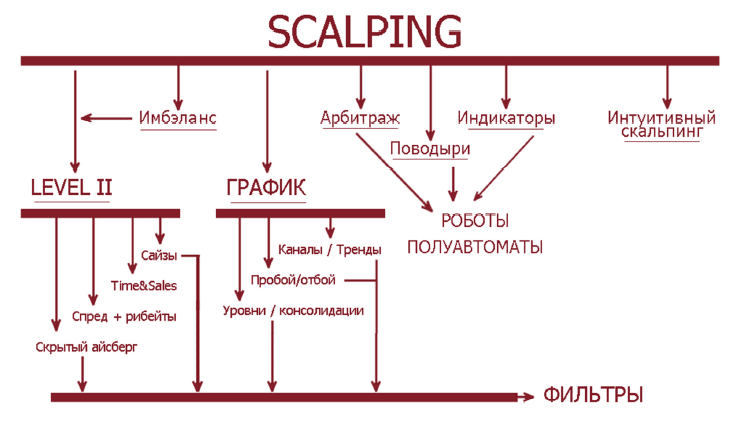

What is scalping and what is its essence, what are scalping robots.

scalping .

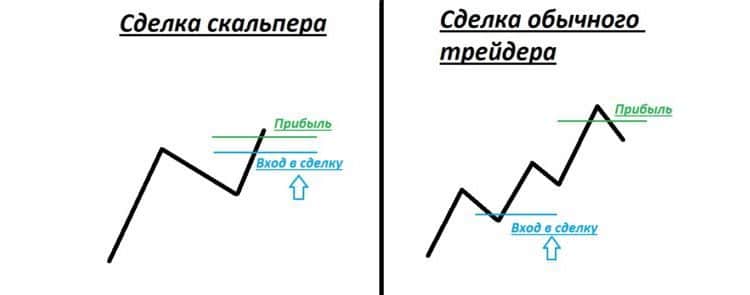

The name of the strategy speaks for itself. Scalping is literally “removing the top”, a small part of the profit in a short period of time. It is customary to consider such a period of time 1 day.

The strategy is as follows:

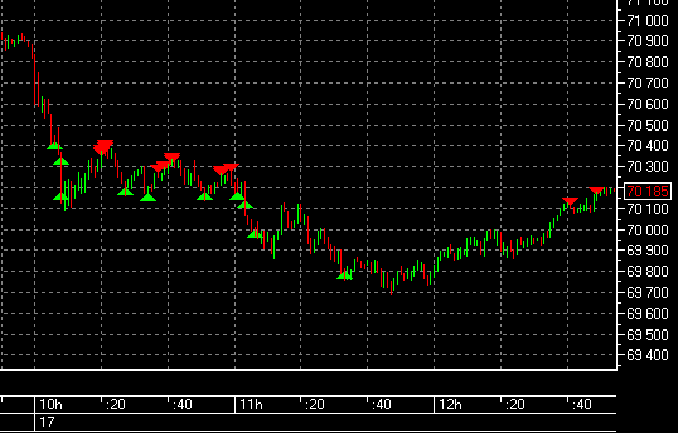

- the choice of an exchange commodity, which is characterized by price fluctuations in the selected period;

- acquisition of an asset in the lower area;

- sale upon reaching the optimal difference between the purchase price and the current offers on the exchange.

volatility for a limited period of time is typical for artificial financial assets, which include futures, derivatives, swaps and other derivatives of exchange processes. All of the listed instruments are more dependent on speculative actions, so prices can change by 2-3 percent or more during the day, which makes derivative exchange assets attractive from the scalper’s point of view.

Thus, the futures for wheat as of 05:00 on 03/08/2022 was 1210.70, by 10:15 it rose to 1329.25. Thus, for 5 hours the cost difference was 118.55 or 9% of the initial price. The purchase of an option or an IOU with subsequent sale can be unprofitable even if the result of the transaction is positive – the exchange charges interest from the participants in the transaction, the amount of which can be significant when implementing scalping.

