Menene saman biyu a cikin ciniki, menene tsarin, bayaninsa da fassarar ƙirar juzu’i na saman Biyu. A cikin bincike na fasaha, tsari shine tsarin farashi mai maimaita akai-akai wanda ke ƙayyade motsin kasuwa a nan gaba. A wasu kalmomi, tsarin yana nuna ko wani yanayi a kasuwa zai ci gaba ko ya koma baya. Akwai nau’ikan alamu da yawa:

- nazarin hoto (lambobi);

- nazarin kyandir (haɗin kyandir);

- fractals;

- ƙirar ƙididdiga masu mahimmancin farashi.

https://articles.opexflow.com/analysis-methods-and-tools/svechnye-formacii-v-trajdinge.htm saman biyu shine ɗayan mafi yawan alamu a cikin nazarin hoto na kasuwar kuɗi. Bayyanarsa a kan ginshiƙi a cikin

tashar ciniki yana ba mai ciniki ra’ayin cewa farashin zai fi dacewa ya kasance daidai da lokacin da wannan tsarin ya bayyana akan ginshiƙi a baya. Babban ninki biyu a ciniki yana nuna lokacin juyawar farashin farashi. Bambance-bambancen adadi shine cewa ba shi da gangara, amma yana da kololuwa masu ma’ana, yana bayyana sakamakon kammalawar haɓakawa.

- Yadda ake gane saman biyu da lissafin saman Biyu akan ginshiƙi

- Abubuwan ƙirar saman saman biyu

- Samar da samfuri na sama biyu a ciniki

- Nau’o’in saman biyu a cikin ciniki

- Yaya ake amfani da shi a cikin bincike na fasaha?

- Ciniki a kan musayar hannun jari a kan saman biyu – dabaru masu amfani da misalai tare da kwatancen da bayanin hoto

- Karka Yi Wannan Kuskuren Lokacin Kasuwancin Babban Tsarin Biyu

- Yadda za a kasuwanci da samfurin saman biyu kuma ku sami riba?

- Amintaccen Fasahar Shigarwa

- Ribobi da rashin amfani na tsarin

- Kuskure da kasada

Yadda ake gane saman biyu da lissafin saman Biyu akan ginshiƙi

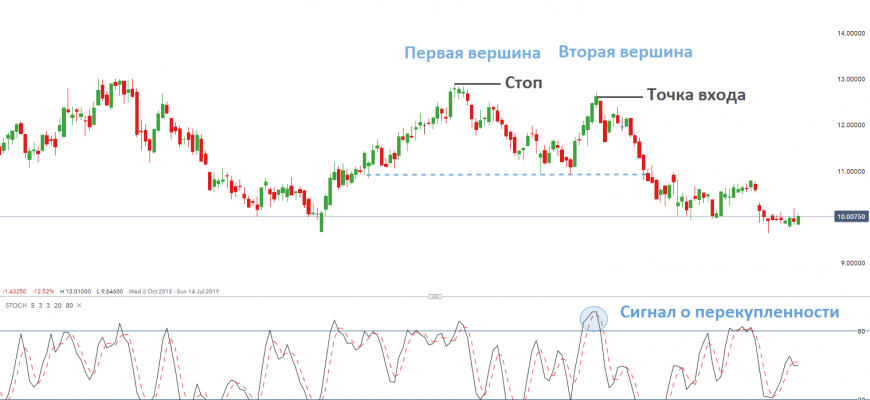

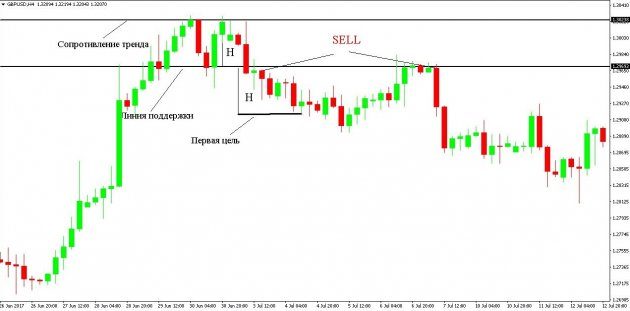

Don ƙarin ingantacciyar karatun ƙirar saman Biyu, kuna buƙatar sanin ainihin abin da saman biyu yake kama da bincike na fasaha. A zane-zane, yana kama da harafin M. Tsarin saman saman biyu ya samo asali ne sakamakon haɓakar haɓakar haɓakar farashi zuwa matsakaicin (A), bayan haka farashin ya juyo sosai kuma ya faɗi zuwa tallafi na ƙasa (B). Tashin farashin da ya biyo baya ya kai matakin saman A baya, yayin da za a iya samun ɗan canji a cikin wata hanya ko wata (A1), yayin da babu raguwar farashin. Juyawa na gaba yana rage farashin zuwa ƙimar baya B ko ƙasa. Ragewar farashin ƙasa matakin B yana sa ƙirar saman biyu ta cika kuma yanayin ya karye. Tsarin sama na biyu akan ginshiƙi:

