Scalping in trading – what is it in simple words for beginners, strategies and understanding of pipsing processes. The scalping strategy (another name for pipsing) involves the rapid closing of profits or losses, and a large number of transactions in a short trading time. The number of transactions can vary from 30-50 for manual traders to 200-600 for

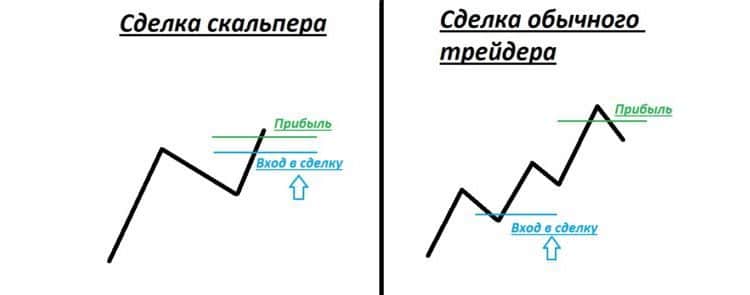

algorithmic traders. https://articles.opexflow.com/trading-training/algoritmicheskaya-torgovlya.htm It is extremely important for a scalper to set a short hard stop. Unlike conservative day traders, scalpers enter a trade on the entire deposit with leverage. So a day trader enters 5% of the deposit and puts a 10% stop, the leverage is not used, in case of failure, the loss will be 0.5%. The scalper enters the entire deposit and takes leverage 5. He places a stop at 0.1% of the price movement and, in case of failure, loses 0.5%. He mainly trades on tick, minute or five minute charts. It is extremely important that the stop-take ratio is not less than 1-1.5. Scalpers

pay a very large commission to the broker, so they need to take this into account.

- What is scalping in stock market trading in simple terms

- Scalping – pros and cons

- Commissions

- What to trade

- scalper tools

- Types of scalping

- Price impulses

- Scalping by glass

- Mixed

- How to trade scalping

- Training

- European session

- “Lunch time”

- Statistics output

- American session

- Algorithmic trading in the stock market

- How to install a robot in Metatrader 5

- Forex scalping

- Mistakes and risks in scalping

What is scalping in stock market trading in simple terms

Historically, scalping in Russia originated in the stock market. At first, traders were piping the most liquid and volatile stocks on RAO UES. Later, the RTS index appeared, and scalping on futures became popular.

Scalping – pros and cons

Scalping is one of the least risky and profitable trading methods on the stock exchange. The trader does not postpone transactions through the night or weekend, which means that he does not bear the risks of morning gaps, when sudden news affects quotes too much. The scalper clearly controls his risks, while the day trader can get a larger stop than he expected. A trader can profit from any move, even if the market is stalling. He can devote as much time to this activity as he decides, he does not care who will become the next US president, whether the Fed will change monetary policy, he does not look at the statistics on inflation and unemployment. The movements on which he earns are so small that he does not need to make forecasts. Disadvantages – great nervous tension, high time costs. Some traders make random trades and call it scalping.

Commissions

When trading stocks, the broker charges a commission. When trading on daily charts, it is not significant, but it can have an impact on trading with the scalper method of trading. The trader must take from 10 to 30 kopecks of the price movement, collecting it in order to recoup the commission. Moreover, the commission is charged regardless of the result of the trade. If a trader makes a large turnover, the broker can offer him more favorable conditions with a reduced commission. There are futures for liquid stocks – derivatives that give the right to profit from changes in quotes, but do not give ownership rights. Scalpers are not going to hold shares, so they switch to futures trading because of the low commission. When trading shares, a commission is charged from 0.05% of the transaction price, and for 1 futures (100 shares) – a fixed price of 40 kopecks.

The danger of scalping in futures is the automatically provided

leverage . If the position volumes are not correctly calculated, this can lead to large losses.

