Iibhendi zeBollinger (ngamanye amaxesha iBollinger Bands) – yintoni na kwaye isalathisi seBollinger sisetyenziswa njani? Ukuze kuhlalutywe ngokuchanekileyo ukuba nokwenzeka kokhetho oluthile lokutshintsha amaxabiso kwixesha elizayo,

iindlela zohlalutyo olusisiseko kunye nobuchwepheshe zisetyenziswa . Kwimeko yokuqala, imeko ihlalutywa ngokuqwalasela impembelelo yezoqoqosho. Ngexesha elifanayo, akusoloko kunokwenzeka ukuqikelela ukuba baya kuchaphazela njani ixabiso lezabelo ezithile. Ngokuqhelekileyo kwenzeka ukuba iziganeko ezibalulekileyo zichaphazela amaxabiso ngokukhawuleza kwaye umthengisi akanalo ixesha lokuyisebenzisa. Isalathisi seBollinger Bands:

- I-central imele ixabiso eliphakathi kwexabiso. Ibonisa umkhwa wokuhamba kwaye ikuvumela ukuba wakhe ingqikelelo malunga nohlobo oluqhelekileyo lotshintsho.

- Imigca ephezulu kunye nesezantsi ibonisa iqondo lokutenxa ukusuka kumgca ophakathi. Umahluko phakathi kwabo ngowona mkhulu, ubukhali ngakumbi utshintsho kwiikowuteshini.

- Ifilosofi kunye nembali yesalathisi

- Iibhendi ze-bollinger zisetyenziswa njani

- Okuhle nokubi

- Ukwakha

- I-Bollinger Band Strategies – Isicelo esiSebenzayo ekuHlalutyeni

- Buyela kwakhona ukusuka kwimida

- Impumelelo yenqanaba ekujoliswe kulo

- Inkxaso ethambekileyo okanye imigca yokumelana

- Inkxaso ethe tye okanye imigca yokumelana

- Sebenzisa kwiitheminali

Ifilosofi kunye nembali yesalathisi

Esi sibonakaliso senziwa nguJohn Bollinger kwi-1980, umthengisi waseWall Street kunye nomhlalutyi. Sele kwiminyaka elishumi yokuqala emva kokudalwa kwayo, isalathisi safumana ukuthandwa ngokubanzi, okuqhubeka kumashumi eminyaka kamva. Ikuvumela ukuba uqonde ukuba amaxabiso asasazwa njani xa kuthelekiswa nomndilili wexabiso le-asethi. Xa kukho ukuguquguquka okuphezulu, umgama phakathi kwemigca ephantsi kunye nephezulu iyanda. UJohn Bollinger wabhala incwadi ethi “Bollinger kwi-Bollinger Band” echaza imithetho yesicelo.

Inkxaso ethambekileyo okanye imigca yokumelana

Kwitshathi eboniswe apha, iintolo ezibomvu zibonisa ukutsiba oku-4 ukusuka kumgca ophakathi ngexesha lentshukumo esezantsi. Ezi meko ngamaxesha anenzuzo yokungena kurhwebo lokuthengisa. Uyabona ukuba kule tshathi, urhwebo lokuqala oluthathu luya kuphumelela ukuba luvaliwe emva kokuwela umgca ophantsi. Le yokugqibela, ngenxa yotshintsho kwindlela yendlela ukuya phezulu, ayiyi kukhokelela ekudibaneni kwangaphambili kunye nomgca ophantsi. Ukunciphisa ilahleko kwimeko yokugqibela, kwanele ukubeka ukumisa kumgca ophakathi wesalathisi seBollinger.

Inkxaso ethe tye okanye imigca yokumelana

Ukuba isalathisi sisetyenziswe kwimarike ehamba phambili, inokuchukumisa ngokuphindaphindiweyo umgca wangaphandle kwaye ubuyele umva. I-rebound nganye enjalo inokuqwalaselwa njengomgca wokuchasa kwimarike ekhulayo. Xa iingcaphuno zidlula ngexesha lokunyakaza okuqhubekayo, oku kubonisa amandla okunyakaza kwaye kukuvumela ukuba usebenzise lo mzuzu ukufaka isivumelwano okanye ukwandisa. Kwangoko emva komgca ngamnye wokuchasa, unokumisa, ukubonelela malunga nophuhliso olungakumbi lwentengiselwano. Ukuqwalasela itshathi enikeziweyo njengomzekelo, kucacile ukuba ukuyeka okunjalo kuya kusebenza kuphela emva kokuba imigca yokugqibela yoyisiwe. Ukuze unqume ngokuchanekileyo zonke iiparitha eziyimfuneko zokuthengiselana kule kunye neminye imizekelo, kunenzuzo ukusebenzisa izibonakaliso ezongezelelweyo ezifunyenwe zizibonakaliso. Umrhwebi kufuneka anqume ukuba yeyiphi kubo efunekayo ngokumisela

Sebenzisa kwiitheminali

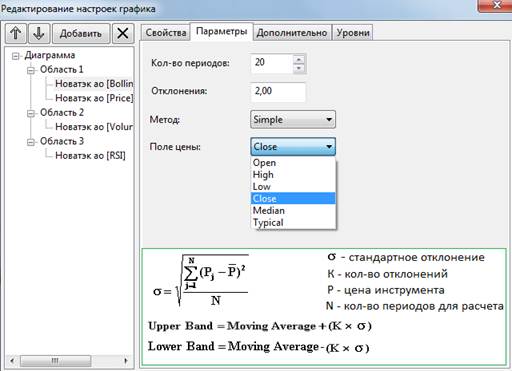

Iibhendi zeBollinger sele zithathwa njengesixhobo seklasikhi sohlalutyo lobugcisa. Ke ngoko, kwiimeko ezininzi, ziphakathi kwezixhobo zohlalutyo lobugcisa ezifakwe ngaphambili. Inkqubo yokubala yesalathisi: