule. Izakhi ziphambene ngombala. Uma iphethini ye-Harami ivela eshadini, ukuguqulwa kwethrendi kuyenzeka.

Igama elithi “harami” lihunyushwa lisuka ku-Japanese ngokuthi “okhulelwe”. Lokhu kubonisa ingqikithi yephethini: umzimba wekhandlela lesibili awuhambi ngaphezu komzimba wokuqala.

Iphethini yekhandlela emashadini ibonisa ukungaqiniseki kwemakethe. Ngesikhathi sokwakhiwa kwesibalo, kukhona ukungqubuzana phakathi “kwezinkunzi” kanye “namabhere”. Ukuze uqonde ukuthi yiluphi uhlangothi oluzowina, udinga ukusebenzisa amathuluzi engeziwe: amaphethini ahambisanayo nezinkomba. Kunemibandela eminingana eyisibopho ekuvumela ukuthi ubone iphethini:

- kukhona ukuthambekela okukhona okuveza ngokucacile (phezulu noma phansi);

- ikhandlela lokuqala le-Harami elakhiwe ngendlela yokuthambekela kwamanje;

- umzimba wekhandlela lesibili ungaphakathi ngokuphelele kwebanga lomzimba wokuqala;

- umzimba wesici sesibili unombala ophambene nowokuqala.

Uma okungenani isimo esisodwa singafinyelelwanga, isibalo asikwazi ukubhekwa njenge “Harami”. Ngesikhathi esifanayo, kufanele kucatshangelwe ukuthi inhlanganisela eqinile iqukethe ikhandlela elincane lesibili, ubukhulu bayo obungekho ngaphezu kwama-25% ubude besici “sikamama”.

Izinhlobo ze-Harami

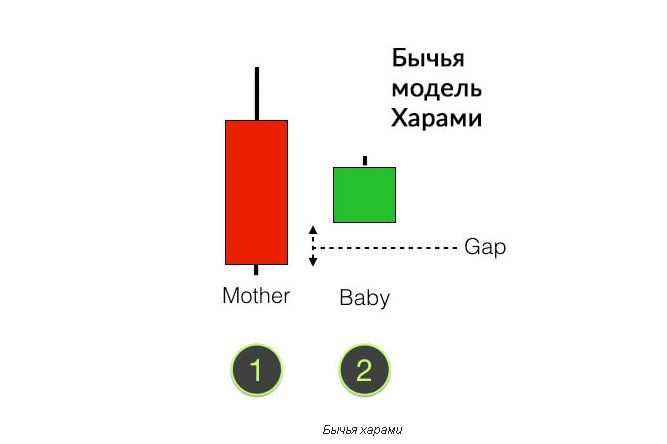

Kunezinhlobo ezi-2 zamaphethini e-Harami: i-bullish ne-bearish. I-bullish Harami isebenza njengenkomba ekhombisa amathuba aphezulu okuthi i-downtrend iyaphela. Lapho benza lesi sibalo, abatshalizimali abaningi bakhetha ukuvula izikhundla ezinde kumpahla ngokulindela ukuzuza ekukhuleni okulindelekile. Ngokungafani ne-bullish, i-bearish Harami ikhombisa ukuthi kungenzeka ukuhlehla kwe-uptrend. Ngesikhathi esifanayo, kukholelwa ukuthi ubukhulu bekhandlela lesibili bunquma amandla emodeli: encane, amathuba okushintsha kwesimo esiyinhloko.

Cross Harami

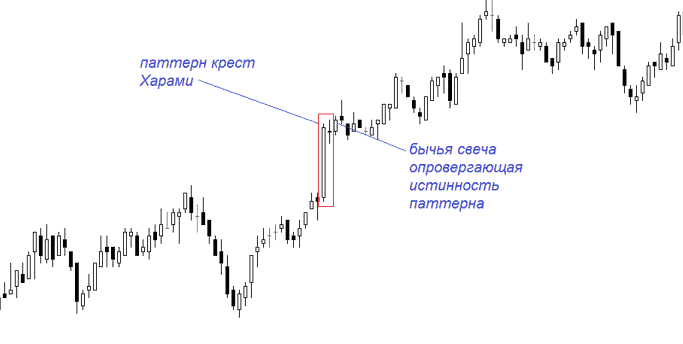

Isiphambano se-harami yokuhweba iphethini equkethe ikhandlela elikhulu elihambayo libheke kumkhuba okhona olandelwa yi-doji encane. Kulokhu, isici sesibili siqukethwe emzimbeni wokuqala. Ikhandlela lesibili laseJapan Harami Cross libizwa nangokuthi ibha yangaphakathi.

