I-Harami – Izibane zaseJapan ezenza ipateni ezinzileyo, edla ngokuthathwa njengesixhobo sesibini ekuhlalutyeni ukuguqulwa kwendlela. Nangona kunjalo, zibalulekile xa ufunda iitshathi zexabiso, imiqulu kunye nokunceda ukwenza izigqibo ezisebenzayo zokurhweba. Iziphatho zezibane zaseJapan zeHarami zezi ntlobo zimbini:

Ingqikelelo yepateni yeHarami

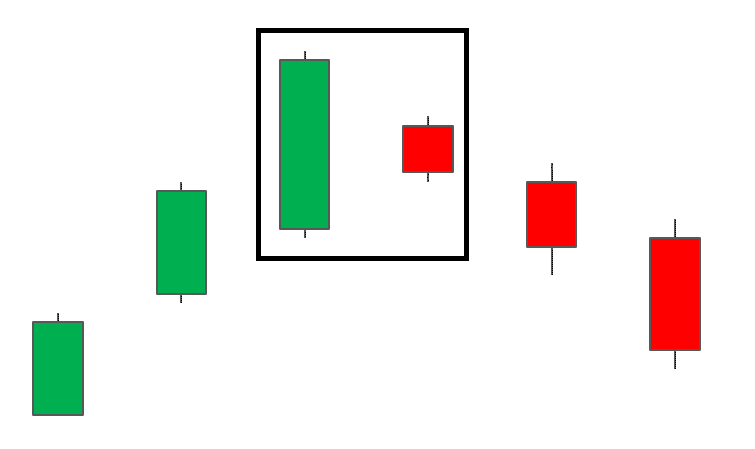

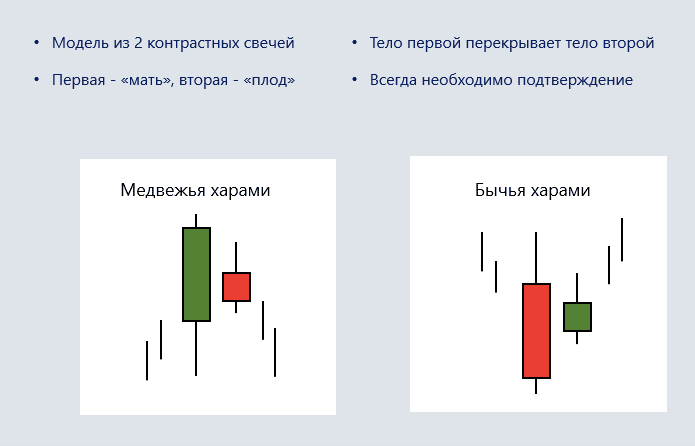

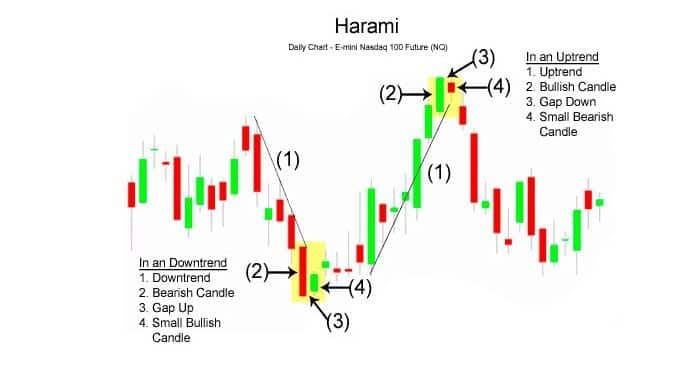

I-Harami yipatheni equka amakhandlela ama-2 alandelelanayo aseJapan. Eyokuqala ngowona mkhulu, owesibini unomzimba omncinci ongagqithiyo ngaphaya koluhlu lomzimba wangaphambili. Izinto zichasene ngombala. Xa ipateni yeHarami ibonakala kwitshathi, ukuguqulwa kwendlela kunokwenzeka.

Igama elithi “harami” liguqulelwe kwiJapan ngokuthi “ukhulelwe”. Oku kubonisa undoqo wepatheni: umzimba wekhandlela lesibini awuhambi ngaphaya komzimba wokuqala.

