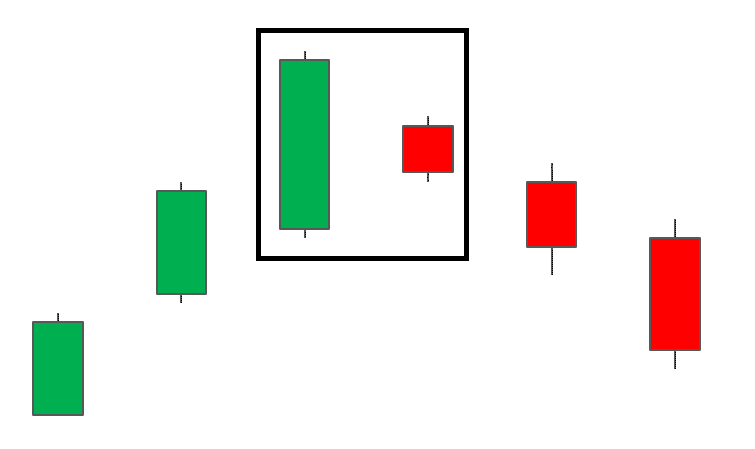

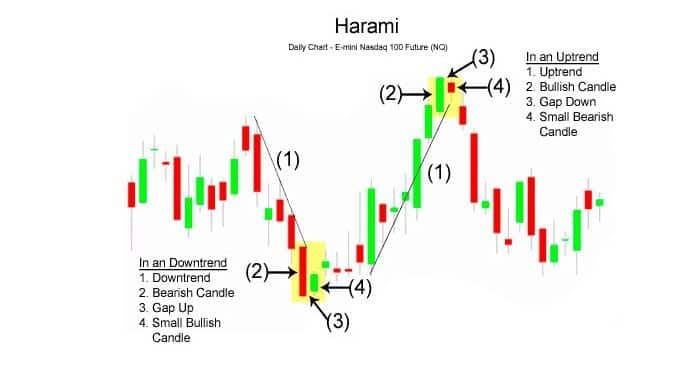

Harami – Sandunan kyandir na Jafananci waɗanda ke samar da tsayayyen tsari, wanda galibi ana ɗaukarsa kayan aiki na biyu a cikin nazarin abubuwan da ke faruwa. Duk da haka, suna da mahimmanci lokacin karanta sigogin farashin, ƙididdiga da kuma taimakawa wajen yanke shawarar ciniki mafi inganci. Hannun kyandir ɗin Jafananci na Harami iri biyu ne: [taken magana id = “abin da aka makala_13388″ align=”aligncenter” nisa = “695”]

Tunanin tsarin Harami

Harami wani tsari ne wanda ya kunshi fitulun Jafanawa guda 2 a jere. Na farko shine mafi girma, na biyu yana da karamin jiki wanda ba ya wuce iyakar jikin da ya gabata. Abubuwan sun saba da launi. Lokacin da tsarin Harami ya bayyana akan ginshiƙi, ana iya samun koma baya.

An fassara kalmar “harami” daga Jafananci a matsayin “mai ciki”. Wannan yana nuna ainihin ma’anar: jikin kyandir na biyu ba ya wuce jikin na farko.

Tsarin fitilar a kan ginshiƙi yana nuna rashin yanke shawara na kasuwa. A lokacin da aka kafa adadi, ana fuskantar adawa tsakanin “bijimai” da “bear”. Don fahimtar wane gefen zai yi nasara, kuna buƙatar amfani da ƙarin kayan aiki: rakiyar alamu da alamu. Akwai wasu sharuɗɗa na wajibi da yawa waɗanda ke ba ku damar gano ƙirar:

- akwai yanayin da aka bayyana a sarari (a sama ko ƙasa);

- kyandir na farko na Harami ya samo asali a cikin al’amuran yau da kullum;

- jikin kyandir na biyu gaba daya yana cikin kewayon jikin na farko;

- jikin kashi na biyu yana da launin sabanin na farko.

Idan aƙalla sharadi ɗaya ba a cika ba, to ba za a iya la’akari da adadi “Harami”. A lokaci guda, ya kamata a la’akari da cewa haɗin gwiwa mai karfi ya ƙunshi ƙananan kyandir na biyu, wanda girmansa bai wuce 25% na tsawon “mahaifin” kashi ba.