For example, a futures contract was purchased for $100, sold for $105, the exchange commission is 10%, and $94.5 is credited to the account when the sale transaction is closed. Calling such a deal profitable is impossible with all desire.Using such a strategy, taking into account all the requirements, you can make a profit in 1 day of trading. When implementing it, it should be remembered that the situation will not always develop according to a known scenario. Because of this probability, the user of the strategy is forced to constantly monitor the state of prices for purchased assets in order not to miss a favorable moment for selling. In order to remove some of the burden associated with cost control and scalper trades, special trading algorithms have been developed to automate the process. In common parlance – robots. Scalping robots are used not only by novice traders, but also by experienced stock speculators, freeing up time for important transactions and other matters that require personal participation.

The principle of operation of the robot for scalping

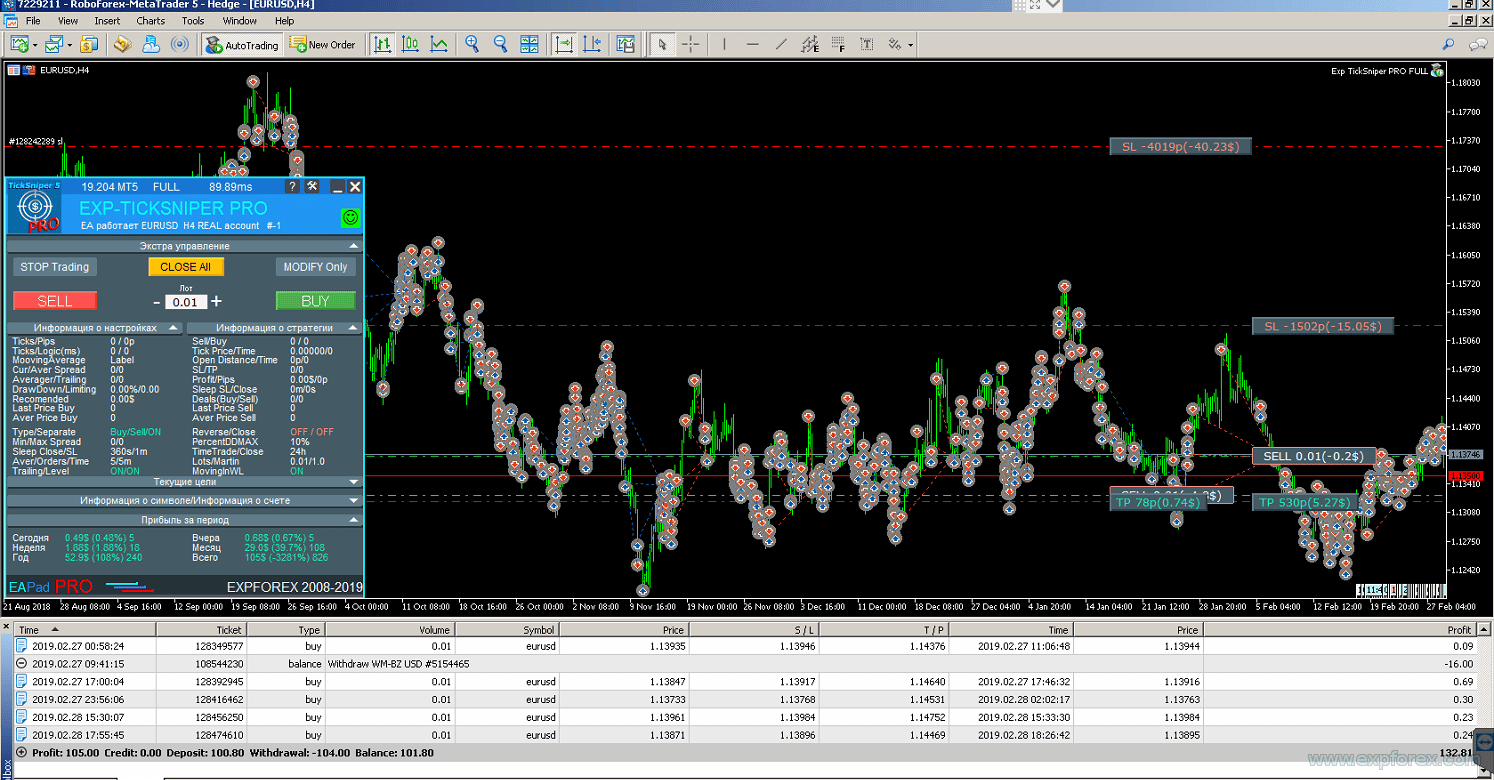