What is scalping in trading in simple terms – an introduction for beginners: https://youtu.be/nor8L_SQjzI

What to trade

Any asset is suitable for trading, but the scalper needs to quickly enter and exit the position. And it is desirable that the shares were volatile. If trading takes place all day for 30 kopecks conditionally, you won’t earn much, the commission will gobble up all the profits.

scalper tools

A trader makes many short-term transactions, but the market is fractal and trading on a minute chart is no different from analyzing on other timeframes. For scalping, a trader uses:

- stochastic;

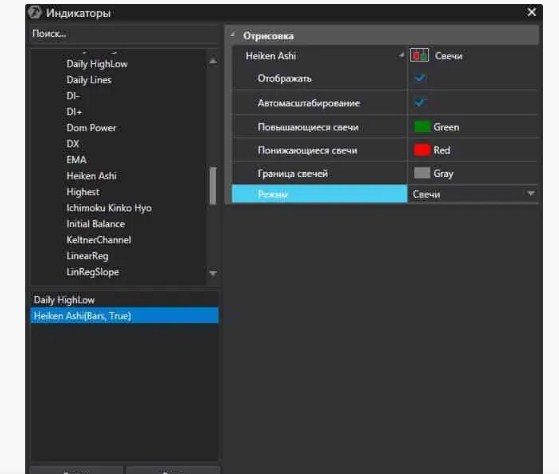

- RSI ; [caption id="attachment_13973" align="aligncenter" width="850"]

- support and resistance levels;

- technical analysis figures ;

- trend lines;

Heiken Ashi scalping - volumes;

- cluster graphs;

- open interest and derivatives market data;

- Fibonacci levels .

a trading drive , for example, Qscalp. In it, you can place or delete an order with one click, set a stop and take.

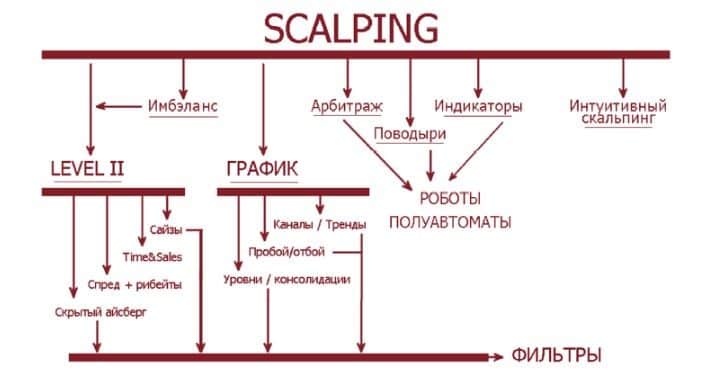

Types of scalping

There are several of the most popular scalping trading methods.