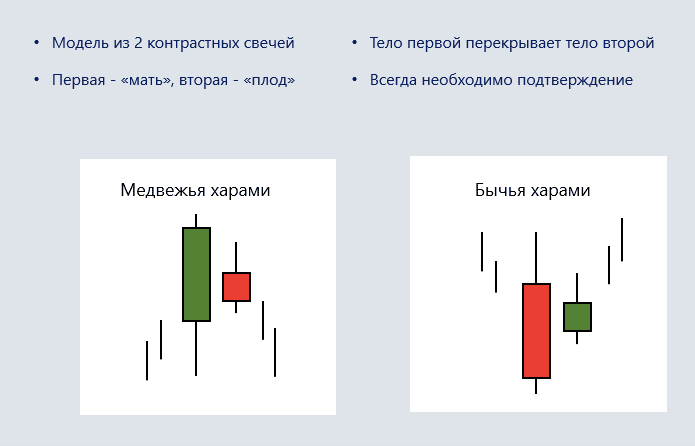

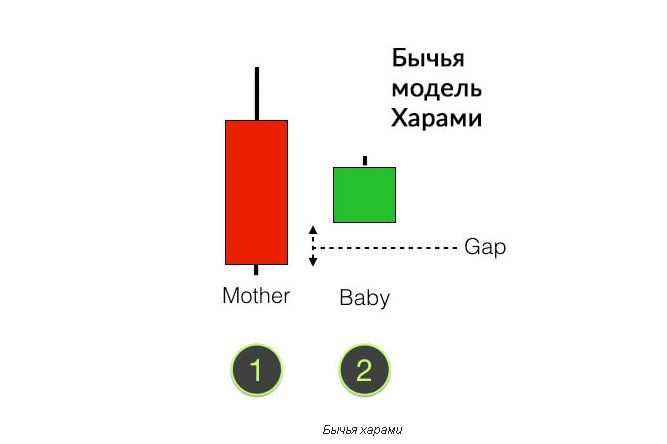

Nau’in Harami

Akwai nau’ikan nau’ikan nau’ikan Harami guda biyu: buguwa da kaushi. Harami mai girman kai yana aiki a matsayin manuniya da ke nuna babban yuwuwar cewa koma baya ya ƙare. Lokacin da aka kafa wannan adadi, yawancin masu zuba jari sun fi son bude matsayi mai tsawo a kan kadari tare da tsammanin samun riba daga ci gaban da ake sa ran. Ba kamar tashin hankali ba, Harami mai ɗaure yana nuna yuwuwar juye juye. A lokaci guda, an yi imanin cewa girman kyandir na biyu yana ƙayyade ƙarfin samfurin: ƙarami, mafi girman yiwuwar canji a cikin babban yanayin.

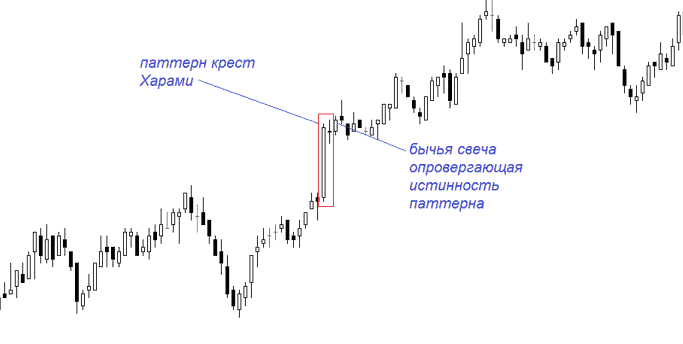

Cross Harami

Gicciyen harami na kasuwanci wani tsari ne wanda ya ƙunshi babban kyandir wanda ke tafiya a cikin al’amuran da aka fi sani da ƙaramin doji. A wannan yanayin, kashi na biyu yana ƙunshe a cikin jikin na farko. Hakanan ana kiran fitilar Haram ta Jafananci ta biyu mashaya ta ciki.

Doji (doji) kyandir ne, wanda jikinsa yayi kankanta sosai saboda daidaiton farashin budewa da rufewa. Yana kama da giciye, giciye mai jujjuyawa, ko alamar ƙari. Tsari ne na tsaka tsaki, amma a matsayin wani ɓangare na wasu alkaluma yana iya nuna alamun canje-canje masu zuwa a kasuwa.