- yi alama a kan jadawali kololu biyu masu faɗi da tsayi iri ɗaya;

- nisa tsakanin madaidaicin kada ya zama karami;

- nuna matakin tallafi.

Don tantance ƙirar saman saman sau biyu, zaku iya amfani da alamun fasaha kamar oscillator da

matsakaicin motsi . Yawancin yan kasuwa suna tsammanin cikakken adadi, tare da farashin farashi, a matsayin tabbatar da gaskiyar yanayin, don yin ciniki.

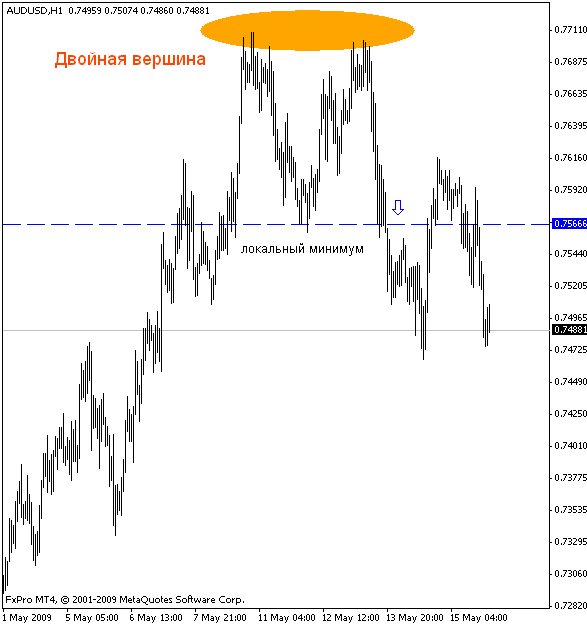

Abubuwan ƙirar saman saman biyu

Tsarin saman biyu, kamar yadda aka ambata a sama, graphically yayi kama da harafin M. Adadin ya ƙunshi kololuwar kololuwa guda biyu waɗanda ke kan matakin ɗaya, da kuma wani tudu dake tsakanin su biyun. Layin kwance da aka zana ta wurin ƙananan ma’auni na trough yana samar da matakin tallafi. Tsayin tsayin adadi yana ba da jagora ga hajoji a farashin. An bayyana shi azaman nisa daga kololuwar ƙirar zuwa layin tallafi.

Samar da samfuri na sama biyu a ciniki

A cikin ciniki, saman biyu shine hoto mai hoto, jujjuya tsarin kuma yana nuna raguwa ko haɓakawa cikin farashi. A kan ginshiƙi, wannan tsari yana bayyana lokacin da farashin ya kai mafi ƙanƙanta/mafi girman ƙima, sannan ya juyo sosai kuma ya kai kusan matakin da ya gabata, inda ya sake juyawa kuma ya dawo hawa / sauka zuwa mafi ƙanƙanta/mafi girman dabi’u, yana yin wani babban juyi. Ƙarshe na ƙarshe na saman biyu yana faruwa bayan farashin ya karye ta hanyar layin tallafi ko layin tabbatarwa.

