Dɛn ne double top wɔ aguadi mu, dɛn ne nhwɛso no, ne nkyerɛkyerɛmu ne nkyerɛase a ɛfa Double top reversal pattern no ho. Wɔ mfiridwuma mu nhwehwɛmu mu no, nhyehyɛe yɛ bo nhyehyɛe a ɛsan ba bere nyinaa a ɛkyerɛ sɛnea gua no bɛkɔ daakye. Ɔkwan foforo so no, nhwɛso no kyerɛ sɛ ebia su pɔtee bi a ɛrekɔ so wɔ gua so no bɛkɔ so anaasɛ ɛbɛsan akɔ akyi. Nhwɛso ahorow pii wɔ hɔ:

- mfonini mu nhwehwɛmu (mfonini ahorow);

- kyɛnere a wɔde yɛ nhwehwɛmu (kyɛnere a wɔaka abom);

- fraktal ahorow;

- akontaabu mu bo ho nhwɛso ahorow a ɛho hia.

https://articles.opexflow.com/analysis-methods-and-tools/svechnye-formacii-v-trajdinge.htm Atifi abien no yɛ nhwɛso ahorow a wɔtaa yɛ wɔ sikasɛm gua no ho mfonini nhwehwɛmu mu no mu biako. Ne puei wɔ nhyehyɛe no so wɔ

aguadidan no mu no ma aguadifo no nya adwene sɛ ɛda adi kɛse sɛ bo no bɛyɛ n’ade wɔ ɔkwan koro no ara so sɛnea bere a saa nhyehyɛe yi puei wɔ nhyehyɛe no so kan no. A mmɔho abien a ɛkorɔn wɔ aguadi mu kyerɛ bere a nneɛma bo a ɛkɔ soro no dannan. Peculiarity a ɛwɔ figure no mu ne sɛ enni slope, na mmom ɛwɔ symmetrical peaks, ɛda adi sɛ nea efi uptrend bi a wɔawie mu aba.

- Sɛnea wobɛhu double top na woabu Double top wɔ chart so

- Nneɛma a ɛwɔ soro nhwɛso abien no mu

- Formation of a mmɔho abien top nhwɛso wɔ aguadi mu

- Ahorow a ɛwɔ soro abien wɔ aguadi mu

- Ɔkwan bɛn so na wɔde di dwuma wɔ mfiridwuma mu nhwehwɛmu mu?

- Aguadi wɔ stock exchange so wɔ soro abien – akwan a mfaso wɔ so ne nhwɛso ahorow a nkyerɛkyerɛmu ne mfonini nkyerɛkyerɛmu wom

- Nyɛ Saa Mfomso Yi Bere a Woredi Aguadi wɔ Double Top Pattern no Ho

- Ɔkwan bɛn so na wobɛdi gua wɔ double top pattern no ho na woanya mfaso?

