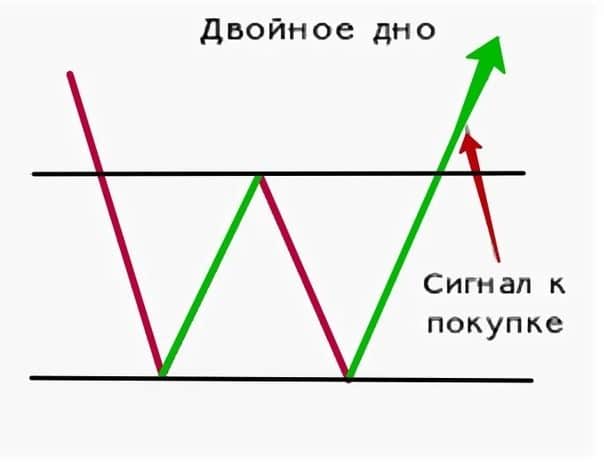

Yiyiphi i-double bottom ekurhwebeni, indlela ekhangeleka ngayo kwitshathi kunye nendlela yokuthengisa – izicwangciso kunye neengcebiso. Into ebalulekileyo kuhlalutyo lobuchwephesha bempahla ye-stock market yi-graphical configurations enegama elikhethekileyo – iipateni. Iskimu seklasiki somzekelo onjalo ngumfanekiso “ophantsi kabini”, ebonisa ukuguqulwa okunokwenzeka kwe-downtrend.

- Inkqubo yemfundo emfutshane – zithini iipateni?

- Indlela yokubala i-double bottom kwitshathi

- Izinto eziyinxalenye yepateni

- Ukuqulunqwa kwepateni ephantsi kabini kwintengiso

- amanani asezantsi kabini

- Ukurhweba kutshintshiselwano ngokwepateni ephantsi kabini

- Sukuyenza le mpazamo xa uRhweba iPhatheni eMazantsi eMbini

- Indlela yokurhweba ngaphantsi kabini kwaye wenze inzuzo

- Ubuchwephesha bokungena obuthembekileyo

- IiPros and Cons of the Double Bottom Pattern

- Iimpazamo kunye neeNgozi kuRhwebo lwePateni

Inkqubo yemfundo emfutshane – zithini iipateni?

Iipateni zokurhweba ziipateni zegraphic ezifunyenwe kwizalathi zexabiso dynamics. Zizinto ezisisiseko zohlalutyo lobugcisa, okukuvumela ukuba uqikelele ukuhamba kwexabiso le-asethi. Baye basetyenziswa ngenkuthalo ngabaxhasi bezimali ukusukela ngexesha apho kwakunokwenzeka ukulandelela iitshathi kwiscreen semonitha. Okwangoku, iipatheni ezingaphezu kwekhulu sele zichongiwe ezisetyenziswa kwintsimi

yohlalutyo lobugcisa . Enkosi kulo mkhwa, nkqu icandelo lonke lohlalutyo lomzobo livele kurhwebo. https://articles.opexflow.com/analysis-methods-and-tools/svechnye-formacii-v-tradinge.htm

Phawula! Iipateni ezininzi ezifumaneka ngokukhululekileyo ziipateni zokucinga ezenziwe ngabahwebi abaqhelekileyo.

Enye yeendlela zokurhweba zakudala yitshathi ephantsi kabini. Ihlala ifumaneka kwiimarike emva kwe-downtrend. Umzobo onjalo ubonisa utshintsho kwintshukumo yexabiso lesixhobo sezemali. Ukunokwenzeka kwesi siganeko kunyuswa ukongezwa ukuba kukho i-gap enkulu phakathi kwe-minima kwipatheni.

