Ma’anar Regression Linear (LRI) – menene ainihin ma’anar mai nuna alama, nazarin yanayin. Lantarki na layi, wanda ake kira mai nuna alamar layi, ya zama muhimmin bangaren bincike na fasaha lokacin cinikin dukiya daban-daban. A cikin 1991, Gilbert Ruff ya ƙirƙira shi, tun lokacin ana amfani da shi sosai a cikin dandamali daban-daban. Ba kamar sauran analogues ba, yana da sauƙin amfani, yana ba ku damar samun bayanan haƙiƙa, waɗanda tare da su zaku iya yin ingantattun hasashen farashin farashin.

Bayanin mai nuna koma baya na layi

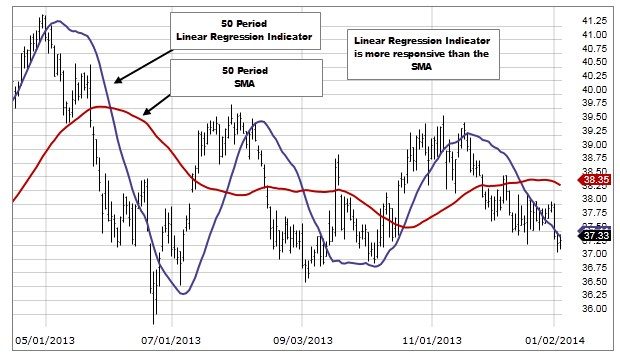

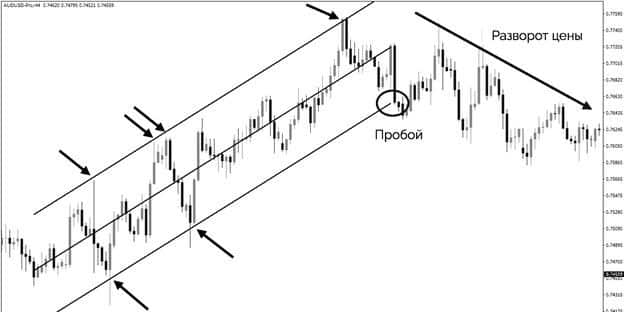

Mai nuna koma baya na layi yana da magana mai hoto. A gani, ana siffanta shi a sigar tashar da aka kirkira ta hanyar layi daya madaidaiciya. A cikin su akwai wani madaidaiciyar layi, wanda yake a nesa ɗaya daga matsanancin layukan, yana nuna motsin farashin a kasuwa. An saita nisa na irin wannan corridor ta mai ciniki ta amfani da firam. Layi na sama yana nuna matsakaicin ƙetare farashin daga yanayin da ke tasowa, kuma ƙananan layi yana nuna ƙananan ƙimarsa. Wannan kayan aiki ne na duniya wanda za’a iya amfani dashi lokacin aiki tare da duk wani kadari da aka sayar akan musayar. Yin amfani da layin da aka ƙirƙira, zaku iya ƙayyade ƙungiyoyi daban-daban na farashin yanzu, ƙirƙirar tashar farashi akan ginshiƙi, wanda ke nuna matsakaicin, ƙarami da tsakiyar motsin farashin. Na farko, an zana matsakaicin layi, wanda ake kira “layin koma baya”, dangane da ƙimar farashin yanayin. Gudun sa ya dogara da inda yanayin kasuwa ke motsawa. Bayan haka, mai nuna alama yana ƙara layukan daidaitattun guda biyu waɗanda ke wakiltar juriya da goyan bayan motsin farashi a kan wani ɗan lokaci.

Layukan Alamar Regression Linear:

Kafa mai nuna alama a cikin tashar ciniki

A cikin menu, zaɓi abu

“Saka” , sannan kuma sashin

“Tashoshi”

. Suna zaɓar

“Linear Regression”. Don saituna na gaba, kuna buƙatar zaɓar wurin da ake so akan ginshiƙi, daga inda za’a gina tashar koma baya ta layi. Ana shawagi siginan kwamfuta akansa, sannan ana danna maɓallin hagu akan linzamin kwamfuta. Bayan haka, ba tare da sakin maɓalli ba, kuna buƙatar ja shi zuwa alamar da ake so akan tsarin lokaci. Wannan shine mataki na ƙarshe na ginin tashar. Bayan haka, kawai kuna buƙatar saita faɗin abin da kuke so, wanda a cikin shirin MT4 yana cikin ɓangaren Fixed Date Time. Ranar aiki kawai aka saita a nan, wanda ya dogara da lokacin da aka saita. Mai amfani zai iya amfani da bayanan kwana ɗaya azaman lokutan lokaci. Shirin zai lissafta ma’auni na layin koma baya dangane da ƙimar farashin da aka bayar a cikin tazara tsakanin takamaiman maki biyu.

Don canja ƙayyadaddun tazarar, danna kan layin tsakiya sau biyu kuma ja abin da ake so daga wuraren da aka yi fice.

Kuna iya shigar da menu na kaddarorin tashar da aka gina ta danna-dama a ko’ina a cikin taga farashin farashi kuma a cikin menu mai saukarwa zaɓi abu “Jerin abubuwa”, inda aka zaɓi sashin “Register Channel”, a ciki ” An zaɓi sashin “Properties”.