I-Doji (doji) ikhandlela, umzimba walo mncane kakhulu ngenxa yokulingana kokuvula nokuvala amanani. Kubukeka njengesiphambano, isiphambano esihlanekezelwe, noma uphawu lokuhlanganisa. Iphethini engathathi hlangothi, kodwa njengengxenye yezibalo ingabonisa izinguquko ezizayo emakethe.

I-psychology ngemuva kokwakhiwa kwe-Harami Cross ifana nokwakhiwa kwephethini evamile ye-Harami. Iphethini ye-Harami Cross nayo ingaba yi-bullish noma i-bearish. Esimweni sokuqala, kubonisa ukuguqulwa kwentengo okungenzeka kuya phezulu, okwesibili, ushintsho ekukhuphukeni.

Ukuhlaziya nokusebenzisa ekuhwebeni okungokoqobo

Isibalo singasetshenziswa njengethuluzi lokuhlaziya elizimele. Ukwenza izinqumo zokuthenga noma zokuthengisa, kwesinye isikhathi kwanele ukuqonda i-psychology yokwakheka kwephethini. Lapho wenza iphethini ye-bullish, i-algorithm elandelayo isetshenziswa:

- Ukuthenga impahla kanzima ngemva kokuba intengo ikhuphuke ngaphezu kwento yesibili ye-Harami. Kulesi simo, “i-stop” igxiliwe ezingeni elincane lekhandlela lokuqala le-bearish. Amathuba okusebenza ngephethini ancishisiwe kancane, kodwa isilinganiso esivumayo sokumisa Ukulahlekelwa / Thatha Inzuzo siyatholakala.

- Ukuthengwa kwe-Conservative kwenziwa lapho intengo ikhuphuka ngaphezu kokuphakama kwekhandlela lokuqala. I-extremum ephansi ithathwa njengeleveli ye-Stop Loss.

- Uma ukhetha isikhathi sokuqedela ukuthengiselana, baqondiswa amazinga okubuyisela we- Fibonacci , okwakhiwa ngesisekelo se-downtrend yangaphambilini.

Lapho benza iphethini ye-bearish, bahweba ngokuya nge-algorithm elandelayo:

- Bathengisa impahla ngendluzula lapho intengo ingena ngaphansi kwekhandlela elincane lephethini. I-Stop Loss isethwe kumkhawulo ongaphezulu we-elementi yokuqala ye-Harami.

- Ukuthengisa okulandelanayo kwenziwa lapho izingcaphuno ziwela ngaphansi kokuphansi kwekhandlela lokuqala, kuyilapho i-Stop Loss isethwe ezingeni eliphezulu kakhulu.

- Lapho ukhetha isikhathi sokuphuma kwezohwebo, sihlaziywa kumazinga okubuyisela we-Fibonacci akhelwe kusisekelo sokukhuphuka kwangaphambilini.

Amasu asebenzisa amathuluzi engeziwe

Iphethini yamakhandlela “Harami” ekuhwebeni ibhekwa njengesibili. Kodwa-ke, ngokuhlanganiswa nezinkomba ezihlukahlukene, kungadlala indima ebalulekile ekwenzeni isinqumo sokuhweba esiphumelelayo.

- Ukuhlaziywa kwe-Harami ne-Price Action . Ukuhlaziywa Kwesenzo Sentengo (ukuziphatha kwentengo) kusetshenziselwa ukuqinisekisa noma ukuphikisa amandla esibalo esakhiwe. Funda ngokucophelela ishadi, uzama ukuthola amaphethini engeziwe.

- Inhlanganisela yephethini namazinga e-EMA kanye ne-Fibonacci . I-exponential move average isetshenziselwa ukunquma indawo yokungena emakethe. Lapho intengo ihamba ngendlela elindelekile, amazinga e-Fibonacci ahlaziywa njalo. Isikhundla siyavalwa lapho izingcaphuno zinqamula ileveli yosekelo yokhiye noma i-EMA yeqa isiqondiso sethrendi eyinhloko.

- Ukuhweba nge-Fast Stochastic Oscillator . I-oscillator ye-stochastic esheshayo isiza ukulinganisa amathuba okwenza iphethini eqinile. Isibonelo, ukuguqulwa okulindelekile kwe-uptrend noma downtrend ngokuvamile kuqinisekiswa isignali “ye-stochastic” mayelana nempahla edayiswa kakhulu noma edayiswa ngokweqile, ngokulandelanayo.

- Ukusetshenziswa kwama-Bollinger Bands . Umhwebi uvula isikhundla uma intengo ithinta umngcele ongaphezulu noma ophansi webhendi yenkomba. Isibonelo, lapho intengo ifinyelela ezingeni eliphezulu, kuvulwa isikhundla esifushane. Yibambe kuze kube yilapho izingcaphuno zisondela emngceleni ophansi webhendi.