Modern trading programs, or as they are also called – ”

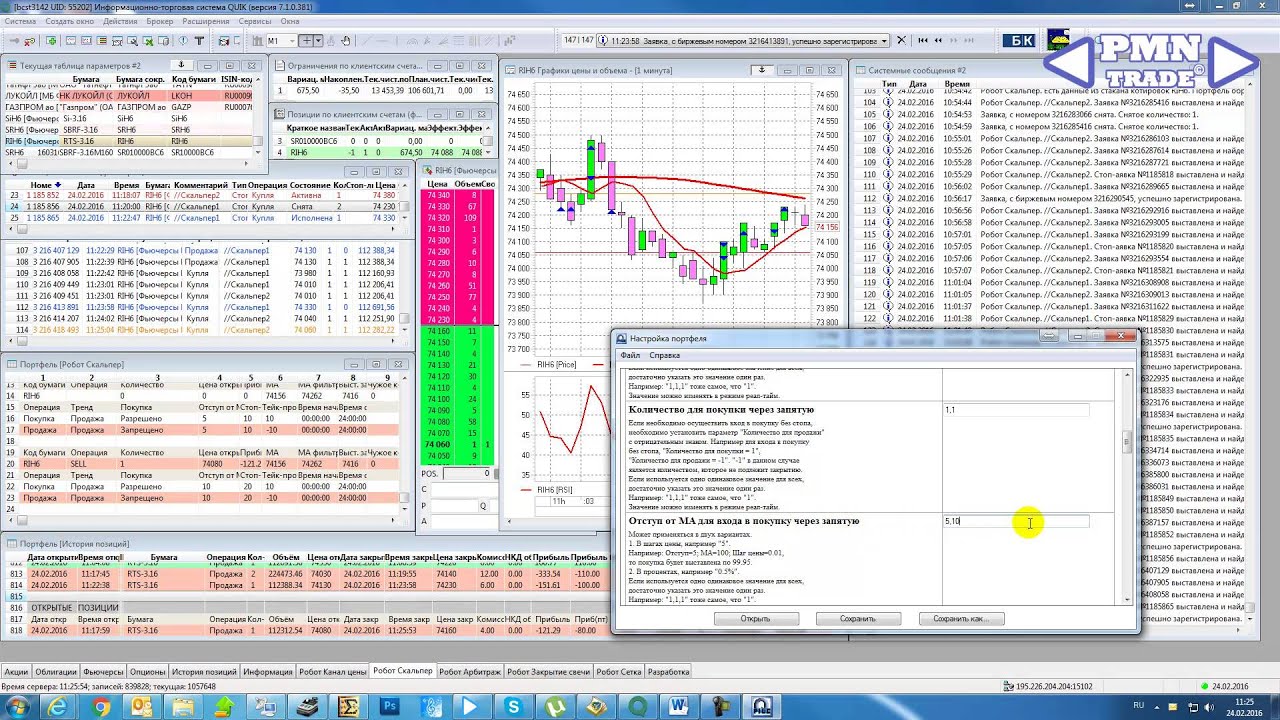

terminals“, thanks to which a trader gains access to the exchange, are initially capable of using automated algorithms. Trading terminals with authentication data are supplied by registered brokers on a commercial basis. MetaStock, MetaTrader, QUIK are considered popular in Russia. https://articles.opexflow.com/software- trading/torgovyj-terminal-quik.htm A scalping robot is an add-on, a plug-in for terminals.In its work, it uses the software capabilities of the main software – access to a user account, market observation, performing transactions according to specified parameters.Each plug-in is developed for a specific program, therefore, it will not work to install a robot for QUIK on another terminal – scripts will not allow.The main algorithm of such a robot is as follows:

- identification of a position that meets the criteria specified by the user (type of asset, time, price, etc.);

- acquisition of an asset;

- closing the deal when the target value difference between the purchase and sale prices is reached.