- Ɔkwan a Wɔfa so Hyehyɛ Mu a Wode Ho To So

- Mfaso ne ɔhaw ahorow a ɛwɔ nhwɛso no so

- Mfomso ne asiane ahorow

Sɛnea wobɛhu double top na woabu Double top wɔ chart so

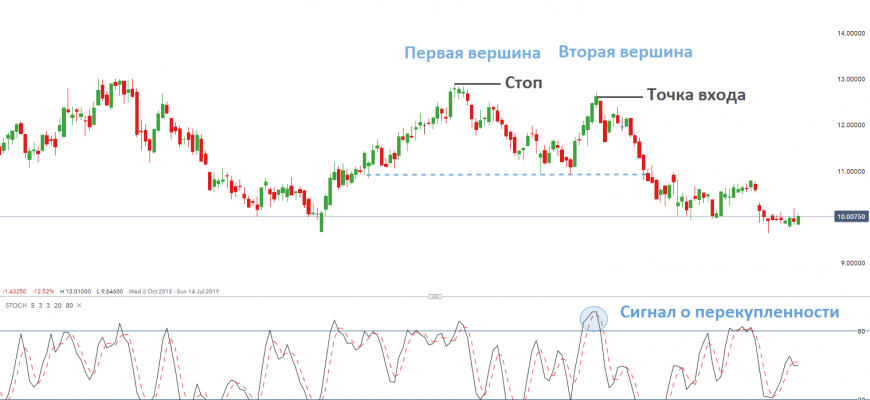

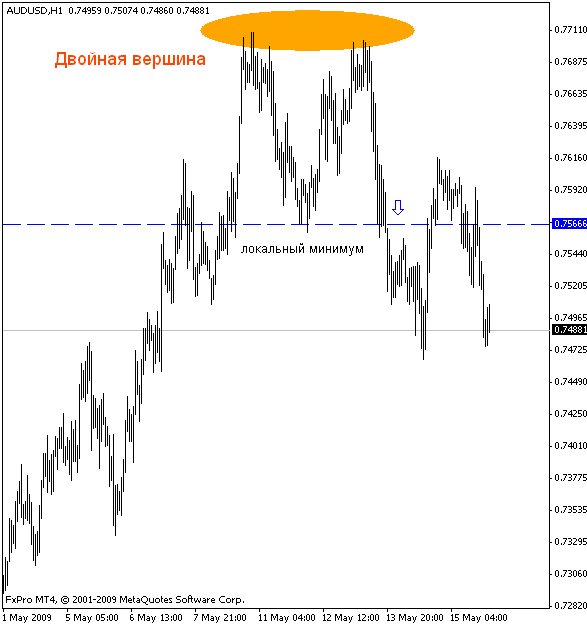

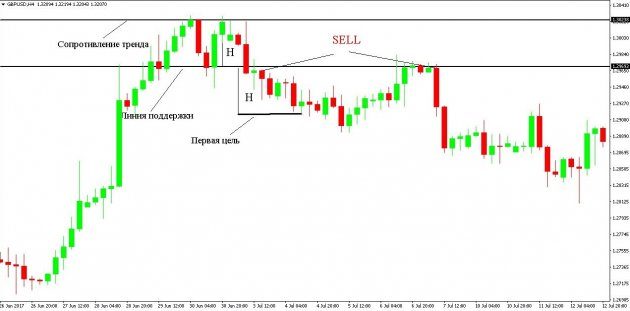

Sɛ wopɛ sɛ wokenkan Double top pattern no pɛpɛɛpɛ a, ɛsɛ sɛ wuhu sɛnea double top te wɔ mfiridwuma mu nhwehwɛmu mu no yiye. Graphically, it looks like the letter M. Wɔhyehyɛ soro nhyehyɛe a ɛbɔ ho abien no esiane nneɛma bo a ɛkɔ soro a ɛkɔ soro kodu nea ɛsen biara (A) nti, ɛno akyi no, bo no dan kɔ soro kɛse na ɛkɔ fam kodu mmoa a ɛkɔ fam (B). Bo a ɛkɔ soro a edi hɔ no du baabi a na ɛwɔ soro A a na ɛwɔ hɔ kan no, bere a ebia nsakrae kakra bɛba ɔkwan biako so anaa ɔkwan foforo so (A1), bere a nneɛma bo a ɛbɛpaapae biara nni hɔ no. Nea edi hɔ a wɔdannan no ma ɛbo no so tew kɔ bo a na ɛwɔ hɔ kan no so B anaa nea ɛba fam. Bo a wɔabubu a ɛwɔ level B ase no ma double top pattern no wie na su no bubu. Nhwɛso a ɛwɔ soro abien wɔ nhyehyɛe no so:

- hyɛ nkoko abien a ne tɛtrɛtɛ ne ne sorokɔ yɛ pɛ agyirae wɔ graph no so;

- ɛnsɛ sɛ kwan a ɛda vertices no ntam no yɛ ketewaa bi;

- kyerɛ sɛnea mmoa no te.

Sɛ wopɛ sɛ wohu Double top pattern no a, wubetumi de mfiridwuma ho nsɛnkyerɛnne te sɛ oscillator ne

moving averages adi dwuma . Aguadifo pii hwɛ kwan sɛ akontaabu a wɔahyehyɛ no koraa, a ɛwɔ bo a ɛbɛpaapae, sɛ nea ɛkyerɛ sɛ nea ɛrekɔ so no yɛ nokware no, bɛyɛ aguadi ahorow.