Indlela yokubala i-double bottom kwitshathi

Izinto eziyinxalenye yepateni

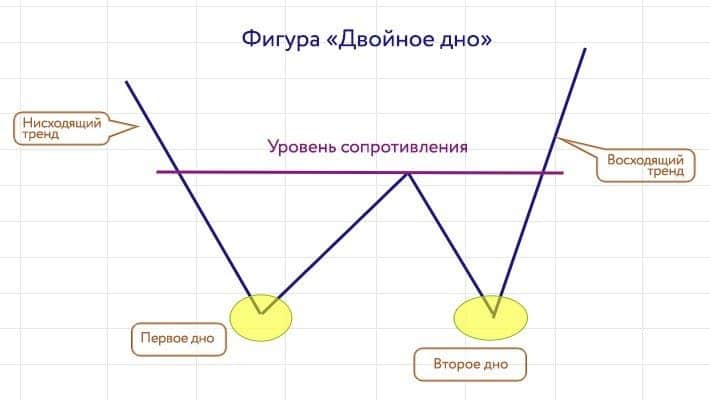

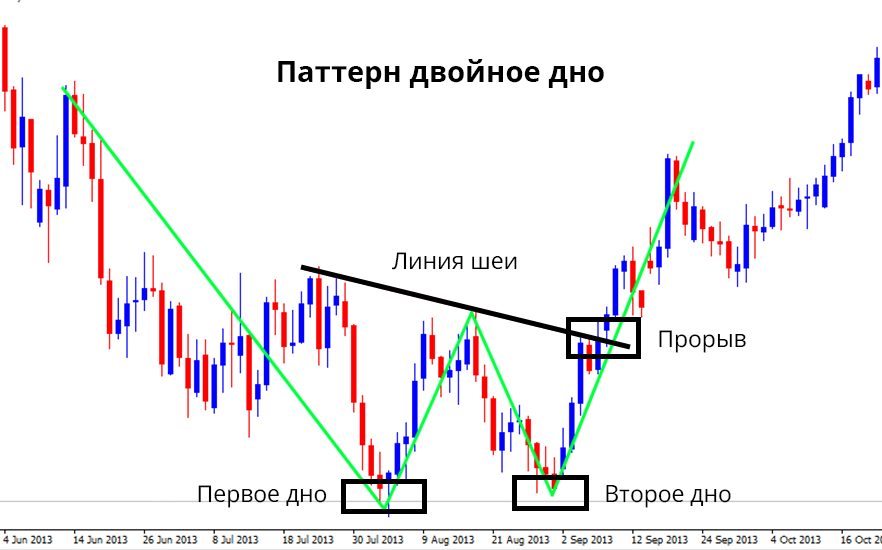

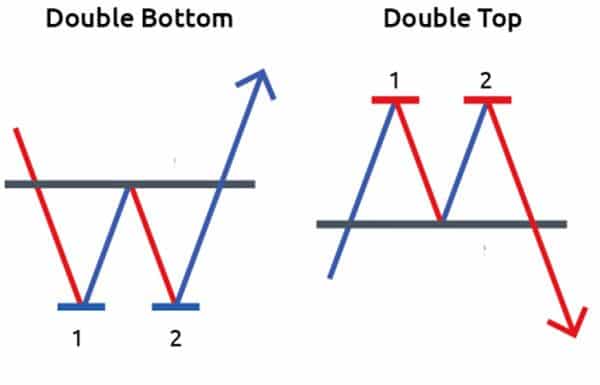

Umzobo uyindibaniselwano yamacandelo amaninzi enza ipateni ephantsi kabini. Ezi ziquka ezi zinto zilandelayo:

- Minima . Umboniso wokuqala kunye nowesibini ophantsi xa ixabiso libuyela kwixabiso elithile.

- Ukunyuka . Ibonakala emva kwezantsi yokuqala kwaye ihamba kunye nokunyuka kwexabiso le-10-20%. Ngokuqhelekileyo iindawo eziphakamileyo zijikelezwe ngamabomu ukuze zenze umgca wokumelana.

- Ukunyuka okuPhumelelayo . Emva kokubonakala kwesibini esisezantsi, ixabiso kufuneka lifikelele kumgca wokunyuka kokuqala. Esi salathisi sibonisa ukuba ixabiso le-asethi linokuthi liqalise ukukhula ngokukhawuleza.

