What is a timeframe in trading (what is a trading period in simple words) and how to use it in practice, what types are most often used? The timeframe in trading comes from the English words time frame. This word refers to the time interval (trading period) of stock quotes. The indicator is a bar,

Japanese candlesticks or a line chart. There are three types of time frame on the stock exchange:

- Short

- medium term

- long term

Their designations and meanings are given in the following table.

| Short term, measured in minutes – M | Medium-term, measured in hours – H or H | Long term – measured in days and weeks – D/W |

| M30 M15 M5 M1 | H4 H1 | D1 W1 WN |

- What timeframes are available for trading?

- What timeframe to choose?

- Advantages and disadvantages of different timeframes

- What timeframes are used in practice in different situations?

- What is multi-timeframe analysis

- The truth about the daily timeframe

- Is the daily timeframe right for you?

- Trading strategies for the daily timeframe

- Timeframe analysis from top to bottom

- Exploring multiple timeframes

- The most common objections to trading on higher timeframes

- How to use multiple timeframes

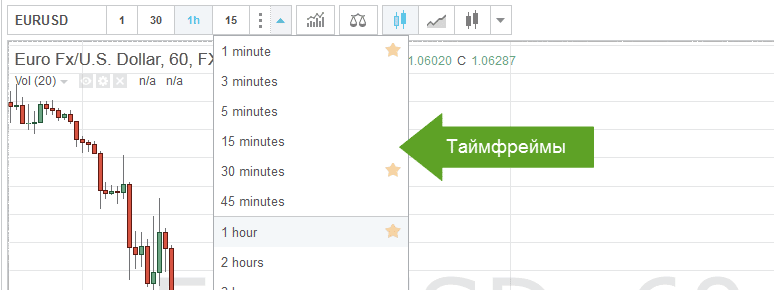

What timeframes are available for trading?

By default, a trader has 9 standard options available:

- 1 minute;

- 1 hour;

- 1 day;

- Week 1;

- 1 month;

- 5 minutes;

- 15 minutes;

- 4 hours;

- 30 minutes.

Each of these time frames represents a separate candle in the chart. As soon as one candle closes, another opens. All options are available for analysis. Professionals consider all types of timeframes for a certain period of time. If desired, the user can choose his own time interval, which differs from the standard ones. This can be a 6 or 9 hour time interval. But this is a risky move. The reason is that most people work with standard candlestick patterns and coordinate their actions according to their dynamics. By choosing a non-standard timeframe, you run the risk of acting against trends.

What timeframe to choose?

Every trader faces the question of which timeframe to choose for trading. There is no single answer to this question. You should be guided by the amount of your own time that the trader devotes to the exchange. If for someone this is an everyday matter, then he will work with daily, hourly and minute timeframes. If a person looks at the stock exchange every few days, then a different time interval will be interesting for him. Professionals find their timeframe through experimentation. In this case, it is important not to drain your deposit. In order to insure against accidental losses, while searching for your timeframe, it is recommended to trade on a demo account. https://articles.opexflow.com/trading-training/chto-takoe-trajdingi-kak-stat-trajderom.htm

Advantages and disadvantages of different timeframes

Why is it so important to find your time frame? The fact is that each time period has its own unique properties. Let’s consider some of them:

- Day trading is a time period from 1 to 15 minutes. Of the advantages, we note that such transactions do not need to be held overnight. Even at this interval, a large number of opportunities are hidden. There are also some disadvantages. For example, a trader will have to spend significant amounts on spreads. If there is a big shift in the trend, then it will not be possible to take all the potential profit. There is also a psychological factor – the difficulty of opening many trades during the day.

- 1-4 hour intervals . They refer to short-term timeframes. Transactions have a cycle from several hours to one day. There is still a lot of spending on the spread. Risks are increased by the need to hold the deal overnight. The advantages are obvious: a lot of opportunities, you can carry out a large number of transactions and less losses in the long run.

- Daily or weekly intervals , in which transactions are carried out by days or weeks. Of the advantages, we can note the freedom when you do not need to monitor the stock exchange during the day. Spread costs are relatively small. New positions are opened slowly, accompanied by deep analysis.

What timeframes are used in practice in different situations?

Professional traders recommend using two intervals: daily and 4 hours in combination with a price action strategy.

- they can clearly trace the trend vector;

- you can count on high-quality trading installations;

- The frequency of trading is reduced, along with the cost of spreads;

- they work as a natural news filter.

What is multi-timeframe analysis

Analysis of several time intervals can be an effective tool for successful trading. This technique should be understood as the observation of different intervals on the same instrument. The results of such an analysis make it possible to identify the trend vector as accurately as possible. It is recommended to first look at indicators of wider time intervals. Based on these data, you can build a more reliable forecast for short timeframes. Considering different time periods helps a trader win on two positions at once: reduce risks and increase the chances of a successful trade. Analysis of different time intervals is a fairly effective strategy. It can be used on any asset, be it futures, options, stocks or cryptocurrencies.

The truth about the daily timeframe

The daily time interval has a number of advantages that other intervals cannot boast of. The benefits are:

- Psychological comfort . There is no need to tense up and experience stress, such as in a 5 minute interval. The trader has enough time to analyze, think and make an informed decision. This reduces the chance of errors. In the balance sheet, this can be reflected as reduced risks and the frequency of profitable transactions.