Nneɛma a ɛwɔ soro nhwɛso abien no mu

Nsusuwii a ɛwɔ soro abien no, sɛnea yɛaka ho asɛm wɔ atifi hɔ no, wɔ mfonini kwan so no te sɛ nkyerɛwde M. Mfonini no yɛ mmepɔw abien a ɛwɔ soro a ɛwɔ soro koro no ara, ne ahina bi a ɛwɔ emu abien ntam. Ntrɛwmu a ɛkɔ soro a wɔtwe fa trough no fã a ɛba fam no mu no na ɛyɛ support level no. Akontaabu no sorokɔ ma akwankyerɛ ma stock no wɔ bo mu. Wɔkyerɛ ase sɛ kwan a ɛda nsusuwso no atifi kosi nhama a ɛboa no so.

Formation of a mmɔho abien top nhwɛso wɔ aguadi mu

Wɔ aguadi mu no, soro abien yɛ mfonini, reversal pattern na ɛkyerɛ downtrend anaasɛ uptrend wɔ bo mu. Wɔ charts no so no, saa nhyehyɛe yi pue bere a bo no du bo a ɛba fam/a ɛsen biara no ho, na afei ɛdannan no denneennen na ɛkɔ bɛyɛ sɛ nea na ɛwɔ hɔ kan no, baabi a ɛsan dan no bio na ɛsan kɔ soro/siane kɔ bo a ɛba fam/a ɛsen biara no so, na ɛma ɛdannan foforo a ɛyɛ nnam. Nhyehyɛe a etwa to a ɛwɔ soro abien no ba bere a bo no abubu wɔ mmoa kwan no anaa nkyerɛwde a wɔde si so dua no mu akyi.

Ahorow a ɛwɔ soro abien wɔ aguadi mu

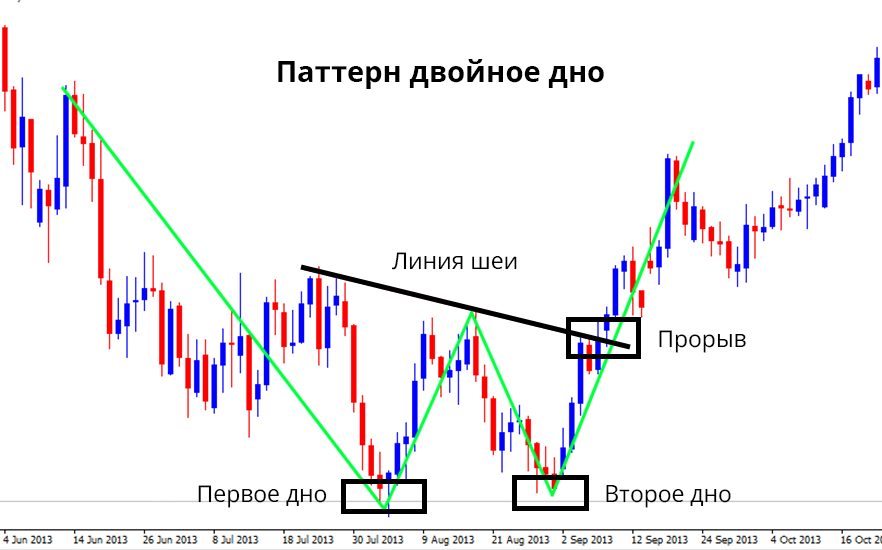

Wɔ aguadi mu no, wɔ soro mmɔho abien nhyehyɛe no akyi no, mpɛn pii no, akontaabu bi a ɛne no bɔ abira wɔ hɔ na wɔfrɛ

no ase mmɔho abien anaa ase mmɔho abien. Wɔ mfonini mu no, nhwɛso no te sɛ nkyerɛwde W na wɔahyehyɛ no wɔ ɔkwan a ɛkɔ fam so. Wɔsan frɛ no bullish reversal na ɛwɔ su ahorow a ɛne nea ɛwɔ soro abien bɔ abira. Eyi kyerɛ sɛ bo no du ne bo a ɛba fam koraa no ho, na ɛno akyi no ɛkɔ soro bere tiaa bi na ɛsan kɔ fam kosi bo a ɛba fam koraa no so.

Ɔkwan bɛn so na wɔde di dwuma wɔ mfiridwuma mu nhwehwɛmu mu?