The work is based on mathematical models that describe certain processes occurring in the markets. The more such models are laid down, the more likely the robot will react correctly to what is happening. Early versions of such subroutines had flexible enough settings to simplify the life of a trader. Modern robots, using well-established algorithms for analysis, make it possible to exclude human participation during the operational day.

Robots for scalping

Scalping robots are developed by user teams or single developers for material rewards, so free scalping robots are typical

screeners at best., at worst – pest programs. The main limitation on the distribution of programs for the automation of stock trading is the price. The cost of one robot is from 18 to 45 thousand rubles. The second limiting factor is the entry threshold, a newcomer to trading without knowledge of the basic working mechanisms is unable to correctly configure the plugin in accordance with their preferences, and the default settings are not always adequate to the realities. Various Internet resources can offer a free scalping robot for binance, this is a bait for beginners in order to involve them in various pyramids and other fraudulent schemes. Banks and credit organizations also do not provide access to such services, offers like the Tinkoff scalping robot or the alpha scalping robot are a publicity stunt. Tinkoff supports a trading advisor service, but there is no trade. You can determine a workable scalping robot for the QUIK terminal based on reviews on specialized resources – forums, online stores. Below are examples of really working programs tailored for scalping. https://articles.opexflow.com/strategies/skalping-v-tradinge.htm

Sigma LUA

In his work, he uses the techniques of mathematical analysis based on the rule of three sigmas (sigma in mathematical analysis denotes the standard deviation of a value with a normal distribution). The essence of the rule is that a change in a random variable from its average value under normal conditions is possible within a threefold value of the standard deviation of this value, both plus and minus. The robot uses the specified rule to determine the upper and lower limits for changing the lot price. The mathematical approach simplifies decision-making and contributes to the best outcome of a possible transaction. Designed for the QUIK trading terminal, after installation it is integrated into its interface.

- simplicity and convenience of the interface;

- complete and understandable setup instructions;

- the possibility of a stop loss;

- the possibility of limiting the volume of unsuccessful transactions;

- work within the ranges of specified standard deviations for each position (do not apply without knowledge of mathematical statistics);

- work stability;

- low consumption of device resources;

- affordable price.

Program disadvantages:

- annual paid license renewal;

- the main advantages are inaccessible to people who do not have knowledge in the field of mathematical statistics and probability theory.

Installation order:

