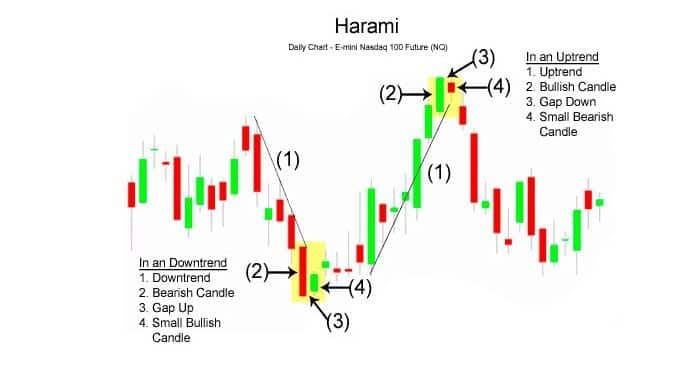

Harami – Japon kandili minnu bɛ kɛ misali sabatilen ye, min ka teli ka jate baarakɛminɛn filanan ye ŋaniya jiginni sɛgɛsɛgɛli la. Nka, u nafa ka bon ni u bɛ sɔngɔ jatebɔsɛbɛnw kalan, u hakɛw ani ka dɛmɛ don ka jago latigɛ nafamaw kɛ. Harami Zapɔnkan kandili ye suguya fila ye:

Harami ka misali hakilina

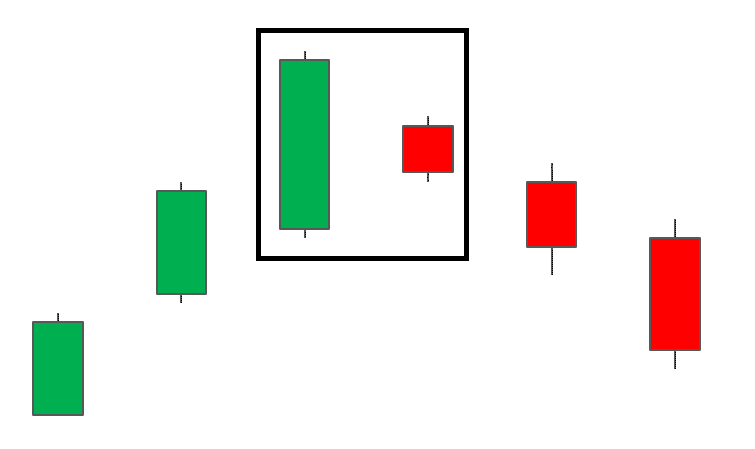

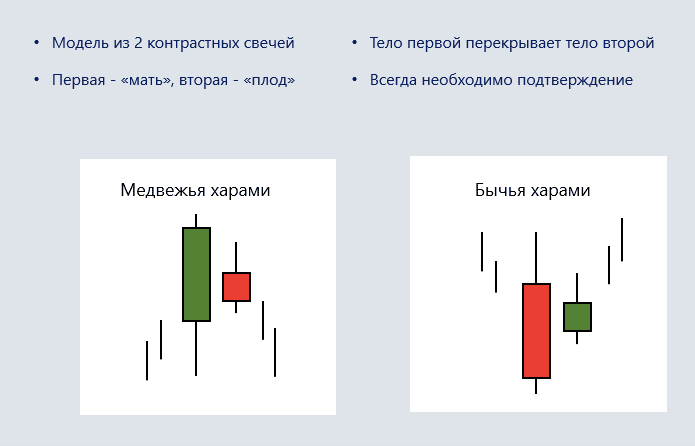

Harami ye misali ye min bɛ Kɛ ni Zapɔn kandili 2 ye minnu bɛ tugu ɲɔgɔn na. Fɔlɔ de ka bon, filanan bɛ ni farikolo fitinin ye min tɛ tɛmɛ a tɛmɛnen farikolo dankan kan. Fɛn minnu bɛ yen olu kulɛri bɛ ɲɔgɔn sɔsɔ. Ni Harami misali dɔ bɛ sɔrɔ jatebɔsɛbɛn kan, ŋaniya jiginni bɛ se ka kɛ.

Daɲɛ “harami” bamanankan na ka bɔ Zapɔnkan na ko “kɔnɔma”. O bɛ misali kunba jira: kandili filanan farikolo tɛ tɛmɛ fɔlɔ farikolo kan.