Ilimin halayyar da aka kafa ta Harami Cross ya yi kama da samar da daidaitattun tsarin Harami. Tsarin Harami Cross kuma yana iya zama mai ɗorewa ko ɓacin rai. A cikin yanayin farko, yana nuna alamar yuwuwar komawar farashin sama, a cikin na biyu, canji a cikin haɓakawa.

Analysis da aikace-aikace a m ciniki

Ana iya amfani da adadi azaman kayan aikin bincike na tsaye. Don yanke shawara na siye ko siyarwa, wani lokacin ya isa ya fahimci ilimin halin ɗan adam na ƙirar ƙira. Lokacin ƙirƙirar ƙirar bullish, ana amfani da algorithm mai zuwa:

- Siyan kadara da zage-zage bayan farashin ya tashi sama da mafi girman kashi na biyu na Harami. A wannan yanayin, an daidaita “tsayawa” a matakin mafi ƙarancin kyandir bearish na farko. Yiwuwar yin aiki da tsarin an ɗan rage kaɗan, amma ana samun madaidaicin Tsaida Asarar / Take Riba.

- Ana yin sayayya masu ra’ayin mazan jiya lokacin da farashin ya tashi sama da tsayin kyandir na farko. Ana ɗaukar ƙananan ƙarshen a matsayin matakin Dakatar da Asara.

- Lokacin zabar lokacin da za a kammala ma’amala, ana jagorantar su ta hanyar Fibonacci matakan retracement , wanda aka gina akan tushen baya na baya.

Lokacin ƙirƙirar ƙirar bearish, suna kasuwanci bisa ga algorithm mai zuwa:

- Suna sayar da kadari da ƙarfi lokacin da farashin ke ƙasa da ƙarancin ƙaramin kyandir na ƙirar. Tsaya hasara an saita shi a gefen sama na kashi na farko na Harami.

- Ana gudanar da tallace-tallace na ra’ayin mazan jiya lokacin da ƙididdiga suka faɗi ƙasa da ƙarancin kyandir na farko, yayin da aka saita Tsaida Loss a iyakarta.

- Lokacin zabar lokacin da za a fita kasuwanci, ana nazarin shi don matakan dawo da Fibonacci da aka gina akan haɓakar da ta gabata.

Dabaru ta amfani da ƙarin kayan aiki

Tsarin fitilar “Harami” a cikin ciniki ana ɗaukarsa na biyu. Duk da haka, a hade tare da daban-daban Manuniya, zai iya taka muhimmiyar rawa wajen yin tasiri ciniki yanke shawara.

- Binciken Ayyukan Harami da Farashin . Ana amfani da nazarin Ayyukan Farashi (halayen farashi) don tabbatarwa ko karyata ƙarfin adadi da aka kafa. Yi nazarin ginshiƙi a hankali, ƙoƙarin nemo ƙarin alamu.

- Haɗin ƙirar tare da EMA da matakan Fibonacci . Ana amfani da matsakaicin motsi mai ma’ana don tantance wurin shiga kasuwa. Lokacin da farashin ke motsawa a cikin hanyar da ake sa ran, ana nazarin matakan Fibonacci akai-akai. Matsayin yana rufe lokacin da ƙididdiga suka karya ta matakin maɓalli na tallafi ko EMA ta ketare alkiblar babban yanayin.

- Ciniki tare da Fast Stochastic Oscillator . Mai saurin oscillator na stochastic yana taimakawa wajen kimanta yuwuwar samar da tsari mai ƙarfi. Misali, ana iya tabbatar da juyar da ake tsammani na haɓakawa ko ƙasa ta hanyar siginar “stochastic” game da kadari da aka yi sama da ɗorewa ko aka yi da yawa, bi da bi.

- Aikace-aikacen Bollinger Bands . Mai ciniki yana buɗe matsayi idan farashin ya taɓa iyakar babba ko ƙasa na ƙungiyar mai nuna alama. Misali, lokacin da farashin ya kai matakin sama, an buɗe ɗan gajeren matsayi. Riƙe shi har sai fa’idodin sun kusanci ƙananan iyakar band ɗin.