What is a gap in trading in simple words, types, unclosed and open gap on the chart, how to trade at the opening, how to read on charts and put into practice. A gap is quite common in the stock market, and it can be used to judge the dynamics of price movement. It usually occurs when the price at the time of closing and opening the next day is very different. And if there is a strong

volatility in the market , then intraday gaps are also possible. Gap analysis allows you to see additional structural factors when drawing

resistance and support levels . Accordingly, the more structural factors are observed at a certain level, the more significant this level will be.

- Gap on the stock exchange – what is it and how to read it

- Description of the essence of the concept

- Gap on the stock exchange: causes

- Why gaps form

- Types of gaps

- Div gap – what is it?

- How to trade a gap, and what to choose

- Gap Trading Strategies

- Gap filling

- Unclosed gaps and other types

- How to trade a gap with leverage

- How to use gaps in trading at key levels

Gap on the stock exchange – what is it and how to read it

So, a gap on the stock exchange – what is it in simple words? This is a situation during trading on the stock exchange, when there is a significant gap in price due to a sharp increase in the value of shares, or because of their fall. In this case, you can see a characteristic “candlestick” on the chart, which displays the movement up or down.

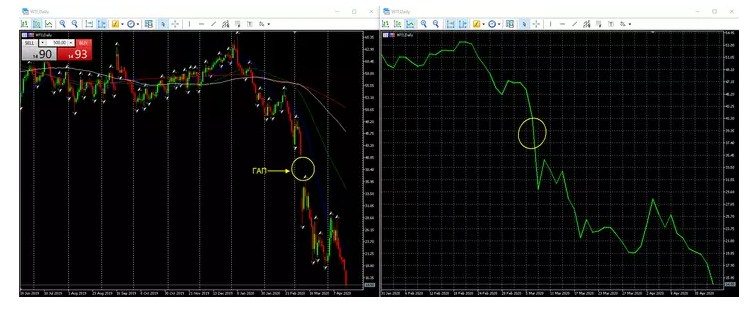

Gap in price on candlestick chart

Description of the essence of the concept

The word gap appeared in English, and for us it is translated as “gap”. Accordingly, on the market it looks like a big gap between the closing price of the last trades and the opening price of new trades. This phenomenon is best seen on a candlestick chart. But on a line chart, you are unlikely to find a closed gap. Gap closing is the movement of the stock price away from the gap or price gap. The reality is that about 30% of all gaps close for a very long time. Therefore, do not count on too fast earnings. The occurrence of a stock gap in the stock market is considered a common occurrence during trading. Most often, it appears after the end of the trading period. It can be seen especially well on the daily charts. The same picture can be seen in the older trading periods. The advantage of this phenomenon is that further behavior of quotes is usually easy to predict. This is why the gap is so important in trading.

So, what is a gap on the stock exchange in simple terms? This is a gap in price that usually occurs at the end of a trading session, but can also appear during the trading day.

Gap on the stock exchange: causes

The value of shares cannot be permanently fixed. Price gaps, especially on the daily chart, are constantly visible. Smooth drops are a common thing during the day. But there are also significant jumps, for which there are several reasons:

- The exchange opened after a long break, or after the weekend.

- Important news came out that affected the stock price.

- Dividend gap.

- Failures that occur on the stock exchange.

Usually, the largest jumps appear during corporate reports, especially if there is not enough liquidity in the financial instrument. More often it concerns securities of the second and third echelons. It is not always possible to close the gap – it can take not just months, but even years. Therefore, it is better to make money on this only when you are completely confident in the quick closing of the position.

What do gaps look like in trading? Since a gap is a price gap, it also looks like a window between several candles on the chart. While in a normal situation, the opening price of the current candle and the closing price of the previous candle are approximately the same.

Why gaps form

The gap factor can appear for various reasons:

- The value of shares changed dramatically between the close of the previous session and the opening of a new one . There may be several reasons for this – important economic news released at the end of the session, deals on low liquid assets, and so on.

- The difference between closing and opening due to the price charged by the market maker . A specialist can set a price that does not suit bidders too much.

Types of gaps

Depending on the reasons, four types of the phenomenon can be distinguished:

- General . Such a gap appears between the resistance and support levels. It usually lasts for a short time with large trading volumes. The market value goes sideways.

