The vast majority of traders who can earn five or six zero amounts over time start their journey by learning the rules of prop trading. From this article, novice traders will be able to find answers to the following questions:

- What is prop trading.

- System structure of companies based on prop trading.

- What are the benefits for a private trader and financial institutions?

- How prop trading works.

- How is the prop trading business model set up?

- prop trading strategy

- Training system and first steps

- Distant work

- What should a trader pay attention to when choosing a trading company proprietor?

- Trading contests in pro-trading companies

- Benefits of prop trading

- Domestic and foreign prop trading companies

- What else does a trader need

How is the prop trading business model set up?

Prop trading has a simple and understandable financial model. Despite this, prop trading has not found much popularity in Eastern Europe. The reason for this is stock history. In the West, exchanges have been operating for about a hundred years, while in the Russian Federation and CIS countries, exchanges have been operating for only a few decades.

Proprietary trading is an investment-based business model in which investments are managed on the exchange by invited outside traders. All income will be divided in different shares between the company and the prop trader.

In order for an investment company to be able to trade on the exchange, it must have the following elements: capital, stable brokerage commissions, and special software. However, this is not quite all that is needed for a successful business. Prop companies most often lack trading skills. This is where traders come in who know how to trade on the stock exchange, but do not have the appropriate software and capital. Prop appears at the moment when traders and an investor meet. When considering a classic prop, money moves exclusively in one direction throughout the entire time. The profit that is earned on the stock exchange is withdrawn from circulation and divided between the company and the trader. Usually the skip gets a smaller part, and the trader gets a large part. The purpose of the prop is profit,

In the prop business system, its weak side immediately becomes visible. There will be no business until traders start earning. This is an important point that must be taken into account.

The broker’s earnings are based on percentages of balances and commissions. For him, it makes no difference whether the trader trades in profit or, conversely, goes into the red. A trader-blogger earns on advertising and his subscribers, so his income does not depend on the quality of the audience’s trading. Some brokers create special training centers for traders whose profit depends on tuition fees. Only the prop is knocked out of the whole system, which, like an ordinary trader, earns only on the exchange market.

prop trading strategy

In theory, a prop can trade whatever he wants. Prop can engage in opposition trading, arbitrage, option strategy and pair trading. However, in most cases, props prefer those tools where they can carefully monitor possible risks. For such a business, it is vital to control all kinds of risks. If a company begins to incur losses one day, as often happens, then the very next day it will have to continue its work properly, as if nothing had happened. To do this, you need to set the maximum loss limit for the company. Among all trading instruments, it is best to monitor intraday risks. For this reason, many proppers are intraday or scalpers. Another feature is also important for intraday traders. It gives a significant income and does not require a large capital. The amount of capital is limited by daily liquidity, while sky-high profitability is provided by high activity of transactions.

Training system and first steps

One of the main details of the prop is the preparation of future traders. There is a lot of turnover in the prop business, a lot of people come and go. By investing in training beginners today, you can get a first-class professional trader tomorrow. This will provide the prop business with a stable income. Therefore, for props, staff training is a matter of survival. By training to the level of the best traders, company owners try to keep them. To this end, they organize a team atmosphere in their team. Here people should support each other and create a friendly atmosphere. This makes it easy for a beginner to join a team of professionals. [caption id="attachment_486" align="aligncenter" width="563"]

Distant work

All modern exchanges operate using an Internet connection. Previously, only residents of large cities could become exchange players. Now a trader can work remotely from anywhere in the world. About ten years ago, they were looking for their candidates exclusively in their city. Now this system has been radically restructured. Despite the fact that dealing rooms remain, newcomers can be found almost everywhere. The clarifying word is almost here for a reason, as the time zone for traders is still very important. Remote work has also changed the format of interaction in the prop. At the beginning of the 2000s, newcomers were trained in the company’s office. Now we have moved away from this a long time ago, and all training takes place in the format of webinars and voice chats. This quickly gave its results. Many prop teams have traders,

What should a trader pay attention to when choosing a trading company proprietor?

You need to look at the amount of the insurance premium and the conditions for its payment. The deposit should ensure an increase in the volume of transactions at the expense of a part of the capital of the organization. At the same time, a trader should not limit the volume of transactions, and also not increase risks during current drawdowns. How to become a trader in a prop trading company in practice: https://youtu.be/RGEVaEtaQ4g

Trading contests in pro-trading companies

Large prop companies use demo accounts when holding such events. If you hold contests on real accounts, then the funds deposited without a prize will not be returned to the owners. However, even the winners of the competition may not receive cash management. Real trading in market conditions differ significantly from the conditions of the competition. The trader will have to prove his worth with numbers so that he can get into a large prop company.

Benefits of prop trading

Financial institutions can note the following advantages:

- With minimal risk and investment, the possibility of obtaining maximum profit.

- When trading in the stock market, there is a supply of securities.

- It is possible to create your own liquidity, as well as to become a market maker for certain securities.

Benefits for traders:

- Maximum leverage.

- Internship with successful traders.

- The trader’s earnings are unlimited.

- You can then use the experience gained in other areas of life.

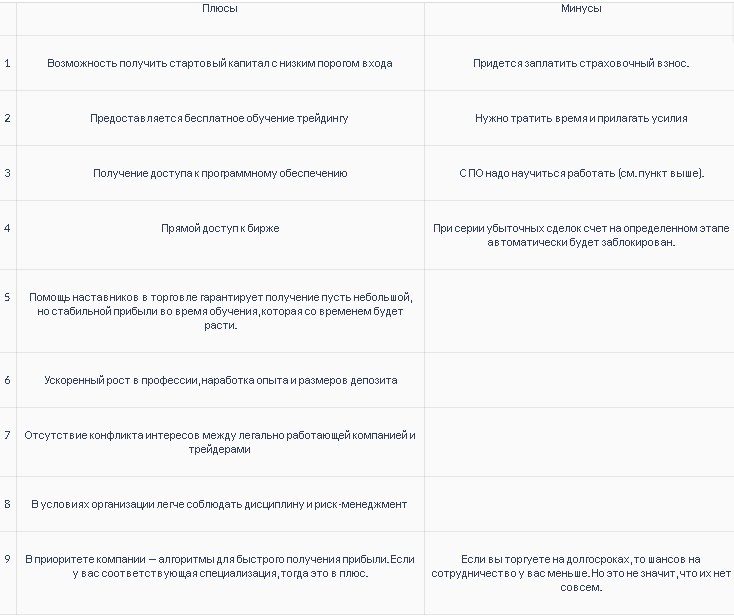

Pros and cons of a trader when working through a prop company:

Domestic and foreign prop trading companies

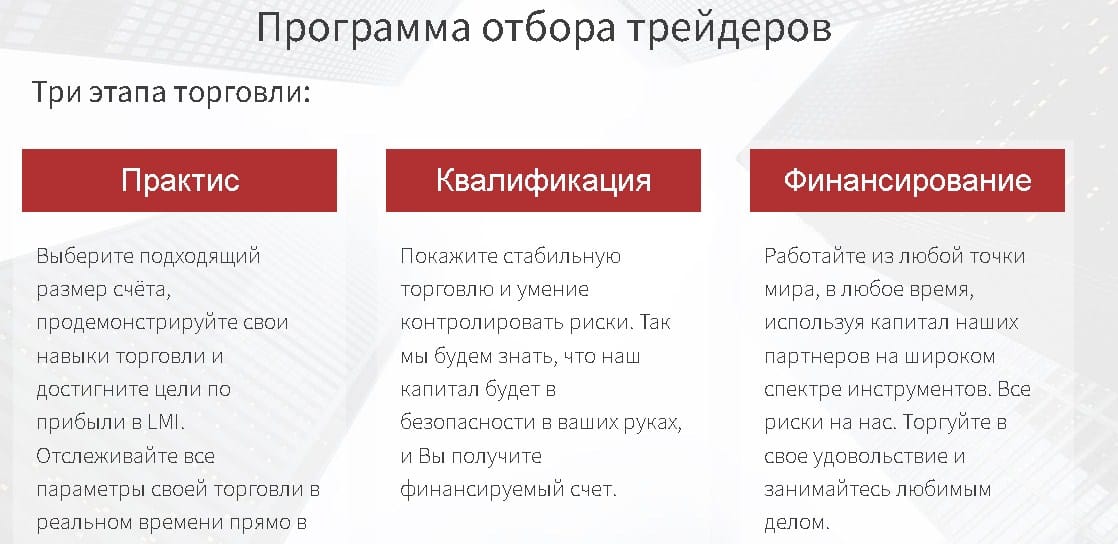

The most popular American firm is SMB Capital. Its founder, Mike Bellafiore, wrote the famous book One Good Trade. On the territory of Russia, companies involved in prop trading appeared only in the early 2000s, because of this there are not so many of them now. Some companies recruit people to their team through contests. One of the currently popular prop trading companies LMI Liberty Market Investment https://www.lmitrade.com/.

What else does a trader need

To make trading the main source of income, you must:

- Time . In trading, there is a direct correlation between the time spent and the closing of successful trades.

- Flexibility . A person should not be afraid to make a mistake, as well as constantly learn and improve himself.

- Willpower . While learning to trade, a person will make many mistakes. You need to try to cope with mistakes, as well as the loss of money. Only control of emotions and work on mistakes will achieve success.

მოგესალმებით.საინტერესო

სტატიაა. თბილისში თუ არის მსგავსი ორგანიზაცია რომელიც ტრეიდერების პრაქტიკულ მომზადებას უზრუნველყოფს