Kandili cogoya min bɛ jatebɔsɛbɛnw kan, o bɛ sugu ka latigɛbaliya jira. Jaa in jɔli waati la, ɲɔgɔndan bɛ ” misiw” ni “ursi” cɛ. Walasa k’a faamu fan min bɛna se sɔrɔ, i ka kan ka baara kɛ ni baarakɛminɛn wɛrɛw ye: misaliw ni taamasiyɛnw minnu bɛ taa ni u ye. Sarati wajibiyalen damadɔ bɛ yen minnu b’a to i bɛ se ka misali dɔn:

- taabolo dɔ bɛ yen min bɛ sen na min jiralen don ka jɛya (sanfɛ walima duguma);

- Harami kandili fɔlɔ min dilanna sisan taabolo siratigɛ la;

- kandili filanan farikolo bɛ fɔlɔ farikolo yɔrɔ la pewu;

- fɛn filanan farikolo bɛ kulɛri kɛ ka ɲɛsin fɔlɔ ma.

Ni sarati kelen ma dafa, o tuma na, jate tɛ se ka jate “Harami” ye. O waati kelen na, a ka kan ka jateminɛ ko faralen barikama dɔ kɔnɔ, kandili filanan fitinin dɔ bɛ yen, min bonya tɛ tɛmɛ 25% kan “ba” yɔrɔ janya la.

Harami suguyaw

Harami cogoya suguya 2 bɛ yen: bullish ani bearish. Harami min bɛ wuli, o bɛ kɛ taamasiyɛn ye min b’a jira ko a bɛ se ka kɛ kosɛbɛ ko jigincogo bɛ ban. Ni u bɛ nin jatebɔ in dilan, waridonna caman b’a fɛ ka jɔyɔrɔ janw da wuli nafolo kan ni jigiya ye ka nafa sɔrɔ bonya makɔnɔnen na. A tɛ i n’a fɔ bullish, bearish Harami b’a jira ko a bɛ se ka kɛ uptrend reversal ye. O waati kelen na, a bɛ da a la ko kandili filanan bonya de bɛ modɛli fanga jira: n’a ka dɔgɔ, a bɛ se ka kɛ ko fɛn dɔ bɛ se ka Changé (Yɛlɛma) fɛnba in na.

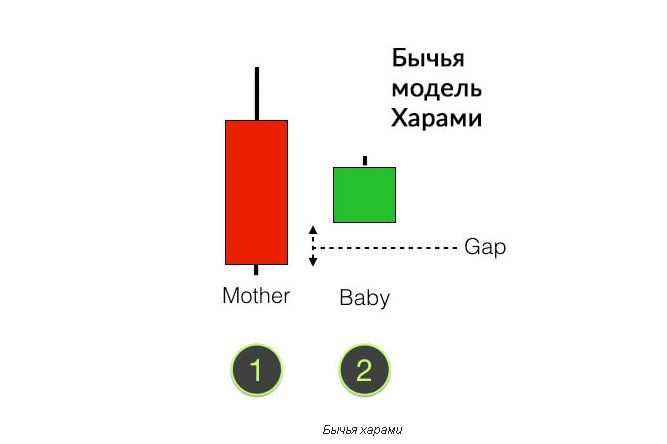

Kurukuru Harami

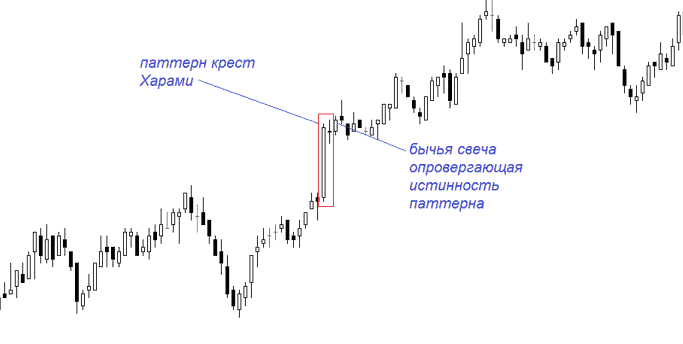

Jago harami kuruwa ye misali ye min bɛ kɛ ni kandili belebele ye min bɛ taa sira fɛ min bɛ sen na, ka tugu doji fitinin dɔ kɔ. O cogo la, fɛn filanan bɛ sɔrɔ fɔlɔ farikolo la. Japon Harami Cross kandili filanan fana bɛ wele ko kɔnɔna bara.

Doji (doji) ye kandili ye, a farikolo ka dɔgɔ kosɛbɛ k’a sababu kɛ daminɛ ni dadon sɔngɔw bɛnkan ye. A bɛ i n’a fɔ kuruwa, kuruwa min bɛ wuli ka bɔ a nɔ na, walima taamasiyɛn faralen ɲɔgɔn kan. O ye misali ye min tɛ mɔgɔ si ta ye, nka jatebɔ dɔw kɔnɔ a bɛ se ka fɛn caman jira fɛn nataw la sugu la.