Ipateni yekhandlela kwiitshathi ibonisa ukungaqiniseki kweemarike. Ngethuba lokuqulunqwa komzobo, kukho ukungqubana phakathi “kweenkunzi zeenkomo” kunye “neebhere”. Ukuqonda ukuba yeyiphi icala eliya kuphumelela, kufuneka usebenzise izixhobo ezongezelelweyo: iipatheni ezihamba kunye nezikhombisi. Kukho iimeko ezininzi ezinyanzelekileyo ezikuvumela ukuba uchonge ipateni:

- kukho intsingiselo ekhoyo echazwe ngokucacileyo (ephezulu okanye ezantsi);

- ikhandlela lokuqala leHarami elenziwe kwicala lendlela yangoku;

- umzimba wekhandlela lesibini ngokupheleleyo ngaphakathi kuluhlu lomzimba wokuqala;

- umzimba wesiqalelo sesibini unombala ochasene neyokuqala.

Ukuba ubuncinci umqathango awuhlangabezwanga, ngoko umzobo awukwazi kuthathwa njenge “Harami”. Ngexesha elifanayo, kufuneka kuthathelwe ingqalelo ukuba ukudibanisa okuqinileyo kuqulethe ikhandlela elincinci lesibini, ubungakanani obungekho ngaphezu kwe-25% yobude bento “yomama”.

Iintlobo zeHarami

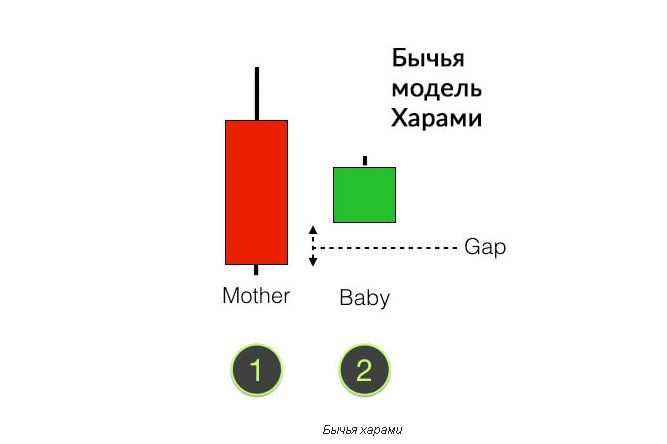

Kukho iintlobo ezi-2 zeepateni zeHarami: i-bullish kunye ne-bearish. I-bullish Harami isebenza njengesalathisi esibonisa ukuba kunokwenzeka ukuba i-downtrend iyaphela. Xa kusenziwa eli nani, abatyali-mali abaninzi bakhetha ukuvula izikhundla ezinde kwi-asethi kunye nokulindela inzuzo ekukhuleni okulindelekileyo. Ngokungafaniyo ne-bullish, i-bearish Harami ibonisa ukubakho kokuguqulwa kwe-uptrend. Ngelo xesha, kukholelwa ukuba ubungakanani bekhandlela lesibini bumisela amandla omzekelo: incinci, iphezulu amathuba okutshintsha kwindlela ehamba phambili.

Ukuwela iHarami

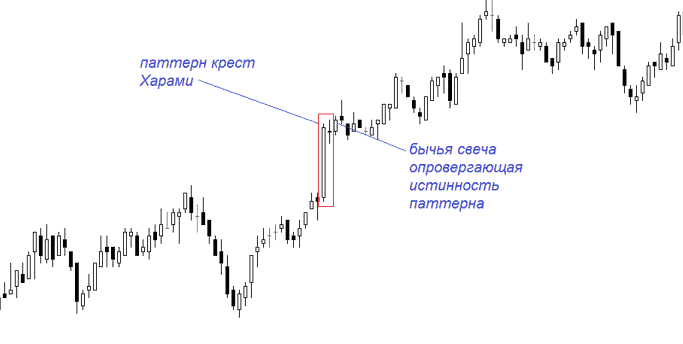

Umnqamlezo we-harami wokurhweba yipatheni equkethe ikhandlela elikhulu elihambayo kwicala lendlela ehamba phambili elandelwa yi-doji encinci. Kule meko, into yesibini iqulethwe kumzimba wokuqala. Ikhandlela lesibini laseJapan Harami Cross likwabizwa ngokuba yibar yangaphakathi.

I-Doji (i-doji) likhandlela, umzimba walo mncinci kakhulu ngenxa yokulingana kwamaxabiso okuvula nokuvala. Ijongeka njengomnqamlezo, umnqamlezo oguqulweyo, okanye uphawu lokudibanisa. Yipateni engathathi hlangothi, kodwa njengenxalenye yamanani athile angabonisa utshintsho oluzayo kwimarike.