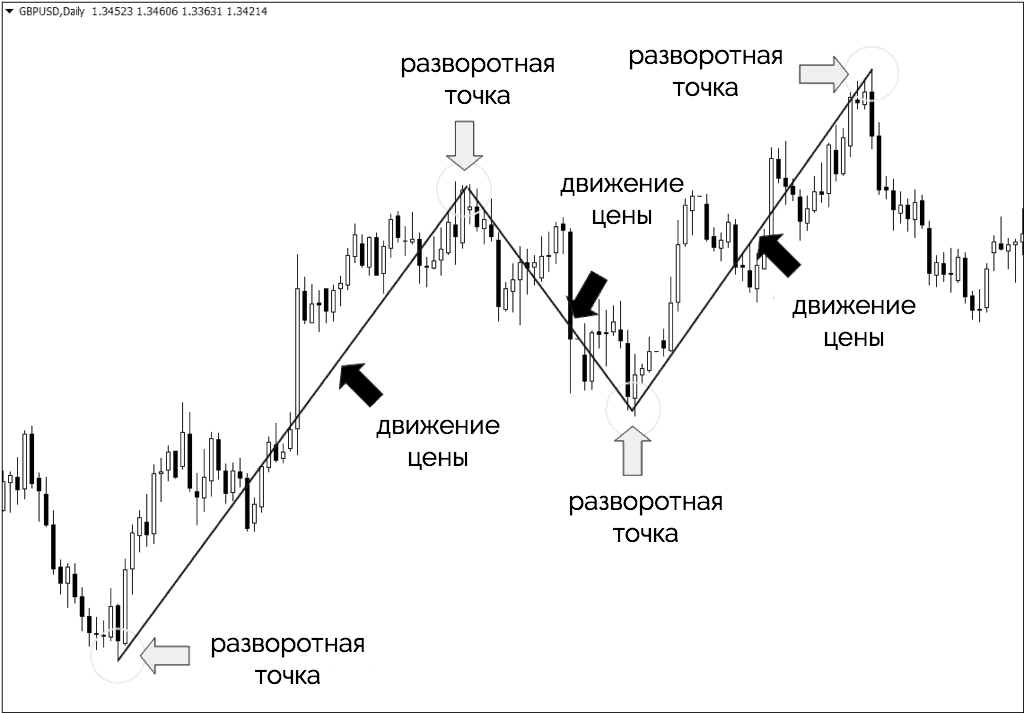

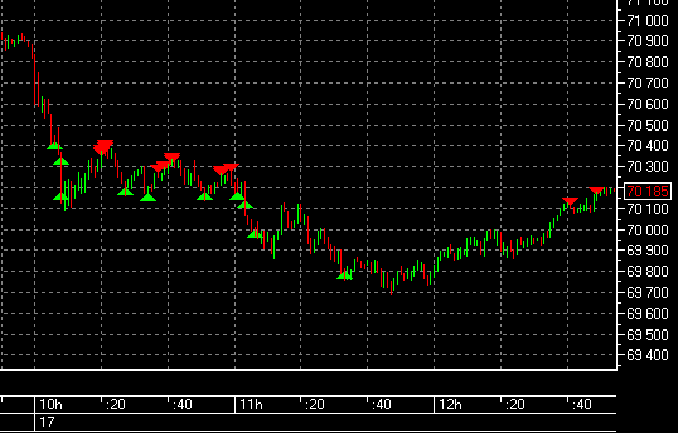

Price impulses

A trader should carefully look at the volumes and indicators and find the moment of the trend on the minute chart. He joins the movement and makes several trades in the direction of the trend. He never waits for the trend to fade, he clearly knows how many points he wants to get and exits when the goal is reached. The scalper’s take is not large, so in most cases, trades are closed with a profit on strong impulses.

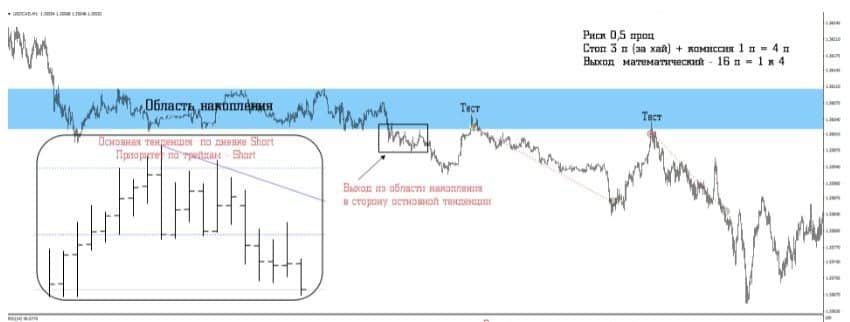

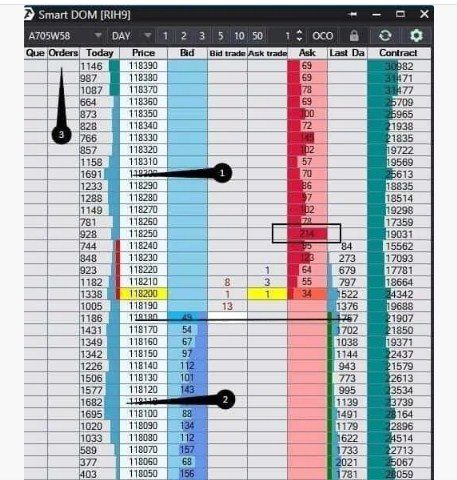

Scalping by glass

The trader analyzes the alignment of forces of bulls and bears, placing large limit orders in the exchange country. Often, traders still mark support and resistance, build trend lines, and watch indicators. This is not necessary, with this type of scalping, all decisions are made by the order book, the chart can not be opened at all. The task of the trader is to find a situation with a very short stop and try to take a small price movement. Take does not exceed 0.1-0.2%.

Mixed

Traders use both methods, they can find price momentum and look for an entry on the order book. Or vice versa, expect that a small pullback will give birth to a new trend.

How to trade scalping

Good results in the stock market is considered to be a yield of 20% per annum. At the same time, stocks in a calm market move about 1-2% per day. It is enough for a trader to take 0.3% of the price movement (multiply by the third leverage) to get 0.9% per day. And this is 18% per month, and without the risk of gaps, and worries about whether Nord Stream 2 will be built. It is important to adhere to risk management and clearly follow the rules of the strategy.