Hakilila min bɛ Harami Kuruwa jɔli kɔfɛ, o ni Harami ka misali jɔnjɔn dilancogo bɛ tali kɛ ɲɔgɔn na. Harami Cross pattern fana bɛ se ka kɛ bullish walima bearish ye. Fɔlɔ la, a bɛ sɔngɔ wulicogo jira min bɛ se ka kɛ sanfɛ, filanan na, wulicogo caman yeli.

Sɛgɛsɛgɛli ni waleyali jago waleyali la

Ja in bɛ se ka kɛ sɛgɛsɛgɛlikɛminɛn jɔlen ye. Walasa ka sanni walima feereli latigɛw kɛ, tuma dɔw la, a bɛ bɔ ka misali dicogo hakilijagabɔ faamuya. Ni bullish pattern bɛ kɛ, nin algorithme in bɛ kɛ:

- Nafolo sanni ni fanga ye sɔngɔ wulilen kɔfɛ ka tɛmɛ Harami fɛn filanan sanfɛla kan. O cogo la, “jɔyɔrɔ” bɛ Labɛn nivo min ka dɔgɔn fɔlɔ bearish kandili la. A ka se ka baara kɛ ni patɔrɔn ye, o bɛ dɔgɔya dɔɔnin, nka Stop Loss / Take Profit ratio ɲuman bɛ sɔrɔ.

- Sanni minnu bɛ kɛ ni kɔrɔlenko ye, olu bɛ kɛ ni sɔngɔ wulila ka tɛmɛ kandili fɔlɔ sanfɛla kan. Jiginni dakun bɛ ta i n’a fɔ Stop Loss hakɛ.

- Ni u bɛ waati sugandi walasa ka jago dafa, u bɛ bilasira ni Fibonacci kɔsegin hakɛw ye , minnu jɔlen bɛ ka da jigincogo tɛmɛnen kan.

Ni u bɛ bearish pattern (daɲɛ kɔrɔtalen) dɔ Dabɔ, u bɛ jago Kɛ ka Kɛɲɛ ni nin algorithme (algorisimu) in ye:

- U bɛ nafolo feere ni fanga ye ni sɔngɔ bɛ taa patɔrɔn ka kandili fitinin duguma. Stop Loss bɛ sigi Harami fɛn fɔlɔ sanfɛyɔrɔ la.

- Feereli kɔrɔlenw bɛ kɛ ni quotations binna kandili fɔlɔ duguma, ka sɔrɔ Stop Loss bɛ sigi a danma na.

- Ni waati sugandira ka bɔ jago dɔ la, a bɛ sɛgɛsɛgɛ Fibonacci kɔsegin hakɛw kama minnu jɔlen bɛ ka da wulicogo tɛmɛnen kan.

Fɛɛrɛ minnu bɛ kɛ ni baarakɛminɛn wɛrɛw ye

Kandili cogoya “Harami” jago la o bɛ jate filanan ye. Nka, ni a farala taamasiyɛn suguya caman kan, a bɛ se ka jɔyɔrɔba ta jago latigɛcogo ɲuman na.

- Harami ni sɔngɔko wale sɛgɛsɛgɛli . Sannifeere Waleya sɛgɛsɛgɛli (sɔngɔ kɛcogo) bɛ kɛ ka jatebɔsen sigilen fanga dafa walima k’a sɔsɔ. Tablo in kalan ka ɲɛ, k’a ɲini ka misali wɛrɛw sɔrɔ.

- misali faralen ɲɔgɔn kan ni EMA ni Fibonacci hakɛw ye . Moyenne mouvement exponentielle bɛ kɛ ka don yɔrɔ dɔn sugu la. Ni sɔngɔ bɛ taa sira makɔnɔnen na, Fibonacci hakɛw bɛ sɛgɛsɛgɛ tuma bɛɛ. Jyɔrɔ bɛ datugu ni quotations bɛ kari dɛmɛn hakɛ jɔnjɔn dɔ la walima EMA ye taabolo kunba sira tigɛ.

- Jago kɛli ni Fast Stochastic Oscillator ye . Oscillateur stochastique rapide bɛ dɛmɛ ka jateminɛ kɛ ka se ka kɛ cogoya barikama dɔ la. Misali la, wulicogo walima jigincogo jiginni makɔnɔnen, a ka c’a la, o bɛ dafa ni taamasiyɛn “stokastiki” ye min bɛ kuma nafolo feereli kan ka tɛmɛ walima ka feere kojugu kan, o cogo kelen na.

- Bollinger Bandiw tali . Jagokɛla bɛ jɔyɔrɔ dɔ da wuli ni sɔngɔ magara taamasiyɛn bandi sanfɛla walima duguma dan na. Misali la, ni sɔngɔ sera sanfɛyɔrɔ la, jɔyɔrɔ surun dɔ bɛ dabɔ. Aw bɛ a minɛ fo kumasenw ka gɛrɛ bandi duguma dan na.