Yaya ake amfani da shi

An shigar da irin wannan kayan aiki a yau a yawancin dandamali na kasuwanci. Don ƙara shi zuwa ginshiƙi, kuna buƙatar zaɓar shi daga menu. Don amfani da alamar koma bayan layin layi a cikin tashar MT4, yakamata ku same ta a saman taga. Don saukewa, kuna buƙatar danna maɓallan masu zuwa a jere, kuna shawagi bisa su:

- farko “Saka”;

- sannan ka zabi “Tashoshi”;

- sai a latsa sashin “Linear Regression”.

Bayan haka, shirin zai kunna akan kwamfutar. Bayan kunnawa, mai ciniki na iya amfani da shi a cikin ginin ginshiƙi wanda zai taimaka wajen ƙayyade yanayin farashin kasuwa a cikin yanayin da aka ba da lokaci. Don zana tashar, zaɓi farkon yanayin kuma ja mai nuna alama zuwa mahimmin batu na gaba na yanayin. Ta hanyar ƙaddamar da sama da ƙasa na yanayin farashi akan ginshiƙi, zaku iya sanya tashar ta daidaita kanta. A wannan yanayin, layin tsakiya ta atomatik yana ɗaukar matsayinsa tsakanin manyan layika na sama da na ƙasa. Lokacin ƙayyade wuraren shigarwa da fita daga kasuwa, ya kamata ku bi hulɗar farashin tare da manyan layi da ƙananan layi. Da zarar wannan ya faru, yana nufin cewa ƙimar farashin yanzu zai canza ba da daɗewa ba. Lokacin da yake hulɗa tare da layin tsakiya, yana nufin cewa farashin motsawa na yanzu ya fara samuwa, wanda ke nuna ci gaba da yanayin farashin halin yanzu. Lokacin gudanar da bincike na regression, kana buƙatar saka idanu akan rushewar hanyar da aka halicce. Lokacin da farashin ya karya amincin sa a cikin hanyar da ta saba da babban yanayin, yana nufin cewa a cikin wannan yanayin farashin farashin a kasuwa na iya canzawa a nan gaba. Binciken ya dogara ne akan lura da yadda farashin ke hulɗa tare da layi guda uku masu daidaitawa waɗanda ke haifar da corridor. A lokacin da ya fara hulɗa tare da ƙananan ko babba na tashar tashar, ya kamata ku kasance a shirye don gaskiyar cewa a nan gaba farashin farashi a kasuwa na iya canzawa sosai. Mai ciniki zai buƙaci kawai kallon yadda farashin zai yi hulɗa tare da ginanniyar layukan nuni. A lokacin hulɗar a saman ko kasan tashar, farashin farashin zai canza a nan gaba. Wannan zai zama alamar cewa idan farashin ya faɗi, za ku iya shiga kasuwa, kuma idan an sami raguwa, za ku iya fita. Misalin titin bullish inda farashin ke raguwa:

Ribobi da rashin amfani

Ana ɗaukar Regression Linear ɗaya daga cikin mafi dacewa da alamar alamar alamar mai ciniki. Tare da taimakonsa, koyaushe zaka iya gano ainihin canje-canjen da ke faruwa a kasuwa, shugabanci da ƙarfin su don samun lokacin yin rahoto game da gyare-gyare masu zuwa. Rashin amfanin irin wannan kayan aiki shine bayan an rufe mashaya, kuna buƙatar sake zana sigogin. Lokacin fassara siginar alamar da aka karɓa, ya zama dole a la’akari da maki da yawa:

- hawan layin da ke kan ginshiƙi yana nufin haɓakawa zuwa sama, kuma raguwar sa yana nuna cewa raguwa zai yi nasara a nan gaba;

- lokacin da darajar ta sake dawowa daga iyakokin da aka saita akasin yanayin, ya kamata mutum ya shirya don komawa baya;

- tunkuɗe farashin daga layin gefe yana ba ku damar ƙidayar gaskiyar cewa yanayin da aka kafa zai ci gaba da motsi.

Siffofin amfani da koma baya na Linear

Wannan kayan aiki ne na duniya wanda ya dace don amfani a fannoni daban-daban na ciniki:

- a cikin fatar fata ;

- don lebur;

- a tsakiyar ciniki;

- kayyade shugabanci na Trend.

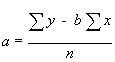

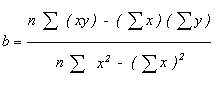

Mahimmin ka’idar mai nuna alamar layi shine cewa farashin zai canza a cikin tashar regression kanta. Irin wannan kayan aiki yana ba ku damar rufewa da buɗe kasuwancin, yayin da kuke tunawa cewa ba za ku iya kasuwanci da yanayin halin yanzu ba. Regression Linear an haɗa shi daidai da sauran kayan aikin da ɗan kasuwa ke amfani da shi, dangane da dabarun ciniki da aka yi amfani da su, nau’in ciniki, abubuwan da ake so: Stochastic, Bollinger da sauran kayan aikin da mai ciniki ke amfani da shi. Haƙiƙanin ma’anar madaidaicin Maɗaukakin layi yana da garanti ta gaskiyar cewa yana aiki akan takamaiman nau’i na lissafi, don haka an rage girman tasirin abin da ke cikin ciniki. Har ila yau, ya kamata a fahimci cewa don samun cikakkun bayanai da ke ba ku damar yanke shawara marar kuskure. kuna buƙatar amfani da ƙarin kayan aikin bincike na fasaha tare da mai nuna alama. Tare da taimakonsu, zai yiwu a kawar da hayaniya maras dacewa kuma daidai ƙayyade wuraren shigarwa da fita. Saita irin wannan kayan aiki da amfani da shi a wurin aiki yana da sauƙi idan kun bi umarnin da aka bayyana a sama.