Ingqondo emva kokubunjwa kweHarami Cross ifana nokuqulunqwa kwepateni eqhelekileyo yeHarami. Ipateni ye-Harami Cross inokuba yi-bullish okanye i-bearish. Kwimeko yokuqala, ibonisa ukuguqulwa kwexabiso elinokwenzeka ukuya phezulu, okwesibini, utshintsho kwi-uptrend.

Uhlalutyo kunye nokusetyenziswa kurhwebo olusebenzayo

Umzobo unokusetyenziswa njengesixhobo sokuhlalutya esizimeleyo. Ukwenza izigqibo zokuthenga okanye zokuthengisa, ngamanye amaxesha kwanele ukuqonda i-psychology yokwakheka kwepateni. Xa usenza ipateni ye-bullish, le algorithm ilandelayo isetyenziswa:

- Ukuthenga i-asethi ngokukhawuleza emva kokuba ixabiso linyuke ngaphezu kwendawo ephakamileyo yesibini ye-Harami element. Kule meko, “i-stop” igxininiswe kwinqanaba lomncinci wekhandlela lokuqala le-bearish. Amathuba okusebenza ngaphandle kwepateni ancitshiswe kancinane, kodwa umlinganiselo ofanelekileyo we-Stop Loss / Thatha iNzuzo ufunyenwe.

- Ukuthengwa kwe-Conservative kwenziwa xa ixabiso likhuphuka ngaphezu kwekhandlela lokuqala. I-extremum esezantsi ithathwa njengenqanaba lokumisa ilahleko.

- Xa ukhetha umzuzu wokugqiba ukuthengiselana, zikhokelwa ngamanqanaba okubuyisela iFibonacci , eyakhiwe ngesiseko se-downtrend yangaphambili.

Xa besenza ipateni ye-bearish, barhweba ngokwe-algorithm ilandelayo:

- Bathengisa ngokugqithiseleyo i-asethi xa ixabiso lihamba ngaphantsi kwekhandlela elincinci lepatheni. Misa ilahleko isetiwe kwindawo engaphezulu yento yokuqala yeHarami.

- Ukuthengiswa kwe-Conservative kuqhutyelwa xa iingcaphuno ziwela ngaphantsi kwekhandlela eliphantsi, ngelixa i-Stop Loss ibekwe kubuninzi bayo.

- Xa ukhetha umzuzu wokuphuma kwintengiso, ihlalutywa kumanqanaba okubuyisela i-Fibonacci eyakhelwe kwisiseko se-uptrend yangaphambili.

Amaqhinga usebenzisa izixhobo ezongezelelweyo

Ipateni yekhandlela “Harami” ekurhwebeni ithathwa njengesibini. Nangona kunjalo, ngokudibanisa nezalathisi ezahlukeneyo, inokudlala indima ebalulekileyo ekwenzeni isigqibo esisebenzayo sokurhweba.

- Uhlalutyo lweHarami kunye neNtlawulo yeXabiso . Uhlalutyo lwesenzo sexabiso (ukuziphatha kwexabiso) kusetyenziselwa ukuqinisekisa okanye ukuchasa amandla omfanekiso owenziweyo. Funda ngokucophelela itshathi, uzama ukufumana iipatheni ezongezelelweyo.

- Ukudibanisa ipateni kunye namanqanaba e-EMA kunye neFibonacci . I-exponential move average isetyenziselwa ukumisela indawo yokungena kwimarike. Xa ixabiso lihamba kwicala elilindelekileyo, amanqanaba eFibonacci ahlalutywa rhoqo. Isikhundla sivaliwe xa iingcaphuno ziqhekeza kwinqanaba eliphambili lokuxhasa okanye i-EMA iwela ulwalathiso lwendlela ehamba phambili.

- Ukurhweba nge-Fast Stochastic Oscillator . I-oscillator ye-stochastic ekhawulezayo inceda ukuqikelela ukuba kunokwenzeka ukwenza iphethini eyomeleleyo. Umzekelo, ukuguqulwa okulindelweyo kwe-uptrend okanye i-downtrend kaninzi kuqinisekiswa ngumqondiso “westochastic” malunga ne-asethi ethengiswa kakhulu okanye ethengiswa kakhulu, ngokulandelelanayo.

- Ukusetyenziswa kweeBands zeBollinger . Umrhwebi uvula isikhundla ukuba ixabiso lithinta umda ophezulu okanye ophantsi webhanti yesalathisi. Ngokomzekelo, xa ixabiso lifikelela kwinqanaba eliphezulu, indawo emfutshane ivuliwe. Yibambe de iingcaphuno zisondele kumda ongezantsi webhendi.