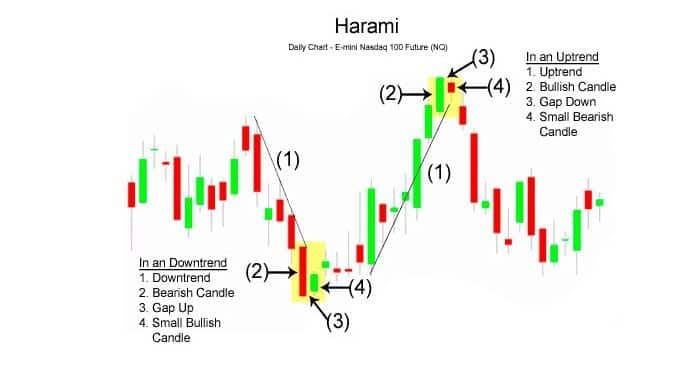

Harami – Japanfo kyɛnere a ɛyɛ nsusuwii a ɛyɛ den, a wɔtaa bu no sɛ adwinnade a ɛto so abien wɔ nhwehwɛmu a wɔyɛ wɔ su bi a ɛdannan ho mu. Nanso, ɛho hia bere a wokenkan bo ho nhyehyɛe, dodow ne boa ma wosisi aguadi ho gyinae a etu mpɔn kɛse no. Harami Japanfo kyɛnere no yɛ ahorow abien:

Adwene a ɛfa Harami nhwɛso no ho

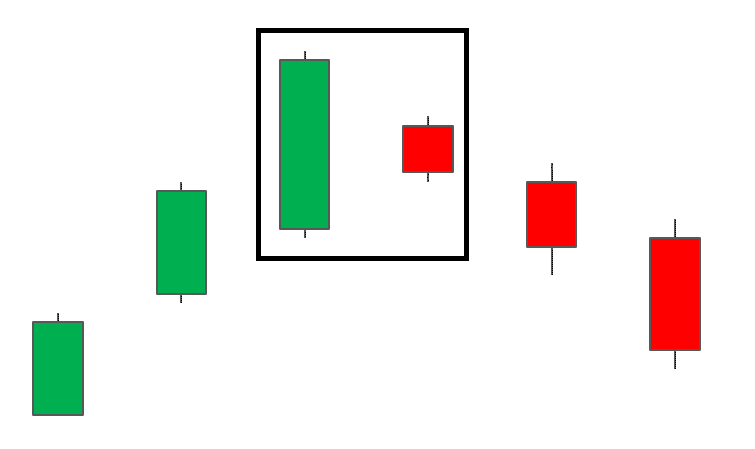

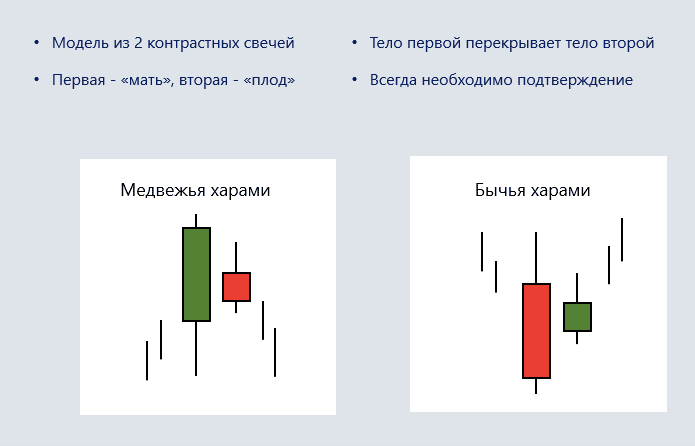

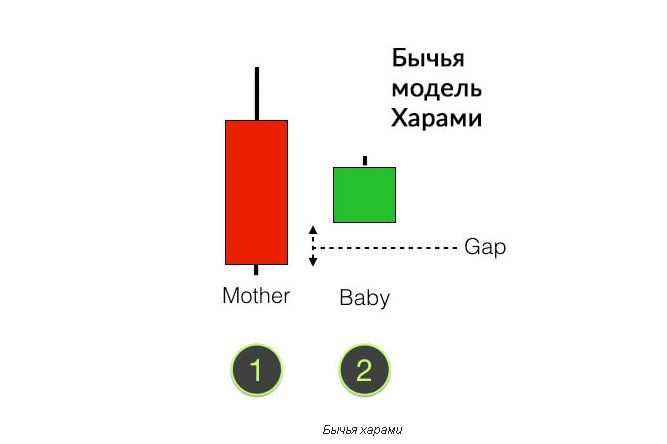

Harami yɛ nhwɛsode a Japanfo kyɛnere 2 a ɛtoatoa so wom. Nea edi kan no ne nea ɛsõ sen biara, nea ɛto so abien no wɔ nipadua ketewaa bi a ɛnkɔ akyiri nsen nea edi kan no nipadua no. Nneɛma a ɛwom no kɔla bɔ abira. Sɛ Harami nhwɛso bi pue wɔ nhyehyɛe no so a, ebetumi aba sɛ wɔbɛdan nea ɛrekɔ so no.