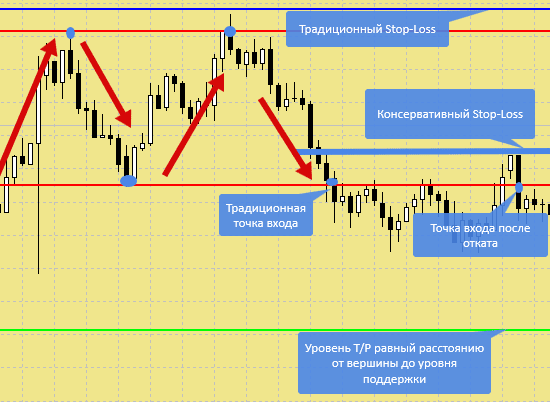

Wɔ mfiridwuma mu nhwehwɛmu a wɔyɛ wɔ gua no ho mu no, wɔde atifi abien di dwuma sɛ sɛnkyerɛnne a ɛkyerɛ sɛ wɔyɛ apam na wɔhyɛn gua no mu. Wɔ classic version of technical analysis mu no, nyansahyɛ ahorow wɔ hɔ sɛ wobɛhyɛn gua so na woayɛ deals bere a bo no abubu wɔ support level no mu na wode stop loss ahyɛ soro kakra wɔ soro a ɛto so abien no so. https://articles.opexflow.com/trading-training/stop-loss.htm Wɔn a wɔde wɔn ho hyɛ gua so no te ase sɛ sɛ bo no sakra a, ɛdu ne bo a ɛkorɔn sen biara no ho na ɛsɛ sɛ wosi gyinae ahorow bi:

- wɔn a wɔte gyinabea ahorow no nya mfaso, na wɔhwehwɛ baabi a wobetumi afi aguadi mu;

- ahwɛfoɔ – a wɔrehwehwɛ baabi a wɔbɛkɔ mu atia su no, a wɔde wɔn adwene si gyinabea a ɛyɛ den so.

Aguadi wɔ stock exchange so wɔ soro abien – akwan a mfaso wɔ so ne nhwɛso ahorow a nkyerɛkyerɛmu ne mfonini nkyerɛkyerɛmu wom

Sɛnea ɛbɛyɛ a asiane ne mfaso a wubenya afi aguadi mu no so atew no, ɛsɛ sɛ wudi mmara abien akyi:

- Hyɛn gua so kɔtɔn bere a ne bo no abubu kɔn no nkutoo.

- Bue adetɔn gyinabea akyi a ɛto so abien breakout of the support line by the price.

Ase abien yɛ ahwehwɛ mfonini a ɛwɔ soro abien, aguadi ho mmara a ɛfa ho no te sɛ nea ɛte saa ara. Ase a ɛbɔ ho abien ba bere a nea ɛrekɔ fam no dan akyi no.

Nyɛ Saa Mfomso Yi Bere a Woredi Aguadi wɔ Double Top Pattern no Ho

Gyina mfiridwuma mu nhwehwɛmu so no, aguadifo retwɛn sɛ wɔbɛpaapae mmoa kwan no mu na ama wɔabue aguadi tenten bi. Nanso, sɛ wofa saa kwan yi so a, wubetumi ahwe ase wɔ atoro a wɔde bɛbɔ wo ho afiri mu, na woadan gua no denneennen. Wubetumi asiesie tebea no denam gyinabea bi a wubebue ama apam bi wɔ atoro breakout akyi no so. Guadi a ɛrekɔ fam no bɛkanyan stop losses a efi aguadifo a wogyina hɔ bere tenten no hɔ, na ɛbɛma bo no akɔ fam mpo. https://articles.opexflow.com/analysis-methods-and-tools/proboj-urovnya.htm Aguadi saa nhyehyɛe yi yɛ aguadi atia tenten. Bo Adeyɛ: mmɔho abien soro/ase nhwɛso – akwankyerɛ a edi mũ a ɛfa chart identification, aguadi ho nhyehyɛe: https://youtu.be/gRyc7Vj-4jA

Ɔkwan bɛn so na wobɛdi gua wɔ double top pattern no ho na woanya mfaso?

Wubetumi asiesie mfaso a wubenya afi aguadi mu, de wo ho ato soro abien no so, denam akontaabu ne fa mfaso line no a wubesiesie no so. Fa mfaso no yɛ akontaabu ma abien atifi nhwɛso, ne mfiridwuma mu nhwehwɛmu akontaabu afoforo nso, sɛnea nhyehyɛe no kyerɛ no:

- susuw kwan a efi support line no so kosi peak no so (resistance level);

- yɛtwɛn mmoa no mu abubu na yɛtu bo a yɛanya afi mmoa kwan no so no ahyɛ da.