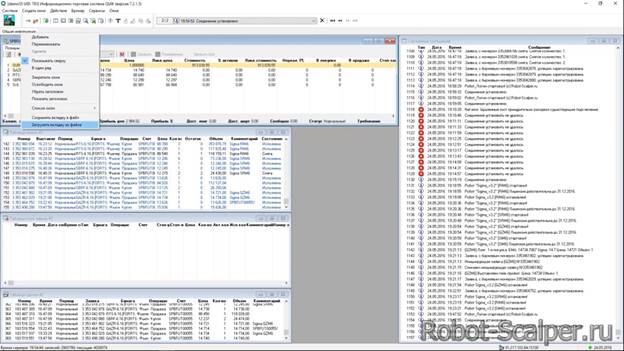

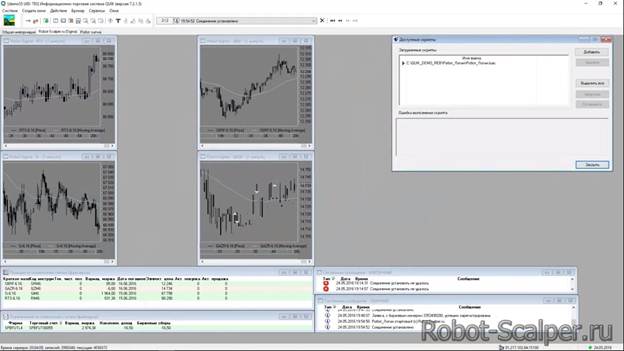

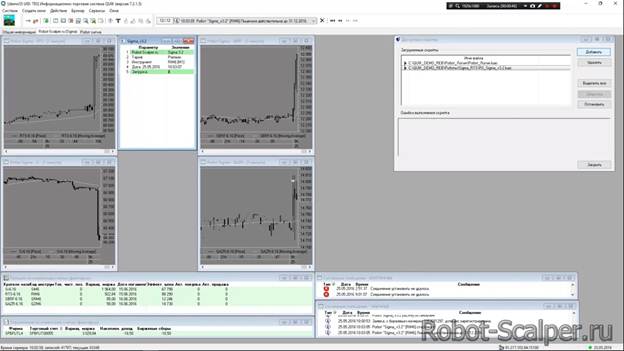

Lua . After clicking on the “Lua scripts” button, the robot control window appears. Upon successful activation, subroutine operation windows appear displaying the specified parameters.

“Cunning scalper”

- work on 3 trading floors;

- the presence of filters for recognizing speculative manipulations, which avoids involvement in rush trading with unpredictable results;

- uptrend and downtrend recognition;

- 20 options for configuring the robot to optimize for current needs;

- Demo version available for review.

From a practical point of view, the robot allows you to optimize the process of trading a specific asset according to the following parameters:

- prohibition of transactions in user-defined time periods during the day (up to 4 time periods);

- fixing the cost of the lot, which must be ignored;

- fixing the size of a limit order;

- the difference between supply and demand in the glass, which is characteristic of manipulations;

- set the upper and lower limits for buying and selling, respectively;

- setting a time delay for the transaction;

- setting charts to control the trend.

- flexibility of settings;

- universality;

- relative ease of use.

Disadvantages:

- high entry threshold for beginners;

- not very convenient technical support from the authors of the program.

Scalping robot for QUIK Cunning scalper: https://youtu.be/3EZ-Uw2sct0

Scalper LUA

- six months of the license;

- one active trading position;

- the ability to work with risk restrictions;

- technical support of the program;

- free updates.

The difference in cost between the “Standard” tariff for 1 lot and the same tariff without a limit is 15,000 rubles, so the second option is preferable. There is a Premium version of the program, but the main functionality is available in the standard one, so it makes no sense to overpay. Available robot settings allow you to define the following trading parameters:

- time of trading activity;

- trade direction (from short, from long, etc.);

- limit of allowable losses in trading;

- upper and lower limits for selling/buying.

Benefits of the program:

- ease of setup;

- informative interface;

- the ability to run multiple robots simultaneously;

- bonus when purchasing a Premium license as a demo account.

Program disadvantages:

- high cost of a standard package for 1 lot;

- the need to renew the license after a specified period.

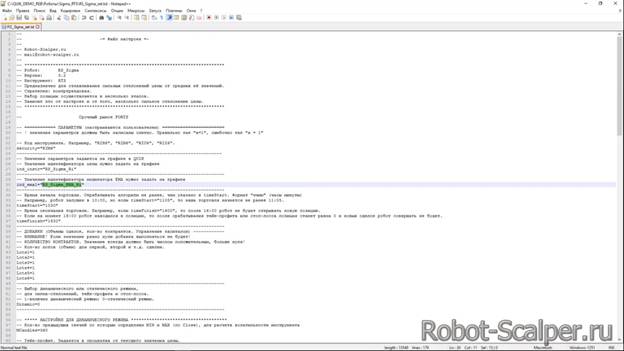

For installation and configuration, you need to copy the license key and files that make up the “body” of the robot to the QUIK root directory, and then launch the robot using software. Parameters and operating modes are configured in a text file. Notepad++ is required to open the latter.

Салом роботлар хакида малумот олмокчи эдим