Wɔkyerɛ asɛmfua “harami” ase fi Japan kasa mu sɛ “nyinsɛn”. Eyi da nhwɛso no mu ade titiriw adi: kyɛnere a ɛto so abien no nipadua nkɔ akyiri nsen nea edi kan no nipadua no.

Kanea a wɔde ayɛ nhyehyɛe a ɛwɔ nhyehyɛe ahorow no so no kyerɛ sɛnea gua no ntumi nsi gyinae. Wɔ bere a wɔhyehyɛɛ mfonini no, akasakasa bi wɔ “anantwinini” ne “asono” ntam. Sɛ wobɛte ɔfã a ɛbɛdi nkonim ase a, ɛsɛ sɛ wode nnwinnade afoforo di dwuma: nhwɛso ne nsɛnkyerɛnne a ɛka ho. Tebea ahorow pii wɔ hɔ a ɛyɛ ahyɛde a ɛma wutumi hu nhwɛso no:

- su bi a ɛda adi pefee wɔ hɔ a ɛwɔ hɔ (a ɛkɔ soro anaasɛ ɛkɔ fam);

- Harami kyɛnere a edi kan a wɔhyehyɛe wɔ mprempren su no kwankyerɛ so;

- kyɛnere a ɛto so abien no nipadua no wɔ nea edi kan no nipadua no mu koraa;

- ade a ɛto so abien no nipadua no wɔ kɔla a ɛne nea edi kan no bɔ abira.

Sɛ anyɛ yiye koraa no, wɔantumi anni tebea biako ho dwuma a, ɛnde wontumi mmu akontaabu no sɛ “Harami”. Bere koro no ara mu no, ɛsɛ sɛ wosusuw ho sɛ nkabom a ɛyɛ den no kura kyɛnere ketewaa bi a ɛto so abien, a ne kɛse ntra “ɛna” element no tenten 25%.

Harami ahorow

Harami nhwɛso ahorow 2 na ɛwɔ hɔ: bullish ne bearish. Harami a ɛyɛ bullish no som sɛ sɛnkyerɛnne a ɛkyerɛ sɛ ɛbɛyɛ yiye sɛ downtrend no reba awiei. Sɛ wɔrehyehyɛ akontaabu yi a, sikakorafo pii pɛ sɛ wobue gyinabea tenten wɔ agyapade no so a wɔhwɛ kwan sɛ wobenya mfaso afi nkɔso a wɔhwɛ kwan no mu. Nea ɛnte sɛ bullish, bearish Harami kyerɛ sɛ ebetumi aba sɛ uptrend reversal. Bere koro no ara mu no, wogye di sɛ kyɛnere a ɛto so abien no kɛse na ɛkyerɛ sɛnea nhwɛso no mu yɛ den: dodow a ɛyɛ ketewaa no, dodow no ara na nsakrae a ɛbɛba wɔ adeyɛ titiriw no mu no yɛ kɛse.

Mmeamudua Harami

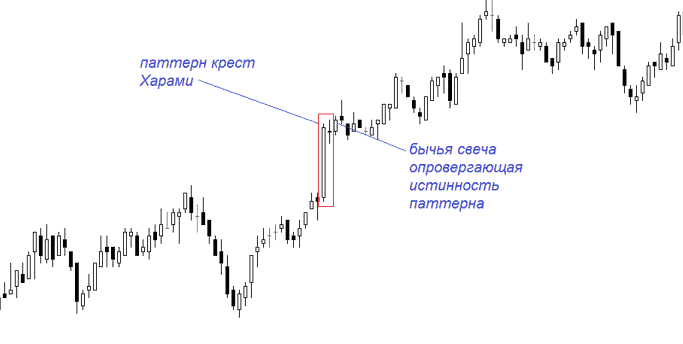

Harami mmeamudua a wɔde di gua yɛ nhwɛso a ɛyɛ kyɛnere kɛse bi a ɛkɔ ɔkwan a ɛkɔ so wɔ hɔ no kwan so a doji ketewaa bi di akyi. Wɔ eyi mu no, ade a ɛto so abien no wɔ nea edi kan no nipadua mu. Wɔsan frɛ Japanfo Harami Mmeamudua kyɛnere a ɛto so abien no sɛ bar a ɛwɔ mu.

Doji (doji) yɛ kyɛnere, a ne nipadua no sua koraa esiane sɛ nneɛma bo a wɔde bue ne nea wɔde to mu no yɛ pɛ nti. Ɛte sɛ mmeamudua, mmeamudua a wɔadan no akyi, anaasɛ sɛnkyerɛnne a wɔde ka ho. Ɛyɛ nhyehyɛe a ɛnyɛ afã biara, nanso sɛ́ akontaabu ahorow bi fã no ebetumi akyerɛ nsakrae a ɛreba wɔ gua so.