Ukuqulunqwa kwepateni ephantsi kabini kwintengiso

Ukuqulunqwa kwepateni kwenzeka xa i-downtrend isenziwa, iqhubela phambili ekuqhekekeni kwezantsi lokuqala kwitshathi. Emva koko, ukunyuka kufuneka kubonakale ngokuyimfuneko, kudlula ngaphantsi ubuncinane nge-10%. Ngethuba lokubonakala kweyokuqala ephantsi kunye nokunyuka, kunzima ukuchonga ukuba iphethini enikezelweyo iya kuba yinto ephantsi kabini. Kucetyiswa ukuba ulinde okwesibini okuphantsi ukuba kuphulwe, okufuneka kwenzeke ngaphambi kwenyanga enye. Yintoni esezantsi kabini kurhwebo: https://youtu.be/q-0E2gPEbk4

amanani asezantsi kabini

– Kwi-70% yamatyala, intshukumo i-bullish emva kokubonakala kwezantsi kabini. – Kwi-67% yamatyala, ixabiso liphakama xa i-neckline iphuka. – Kwi-97% yamatyala, ukunyuka okunyukayo kuyaqhubeka xa umgca wentamo ye-double bottom of the pattern break. – Kwi-59% yamatyala, ixabiso libuyisela umva kwinkxaso yomgca wentamo ephindwe kabini emva kokuphuma.

Ukurhweba kutshintshiselwano ngokwepateni ephantsi kabini

Omnye umzekelo wembali wentelekelelo ephantsi kabini kukunyuka kwezabelo zeVodafone Group ngoNovemba ka-2018. Baye baphakama ngaphezu kwe-9% emva kokuba inkampani ichaze iziphumo ezingcono zemali. Okubaluleke ngakumbi, i-CEO engenayo ibonise ukuba i-dividend yeVodafone ikhuselekile, ngaphandle kweenzame zamashishini aseJamani eLiberty Global ukulwa nawo.

Sukuyenza le mpazamo xa uRhweba iPhatheni eMazantsi eMbini

Impazamo ephambili eyenziwa ngabaqalayo rhoqo xa besebenza nge-double bottom kukuvula ngokukhawuleza indawo ende emva kokuphula i-bottom yesibini xa ixabiso liqhekeza kumgca wokusika. Ukungakhathali okunjalo kukhokelela kwilahleko yemali, njengoko imarike iyonke ingaba kwi-bearish move. I-double bottom encinci ayiyi kunyuka kwaye i-downtrend iyonke iya kuqhubeka. Esi siphumo sihlala sisenzeka xa i-asethi ithengwa ngexabiso elingaphantsi kwe-MA. Ngelo xesha, inyathelo elibalulekileyo eliya kunceda umrhwebi ukuba aphephe imingcipheko ukubeka ukulahleka kokuyeka. Ukuziva uzinzile, kufuneka ibekwe phakathi kokuqhawula kunye nenkxaso.

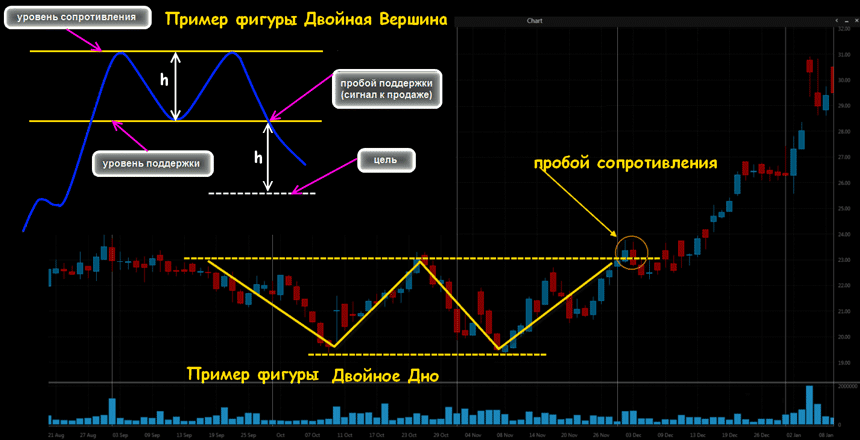

Indlela yokurhweba ngaphantsi kabini kwaye wenze inzuzo

Eli gama lithathwe kulwakhiwo lweenqanawa. Kurhwebo, ngumzekelo womzobo wokuziphatha kwesitokhwe. Kubonakala ngathi le nto – inqanaba le-asethi kwitshathi lihla liye kumgangatho ophantsi kwaye liphule phantsi, emva koko liphakama lingekho kakhulu kwaye lifutshane. Emva koko iphinda yonke into kwakhona. Emva kokubonakala kwalo mzobo kwitshathi, iingcali zilindele ukunyuka okunamandla kwi-asethi. Kukholelwa ukuba, xa ufumene i-double bottom yokwenyani, unokwenza ngempumelelo inzuzo ngokurhweba. Nangona kunjalo, kukho iimeko zobuxoki ezisezantsi eziphindwe kabini:

- Ukudakumba kubonakala kwangoko kakhulu, ngokukhawuleza kunenyanga.