Nau’o’in saman biyu a cikin ciniki

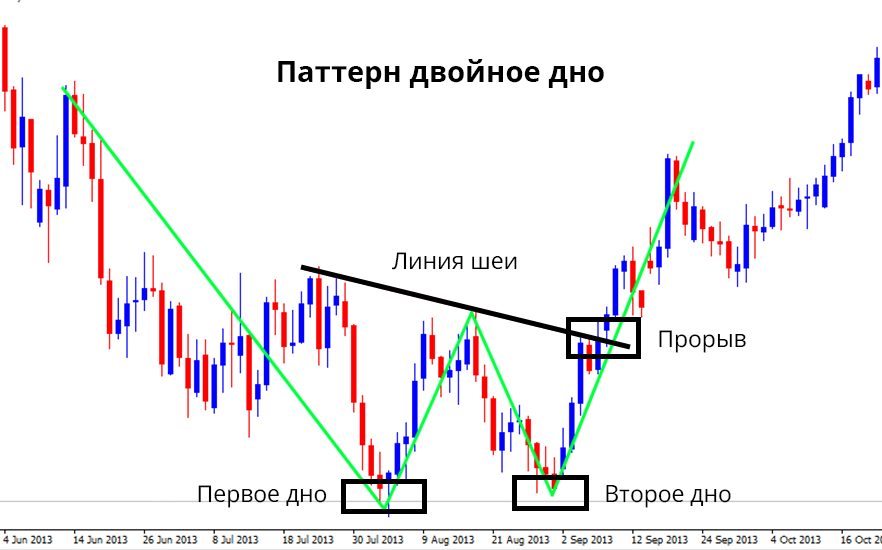

A cikin ciniki, ban da abin hawa biyu na sama, sau da yawa akwai adadi kishiyarsa kuma ana kiransa

ƙasa biyu ko ƙasa biyu. A zane-zane, ƙirar tana kama da harafin W kuma an ƙirƙira ta cikin ƙasa. Hakanan ana kiransa jujjuyawar bullish kuma yana da sabanin halaye na saman biyu. Wannan yana nufin cewa farashin ya kai ƙaramar ƙimarsa, bayan haka ya tashi na ɗan lokaci kaɗan kuma ya sake mirginawa zuwa mafi ƙarancin ƙima. [taken magana id = “abin da aka makala_15165” align = “aligncenter” nisa = “882”]

Yaya ake amfani da shi a cikin bincike na fasaha?

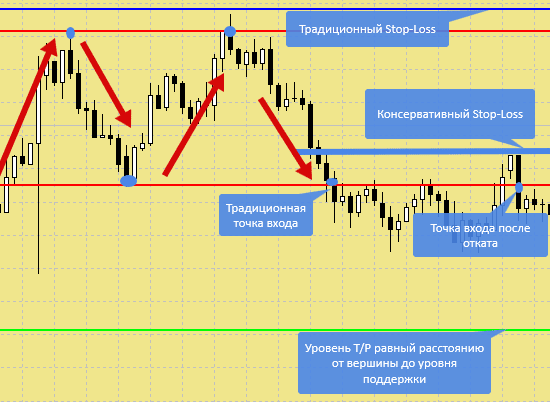

A cikin nazarin fasaha na kasuwa, ana amfani da saman biyu a matsayin sigina don yin yarjejeniya da shiga kasuwa. A cikin classic version of fasaha bincike, akwai shawarwari don shigar da kasuwa da kuma yin kulla a lokacin da farashin ya karya ta hanyar goyon bayan matakin da kuma sanya wani tasha asarar kawai sama na biyu saman. https://articles.opexflow.com/trading-training/stop-loss.htm Masu halartar kasuwa sun fahimci cewa lokacin da farashin ya canza, ya kai kololuwar kimarsa kuma ana buƙatar yanke wasu shawarwari:

- waɗanda ke zaune a matsayi suna karɓar riba, suna neman hanyar fita daga ciniki;

- masu kallo – neman hanyar shiga a kan yanayin, mai da hankali ga matsayi mai karfi.

Ciniki a kan musayar hannun jari a kan saman biyu – dabaru masu amfani da misalai tare da kwatancen da bayanin hoto

Don rage haɗari da riba daga ciniki, ya kamata ku bi dokoki biyu:

- Shiga kasuwa don siyarwa kawai lokacin da farashin ya karya layin wuyansa.

- Bude matsayi na siyarwa bayan rabuwa na biyu na layin goyan baya ta farashin.

Ƙarƙashin ƙasa biyu shine hoton madubi na saman biyu, ka’idodin ciniki don shi suna kama. Ƙasan ƙasa biyu yana buɗewa lokacin da ƙasa ta koma baya.