Adwene ne nneyɛe ho nimdeɛ a ɛwɔ Harami Mmeamudua no a wɔhyehyɛe no akyi no te sɛ nea wɔhyehyɛɛ Harami nhyehyɛe a ɛwɔ hɔ no. Harami Mmeamudua nhwɛso no nso betumi ayɛ bullish anaasɛ bearish. Wɔ nea edi kan no mu no, ɛkyerɛ sɛ ebetumi aba sɛ nneɛma bo bɛdan akɔ soro, wɔ nea ɛto so abien no mu no, ɛkyerɛ nsakrae a ɛba wɔ ɔkwan a ɛkɔ soro no mu.

Analysis ne dwumadie wɔ practical aguadi mu

Wobetumi de akontaabu no adi dwuma sɛ adwinnade a wɔde hwehwɛ nneɛma mu a egyina hɔ ma ne ho. Sɛ wobɛsi adetɔ anaa tɔn ho gyinae a, ɛtɔ mmere bi a ɛdɔɔso sɛ wobɛte adwene a ɛfa nhwɛso ahorow a wɔhyehyɛ ho no ase. Sɛ woreyɛ bullish pattern a, wɔde algorithm a edidi so yi na edi dwuma:

- Aggressively tɔ agyapade bi bere a ne bo kɔ soro sen Harami element a ɛto so abien no sorokɔ. Wɔ eyi mu no, “gyina” no yɛ fixed wɔ level a minimum a edi kan bearish kyɛnere no. Nneɛma a ebetumi aba sɛ wɔbɛyɛ nhyehyɛe no ho adwuma no so tew kakra, nanso wonya Stop Loss / Take Profit ratio a eye.

- Wɔtɔ nneɛma a wɔde di dwuma wɔ ɔkwan a ɛyɛ katee so bere a ne bo kɔ soro sen kyɛnere a edi kan no kɛse no. Wɔfa extremum a ɛwɔ fam no sɛ level ma Stop Loss.

- Sɛ wɔpaw bere a wɔde bewie asɛm no a, wɔkyerɛ wɔn kwan denam Fibonacci retracement levels , a wɔasisi a egyina kan asehwe no so.

Sɛ wɔreyɛ bearish pattern a, wɔyɛ aguadi sɛnea algorithm a edidi so yi kyerɛ:

- Wɔde ahoɔhare tɔn agyapade no bere a ne bo kɔ fam sen kyɛnere ketewa a ɛwɔ nhwɛso no mu no. Wɔde Stop Loss ato Harami element a edi kan no atifi fam.

- Wɔyɛ Conservative tɔn bere a quotes kɔ fam sen kyɛnere a edi kan no fam, bere a wɔde Stop Loss si nea ɛsen biara no so.

- Sɛ wɔpaw bere a ɛsɛ sɛ wofi aguadi bi mu a, wɔyɛ ho nhwehwɛmu ma Fibonacci retracement levels a wɔasisi no gyina kan uptrend no so.

Akwan a wɔfa so de nnwinnade afoforo di dwuma

Wobu kyɛnere nhyehyɛe “Harami” wɔ aguadi mu sɛ ɛyɛ nea ɛto so abien. Nanso, sɛ wɔde nsɛnkyerɛnne ahorow ka ho a, ebetumi adi dwuma titiriw wɔ aguadi ho gyinaesi a etu mpɔn mu.

- Harami ne Bo Ho Adeyɛ Ho Nhwehwɛmu . Boɔ Adeyɛ nhwehwɛmu (bo suban) na wɔde si so dua anaasɛ ɛbɔ ahoɔden a ɛwɔ akontabuo a wɔahyehyɛ no mu. Sua nhyehyɛe no yiye, na bɔ mmɔden sɛ wubehu nhwɛso afoforo.

- Nhwɛsode a wɔde ka bom ne EMA ne Fibonacci dodow . Wɔde exponential moving average di dwuma de kyerɛ baabi a wɔbɛhyɛn gua no so. Sɛ bo no kɔ ɔkwan a wɔhwɛ kwan no so a, wɔyɛ Fibonacci dodow mu nhwehwɛmu bere nyinaa. Wɔto gyinabea no mu bere a nsɛm a wɔafa aka no bubu mmoa gyinabea titiriw bi mu anaasɛ EMA twa ɔkwan titiriw a ɛrekɔ so no ho no.

- Wɔde Fast Stochastic Oscillator no di gua . Stochastic oscillator a ɛyɛ ntɛm no boa ma wobu akontaa sɛ ɛbɛyɛ yiye sɛ ɛbɛhyehyɛ nsusuwii a emu yɛ den. Sɛ nhwɛso no, wɔtaa de “stochastic” sɛnkyerɛnne bi a ɛfa agyapade bi a wɔtɔn boro so anaasɛ wɔtɔn no boro so ho si so dua sɛ wɔbɛdan akɔ soro anaasɛ wɔrekɔ fam a wɔhwɛ kwan sɛ wɔbɛdan no.

- Bollinger Bands a Wɔde Di Dwuma . Oguadifo bi bue gyinabea bi sɛ bo no ka indicator band no atifi anaa ase hye a. Sɛ nhwɛso no, sɛ bo no du soro a, wobue gyinabea tiawa bi. Kura mu kosi sɛ nsɛm a wɔafa aka no bɛbɛn band no hye a ɛwɔ fam no.