- Ukunyuka phakathi kokuwa kufuneka kube ubuncinane be-10%

Kufuneka kuhlale kukhunjulwe ukuba i-algorithms yokuziphatha kweegrafu inzima kakhulu kwaye ayizange ifundwe. Akufanelekanga ukuthembela ngokupheleleyo kumaqhinga athile. Nangona kunjalo, ukulandelwa kwepateni kunokukhokelela kwinzuzo ephezulu.

Ubuchwephesha bokungena obuthembekileyo

Amaxesha amaninzi, ukubuyiswa kwexabiso kwenzeka emva kokufikelela kumgca onyukayo. Nangona kunjalo, umrhwebi unokubona kwangaphambili ukuba imeko iya kuba njani ne-asethi ukuba ulandela izinto ezininzi:

- Chonga i-double bottom enokubakho kwi-stock market.

- Lindela ukuba ixabiso liphakame emva kokufikelela kwisibini esiphantsi.

- Qinisekisa ubukho bokudibanisa.

- Vula urhwebo emva kokuqhambuka kokunyuka.

Esi sesona sicwangciso silungileyo nesithembekileyo sokungena esinika umsebenzisi ithuba lokugqiba intengiselwano ngomngcipheko omncinci. Kule meko, kufuneka ubeke ilahleko yokuyeka kwindawo ephantsi yoluhlu lwemida.

Iinkcukacha ezongezelelweyo! I-pullback ebuthakathaka, ijika ibe yimbumba eqinile, ibonisa ukungabikho koxinzelelo kubathengisi. Nangona kunjalo, ukuba ixabiso liyaqhubeka nokunyuka, lenza ukutsiba ngokukhawuleza ukusuka kwindawo yokunyuka, akufanele uqhubeke nokugxotha imarike. Isicwangciso esona silungileyo siya kuba kukuhlalutya imeko kwaye uvule isikhundla ngokulahlekelwa kokuyeka kumgama ongaphantsi kwe-1ATR ukusuka kwindawo yokungena.

IiPros and Cons of the Double Bottom Pattern

Inzuzo ephambili yepateni kukusetyenziswa kwayo ngokubanzi ngamaxesha ahlukeneyo. Ubumbeko lusebenza ngokulinganayo njengakwi-M15, H4 okanye H1. Uhlalutyo lobugcisa lwepateni ephantsi kabini lunokunceda bobabini abahwebi bemini kunye

neengcali ze -swing . Kwangaxeshanye, universality yepateni ilele kwinto yokuba ingasetyenziswa xa kusetyenzwa ngee-asethi ezahlukeneyo:

- izibini zemali.

- Isitokhwe.

- Iintsimbi ezinexabiso.

- Iimveliso.

Nangona kunjalo, njengezinye iipateni, i-double bottom ayinakuqinisekisa inzuzo elinde ixesha elide kunye nokuphindaphinda kwendlela eyenziweyo. Yingakho umsebenzisi ngamnye kufuneka asebenzise izixhobo ezikhethekileyo zokulawula umngcipheko.

Iimpazamo kunye neeNgozi kuRhwebo lwePateni

Ummandla we-stock kunye neemarike zemali ngokuqinisekileyo uhamba kunye nemingcipheko kunye neelahleko ezinokuthi wonke umrhwebi angajamelana nazo. Eyona mpazamo ixhaphakileyo xa usebenza nge-double bottom ingaba yinkcazo yepateni engalunganga. Kwezinye iimeko, kunokuphazamana noqwalaselo olungeyonyani. Oku kunokubonwa kulo mzekelo ulandelayo.