Wɔ saa level yi so no, yesiesie mfaso no. Akwan a edidi so yi bɛma woanya sika wɔ apam no mu:

- bue aguadi tiawa bi wɔ mmoa a ɛrepaapae no ho;

- siesie stop loss no wɔ breakout line no akyi;

- sɛ bo no du fa mfaso a, yesiesie mfaso no.

Ɔkwan a Wɔfa so Hyehyɛ Mu a Wode Ho To So

Ansa na wobɛhyɛn gyinabea tenten bi mu no, ɛsɛ sɛ:

- hwehwɛ ase a ebetumi ayɛ mmɔho abien;

- twɛn ma ɛbo no nkɔ soro;

- hyɛ rollback a ɛyɛ den a ɛyɛ den no nsow;

- bue adetɔn bere a ne bo no akɔ akyiri asen nea ɛwɔ hɔ no akyi.

Mfaso ne ɔhaw ahorow a ɛwɔ nhwɛso no so

Mfaso a ɛwɔ soro abien ne ase abien nsusuwii no so ne sɛnea ɛyɛ adwuma yiye wɔ bere ntam ahorow (M15, H1, H4 anaa D1). Eyi ma ɛyɛ yiye sɛ wɔde wɔn bedi dwuma wɔ da,

swing ne gyinabea aguadifo nhwehwɛmu mu. Eyinom yɛ amansan akontaabu a ɛne stock gua so nnwinnade ahorow yɛ adwuma: stocks, sika abien, nneɛma a wɔde yɛ nneɛma, ne nea ɛkeka ho https://articles.opexflow.com/trading-training/skolko-zarabatyvayut-trajdery.htm nhyehyɛe no wɔ ne sintɔ ahorow. Nea ɛho hia titiriw ne sɛ atifi abien no ntumi mma su a wɔahyehyɛ no bɛhyɛ mu den. Sɛ nhwɛso no, asono wɔ da abien mu betumi adan nneɛma bo ne mprɛnsa so, abubu mmoa gyinabea no. Enti, ɛsɛ sɛ wɔhwɛ yiye na asiane ahorow no so atew.

Mfomso ne asiane ahorow

Mfomso titiriw a ɛwɔ aguadi a ɛwɔ soro nhwɛso mmɔho abien mu ne sɛ wobebue gyinabea atenten ntɛm ara bere a bo no abubu akyi. Asiane no ne sɛ wɔ eyi mu no, hokwan wɔ hɔ sɛ wobefi ase adi gua atia su titiriw bi. Eyi ba bere a gua no yɛ ase ketewaa bi a ɛbɔ ho abien no, mpɛn pii no ɛbɛkɔ so ahwe ase.

Sɛnea ɛbɛyɛ a worenhwere ade kɛse no, ɛsɛ sɛ wode moving average ka ho denam bere no a wode besi hɔ sɛ 20. Sɛ bo no ba fam sen moving average no a, wuntumi ntɔ wɔ breakout line no so.

Sɛ woredi gua wɔ soro abien a, ɛsɛ sɛ wohwɛ hu sɛ bo no nkɔ soro nsen nea ɛkɔ so no bɛboro nsɛntitiriw 20. Sɛnea wotumi yɛ nneɛma pii na wotumi de ho to so a ɛwɔ soro abien ne ase abien no ntumi nkyerɛ sɛ wɔbɛdan nneɛma a ɛrekɔ so no. Wobetumi akwati nneɛma a wɔhwere denam mmara abien a wɔde bedi dwuma so:

- Set stop loss wɔ support/breakout ne peak ntam.

- Worentumi mfa wo sika a aka no bɛboro 1% nni dwuma wɔ aguadi biara mu.

Mmara yi a wɔde di dwuma no hwɛ hu sɛ asiane ahorow no so tew. Ɔkwan a wɔfa so yɛ ade wɔ amansan nyinaa mu na wotumi de ho to so wɔ mfiridwuma mu nhwehwɛmu mu no ma wotumi di gua wɔ bere akɛse mu no yɛ pɛpɛɛpɛ kɛse. Na ntamgyinafo kɛse, patency a nsɛnkyerɛnne no kɔ soro, enhia sɛ aguadifo no twɛn nnɔnhwerew pii wɔ nhwɛso formation monitor no anim.