Training

The working day of the scalper in the stock market starts 1-2 hours before the opening of trading (European session). He must look at the changes in the quotes of the stock exchanges in Europe, America and Asia, oil. See if there is any important news on this day and see the changes in open interest in major stocks over the past day.

European session

At the opening of trading, you can make the main profit – often the shares move at 1-2% per hour, and then go flat before the American session. In the first hour of trading, you should make from 3 to 10 transactions, tightly controlling the risks. After two losing trades in a row, it is recommended to stop trading for a few hours. After completing the profit plan for the day, it is recommended to end trading for that day.

“Lunch time”

Market volatility drops sharply. This time is best used for rest or analysis of morning trading. https://articles.opexflow.com/investments/volatilnost-na-birzhevom-rynke.htm

Statistics output

It is not recommended to make deals, trying to “guess” the direction of movement after the release of statistics. You need to know the release time of statistics, because it can become a driver of volatility growth. You can determine the value of statistics by the volumes that entered the market. The market will shake out the first people who want to enter, and the scalper will determine the alignment of forces by the nature of this movement. You should pay attention to the level of output of statistical data.

American session

The main movement of the day is the American session. Shares at the opening of trading are moving with increased volatility, trading volumes are growing. A trader can make from 3 to 10 trades per hour. You should follow the rules, stop trading after 2 x losing trades. Scalping in stock trading: what is it and the best strategies and indicators for scalping from scratch – https://youtu.be/5R6ls3SEt8c

Algorithmic trading in the stock market

Scalping is a fairly low-risk and profitable way to earn money. It is no secret that in 2022, manual scalpers will compete with

bots – special programs that make transactions according to a certain algorithm. Scalping takes a lot of effort and time, it may be possible to entrust the routine work to a soulless machine.

Robot trading has the following advantages:

- the program has no emotions, will not forget to put a stop;

- does not get sick, does not get tired, acts clearly according to the algorithm.

A trader can write a bot on his own if he knows how

to program . It can be ordered from a programmer, or bought ready-made from a systems developer. In the latter option, you should always be ready to buy a pacifier. Remember that if the robot was really as good as they say it is, it would not be sold. https://articles.opexflow.com/programming/razrabotka-torgovogo-robota.htm If you have decided to trade purchased bots, you should be prepared that you will need not one, not two, but several dozen bots. You need to be able to optimize the parameters of bots. These classes are not for a beginner, but for an experienced trader who understands the market and wants to pass on some of the routine work. I am ready to pay a lot of money to nowhere and be responsible for the performance of the robot.

How to install a robot in Metatrader 5

After the purchase, the user will receive a file with the extension ex4. To start using the robot, you need:

- Open the Metatrader 5 terminal, in the file menu find the “open data directory” tab.

- Place the robot file in the “experts” folder.

- Restart the program.

- Open the chart of the desired stock.

- Find the indicator in the “Navigator” list and right-click, in the menu that opens, click “Attach to chart”.

- The robot settings window will open, so that the robot can make transactions, you need to click “Allow the adviser to trade”.

- Open the settings tab and make the necessary settings.

- Press OK. The smiling little man at the top right says that everything is done correctly.

Scalping: what is it, scalping strategies with examples: https://youtu.be/nRdtujqYwdU

Forex scalping

Traders are pipsing on currency pairs. The name “pips” comes from Pips, the minimum price move. The trade is held until it brings at least a few pips up. In Forex, spreads (or commissions) are quite large, and a trader must catch at least 0.5 points on four-digit quotes. The currency market most of the time, especially in the European session, in the absence of news, is in the sideways and the scalping strategy shows good results. A trader can take a total of 100-200 points (four digits) per day, while a day trader is waiting for a signal. A common strategy is to enter a level breakout with a short stop loss, in the expectation that 1 p of profit will be given before the stop is hit.

Mistakes and risks in scalping

Some traders make a big mistake and call it scalping. The deal closes in a small plus, and if the price goes in the opposite direction, the trader does not accept the stop, but averages the position or stays out without averaging. This is not scalping, but can be quite profitable if the trader has a sufficient deposit, risks a small amount of capital, and has a positive trade count of over 70%. But in most cases, this approach leads to the drain of the deposit, because this is not a well-thought-out strategy with a calculated risk, but a violation of discipline and loss aversion. When scalping, a trader should easily accept stops, there are a lot of them with this approach. One not exposed stop can cost a month of everyday work. When trading manually, it is easy to make a mistake if you are not healthy or tired.