- News about changes in quotes on the market does not matter much . It is possible to set stop losses wide enough so that daily fluctuations do not knock them out. Trading on wide time frames makes you more autonomous from short-term trends.

- More freedom . This is due to one candle that matters to you. Day trading forms only one candle. There is no need to constantly monitor the graphs and their vectors. More free time means more opportunities to raise capital. It can be a job or any other parallel project that can develop in parallel with trade.

- Practice shows that traders with a more relaxed approach are more successful than those who trade all day long . Additionally, the daily time frame in trading allows you to work full-time in parallel. This opportunity is not limited to a stable income, but also helps to stay afloat, even if a series of failures comes.

Is the daily timeframe right for you?

What is a timeframe in trading in simple words in ordinary words and for whom is the daily timeframe? It depends on the goal of the trader. One can only emphasize the features that the daily time interval for trading does not have. It’s the following:

- no need to count on easy profit;

- you will not be able to catch a super-profitable deal;

- will not be able to engage in proprietary trade.

The lack of quick income is due to the fact that wide time intervals involve rare transactions. Between transactions, the trader has time to make a qualitative analysis and wait for his trading advantage to appear. When starting to trade on day trading, it is advisable to count on income in months, and not in days.

The daily interval assumes a single candle. This is another reason why you should not expect super profits in this time period. Only two strategies are suitable for trading in the daily time frame:

swing and position trading. What timeframe to choose for trading, all you need to know about the timeframe: https://youtu.be/9AhOtbE4tT0

Trading strategies for the daily timeframe

But for success it is not enough to rely only on a good time passage. It’s good to have a trading plan. The plan should include three mandatory components: watch the market and record the results, trade strictly according to the schedule, consider your results and take them into account in the analysis.

Successful traders keep special trading diaries. In such documents, they reflect their transactions for a specific long period and determine the level of profitability of their transactions. Several tens or hundreds of transactions can be taken as a basis for analysis.

If, according to the results, the income coefficient is positive, then this is a good result. If the coefficient is negative, then you should carefully revise your strategy and trading plan.

Timeframe analysis from top to bottom

Looking at the time interval from top to bottom is one of the most objective ways. To use this method, three important periods must be distinguished:

- Select a timeframe for trading on the stock exchange.

- Choose an even wider timeframe.

- Time to find the entry point.

However, in practice, many novice traders use this method in exactly the opposite way – from the bottom up, which is a big strategic mistake.

Exploring multiple timeframes

Each trader finds his optimal trading time frame through experimentation. But which of the timeframes is important? To answer this question, one more factor will have to be taken into account – the trader’s trading style. Medium-term traders should look at the daily intervals. For swing traders, a 4-hour interval is suitable. Many experienced traders consider the daily chart important. This is due to the fact that trend lines show up best on the daily chart.

The most common objections to trading on higher timeframes

Against higher timeframes, traders mainly adhere to two arguments. The first argument states that it takes a lot of money to trade higher timeframes. According to experts, this approach is not correct. If a trader has the funds to open an account, then there are funds to trade. This is what the professional community thinks. To verify this, the expert is recommended to make a correct calculation of the position relative to the size of the deposit. In other cases, leverage helps to use even small amounts. In this case, it is advisable to choose a daily timeframe and gradually increase the size of your deposit. If you want to trade, you can even use a cent account. The initial deposit in this case can be anything, and even $20 or $30. The second argument says that trading on higher timeframes is not dynamic. In this case, we should clarify our own motives in trading: are we looking for thrills or capital increase? If the second option seems more appropriate to you, then there is no need to look for thrills in trading.

How to use multiple timeframes

Trading on different timeframes on the exchange allows you to improve your results. By studying them, the trader finds the best entry and exit points. The secret to efficient use of multiple time slots is described in the writings of Adam Grimes and Alexander Edler. According to their theory, when trading in several time intervals, the longest segment should be 4-6 times larger than the entry zone. And to increase the chances of profitable deals, you must follow the rule when the trend vector in the trading area and the higher timeframe go in the same direction. Many traders are familiar with the situation when the trend suddenly turns back and the trader has to give away part of what he has earned. To avoid this, you need to be able to predict the exit point. According to Grimes, when trading against the trend vector of a higher timeframe in trading, you need to focus on making a profit from one market fluctuation. At the same time, you need to carefully monitor your feet. The timeframe in trading is one of the leading factors that affects the success of trading. Usually everything seems simple when trading on a demo account. As soon as a novice investor switches to operations with real assets, it becomes clear that extensive knowledge and in-depth analysis are needed here. In this analysis, the timeframe plays an important role. A systematic approach to the analysis of different timeframes allows you to find a profitable time-frame combination. Usually everything seems simple when trading on a demo account. As soon as a novice investor switches to operations with real assets, it becomes clear that extensive knowledge and in-depth analysis are needed here. In this analysis, the timeframe plays an important role. A systematic approach to the analysis of different timeframes allows you to find a profitable time-frame combination. Usually everything seems simple when trading on a demo account. As soon as a novice investor switches to operations with real assets, it becomes clear that extensive knowledge and in-depth analysis are needed here. In this analysis, the timeframe plays an important role. A systematic approach to the analysis of different timeframes allows you to find a profitable time-frame combination.