Karka Yi Wannan Kuskuren Lokacin Kasuwancin Babban Tsarin Biyu

Dangane da bincike na fasaha, ‘yan kasuwa suna jiran rushewar layin tallafi don buɗe kasuwanci mai tsawo. Koyaya, tare da wannan hanyar, zaku iya fada cikin tarkon karya karya, tare da jujjuyawar kasuwa. Kuna iya gyara halin da ake ciki ta hanyar buɗe matsayi don yarjejeniya bayan karya karya. Faɗuwar kasuwa zai haifar da haifar da asarar tasha daga ‘yan kasuwa da ke tsaye a cikin dogon lokaci, wanda zai motsa farashin har ma da ƙasa. https://articles.opexflow.com/analysis-methods-and-tools/proboj-urovnya.htm Ciniki wannan tsarin yana ciniki akan dogon lokaci. Ayyukan Farashi: nau’i biyu na sama/ƙasa – cikakken jagora don gano ginshiƙi, dabarun ciniki: https://youtu.be/gRyc7Vj-4jA

Yadda za a kasuwanci da samfurin saman biyu kuma ku sami riba?

Kuna iya gyara ribar daga ciniki, dogaro da saman biyu, ta hanyar ƙididdigewa da gyara layin riba. Ana ƙididdige ribar riba don babban tsari biyu, da kuma ga sauran ƙididdiga na ƙididdiga na fasaha, bisa ga makirci:

- auna nisa daga layin tallafi zuwa kololuwa (matakin juriya);

- muna jiran rushewar tallafi kuma mun jinkirta ƙimar da aka karɓa daga layin tallafi.

A wannan matakin, muna gyara riba. Dabarun da ke gaba za su ba ku damar samun kuɗi akan yarjejeniyar:

- bude wani ɗan gajeren ciniki a kan fashewar tallafi;

- gyara asarar tasha a bayan layin karya;

- idan farashin ya kai riba, mu gyara ribar.

Amintaccen Fasahar Shigarwa

Kafin shiga dogon matsayi, dole ne ku:

- nemo kasa mai yuwuwa biyu;

- jira farashin don motsawa;

- lura da jujjuyawar a cikin nau’in ƙarfafawa mai ƙarfi;

- bude tallace-tallace bayan farashin ya wuce iyaka.

Ribobi da rashin amfani na tsarin

Abubuwan fa’idodin saman biyu da ƙirar ƙasa biyu sun haɗa da inganci a tazarar lokaci daban-daban (M15, H1, H4 ko D1). Wannan ya sa ya yiwu a yi amfani da su a cikin nazarin rana,

lilo da matsayi yan kasuwa. Waɗannan su ne alkaluma na duniya waɗanda ke aiki tare da kayan aikin hannun jari daban-daban: hannun jari, nau’i-nau’i na kuɗi, albarkatun ƙasa, da sauransu https://articles.opexflow.com/trading-training/skolko-zarabatyvayut-trajdery.htm tsarin yana da nasa koma baya. Babban abu shine cewa saman biyu baya bada garantin ƙarfafa yanayin da aka kafa. Misali, bears a cikin kwana biyu na iya juyar da farashi a karo na uku, karya ta matakin tallafi. Don haka, dole ne a kula don rage haɗari.

Kuskure da kasada

Babban kuskure a cikin ciniki tare da nau’i mai nau’i biyu yana buɗe matsayi mai tsawo nan da nan bayan farashin ya tashi. Haɗarin shine cewa a cikin wannan yanayin akwai damar da za a fara ciniki akan babban yanayin. Wannan yana faruwa lokacin da kasuwa ta samar da ƙaramin ƙasa biyu, galibi zai ci gaba da faɗuwa.

Don kauce wa hasara mai yawa, kuna buƙatar ƙara matsakaicin motsi ta hanyar saita lokaci zuwa 20. Idan farashin yana ƙasa da matsakaicin motsi, ba za ku iya saya a kan layi na breakout ba.

Lokacin cinikin saman saman biyu, kuna buƙatar tabbatar da cewa farashin bai fi matsakaicin motsi sama da maki 20 ba. Ƙarfafawa da amincin saman biyu da ƙasa biyu ba za su iya tabbatar da jujjuyawar yanayin ba. Ana iya guje wa hasara ta hanyar amfani da dokoki guda biyu:

- Saita asara tasha tsakanin goyan baya/karyewa da kololuwa.

- Ba za ku iya amfani da fiye da 1% na ma’auni na kowane ciniki ba.

Yin amfani da waɗannan ƙa’idodin yana tabbatar da cewa an rage haɗarin haɗari. Hanya na duniya da abin dogara a cikin bincike na fasaha yana ba da daidaito mafi girma a ciniki a cikin manyan tazara. Tare da babban tazara, patency na sigina yana ƙaruwa, mai ciniki baya buƙatar jira sa’o’i da yawa a gaban ƙirar ƙirar ƙira.