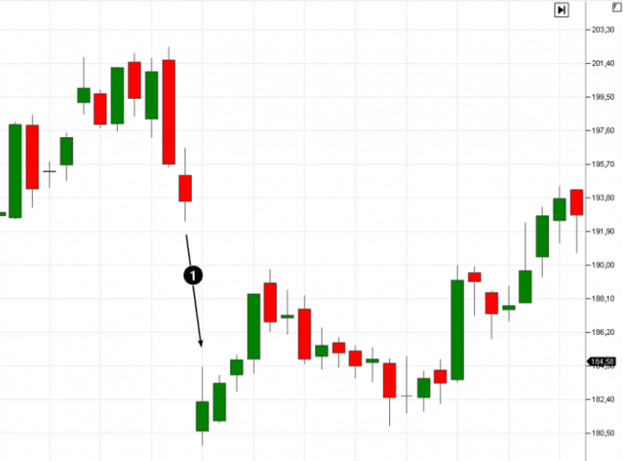

- Gap break . This is the gap that appears when it comes to a large volume of trading when the accumulation of positions of market participants for a serious change in the value of an asset.

- Exhaustion Gap . This is a gap that appears when a trend ends, or when trading volume becomes smaller due to traders exiting stocks.

- Runaway Gap . It appears in the middle of a fast trend trading move, as well as in a narrow trading period.

Also, this phenomenon is divided into dividend and news.

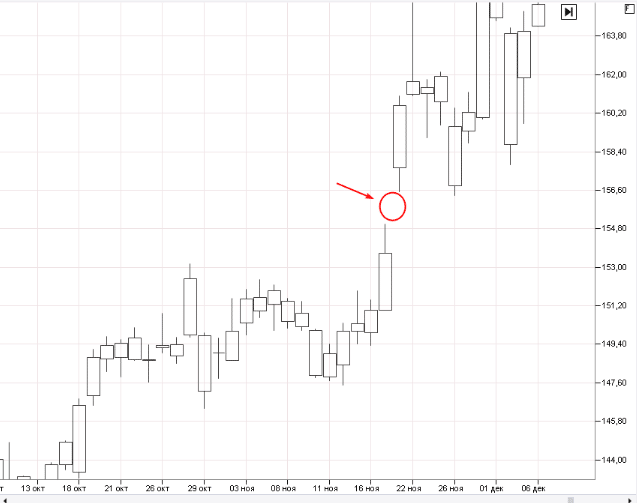

Div gap – what is it?

This is the price gap that appears immediately after the cutoff due to the high number of sell orders in the stock. Many shares provide for the payment of dividends. But some traders do not want to buy shares for a long time, and therefore they acquire them on the eve of the cutoff. Div cutoff is the date on which the shareholder register is closed, which determines who will receive dividends. As soon as the register is formed, traders will try to get rid of the shares. Due to the large increase in applications, a dividend gap is usually formed.

- Most traders support the news . The peculiarity of such gaps is that they give rise to a strong growth or fall, and close for a long time.

- The results did not coincide with the opinion of the majority of traders . In other words, this is force majeure. This type of gap may be longer than the previous one, but it also has a greater chance of recovery.

The type of gap will determine the speed of closing, as well as the level of earnings of the trader.

How to trade a gap, and what to choose

For gap trading, there is a specific instruction that a trader needs to follow:

- Open the economic calendar and pay attention to the news that falls on the weekend.

- On Friday, follow the instructions:

- Analyze fundamental factors. Predict how much they can affect quotes and the length of the gap.

- Compare the opinion of analysts and most traders. And the more reality does not match the forecast, the greater the price gap will be.

- Estimate trading volumes at the end of the session. It is good if it is a flat with small volumes.

- Predict in which direction the gap will move. Open a trade before the trading session ends.

If you decide to capitalize on a dividend gap, then you need to exit the trade as soon as possible after the register is closed, that is, before the price gap occurs.

Gap Trading Strategies

There are several options here. Let’s consider each of them.

- Strategy on pending orders . A breakout of a key level, if accompanied by a breakout, usually indicates that the trend will continue. A trade can be opened after a gap on a candle, if the latter is directed towards the gap.

- Gap Closing Strategy . This strategy implies that a trade should be opened after a gap in the opposite direction. The disadvantage of this method is that the return can take weeks or even months.

- Strategy based on fundamental analysis . The deal is opened on the weekend, at the time of which the key event falls.

What is a gap in trading, gaps in the stock exchange – an explanation for beginners from scratch: https://youtu.be/PokL4SJY7MM

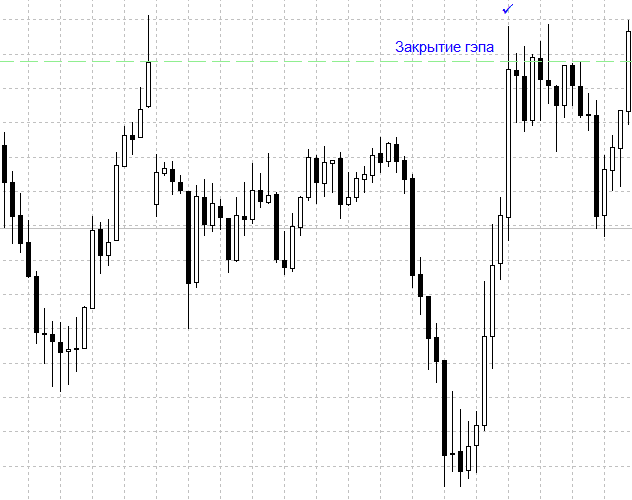

Gap filling

In some cases, a trader hears such a phrase as “the gap is filled.” What is at issue in this case? When a financial security is traded in the interval of the previous price gap, then we are talking about the fact that the gap has been filled. When it comes to candlestick analysis, such gaps in price are usually called windows. Accordingly, if the gap is filled, then traders say “the window has closed”. Some say that the gap is always filled, while others deny this. In fact, while some breaks take less than a week to close the window, others take several years.

What does a gap close on a candlestick chart look like?

Unclosed gaps and other types

What is an open gap? This is usually a gap that formed after the news or the register was closed, but remained open for seven days. To put it simply, the market needs more than five working days to close the gap. How long it will take to close is another question. Some breaks take weeks, others months, and others years. Accordingly, monthly gaps will be more significant than weekly ones, and annual gaps will be more significant than monthly ones. This is what analytics should be based on. But unclosed gaps can also be used to your advantage. For example, you can set a buy or sell limit order at the original gap price to enter the market when the gap closes. These trading setups work well for the following reasons:

- The market was in a good trend before the gap formed.

- Both gaps remained unclosed for more than one week.

- At 50-60 pips, gaps were obvious to all traders.

This means that unclosed gaps can be very profitable for traders. With their help, you can also earn nice amounts.

How to trade a gap with leverage

Traders who have small accounts but high leverage are not interested in long-term trading due to the gap that can occur. As for those traders who have a small leverage, they, on the contrary, are focused on the long term. They use price gaps as a charting tool and also to understand current market sentiment. Such strategies are preferred by traders who earn on high volatility in the market. https://articles.opexflow.com/trading-training/kreditnoe-shoulder.htm

How to use gaps in trading at key levels

In the market, you can make money on gaps with a large difference in price between the close on Friday and the open on Monday. A gap in a financial market is the gap in price between Friday’s close and Monday’s open. And if the difference appears significant, then an empty space appears on the chart, which the price jumps over. Usually, if the jumps in price are significant, then they are clearly visible on the chart, and they immediately catch the trader’s eye. Of course, such gaps do not appear every week, but if they do appear, then we can use them to make good money on them. In this case, some nuances should be taken into account. For example, the empty space that appears between Friday’s close and Monday’s open is a support or resistance zone. As you can see, the gap in the value of an asset can be a serious helper for an investor when you need to make money on shares. If it appears on the chart, then thanks to him you can understand when to buy or sell stocks. There are a few things to remember when using gaps:

- If the gaps are large and obvious, then they are more likely to lead to a change in the direction of the market.

- Those gaps that appear at older time intervals are at the same time more significant than those that occur at lower time intervals.

- An unfilled gap is one that does not close for five trading shifts or more.

- If you use a gap as a structural factor at key levels, then remember that the levels must already be confirmed.

However, there are gaps that are extremely dangerous. They don’t close for months or even years. Therefore, with such gaps one must be extremely dangerous. Calculate in advance whether such a purchase will be beneficial for you. The next time you look at the charts, pay attention to any gaps that occur. Thanks to them, you can consider any trading opportunities, which means getting additional profit.